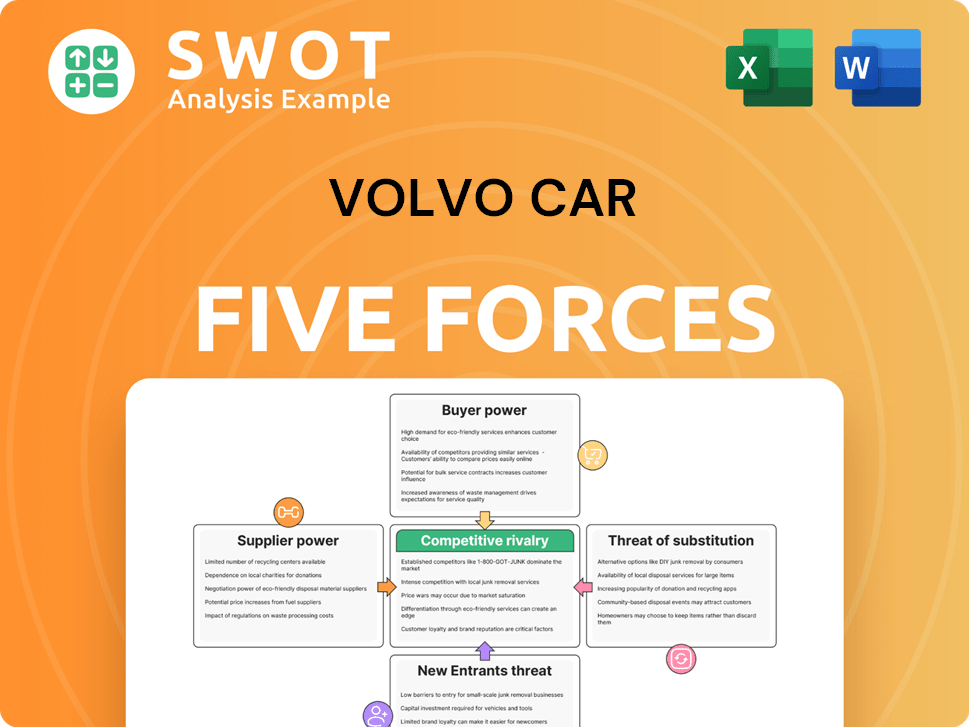

Volvo Car Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volvo Car Bundle

What is included in the product

Analyzes the competitive landscape, supplier & buyer power, & new entrants' threats for Volvo.

Instantly see how your competition is affected. Easily compare Volvo to its rivals.

Full Version Awaits

Volvo Car Porter's Five Forces Analysis

This preview presents the complete Porter's Five Forces analysis for Volvo Cars. The comprehensive document explores competitive rivalry, supplier power, buyer power, threat of substitution, and threat of new entrants. It offers a thorough examination of the automotive industry landscape. You're seeing the final, fully-formatted analysis you'll receive immediately after purchase. This is your ready-to-use analysis; download and benefit instantly.

Porter's Five Forces Analysis Template

Volvo Car faces intense rivalry with established automakers and rising EV competitors. The threat of new entrants is moderate, limited by high capital costs and brand loyalty. Supplier power is a factor, particularly for critical components like batteries. Buyer power is substantial, given consumer choice and price sensitivity. Substitutes, such as public transport, pose a moderate challenge.

The complete report reveals the real forces shaping Volvo Car’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration significantly impacts Volvo's bargaining power. High concentration means fewer suppliers control essential components. This gives them leverage over pricing and terms. For instance, if specialized electronics have few suppliers, Volvo's profits can be squeezed.

High switching costs increase supplier power for Volvo. If changing suppliers demands major production adjustments or design changes, reliance grows. This dependency allows suppliers to negotiate better terms. For example, in 2024, the semiconductor shortage impacted Volvo's production due to limited supplier options.

Suppliers gain power by threatening to enter the automotive market (forward integration). Consider a battery maker: its move into EV production reduces reliance on Volvo, increasing its negotiation leverage. In 2024, the electric vehicle battery market was highly competitive. For instance, CATL and LG Energy Solution are major players.

