Volkswagen Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volkswagen Group Bundle

What is included in the product

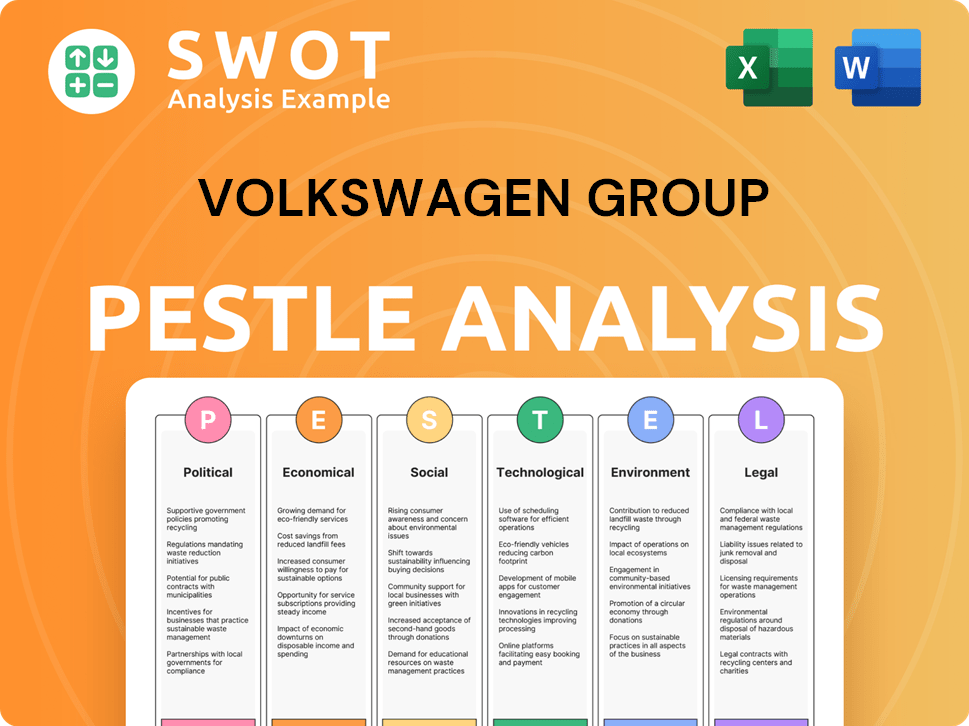

Analyzes VW Group's external factors: Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise version ready for immediate integration in presentations and reports.

Full Version Awaits

Volkswagen Group PESTLE Analysis

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying. This is the complete Volkswagen Group PESTLE analysis, ready for immediate use. You will receive this in a well-formatted document. There's no guesswork, only a finished product.

PESTLE Analysis Template

Uncover the external factors impacting Volkswagen Group. Our PESTLE analysis explores political, economic, social, technological, legal, and environmental influences. Learn about regulatory pressures, market trends, and technological disruptions. Analyze how sustainability efforts impact the company’s trajectory and identify future opportunities. Download the full PESTLE analysis to gain strategic insights!

Political factors

Government regulations and policies heavily influence Volkswagen's operations. Emission standards, like Euro 7, drive R&D spending. Safety regulations also impact vehicle design and manufacturing. Trade policies, such as tariffs, affect market access and profitability. Compliance costs can be substantial; for example, VW invested billions to meet stricter EU emission norms.

International trade agreements significantly affect Volkswagen's global strategy. The EU, US, and China's trade dynamics impact import/export costs, and competitiveness. For example, tariffs on auto parts could increase production expenses. In 2024, Volkswagen's sales in China were 3.2 million vehicles, showing the impact of trade policies.

Political stability is vital for Volkswagen's operations. Geopolitical risks can disrupt supply chains and hurt sales. For example, the Russia-Ukraine war impacted vehicle production. In 2024, Volkswagen faced challenges in some markets due to political instability, affecting its financial outcomes.

Government Incentives for Electric Vehicles

Government incentives significantly boost electric vehicle (EV) adoption, crucial for Volkswagen's strategy. Subsidies and tax credits directly affect consumer choices, increasing EV demand. For instance, in 2024, the U.S. offered up to $7,500 in tax credits for new EVs. These incentives support Volkswagen's expansion of its EV offerings.

- U.S. EV sales increased by 47% in Q1 2024, driven by incentives.

- European Union targets 30 million EVs by 2030, backed by subsidies.

- China provides substantial subsidies, making it the largest EV market.

Industrial Relations and Labor Policies

Industrial relations and labor policies significantly impact Volkswagen's operations, particularly in manufacturing. Agreements with unions influence costs and workforce management, posing key political considerations. For instance, in 2024, labor costs represented a substantial portion of Volkswagen's expenses, varying by region. Negotiations on wages and working conditions are crucial. Decisions regarding workforce reductions are also affected by political and labor relations.

