Volvo Car PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volvo Car Bundle

What is included in the product

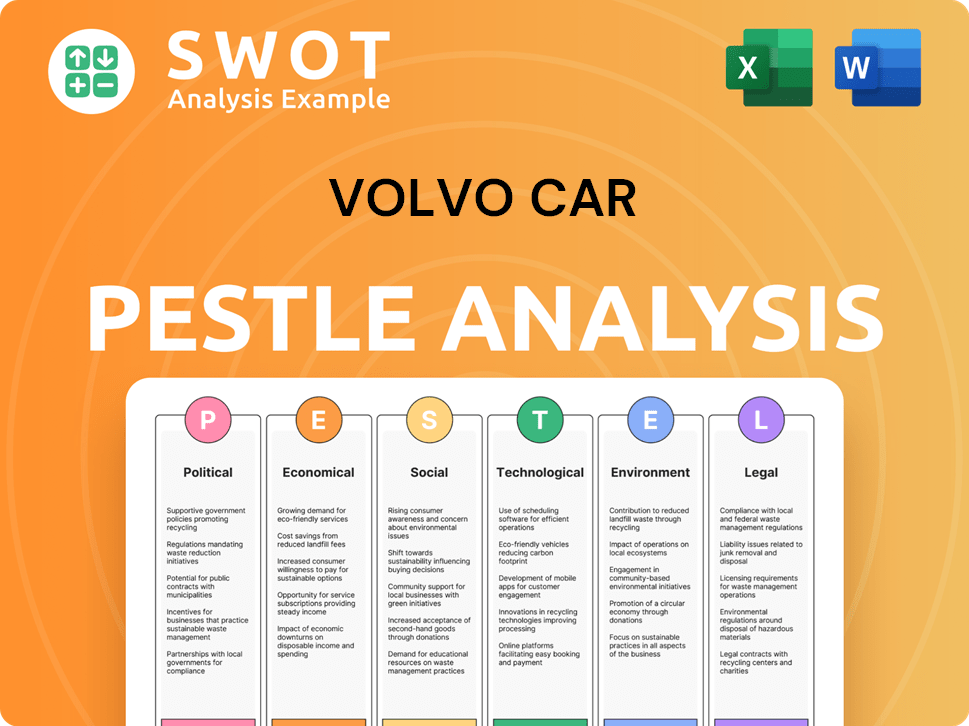

Evaluates how macro-environmental factors influence Volvo Car via Political, Economic, etc.

Helps stakeholders quickly understand external factors impacting Volvo's success.

Preview the Actual Deliverable

Volvo Car PESTLE Analysis

We’re showing you the real product. This is a complete Volvo Car PESTLE analysis.

What you see here is the detailed, ready-to-use file.

Everything you're previewing is the full, final version.

Upon purchase, you'll get the exact document displayed.

Analyze Volvo's business with confidence.

PESTLE Analysis Template

Explore Volvo Car’s future with our PESTLE Analysis. We examine how politics, economics, and technology shape their strategy. Understand social and environmental impacts affecting the brand.

This is key intelligence for strategic decisions and market positioning. Get the full version to gain a competitive advantage and expert insights!

Political factors

Government incentives and regulations play a vital role in boosting EV adoption. In 2024, various countries offer tax credits and subsidies. For example, the US offers up to $7,500 in tax credits. These policies directly impact Volvo's EV sales. Changes in regulations, like emission standards, also affect Volvo's product strategy.

Geopolitical events and trade tensions significantly influence Volvo. Tariffs on imported vehicles and components directly impact production costs and pricing. For instance, the US-China trade war affected global auto supply chains. The imposition of a 25% tariff on imported steel by the US in 2018 increased costs. Uncertainty from potential new tariffs in major markets, like the US, remains a constant concern.

Political stability is vital for Volvo's global operations. Regions with unrest or policy changes can disrupt supply chains. For example, the EU's automotive market saw €1.3 trillion in revenue in 2023. Volvo's 2024 sales reflect this, with 70,000+ units sold in the EU. Stability ensures smooth manufacturing and sales processes.

International Relations and Geopolitical Challenges

International relations and geopolitical challenges significantly impact a global entity like Volvo. Trade disputes, sanctions, and political instability in key sourcing or sales areas can disrupt operations. For instance, in 2024, trade tensions between the EU and China could affect Volvo's production. These factors can lead to increased costs and market volatility.

- EU-China trade disputes could increase tariffs on imported components, affecting Volvo's production costs.

- Political instability in regions like Eastern Europe might disrupt supply chains and sales.

- Sanctions against specific countries could limit Volvo's market access.