Impact of Inputs on Quality

The bargaining power of suppliers significantly influences Volvo's operations. Suppliers of critical components, like advanced driver-assistance systems (ADAS), hold considerable leverage. Volvo's reliance on these inputs directly impacts vehicle quality and performance. This dependence strengthens suppliers' ability to influence pricing and terms. Consider that in 2024, ADAS features contributed to a 15% increase in Volvo's vehicle costs.

- Critical Component Dependence: Suppliers of essential parts like ADAS have more power.

- Quality and Performance: Key suppliers directly affect vehicle quality.

- Negotiating Position: Suppliers can dictate pricing and terms.

- Cost Impact: ADAS features increased vehicle costs by 15% in 2024.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences supplier power in Volvo's operations. If Volvo can switch to alternative materials or components, they have more leverage. This reduces their dependence on any single supplier, impacting pricing and supply terms favorably for Volvo. This strategic flexibility is crucial for maintaining profitability and competitiveness. For example, Volvo's move towards electric vehicles (EVs) allows for different component suppliers.

- Volvo's 2023 sales of EVs increased by 50% compared to 2022.

- The global EV market is expected to reach $823.8 billion by 2030.

- Volvo's investments in battery technology aim to diversify its supply chain.

- The diversification of battery suppliers reduces dependence on any single provider.

Supplier power affects Volvo's costs and operations. Key suppliers of critical parts like ADAS hold significant leverage. Volvo's dependence impacts vehicle quality and pricing. In 2024, ADAS boosted vehicle costs by about 15%. Strategic flexibility and alternative suppliers is important.

| Factor | Impact on Volvo | Data (2024) |

|---|---|---|

| Supplier Concentration | Higher concentration = Less Power for Volvo | Semiconductor shortage affected production. |

| Switching Costs | High costs = Increased Supplier Power | Major production adjustments increase dependency. |

| Forward Integration Threat | Suppliers enter market = more leverage | Battery makers entering EV market. |

| Substitute Inputs | Alternatives = More Power for Volvo | EVs allow different suppliers. |

Customers Bargaining Power

Large-volume buyers, like fleet operators, wield substantial power over Volvo. These buyers, highly price-sensitive, purchase vehicles in bulk. They can negotiate discounts and favorable terms due to their ability to switch to competitors. In 2024, fleet sales accounted for roughly 15% of Volvo's total vehicle sales globally, showcasing this impact.

Customers armed with information on Volvo Car Porter's offerings gain significant leverage. In 2024, online platforms and reviews heavily influence car-buying decisions. Sites like Edmunds and Kelley Blue Book provide pricing and feature comparisons. This data availability strengthens customer bargaining power.

Low switching costs amplify customer bargaining power. Easy brand changes force Volvo to offer competitive prices. In 2024, the average car ownership duration was about 6-7 years, indicating potential for customer shifts. Brand loyalty and differentiation strategies are crucial to retain customers. Consider that Tesla's market share grew significantly, showing the impact of switching.

Price Sensitivity

Price-sensitive buyers often seek the lowest price. Volvo might face pressure to cut prices, affecting profits. This is relevant in segments with cheaper brands. In 2024, Volvo's average transaction price was around $65,000, competing with brands like Tesla and BMW.

- Price wars can hurt profitability.

- Volvo's brand image helps, but price matters.

- Luxury buyers are less price-sensitive.

- Economic downturns heighten price sensitivity.

Product Differentiation

Limited product differentiation amplifies buyer power. If Volvo's cars appear similar to rivals', customers prioritize price. Volvo's brand image and features can reduce buyer power. In 2024, Volvo's sales saw a slight increase, but competition remains fierce. Strong differentiation is crucial for Volvo.

- Price sensitivity increases when products are seen as commodities.

- Unique features and brand loyalty decrease buyer power.

- Volvo's technological advancements aim to differentiate.

- Market analysis shows competitors' pricing strategies.

Customer bargaining power significantly impacts Volvo's profitability. Large fleet buyers and price-sensitive customers can negotiate favorable terms, affecting revenue. In 2024, factors like online reviews and low switching costs intensified customer influence.

