Voltalia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Voltalia Bundle

What is included in the product

The analysis provides forward-looking insights to support scenario planning and proactive strategy design.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Same Document Delivered

Voltalia PESTLE Analysis

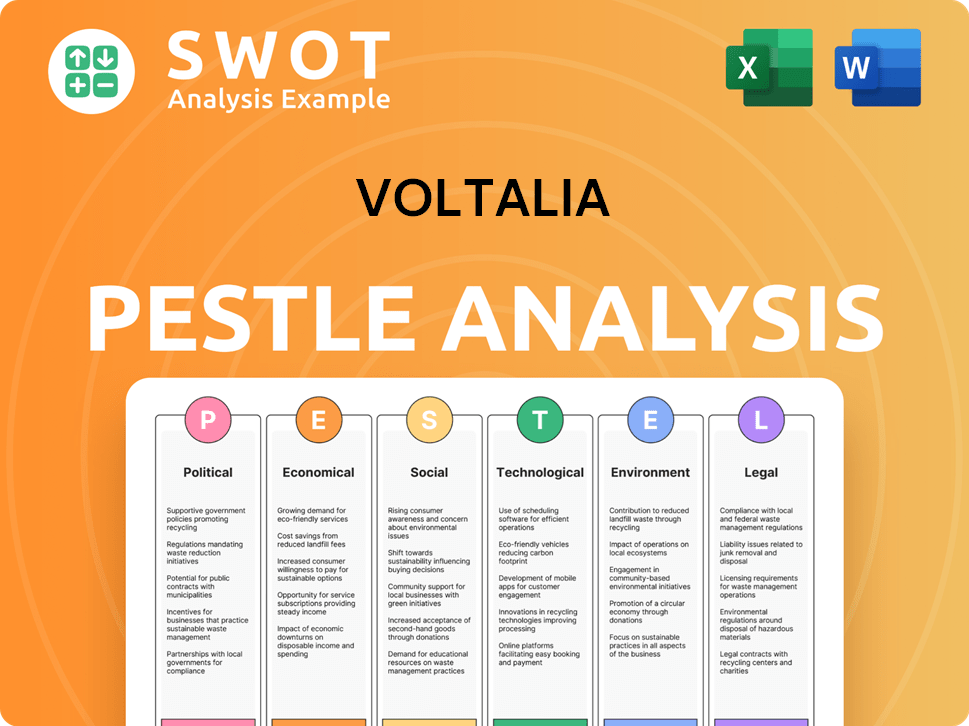

The preview showcases the comprehensive Voltalia PESTLE Analysis you'll receive.

Its complete, professional, and immediately downloadable upon purchase.

See every detail: political, economic, social, technological, legal, & environmental.

Get the full picture with the file as it is. The actual file is identical.

PESTLE Analysis Template

Navigate the complexities facing Voltalia with our detailed PESTLE analysis. We examine the critical political, economic, social, technological, legal, and environmental factors affecting its performance. Uncover potential threats and opportunities. Make informed decisions with our insights—download the full report now!

Political factors

Government support, through incentives and subsidies, is vital for renewable energy firms like Voltalia. Globally, governments are establishing ambitious renewable energy targets, fostering growth. For example, the EU aims for at least 42.5% renewable energy by 2030. This creates a favorable setting for Voltalia's expansion and project development.

Voltalia's global presence, spanning Europe, Latin America, Africa, and Asia, exposes it to varied political landscapes. Political stability is crucial for project continuity and investment security. Regions with instability risk policy shifts, regulatory hurdles, and asset vulnerabilities. For example, in 2024, political instability in certain African nations impacted project timelines. In 2025, Voltalia monitors political risks closely.

International climate agreements, like the Paris Agreement, boost renewable energy demand. These agreements shape national policies, benefiting Voltalia's services. The global push for decarbonization significantly supports the company. The global renewable energy market is projected to reach $1.977 trillion by 2030, according to a report by Grand View Research.

Trade Policies and Tariffs

Voltalia faces political risks tied to trade policies and tariffs, which significantly affect its operations. Trade barriers on solar panels and other renewable energy components can increase project costs, potentially reducing profitability. For instance, the US imposed tariffs on solar imports, impacting project economics. Changes in trade regulations between countries where Voltalia operates or sources equipment can disrupt supply chains and affect project feasibility.

- US tariffs on solar panels can increase project costs by 10-20%.

- Changes in EU trade policies may impact Voltalia's sourcing from Asia.

- Trade disputes can delay project timelines and increase financial risks.