Government Support for Manufacturing and R&D

Government backing significantly impacts Volvo's strategic moves. Subsidies for electric vehicle (EV) development and autonomous driving R&D are crucial. For example, the U.S. government's Inflation Reduction Act offers tax credits that could influence Volvo's EV investments. Incentives for local manufacturing also play a pivotal role.

- In 2024, the U.S. government allocated $7.5 billion for EV charging infrastructure.

- China's subsidies for EVs have spurred significant market growth.

- EU regulations set targets for emissions reductions, impacting Volvo's EV strategy.

Political factors greatly influence Volvo's operations. Trade disputes, like those between the EU and China, can increase costs and affect supply chains. Government policies, such as EV subsidies, significantly impact Volvo's strategy and market. Stability in key regions is crucial for uninterrupted manufacturing and sales.

| Political Aspect | Impact | 2024 Data |

|---|---|---|

| Trade Tensions | Increased costs, supply chain disruptions | EU-China trade discussions on EVs, tariffs |

| Government Policies | EV market growth, R&D incentives | US: $7.5B for EV charging; EU: emission targets |

| Political Stability | Smooth operations and sales | 2024 EU auto market: €1.3T revenue |

Economic factors

Global economic growth and consumer spending are critical for Volvo. In 2024, global GDP growth is projected at 2.9%, influencing demand. Luxury vehicle sales are sensitive to economic fluctuations. Consumer confidence and disposable income levels are key factors. Economic downturns can significantly reduce sales.

Currency fluctuations significantly influence Volvo's financials. In 2024, the Swedish Krona's movements against the USD and Euro impacted reported revenues. A strong SEK can reduce the value of overseas earnings. Volvo hedges some currency risk, but exposure remains.

Inflation and increasing raw material costs, especially for batteries, directly impact Volvo's production expenses. This includes elements like lithium and cobalt. In 2024, global battery material prices fluctuated significantly. These cost increases can squeeze profit margins. The company must then decide whether to absorb costs or raise prices.

Interest Rates and Financing Availability

Interest rates are a key economic factor influencing Volvo's financial health. In 2024, rising interest rates globally have made car financing more expensive, potentially reducing consumer demand for vehicles. This impacts Volvo's sales and profitability, as higher rates increase borrowing costs for both the company and its customers. The European Central Bank (ECB) has maintained its key interest rate at 4.5% as of the latest data, influencing financing across the EU.

- ECB key interest rate at 4.5% (2024)

- Higher rates can decrease car sales volume

- Increased borrowing costs for Volvo's operations

Competition and Pricing Pressure

The automotive industry, especially the premium and EV segments, is fiercely competitive. This competition puts significant pricing pressure on manufacturers like Volvo, influencing revenue and profitability. For instance, in 2024, Tesla initiated price cuts on several models, intensifying the need for Volvo to strategically manage its pricing. This dynamic is particularly noticeable in the EV market, where competition is escalating rapidly.

- Tesla's price cuts in 2024 increased competition.

- EV market competition is growing quickly.

- Pricing strategies must be carefully managed.

Economic conditions greatly impact Volvo's performance. Global GDP growth (projected at 2.9% in 2024) affects sales and consumer confidence. Currency fluctuations, such as SEK's strength, influence revenues and profits. Inflation and rising material costs (like battery components) can squeeze margins and affect pricing decisions.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| GDP Growth | Affects Demand | Global GDP: 2.9% (2024 projected) |

| Currency Fluctuation | Impacts Revenue | SEK vs USD/Euro volatility |

| Inflation/Costs | Squeezes Margins | Battery material cost fluctuations |

Sociological factors

Consumer preferences are shifting, with sustainability, safety, and digital connectivity becoming key. Volvo's focus on electric vehicles (EVs) and advanced driver-assistance systems (ADAS) aligns with these trends. In 2024, EV sales are projected to increase by 15% globally. Volvo's market share in the EV segment is targeted at 10% by 2025.

Consumer acceptance of EVs hinges on environmental consciousness, charging infrastructure, and range anxiety. Volvo's EV sales are directly affected by these sociological elements. In 2024, global EV sales rose by 25% compared to 2023, indicating growing adoption. The availability of public chargers increased by 40% in Europe during the same period.

Volvo's reputation for safety is a cornerstone of its brand identity. A 2024 study indicated that 65% of consumers prioritize safety when buying a car. Volvo's commitment to safety features, such as advanced driver-assistance systems, strengthens this perception. The brand must consistently innovate to maintain its leadership in this area, as safety is a key purchasing driver. Data from 2025 shows that Volvo's investment in safety R&D increased by 12%

Urbanization and Mobility Trends

Urbanization and mobility shifts significantly impact Volvo. Rising city populations drive demand for compact, eco-friendly vehicles. Ride-sharing and subscription services challenge traditional ownership models. These trends shape consumer preferences and influence Volvo's product strategies.