Volvo's brand image and product differentiation are vital to mitigate buyer power. Despite an average transaction price of $65,000 in 2024, price wars and economic downturns remain significant threats.

Focus on brand loyalty is crucial to retain customers in a competitive market. Data from 2024 shows the importance of adapting to customer preferences and market dynamics.

| Factor | Impact on Buyer Power | 2024 Data |

|---|---|---|

| Fleet Sales | High | Approx. 15% of Volvo sales |

| Online Information | High | Influential review sites |

| Switching Costs | Low | Avg. car ownership: 6-7 years |

Rivalry Among Competitors

A high number of competitors, like BMW, Mercedes-Benz, and Tesla, increases rivalry. The luxury vehicle market is crowded, intensifying the need for Volvo to stand out. Companies compete on price, features, and service, squeezing profit margins. Volvo's 2023 global sales were around 708,716 cars, showing its need to compete effectively.

Slow industry growth intensifies competition. In a luxury vehicle market, like the one Volvo operates in, slower growth means brands battle fiercely. This leads to price wars, higher marketing costs, and a scramble for customers. For example, in 2024, the global luxury car market grew by only 2-3%, intensifying rivalry among brands.

Low product differentiation heightens rivalry. If Volvo cars seem similar to rivals', price becomes key, potentially sparking price wars. However, a strong brand image and unique features can soften this. In 2024, Volvo's sales grew, but faced intense competition.

Exit Barriers

High exit barriers significantly amplify competitive rivalry. If exiting the automotive market is tough due to high costs or asset specificity, companies remain and fight harder. This intensified competition can result in overcapacity and price wars. For example, in 2024, the automotive industry saw several companies struggling, yet few exited. This impacts profitability across the board.

- High capital investments create exit barriers.

- Long-term contracts and specialized assets restrict exits.

- Government regulations and social costs also raise barriers.

- Companies may prefer to fight for market share.

Advertising and Marketing Spend

Intense competitive rivalry is evident in the automotive industry, with significant advertising and marketing spending. Volvo, like its competitors, allocates substantial resources to marketing to enhance brand recognition and customer appeal. These high expenditures can elevate operational expenses and impact profitability margins. In 2024, the global automotive advertising spend is projected to reach $43.5 billion.

- Automotive advertising spending is high.

- Volvo invests heavily in marketing.

- Marketing increases operational costs.

- High spending impacts profitability.

Competitive rivalry is intense in the luxury car market, with numerous brands vying for customers. Slow market growth, like the projected 2-3% in 2024, intensifies competition. High exit barriers further fuel rivalry, as companies fight for market share rather than exit.

| Aspect | Impact on Rivalry | 2024 Data |

|---|---|---|

| Competitors | High number increases rivalry | BMW, Mercedes, Tesla, and others |

| Market Growth | Slow growth intensifies competition | 2-3% growth in the luxury car market |

| Differentiation | Low differentiation heightens price competition | Volvo faces intense competition in 2024 |

SSubstitutes Threaten

The availability of substitutes poses a threat to Volvo's pricing power. Consumers can choose from various alternatives. These include public transport, ride-sharing services, and used cars. In 2024, the global ride-sharing market was valued at over $100 billion. The attractiveness of these substitutes impacts Volvo's sales.

The price-performance of substitutes significantly impacts their appeal. If competitors offer similar features at lower prices, they become more attractive. For example, Tesla's Model 3, priced around $40,000 in 2024, offers competitive performance to Volvo's offerings. This prompts Volvo to justify its pricing.

Low buyer switching costs amplify the threat from substitutes for Volvo. If customers readily shift to alternatives like public transport or used cars, Volvo must work harder to keep them. The ease of switching to a Tesla, for instance, means Volvo must compete fiercely. In 2024, the used car market saw a 6% increase in sales, indicating customer willingness to switch.

Perceived Level of Product Differentiation

The perceived level of product differentiation significantly impacts the threat of substitutes for Volvo. If Volvo's cars appear similar to competitors, customers might easily switch. A strong brand image and unique features, like Volvo's focus on safety, can mitigate this. However, the increasing popularity of electric vehicles (EVs) presents a challenge.