Energy Policy and Regulation

Government energy policies and regulations are crucial for Voltalia's renewable energy projects. These policies, which cover grid connections, pricing, and environmental permits, differ widely across countries. For instance, in 2024, the EU's Renewable Energy Directive set ambitious targets, influencing Voltalia's strategy. Navigating these regulations is essential for project success and cost management.

- EU's Renewable Energy Directive set targets for 2030, impacting Voltalia.

- Grid connection regulations vary, affecting project timelines.

- Electricity pricing policies influence project profitability.

- Environmental permitting can delay and increase project costs.

Government incentives, like EU's 2030 targets, drive Voltalia's growth. Political stability and favorable policies are key to investment security. Trade policies, tariffs, and regulatory changes impact costs and project timelines. The global renewable energy market is projected to reach $1.977 trillion by 2030.

| Factor | Impact on Voltalia | Data/Example (2024/2025) |

|---|---|---|

| Government Support | Positive: Boosts growth | EU aims for 42.5% renewables by 2030 |

| Political Stability | Critical for projects | Instability in Africa delayed projects |

| Trade Policies | Affects costs/timelines | US tariffs on solar increased costs 10-20% |

Economic factors

Voltalia's revenue is highly sensitive to electricity prices. Wholesale electricity price fluctuations, driven by supply, demand, and fuel costs, directly impact its financial results. In 2024, European power prices saw volatility, with spikes due to geopolitical events. The company's profitability is thus linked to these market dynamics.

Inflation significantly affects Voltalia's operational costs, including materials and labor. As of May 2024, the Eurozone's inflation rate is around 2.6%. Currency fluctuations also pose risks. In Q1 2024, the EUR/BRL exchange rate saw volatility, impacting Voltalia's Brazilian operations. These factors require careful financial planning.

Voltalia heavily relies on financing for its renewable energy projects. Securing favorable terms, like green bonds, is vital. In 2024, green bond issuances hit $400 billion globally. Access to capital impacts project development. Syndicated loans also play a key role.

Economic Growth and Energy Demand

Economic growth significantly shapes energy demand where Voltalia operates. Rising economic activity typically boosts electricity consumption, benefiting Voltalia's expansion. For example, Brazil's GDP grew by 2.9% in 2023, increasing energy needs. Voltalia can capitalize on this growth by increasing its renewable energy supply.

- Brazil's 2.9% GDP growth in 2023 drove energy demand.

- Voltalia can expand renewable capacity to meet rising needs.

Cost Competitiveness of Renewable Energy

The falling costs of renewable energy, especially solar and wind, are boosting their competitiveness against fossil fuels. This trend directly benefits companies like Voltalia, improving the economic feasibility of their projects. This cost advantage makes Voltalia more appealing to clients and investors looking for sustainable energy solutions.

- Solar PV costs fell 89% from 2010 to 2023, making it highly competitive.

- Wind energy costs decreased 60% to 70% in the same period.

- Voltalia's focus on these technologies aligns with this cost-effective trend.

Voltalia faces market-driven revenue volatility, with wholesale electricity price changes impacting its financial results; the Eurozone's May 2024 inflation at 2.6% affects costs, including currency impacts. Financing, such as green bonds which hit $400B globally in 2024, influences project viability.

Economic growth, like Brazil's 2.9% GDP in 2023, fuels demand and opportunities.

Decreasing renewable energy costs strengthen their competitiveness, like solar PV costs dropping 89% from 2010 to 2023. These factors shape Voltalia’s operations and success.

| Economic Factor | Impact on Voltalia | Data Point (2023/2024) |

|---|---|---|

| Electricity Prices | Revenue Volatility | European Power Price Volatility |

| Inflation | Operational Costs | Eurozone Inflation: 2.6% (May 2024) |

| Financing | Project Development | Green Bond Issuances: $400B (2024) |

Sociological factors

Public opinion significantly impacts renewable energy projects. In 2024, 88% of Americans supported expanding solar power. Community engagement is crucial for Voltalia. Addressing local concerns helps secure project approvals and avoid delays. Successful projects often prioritize transparent communication and community benefits.

Voltalia's ventures generate employment opportunities during construction, operation, and maintenance, boosting local economies. In 2024, renewable energy projects created over 10,000 jobs globally. These efforts enhance community relations by promoting local employment and economic growth. For example, in Brazil, Voltalia's projects have significantly contributed to regional GDP.

Voltalia must build strong relationships with local communities. This includes landowners and other stakeholders, critical for project development. Effective engagement, including addressing grievances and incorporating feedback, is essential. In 2024, Voltalia's community investment reached €2.5 million. This investment supported local initiatives, improving social acceptance and project sustainability.

