Voltalia Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Voltalia Bundle

What is included in the product

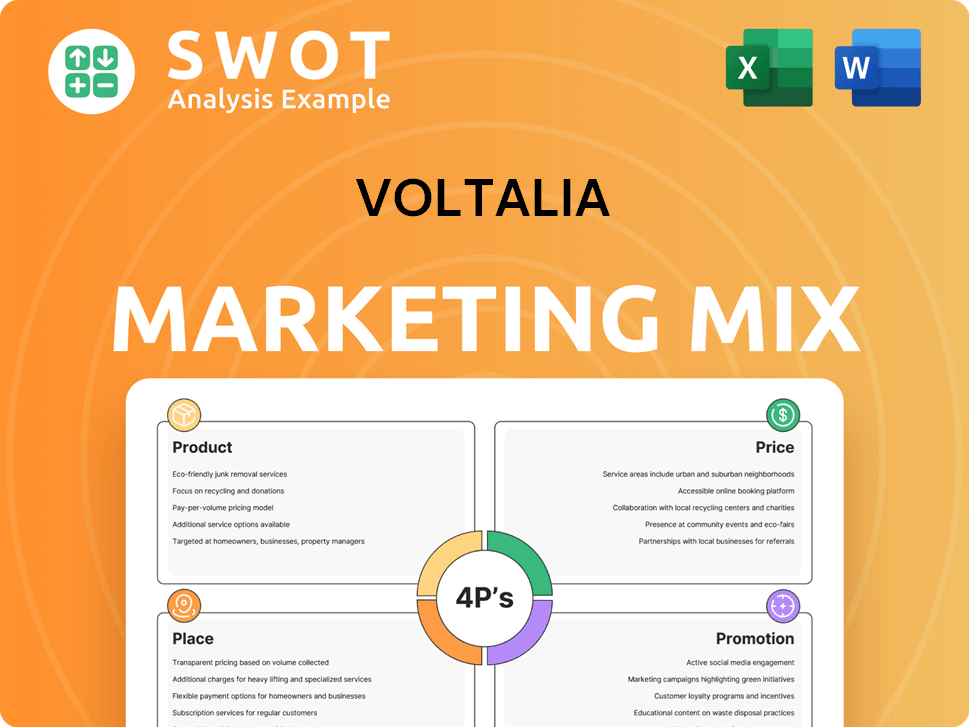

A thorough 4Ps analysis of Voltalia's marketing strategies, exploring Product, Price, Place & Promotion.

Summarizes the 4Ps concisely, so teams quickly see Voltalia's strategic focus and key selling points.

Full Version Awaits

Voltalia 4P's Marketing Mix Analysis

The preview illustrates Voltalia's 4Ps Marketing Mix Analysis, which you'll receive after purchase.

This isn't a sample—it's the final document, complete and ready to be implemented.

Get the identical analysis you see right here, with no alterations post-purchase.

Download it instantly; you get precisely what's on display.

4P's Marketing Mix Analysis Template

Voltalia's strategic marketing mix is a key factor in its market performance. Their product offerings and branding position them effectively in the renewable energy sector. Pricing is competitive, reflecting the current market trends and technological advancements. Distribution focuses on global presence and accessibility. Promotion utilizes digital channels.

Delve deeper! Gain actionable insights by purchasing the full 4Ps Marketing Mix Analysis to understand Voltalia’s integrated approach and create your own effective marketing plans.

Product

Voltalia's product strategy centers on renewable energy generation from wind, solar, hydro, and biomass. This diversified approach ensures a stable energy supply. In Q1 2024, Voltalia's total installed capacity reached 2.8 GW. Their owned facilities are a key part of this offering. In 2024, Voltalia generated 6.5 TWh of energy.

Voltalia's service offerings extend beyond its own energy production, providing comprehensive support to third-party clients in renewables. Their services span the entire project lifecycle, including development, financing, EPC, and O&M. In 2024, Voltalia's services generated €150 million in revenue, showcasing their strong market position. This dual role strengthens their product strategy and diversifies revenue streams.

Voltalia enhances renewable energy reliability through energy storage. These solutions stabilize intermittent sources like solar and wind, ensuring a consistent power supply. Their investment in storage showcases a commitment to comprehensive energy solutions. In Q1 2024, Voltalia's storage projects increased by 30%, demonstrating strong growth.

Turnkey and Bespoke Power Plant Services

Voltalia's turnkey and bespoke power plant services form a crucial part of its 4P marketing mix, offering comprehensive solutions. They provide full project management, from development to construction, and tailor these services to client needs. This approach allows Voltalia to serve diverse clients effectively, as evidenced by their growing project portfolio. As of Q1 2024, Voltalia's total installed capacity reached 2.7 GW.