- Global urban population is projected to reach 6.7 billion by 2050.

- Ride-sharing market is expected to hit $117 billion by 2025.

- Subscription services in automotive are growing 15-20% annually.

Demographic Shifts andTarget Markets

Demographic shifts play a crucial role in shaping Volvo's target markets. Changes in age distribution and income levels influence consumer preferences and purchasing power. For example, the aging population in Europe presents opportunities for Volvo's safety-focused vehicles. Understanding these trends is essential for effective product development and marketing strategies.

- In 2024, the global population aged 60+ is projected to reach 1.4 billion.

- China's middle class is expanding, increasing demand for premium vehicles like Volvo.

- Millennials and Gen Z are increasingly focused on sustainability, influencing car purchase decisions.

Sociological factors, like sustainability and safety, are reshaping consumer choices in the automotive market. In 2024, 65% of consumers prioritized safety when buying a car, and EVs saw a 25% sales increase. Volvo’s strategic focus on these areas positions it well for continued growth.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Consumer Preferences | Sustainability & Safety | EV sales increased 25%; Safety is top priority |

| Urbanization | Demand for Compact EVs | Ride-sharing market: $117B by 2025 |

| Demographics | Aging population & middle class | Global 60+ population: 1.4B in 2024 |

Technological factors

Volvo must navigate rapid EV tech advancements. Battery tech, charging infrastructure, and powertrain efficiency are key. Staying ahead is vital for its EV success. In 2024, EV sales grew, with Volvo's Recharge models increasing market share. Investment in these areas is crucial.

The evolution of autonomous driving is reshaping the automotive landscape. Volvo is actively investing in advanced driver-assistance systems (ADAS) and self-driving technologies. In 2024, Volvo aims to enhance its "Ride Pilot" system. This will allow hands-free driving in specific conditions. Volvo's commitment to safety is key in this tech shift. They allocated $1.5 billion for autonomous driving development in 2023.

Volvo is responding to the rise of digitalization by enhancing its infotainment systems and connectivity features. In 2024, Volvo invested heavily in software development, allocating 15% of its R&D budget to digital services. The demand for over-the-air updates and advanced in-car tech is growing, with connected car services generating $50 million in revenue in Q1 2024. By 2025, Volvo aims to have all new models fully connected, increasing digital service revenue by 20%.

Manufacturing Technology and Automation

Volvo's adoption of advanced manufacturing technologies is critical. Automation and smart factories boost efficiency and cut expenses. These technologies also refine vehicle quality. Volvo aims to integrate these advancements across its operations. The company's investment in these areas is substantial, with a focus on sustainable practices.

- Volvo's Ghent plant in Belgium uses advanced automation.

- Smart factory initiatives are key for cost reduction.

- Quality control is enhanced via automated systems.

- Investments in these technologies reached $500 million in 2024.

Battery Production and Supply Chain Innovation

Volvo's success hinges on battery advancements. Innovation in battery production, including material sourcing and new chemistries, is crucial. This impacts EV scaling and cost management. The global lithium-ion battery market is projected to reach $130.7 billion by 2025, per Statista.

- Volvo aims for 100% electric car sales by 2030.

- Securing raw materials, like lithium and cobalt, is essential.

- Battery tech improvements directly influence EV range and charging times.

Volvo's focus on EV tech includes battery tech, charging and powertrain efficiency. EV sales in 2024 saw Volvo's Recharge models increase. Autonomous driving tech is vital. Volvo invested $1.5B in 2023.

Digitalization boosts infotainment. Connected services brought in $50M in Q1 2024, aiming for a 20% revenue increase by 2025. Advanced manufacturing uses automation for cost savings; investments hit $500M in 2024.

| Technology Focus | Investment/Impact | 2024 Data/Target |

|---|---|---|

| EV Development | Battery Tech, Charging, Powertrain | Recharge Models: Increased Market Share |

| Autonomous Driving | ADAS, "Ride Pilot" System | $1.5B Investment (2023), Ongoing Enhancement |

| Digitalization | Infotainment, Connectivity, OTA Updates | $50M Revenue (Q1 2024), 20% Revenue Increase (2025 Target) |

Legal factors

Volvo faces stringent vehicle safety standards globally, demanding ongoing investment in safety tech. These regulations significantly impact R&D budgets. For example, in 2024, Volvo allocated approximately $1.8 billion to safety-related research. Compliance costs, including testing and certification, are considerable. Failure to meet these standards can lead to hefty fines and market access restrictions.

Environmental regulations are crucial for Volvo. Stricter emissions standards globally, including Euro 7, push Volvo towards electric vehicles (EVs). In 2024, Volvo increased EV sales by 15%, showing adaptation. Meeting CO2 targets affects production costs and strategic planning.