Awareness and Adoption of Clean Energy

Public awareness of climate change is boosting demand for clean energy. This shift impacts consumer choices and corporate sustainability plans, creating opportunities for Voltalia. Globally, the renewable energy market is expanding, with significant growth expected. For example, the International Energy Agency (IEA) projects a substantial increase in renewable capacity by 2025.

- Consumer preference for sustainable products.

- Corporate commitments to reduce carbon emissions.

- Government incentives for renewable energy adoption.

- Increased media coverage of climate issues.

Workforce Skills and Availability

The availability of a skilled workforce is crucial for Voltalia's projects. A trained workforce is essential for the construction, operation, and maintenance of renewable energy plants. Regions with a skilled workforce will see more efficient project execution. The renewable energy sector's workforce grew significantly, with over 3.8 million jobs globally in 2023, and is projected to continue growing.

- In 2023, the global renewable energy sector employed over 3.8 million people.

- The U.S. solar industry's workforce increased by 3.4% in 2023.

- Skills training programs are vital for meeting the industry's growing labor demands.

Consumer demand and corporate sustainability initiatives fuel renewable energy growth, creating opportunities for Voltalia. Public awareness and government incentives are also crucial. Workforce availability and skills training remain critical for efficient project execution and sector expansion. In 2024, US solar workforce grew by 3.4%.

| Factor | Impact on Voltalia | Data Point (2024-2025) |

|---|---|---|

| Public Opinion | Influences project approval & support | 88% US support solar expansion (2024) |

| Community Engagement | Builds social acceptance | Voltalia's community investment €2.5M (2024) |

| Workforce Availability | Affects project execution | US solar industry's workforce +3.4% (2024) |

Technological factors

Advancements in renewable energy technologies are crucial for Voltalia. Solar panel efficiency has increased, with some panels exceeding 24% efficiency in 2024. Wind turbine technology continues to evolve, and energy storage solutions are becoming more efficient. These improvements can lower costs, enhance project performance, and boost energy production.

Energy storage solutions, especially batteries, are vital for managing the variability of renewable energy. Voltalia boosts the dependability and operational control of its plants by incorporating storage. For instance, in Q1 2024, Voltalia increased its battery storage capacity by 20% across its projects. This growth is set to continue, with an anticipated 30% increase by the end of 2025.

The evolution of grid technology, including smart grids, is crucial for integrating renewable energy. Modern grids reduce curtailment and boost efficiency. The global smart grid market is projected to reach $61.3 billion by 2024. Investments are increasing to modernize infrastructure.

Digitalization and Data Analytics

Voltalia can significantly enhance its operations by embracing digitalization and data analytics. These technologies allow for predictive maintenance, reducing unexpected downtime and increasing efficiency. For example, integrating AI can optimize energy production and asset management. In 2024, the global predictive maintenance market was valued at $6.9 billion, expected to reach $28.5 billion by 2030.

- Predictive maintenance can reduce downtime by up to 50%.

- AI-driven optimization can improve energy output by 10-15%.

- Data analytics enhances decision-making in real-time.

- Digitalization streamlines operational processes.

Innovation in Project Development and Construction

Voltalia can leverage innovative project development and construction techniques to improve efficiency. Modular construction and advanced modeling can speed up deployment and cut costs. For example, the global modular construction market is expected to reach $157 billion by 2025. Staying current with these advancements helps maintain a competitive advantage.

- Modular construction can reduce project timelines by up to 50%.

- Advanced modeling tools can decrease design errors by 20%.

- The use of drones for site monitoring can improve safety and reduce labor costs by 15%.

Technological advancements are vital for Voltalia's success. Efficient solar panels, improving wind turbines, and energy storage solutions enhance operational performance. Data analytics, digital solutions, and innovative construction techniques drive further efficiencies. The modular construction market is expected to hit $157B by 2025, offering substantial benefits.

| Technology Area | Specific Advancement | Impact on Voltalia |

|---|---|---|

| Solar Panels | Efficiency exceeding 24% | Increased energy production, lower costs |

| Energy Storage | 20% increase in battery storage in Q1 2024 (with a projected 30% increase by the end of 2025) | Improved reliability, operational control |

| Smart Grids | Market size projected to reach $61.3B by 2024 | Enhanced grid efficiency and integration of renewables |

Legal factors

Voltalia's success hinges on navigating diverse legal landscapes. Regulations cover licensing, permitting, and grid connections. Environmental impact assessments and safety standards also play a crucial role. In 2024, Voltalia secured 1.3 GW of new projects, demonstrating adaptability.

Voltalia's revenue hinges on Power Purchase Agreements (PPAs), making their legal standing crucial. These long-term contracts guarantee income, but legal enforceability is key. Any changes to contract law or disputes could impact Voltalia. In 2024, over 90% of Voltalia's revenue came from PPAs.