- Volvo's global sales in 2023 were 708,716 cars, a 15% increase from 2022, showing resilience.

- The EV market's growth rate in 2024 is projected to be around 20-25%, increasing the availability of substitutes.

- Volvo's market share in the premium EV segment needs to be maintained against rivals.

- Investments in autonomous driving technology are crucial for differentiating Volvo.

Technological Innovation

Technological innovation introduces substitutes, like electric scooters and autonomous vehicles, challenging traditional car ownership. In urban areas, these alternatives are gaining traction. Volvo needs to adapt to this shift to stay relevant. The global electric scooter market, for example, was valued at $18.65 billion in 2023. Volvo must embrace these changes.

- Electric scooters and e-bikes offer alternatives, especially in cities.

- Autonomous vehicles could replace traditional car use.

- Volvo must innovate to compete with these new options.

- The rise of shared mobility services adds to the challenge.

Substitutes like ride-sharing and used cars challenge Volvo's pricing. The global ride-sharing market hit over $100 billion in 2024. Tesla, with competitive pricing, adds to the pressure.

| Factor | Impact | 2024 Data |

|---|---|---|

| Ride-sharing market | Increased Availability | $100B+ valuation |

| Used car market | Customer Switching | 6% Sales Increase |

| EV Market Growth | Substitute Appeal | 20-25% Projected |

Entrants Threaten

High barriers to entry protect Volvo from new competitors. The car industry demands substantial capital investments, with billions needed for manufacturing plants and R&D. Technological expertise, particularly in EVs, is crucial. Established distribution networks are also essential; Volvo has spent billions on its global dealer network, making it difficult for new firms to compete. In 2024, the average cost to launch a new car model exceeded $1 billion, highlighting the financial hurdle.

High capital requirements are a significant barrier. Constructing manufacturing facilities, designing vehicles, and creating a brand demand considerable financial backing, as Volvo did. In 2024, the average cost to launch a new car model exceeded $1 billion. This financial burden limits new entrants, particularly in luxury markets.

Established companies like Volvo have advantages due to economies of scale. In 2024, Volvo's production volume allows for lower per-unit costs. This efficiency stems from its extensive manufacturing network and global supply chains. New entrants struggle to match these cost efficiencies, hindering their ability to compete effectively on price. Volvo's production in 2023 was around 613,000 cars.

Brand Loyalty

Strong brand loyalty significantly hinders new competitors. Volvo's long-standing reputation for safety, reliability, and design acts as a major deterrent. This loyalty makes it tough for newcomers to steal customers from established brands like Volvo. In 2024, Volvo's global sales reached approximately 702,000 cars, demonstrating strong customer retention despite market challenges.

- Volvo's brand recognition provides a competitive advantage.

- New entrants face high costs to build similar brand trust.

- Customer stickiness is a key factor in the automotive industry.

Government Regulations and Policies

Government regulations significantly impact the automotive industry, acting as a barrier to entry. Automakers, including Volvo, must adhere to stringent safety, emissions, and fuel efficiency standards. Compliance with these regulations necessitates substantial investment in research, development, and manufacturing processes. These costs can deter new entrants, especially smaller companies lacking the resources to meet these demands.

- Emissions standards, like those in the EU and the US, necessitate costly engine and technology upgrades.

- Safety regulations require rigorous testing and design modifications, adding to expenses.

- Fuel efficiency mandates drive investment in new technologies like electric vehicles (EVs), posing a high barrier for new entrants.

New entrants face high hurdles in the automotive market. Volvo benefits from substantial entry barriers, including high capital costs and established brand loyalty. Regulations and economies of scale further protect Volvo from new competitors. These factors make it difficult for new firms to gain market share.

| Barrier | Impact on Volvo | 2024 Data |

|---|---|---|

| Capital Investment | Reduces new competition | Avg. model launch cost: $1B+ |

| Brand Loyalty | Protects market share | Volvo sales: ~702k cars |

| Regulations | Increases costs | Emissions compliance costs are high |

Porter's Five Forces Analysis Data Sources

This analysis utilizes Volvo Cars' financial reports, automotive industry research, and market share data.