- In 2024, Volkswagen's labor costs were a significant portion of its total expenses.

- Negotiations with unions on wages and working conditions are ongoing political considerations.

- Workforce reduction decisions are influenced by political and labor relations.

Political factors strongly shape Volkswagen's performance, especially regulations. Government policies like emission standards require significant investments. Trade dynamics impact profitability; in 2024, China sales hit 3.2M units.

| Political Factor | Impact | 2024/2025 Data |

|---|---|---|

| Emission Standards | R&D Costs | Euro 7 regulations drive R&D spending |

| Trade Policies | Market Access/Cost | Tariffs on auto parts affect production cost |

| Government Incentives | EV Demand | U.S. EV sales up 47% in Q1 2024, EU aims for 30M EVs by 2030 |

Economic factors

Global economic growth significantly affects Volkswagen's sales. In 2024, the global GDP growth is projected at 3.2%, impacting vehicle demand. Economic instability, like the Eurozone's fluctuations, can decrease consumer spending. For example, a 1% GDP drop may cut car sales by 0.5%.

Exchange rate swings, especially between the Euro and other currencies, significantly influence Volkswagen's financial performance. The company's global sales and production expose it to currency risks. For instance, a weaker Euro can boost competitiveness in export markets. In 2024, VW reported currency impacts on revenue.

Inflation and interest rates significantly affect Volkswagen's operations. Rising inflation can increase production costs and raw material prices. Higher interest rates make car loans pricier, potentially decreasing sales. In 2024, the Eurozone's inflation rate was around 2.4%. The European Central Bank's interest rates also had fluctuations. These economic shifts directly influence consumer behavior and Volkswagen's profitability.

Consumer Spending and Disposable Income

Consumer spending and disposable income significantly impact the affordability of Volkswagen's vehicles. Strong economic conditions, such as low unemployment and rising wages, boost consumer confidence and car purchases. Conversely, economic downturns, like the recent inflation, can reduce consumer spending on discretionary items such as new cars. For 2024, the European new car market showed mixed results with some growth, but overall sales remained below pre-pandemic levels, affecting Volkswagen's sales volumes.

- Inflation rates and interest rates influence consumer purchasing decisions.

- Consumer confidence levels are a key indicator of spending behavior.

- Government economic policies (tax incentives, subsidies) affect car affordability.

- The availability of credit and financing options impacts consumer access.

Competition Intensity

The automotive market is fiercely competitive, especially with the rise of EVs. This competition impacts Volkswagen's pricing strategies, market share, and overall profitability. The EV market is seeing increased rivalry from both established automakers and new entrants. For instance, in 2024, Tesla's global market share in EVs was around 18%, while Volkswagen aimed to increase its EV sales significantly.

- Tesla's global EV market share: ~18% (2024).

- Volkswagen's EV sales growth target: Significant increase (2024/2025).

- Competitive pressure on pricing: Increased due to multiple players.

- Impact on profitability: Potential for margin compression.

Economic growth, inflation, and interest rates impact VW's performance; in 2024, global GDP growth was around 3.2%. Exchange rate fluctuations, especially between Euro and other currencies influence VW’s finances, as shown in financial reports. Consumer spending, significantly affected by income and confidence levels, dictates demand for Volkswagen cars. The European new car market reflected these trends in 2024.

| Metric | Data |

|---|---|

| Global GDP Growth (2024) | 3.2% |

| Eurozone Inflation (2024) | 2.4% |

| Tesla's EV Market Share (2024) | ~18% |

Sociological factors

Consumer preferences are shifting, with a focus on sustainable mobility and digital features. Lifestyle trends, like urban living, impact vehicle choices. In 2024, electric vehicle (EV) sales increased, reflecting this shift. Volkswagen is adapting, with EVs accounting for a growing share of sales. Digital connectivity is crucial; Volkswagen offers connected services in its vehicles.

Volkswagen Group faces demographic shifts influencing vehicle demand. An aging global population may increase demand for SUVs and EVs. Urbanization trends impact city-focused vehicle preferences. In 2024, SUV sales grew, reflecting these changes. Household structures also shape car choices.

Growing environmental awareness influences consumer choices significantly. Demand for EVs is fueled by climate change concerns. In 2024, global EV sales increased by 30%, reflecting this shift. Volkswagen's e-mobility strategy directly responds to these attitudes.

Social Acceptance of New Technologies

Social acceptance is vital for Volkswagen's tech success. Consumer trust in EVs and autonomous driving is a huge factor. Adoption rates depend on how well VW addresses safety and usability concerns. Public perception shapes market growth significantly. In 2024, EV sales rose, but concerns linger.