Voltalia must comply with environmental laws. Securing permits and meeting environmental standards throughout project lifecycles is crucial. In 2024, environmental compliance costs represented a notable portion of operational expenses. For instance, in Q3 2024, they spent €1.5 million on environmental compliance across its projects.

Land Use and Zoning Laws

Land use and zoning laws significantly affect Voltalia's renewable energy project locations. These regulations determine where projects can be built, requiring careful navigation. Securing land rights and permits is essential for project development. For example, in 2024, permitting delays in the US caused some project postponements.

- Permitting delays can push project timelines.

- Land acquisition costs vary by location.

- Zoning restrictions can limit project size.

International and National Legal Disputes

Voltalia faces legal risks from project disputes across diverse jurisdictions. These disputes, concerning contracts or operations, can significantly impact finances and operations. Recent data shows legal provisions rose to €10.7 million in 2023, up from €5.6 million in 2022, reflecting increased litigation. The outcomes of these cases can affect project timelines and profitability.

- 2023 legal provisions: €10.7 million.

- 2022 legal provisions: €5.6 million.

- Impact on project timelines and profitability.

Legal factors substantially shape Voltalia's operations. Licensing, permits, and grid connections require careful compliance. PPAs, vital for revenue, depend on legal enforceability. Environmental regulations, land use laws, and project disputes also introduce risks, exemplified by the rising legal provisions.

| Factor | Impact | Data (2024) |

|---|---|---|

| Permitting Delays | Project delays, cost increases | US project postponements |

| PPAs | Revenue stability | >90% revenue from PPAs |

| Legal Provisions | Financial impact | €10.7M (2023) |

Environmental factors

Climate change increases extreme weather events like storms and floods, potentially damaging Voltalia's renewable energy infrastructure. For example, in 2024, the frequency of extreme weather events rose by 15% globally, as reported by the World Meteorological Organization. This can lead to operational disruptions and financial losses. Physical risks directly affect asset performance.

Voltalia's renewable energy projects face environmental challenges. Projects can affect biodiversity and habitats, requiring mitigation. A 2024 study indicated that 65% of renewable projects need environmental assessments. Voltalia uses site selection and environmental studies. It implements protection measures for local ecosystems, as outlined in its 2024 sustainability report.

Land use is crucial for solar and wind farms. Voltalia aims to use land efficiently. In 2024, agrivoltaics projects increased by 15%. They also develop on degraded land, reducing environmental impact. This approach helps minimize footprint and boosts sustainability.

Water Usage in Hydro and Biomass Projects

Hydro and biomass projects significantly impact water usage and quality, requiring careful environmental management by Voltalia. Compliance with water resource regulations is crucial for sustainable operations. For instance, in 2024, the global hydropower market was valued at approximately $88.4 billion, highlighting the scale of water-related considerations. Moreover, the water footprint of biomass projects, including water consumption for irrigation and processing, needs thorough assessment and management.

- 2024 Global Hydropower Market Value: $88.4 billion.

- Water consumption data for biomass projects is essential for environmental impact assessment.

- Voltalia must adhere to water quality and usage regulations.

Carbon Footprint of the Supply Chain

Even though Voltalia focuses on renewable energy, its supply chain has a carbon footprint, mainly from making and moving components (Scope 3 emissions). Voltalia aims to lower this by choosing low-carbon equipment. Supply chain emissions can be substantial; for example, the International Energy Agency (IEA) in 2024 estimated that manufacturing solar PV modules alone generates significant CO2 emissions. This is a key area for Voltalia to manage.

- Scope 3 emissions often represent a large portion of a company's total carbon footprint.

- The IEA's 2024 report highlights the carbon intensity of solar panel production.

- Voltalia's efforts to use low-carbon equipment are crucial for reducing its environmental impact.

Environmental factors significantly affect Voltalia. Extreme weather risks damage infrastructure; events rose 15% in 2024. Project biodiversity and water usage impacts demand careful management.

Land use and supply chain emissions are critical. Agrivoltaics increased 15% in 2024. Supply chain carbon emissions are also managed. Hydro and biomass impact is also relevant.

| Factor | Impact | Mitigation |

|---|---|---|

| Climate Change | Extreme weather; damage | Infrastructure resilience. |

| Biodiversity | Habitat Impact | Site selection, assessments. |

| Land Use | Footprint, efficiency | Agrivoltaics, degraded land. |

PESTLE Analysis Data Sources

This Voltalia PESTLE analysis is compiled from global databases, policy updates, market reports, and reputable energy sources, guaranteeing credible insights.