Volvo faces stringent data privacy laws. The company must adhere to GDPR and CCPA, impacting data handling practices. Cyberattacks are a threat; in 2024, cybercrime cost the automotive industry billions. Strong cybersecurity is crucial to protect customer data.

Product Liability Laws

Volvo faces product liability laws, posing legal and financial risks from vehicle defects or accidents. In 2024, automotive product liability claims averaged $500,000 per case. The company must adhere to stringent safety standards and recall procedures. Non-compliance can lead to significant penalties and reputational damage. Legal costs and settlements can severely impact profitability.

- Average product liability claims in 2024: $500,000 per case.

- Stringent safety standards and recall procedures are mandatory.

- Non-compliance may result in penalties and reputational damage.

Labor Laws and Employment Regulations

Volvo Cars must comply with diverse labor laws across its global operations. These regulations shape HR practices, including hiring and working conditions. Non-compliance can lead to legal issues and financial penalties. For example, in 2024, labor disputes in Sweden impacted production.

- In 2024, Volvo faced labor disputes in Sweden affecting production.

- Compliance costs are a significant operational expense.

- Regulations vary widely by country, increasing complexity.

- Restructuring efforts must adhere to local labor laws.

Volvo adheres to strict safety regulations, allocating ~$1.8B for safety R&D in 2024. Product liability remains a concern, with average claims at $500K/case. Labor laws and data privacy (GDPR, CCPA) also present significant challenges, increasing compliance costs and risks.

| Regulation Area | Impact | 2024 Data |

|---|---|---|

| Safety | High R&D costs, compliance needs | ~$1.8B in safety-related R&D |

| Product Liability | Financial risk from defects | $500K average claim/case |

| Labor | HR practice shaping, production affected | Sweden labor disputes |

Environmental factors

Climate change and sustainability are significant factors. Consumer demand for sustainable products is increasing, with electric vehicles (EVs) gaining popularity. Volvo's focus on sustainability is a core strategy. In 2024, Volvo aimed for 100% electric car sales by 2030. The company's commitment is evident in its initiatives.

Governments globally are tightening emissions rules. They're also setting CO2 reduction goals. This pushes Volvo to speed up its shift to electric vehicles. For example, the EU aims for a 55% emissions cut by 2030. Volvo plans to be fully electric by 2030, ahead of many competitors, aligning with these targets.

The expansion of charging stations is key for EV adoption. Volvo's EV sales growth directly correlates with charging infrastructure. In Q1 2024, the U.S. saw over 6,000 new public charging ports added. This growth is essential for Volvo's EV market penetration, targeting a 50% EV sales share by 2027.

Sourcing of Raw Materials for Batteries

Volvo's PESTLE analysis must consider the environmental impact of sourcing raw materials for EV batteries. Cobalt and lithium mining, crucial for battery production, raise ethical and environmental concerns. These include habitat destruction and water pollution. Volvo is working to ensure responsible sourcing of materials, including investments in sustainable supply chain practices.

- In 2024, the global lithium market was valued at approximately $24.8 billion.

- The Democratic Republic of Congo (DRC) accounts for about 70% of global cobalt production.

- Volvo aims for 100% climate-neutral operations by 2040.

Recycling and End-of-Life Vehicle Disposal

Volvo faces increasing pressure from regulations and consumers to manage vehicle recycling and disposal responsibly. This includes the sustainable handling of EV batteries. The company must create effective end-of-life strategies. In 2024, the global recycling rate for end-of-life vehicles was approximately 90%. Volvo aims to enhance its recycling processes.

- EU regulations mandate specific recycling targets for vehicles and batteries.

- Consumer demand for sustainable products is growing, influencing purchasing decisions.

- Volvo invests in battery recycling technologies and partnerships.

- The company is working to minimize environmental impact.

Environmental factors significantly influence Volvo. Consumer demand for EVs is rising, driving the need for sustainable materials. Regulations on emissions and waste management push Volvo to adapt.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Sustainability Focus | EV shift, material sourcing, and recycling efforts | $24.8B Global Lithium Market (2024). Volvo's aim: 100% climate-neutral by 2040. |

| Regulations | Emission rules, recycling mandates, and battery handling. | EU targets a 55% emission cut by 2030. Approx. 90% global vehicle recycling rate (2024). |

| Consumer Demand | Increased preference for EVs, influencing purchase decisions. | EV sales are crucial, aiming for 50% sales share by 2027. The DRC: 70% of Cobalt. |

PESTLE Analysis Data Sources

This Volvo PESTLE draws from diverse sources: governmental reports, industry analyses, and economic forecasts, ensuring accurate insights.