- EV adoption is growing, with sales up 30% in Q1 2024.

- Autonomous tech faces skepticism; only 20% trust it fully.

- Safety and reliability are top consumer priorities.

- Government incentives greatly influence adoption rates.

Urbanization and Mobility Trends

Urbanization and mobility shifts present both challenges and chances for Volkswagen Group. Growing urban populations and evolving transportation preferences are reshaping car ownership. The rise of ride-sharing and alternative transport options demands VW to adapt its business strategies. In 2024, urban areas saw a 6% increase in ride-sharing usage. VW's response involves electric vehicle (EV) development and mobility services.

- The global urban population is projected to reach 6.7 billion by 2050.

- Ride-sharing revenue is forecast to hit $140 billion by 2025.

- EV sales in urban areas increased by 15% in 2024.

Societal trends significantly shape Volkswagen's market. Shifting consumer preferences favor sustainable options. Demand for EVs rose, but safety and tech acceptance are crucial.

| Factor | Impact | 2024 Data |

|---|---|---|

| EV Adoption | Growing demand | Sales up 30% (Q1) |

| Tech Trust | Skepticism | 20% fully trust autonomous |

| Urbanization | Mobility changes | Ride-sharing up 6% |

Technological factors

Volkswagen is heavily invested in electric vehicle (EV) tech. Battery tech, charging infrastructure, and drivetrain efficiency are key. They plan to invest billions in EVs. In 2024, Volkswagen aimed for 100% EV sales in Europe by 2035.

Autonomous driving is reshaping the auto industry. Volkswagen's future hinges on its advancements in this field. In 2024, VW invested heavily in self-driving tech. Their goal is to launch Level 4 autonomy by 2026, significantly impacting their market position. This is driven by a projected autonomous vehicle market worth $60 billion by 2030.

Volkswagen is heavily investing in digital technologies. This includes advanced infotainment systems and over-the-air software updates. In 2024, the group planned to spend €180 billion over five years, with a significant portion allocated to digitalization. The goal is to enhance the driving experience and offer seamless connectivity. By 2025, they aim to have a fully connected car.

Manufacturing Technology and Automation

Volkswagen Group heavily invests in advanced manufacturing technologies to boost efficiency. Automation, including robotics and AI, streamlines production processes. This leads to reduced operational costs and improved vehicle quality. Volkswagen aims to increase electric vehicle production through these advancements.

- Volkswagen plans to invest €180 billion in the next five years, focusing on e-mobility and digitalization.

- Automated production lines can increase output by 15-20%.

- Robotics in welding and painting reduce defects by up to 10%.

Software Development and Integration

Volkswagen Group faces significant technological hurdles due to the rising importance of software in vehicles. This includes operating systems and advanced driver-assistance systems (ADAS), necessitating robust internal software development and integration. The company is investing heavily; for instance, Volkswagen plans to spend approximately €180 billion in the next five years, with a significant portion allocated to software and digital capabilities. This shift is crucial, as software-defined vehicles are expected to capture 40% of the automotive market by 2030.

- Volkswagen aims to have its own software platform, VW.OS, to control the vehicle's functions.

- The company needs to integrate this software seamlessly with its existing hardware.

- Failure to adapt could lead to a loss of competitiveness.

Volkswagen's focus is on EV tech and autonomous driving, aiming for Level 4 autonomy by 2026. Investments include €180 billion in five years for e-mobility and digitalization. They are enhancing driving experiences through software-defined vehicles.

| Tech Area | Investment (est.) | Goal/Impact |

|---|---|---|

| EVs | Billions | 100% EV sales in Europe by 2035 |

| Autonomous Driving | Significant | Level 4 autonomy by 2026; $60B market by 2030 |

| Digitalization | €180B in 5 years | Fully connected car by 2025, software-defined vehicles (40% by 2030) |

Legal factors

Vehicle emissions standards and regulations are crucial for Volkswagen. They face strict, evolving global standards, affecting product development and compliance expenses. Non-compliance can lead to fines and harm the brand's reputation. In 2024, VW allocated billions to meet these standards. For example, in 2023, VW spent €1.5 billion on emissions-related adjustments.

Volkswagen must adhere to strict vehicle safety regulations globally. These regulations, like those from the IIHS, necessitate ongoing R&D investment. In 2024, Volkswagen spent billions on safety features. Compliance is crucial for market access and brand reputation. Failure can lead to recalls and significant financial penalties.

Volkswagen faces legal risks from product liability and consumer protection laws. These laws can lead to lawsuits if vehicles have defects or safety problems. In 2024, the company faced ongoing legal battles regarding the "Dieselgate" scandal. The U.S. Department of Justice and the EPA have imposed significant penalties. The company has spent billions on settlements and recalls.