- Turnkey solutions for complete project management.

- Bespoke options tailored to specific client needs.

- Caters to a wide range of clients and expertise levels.

- Contributes to Voltalia's expanding project portfolio.

Green Electricity Supply and Energy Efficiency Services

Voltalia's offering includes green electricity supply and energy efficiency services, expanding its product range. This strategy enables direct energy sales and supports clients in lowering traditional energy usage. In 2024, the global market for energy efficiency services was valued at approximately $300 billion, with expected growth. Voltalia's focus on these areas aligns with growing demand for sustainable solutions.

- Direct supply of green electricity to businesses.

- Energy efficiency services to reduce conventional energy consumption.

- Expanding the product portfolio to include energy sales and services.

Voltalia's product portfolio features renewable energy generation and diverse services, showcasing its dedication to sustainable energy. They offer turnkey and custom power plant solutions for comprehensive project management. In 2024, revenue from services hit €150 million, and the storage projects rose 30% in Q1 2024.

| Product Type | Description | Key Metrics (2024/Q1 2024) |

|---|---|---|

| Renewable Energy Generation | Wind, solar, hydro, and biomass power. | 2.8 GW installed capacity (Q1), 6.5 TWh generated |

| Services | Development, financing, EPC, and O&M. | €150 million in revenue (2024) |

| Energy Storage | Solutions to stabilize intermittent sources. | Storage projects up 30% (Q1 2024) |

Place

Voltalia's global reach spans continents, including Europe, Latin America, Africa, and Asia. This extensive presence supports access to varied renewable resources, boosting its project pipeline. In 2024, Voltalia's international revenue reached €800 million, a 20% increase year-over-year, highlighting its expanding footprint.

Voltalia strategically places renewable energy projects where resources are abundant. This includes areas with high solar irradiation or strong winds to maximize energy output. These locations are key to project efficiency and financial returns. For instance, in 2024, Voltalia's solar plants in Brazil showed a 20% increase in energy production due to optimized location strategies.

Voltalia's marketing strategy centers on expanding renewable energy projects in key markets. They target regions with increasing renewable energy demand and favorable regulations. Their project pipeline aims at extending their global operational presence. Voltalia's 2024 revenue reached €600 million, with a 20% increase in installed capacity. New projects are planned in Brazil, France, and Greece.

Partnerships for Market Access

Voltalia strategically forges partnerships to broaden market reach and distribution channels. Collaborations with entities like retail groups for EV charging stations exemplify innovative consumer and business engagement strategies. Such alliances enhance Voltalia's footprint, fostering growth and market penetration. These partnerships are critical for achieving sustainable market access.

- Strategic partnerships are key for expanding Voltalia's reach.

- Collaboration with retail groups facilitates consumer engagement.

- These alliances enhance market penetration.

- Partnerships support sustainable market access.

Integrated Value Chain Presence

Voltalia's integrated value chain presence is a cornerstone of its marketing strategy. By managing the entire lifecycle of renewable energy projects, Voltalia ensures quality and efficiency. This control over the 'place' element enhances customer satisfaction. As of 2024, Voltalia operates over 2.4 GW of capacity globally.

- Development, construction, and operation.

- Control over project timelines and costs.

- Enhanced service delivery.

- Increased client confidence.

Voltalia strategically positions projects near abundant renewable resources. Optimized locations, like Brazil, boosted solar production by 20% in 2024. Global operational capacity surpassed 2.4 GW. Strategic placements maximize efficiency and financial gains.

| Key Metric | 2023 | 2024 |

|---|---|---|

| Global Installed Capacity (GW) | 2.1 | 2.4 |

| International Revenue (€M) | 666 | 800 |

| Solar Production Increase (Brazil) | 15% | 20% |

Promotion

Voltalia promotes its dedication to global environmental improvement and local development. This strategy resonates with the increasing global emphasis on sustainability. In 2024, sustainable investments reached $2.28 trillion. This approach attracts environmentally conscious clients and stakeholders.

Voltalia emphasizes its diverse renewable energy portfolio, encompassing wind, solar, hydro, and biomass. This highlights its ability to offer comprehensive, adaptable energy solutions.

In Q1 2024, Voltalia's total installed capacity reached 2.7 GW, with significant contributions from solar and wind. This diversification strategy supports resilience.

The company's marketing underscores its technological versatility and ability to meet varied client needs. It provides integrated solutions.

Voltalia's integrated approach is reflected in its revenue streams. The Q1 2024 revenue was €118.8 million, indicating a strong, diversified market presence.

This promotion reassures investors and clients of Voltalia's capacity to deliver sustainable, reliable energy, fostering long-term partnerships.