Data Privacy and Cybersecurity Regulations

Volkswagen faces stringent data privacy and cybersecurity regulations due to connected vehicle technology. These regulations, like GDPR in Europe and CCPA in California, mandate how consumer data is collected, stored, and used. Non-compliance can result in significant penalties. VW is investing heavily in cybersecurity measures, allocating €1 billion between 2020 and 2024 to protect its digital infrastructure. This includes securing vehicle software and customer data.

- GDPR fines can reach up to 4% of global annual turnover.

- In 2023, the global cybersecurity market was valued at $187.3 billion.

- VW's digital investments are crucial for compliance and maintaining customer trust.

Antitrust and Competition Law

Antitrust and competition laws are crucial for Volkswagen, influencing its market dynamics, and strategic moves. These regulations scrutinize the company's acquisitions, partnerships, and overall competitive behavior. Breaches can lead to substantial fines; for example, in 2023, the EU imposed a fine on Volkswagen for emissions-related issues. Volkswagen must comply with diverse regulations to maintain market access and avoid legal repercussions.

- EU fines can significantly impact Volkswagen's financial performance, as seen in past cases.

- Compliance costs are a continuous operational expense.

- Antitrust scrutiny can delay or block strategic acquisitions.

- Collaborations face regulatory hurdles, affecting innovation.

Volkswagen navigates complex legal terrains. This includes emissions, safety, product liability, and data privacy laws, each affecting its operations. They faced significant fines, such as EU penalties. In 2024/2025, continued compliance and data protection investment will be critical.

| Legal Area | Regulation Impact | Financial Impact (2024-2025 est.) |

|---|---|---|

| Emissions | Strict Global Standards | €1.6B+ (compliance & adjustments) |

| Safety | Global Vehicle Safety | $3B+ (R&D, recalls) |

| Product Liability | Lawsuits & Settlements | Ongoing, potentially billions |

| Data Privacy | GDPR, CCPA | €500M+ (cybersecurity investments) |

Environmental factors

Growing climate concerns push for stringent emissions rules. Volkswagen pivots to EVs, a key response. In Q1 2024, VW's EV sales rose, despite market challenges. The EU's 2035 ban on new ICE vehicles fuels this shift. This strategic move aligns with global carbon reduction goals.

Volkswagen faces stringent environmental regulations across its global production network. These regulations govern waste disposal, water use, and energy consumption, influencing operational costs. The company invested €1.8 billion in environmental protection in 2024. Compliance is crucial for maintaining production licenses and avoiding penalties, affecting profitability and market access.

Volkswagen faces growing pressure due to resource scarcity and environmental concerns. Sustainable sourcing is crucial for materials. In 2024, the company invested heavily in sustainable practices. They aim to reduce their environmental footprint. The Volkswagen Group plans to increase the use of recycled materials by 40% by 2030.

Recycling and Circular Economy Initiatives

Volkswagen faces increasing pressure to adopt circular economy models, focusing on vehicle recycling and sustainable material usage. This shift impacts product design, necessitating end-of-life vehicle management. The EU's End-of-Life Vehicles Directive mandates recycling targets, driving innovation.

- 2024: Volkswagen aims for 95% recyclability of new vehicles.

- By 2025, Volkswagen plans to increase the use of recycled materials in its vehicles.

- The company invested €450 million in recycling facilities by 2023.

Biodiversity and Ecosystem Protection

Biodiversity and ecosystem protection are increasingly critical for industrial activities. Volkswagen actively addresses these concerns through its environmental strategy. This includes initiatives aimed at preserving biodiversity and minimizing ecological impact. The Volkswagen Group aims to become a net-positive company by 2050.

- Volkswagen's "goTOzero" environmental strategy focuses on minimizing environmental impact.

- The company supports projects that restore and protect natural habitats.

- Volkswagen is investing in sustainable supply chains to protect biodiversity.

Environmental factors critically shape Volkswagen's strategy. Stricter emission rules and the 2035 ICE ban in the EU accelerate its EV transition; VW's Q1 2024 EV sales saw growth. Sustainable practices and resource management are also key, with €1.8B invested in environmental protection in 2024 and a goal of using 40% recycled materials by 2030. The company's recycling program aims to increase the use of recycled materials by 2025.

| Environmental Aspect | Volkswagen's Response | Relevant Data (2024/2025) |

|---|---|---|

| Emissions | Transition to EVs | Q1 2024 EV sales growth. |

| Regulations | Compliance and Investment | €1.8B invested in environmental protection. |

| Sustainability | Resource Management & Circular Economy | Aim for 40% recycled materials by 2030. Increase recycled materials by 2025. |

PESTLE Analysis Data Sources

Our analysis relies on diverse sources: IMF, World Bank, OECD data, along with industry reports & governmental portals. Every aspect is built on validated insights.