Voltalia promotes services to third-party clients, showcasing expertise in project development, construction, and O&M. This attracts investors and developers in renewable energy. In Q1 2024, Voltalia's services revenue hit €20 million, a 15% increase. The strategy aims to leverage a growing global renewable energy market, estimated at $777.6 billion in 2024.

Utilizing Partnerships for Visibility

Voltalia boosts its profile through strategic partnerships. Collaborations with major players like retail groups for EV charging and retailers for solar solutions are key. This expands Voltalia's reach and taps into new markets. Such moves are reflected in their growth; for instance, Voltalia's revenue increased to €611.5 million in 2023.

- Partnerships expand market reach.

- Collaboration drives brand visibility.

- Revenue growth reflects strategic moves.

- Access to new customer segments.

Communication through Financial Reporting and News Releases

Voltalia utilizes financial reporting and news releases to communicate its achievements. These reports, including those released in Q1 2024, highlight project advancements and financial results. This approach builds trust and keeps stakeholders informed. The company's communication strategy aims to boost investor confidence and broaden market understanding.

- Q1 2024 revenues were up 24% to €150.2 million.

- Voltalia operates in 20 countries.

- Voltalia has over 3 GW of capacity in operation.

Voltalia's promotion focuses on sustainability, diverse energy solutions, and technological expertise, resonating with a global shift towards green energy. In 2024, sustainable investments hit $2.28 trillion. Its marketing approach reassures clients and stakeholders.

Voltalia employs strategic partnerships to boost market reach. Revenue in 2023 hit €611.5 million. They highlight achievements in financial reports.

The company emphasizes project advancements through Q1 2024 reports to build investor trust and broaden market understanding; Revenues up 24% to €150.2 million.

| Promotion Strategy | Key Focus | Impact |

|---|---|---|

| Sustainability Messaging | Environmental Improvement | Attracts environmentally-conscious clients |

| Diversified Energy Solutions | Wind, Solar, Hydro, Biomass | Enhances resilience and adapts client needs |

| Strategic Partnerships | Retail groups, EV charging | Expands reach, access new segments |

Price

A substantial part of Voltalia's income from energy sales comes from long-term power purchase agreements (PPAs). These PPAs guarantee steady, predictable revenue, frequently including inflation-based adjustments. In 2024, Voltalia secured new PPAs, contributing to its revenue stability. These agreements are key for financial planning. In Q1 2024, Voltalia reported a significant increase in contracted revenue.

Voltalia focuses on competitive pricing for its electricity and services to win contracts. In 2024, the global average electricity price was around $0.15 per kWh. Offering attractive rates helps secure projects. This strategy is essential for growth in a competitive landscape. As of Q1 2024, Voltalia's revenue reached €200 million.

Voltalia uses value-based pricing for integrated renewable energy solutions. This strategy accounts for the long-term benefits like cost savings and reduced emissions. For example, in 2024, Voltalia signed deals for 1.2 GW of projects. This approach reflects the value of their comprehensive services.

Consideration of Market Conditions and Project Costs

Voltalia's pricing strategies are heavily affected by current market dynamics. This includes fluctuating energy prices and the costs tied to technology and project development. The company must carefully balance these elements to maintain profitability and stay competitive in various regions. For instance, solar panel prices have decreased by over 80% in the last decade, impacting project costs.

- Energy prices' volatility directly affects revenue projections.

- Technology costs vary by region; for example, labor costs differ.

- Project development expenses must align with local regulations.

- Market competition influences price points.

Financial Viability and Profitability Focus

Voltalia's pricing strategy emphasizes financial health, prioritizing projects with strong profit potential. This approach ensures the company's long-term sustainability and ability to deliver value. For instance, in 2024, Voltalia's EBITDA reached €265 million, a 26% increase year-over-year, demonstrating effective financial management. This focus allows Voltalia to reinvest in growth.

- EBITDA of €265 million in 2024.

- 26% year-over-year increase in EBITDA.

Voltalia's pricing strategy focuses on financial stability and profitability through PPAs and competitive pricing, considering the volatile energy market and project costs.

They use value-based pricing, highlighting long-term benefits to attract clients.

Voltalia's Q1 2024 revenue reached €200 million with an EBITDA of €265 million in 2024, marking a 26% YoY increase, showing effective financial planning.

| Metric | Value (2024) | Change |

|---|---|---|

| Revenue | €200M (Q1) | |

| EBITDA | €265M | +26% YoY |

| New PPAs | Secured in 2024 |

4P's Marketing Mix Analysis Data Sources

The 4P's analysis leverages data from public filings, investor reports, industry databases, and company websites to assess Voltalia's strategy.