Voya Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Voya Financial Bundle

What is included in the product

Tailored analysis for Voya's product portfolio, outlining strategies for each quadrant.

One-page overview placing each business unit in a quadrant.

What You See Is What You Get

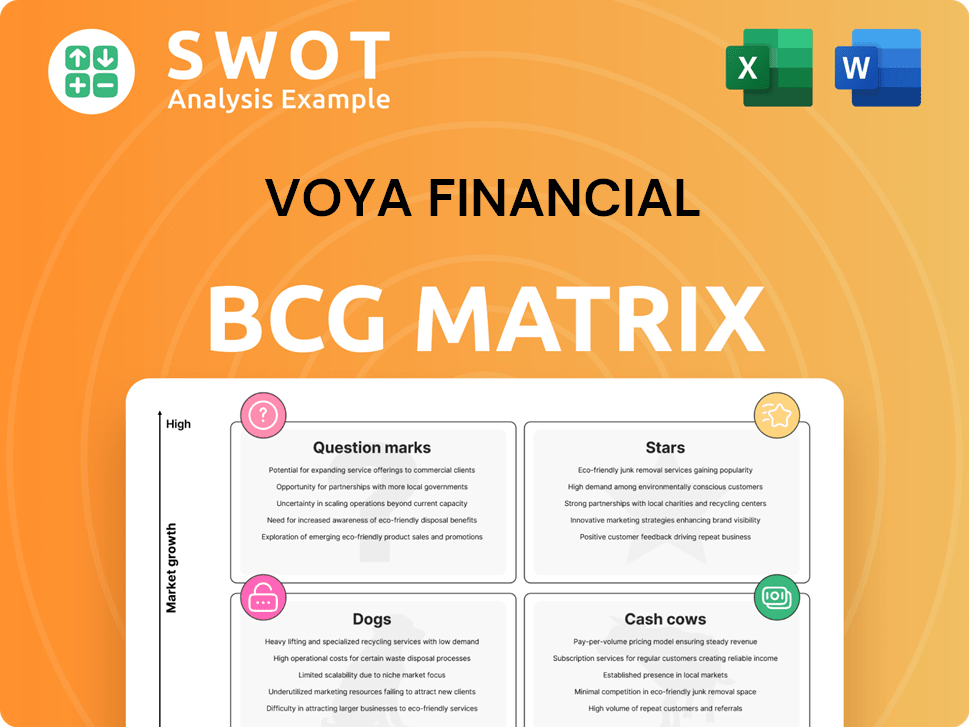

Voya Financial BCG Matrix

The displayed Voya Financial BCG Matrix preview is the complete document you'll receive after purchase. This comprehensive analysis is yours instantly, ready for your strategic insights.

BCG Matrix Template

Explore Voya Financial's strategic landscape with a glimpse into its BCG Matrix. See how their diverse offerings—from retirement plans to investments—are categorized. This preview hints at the strengths and challenges within each market segment. Get the full BCG Matrix report for data-driven analyses and action plans—unlocking a strategic advantage.

Stars

Voya's Wealth Solutions is a key revenue driver, showing strong performance. It benefits from growing fee-based revenues and alternative investment income. This segment serves around 60,000 retirement plans and nearly 8 million participants. In Q3 2024, Wealth Solutions reported $438 million in pre-tax earnings.

Voya Investment Management is thriving, fueled by net inflows and favorable markets. A strategic move into Sconset Re bolsters its position in the insurance sidecar market. They oversee nearly $340 billion in assets, supported by over 300 investment experts. This segment demonstrates Voya's active investing legacy.

Voya Financial has made strategic acquisitions to boost its market standing. A key move was acquiring OneAmerica Financial's retirement plan business. This acquisition provides significant scale to Voya's retirement business within Wealth Solutions. As of Q3 2024, Voya's Wealth Solutions reported $387 billion in assets under management. Successfully integrating these acquisitions is vital for maintaining its strong performance.

Digital Capabilities

Voya Financial's digital capabilities are a key growth driver. They're investing in tech to improve user experience. These platforms support financial professionals and their clients. This focus helps Voya in key markets. In 2024, Voya reported increased digital platform usage by 15%.

- myVoyage platform enhances participant education.

- Investments support financial professionals.

- Focus drives growth in key markets.

- Digital platform usage increased by 15% in 2024.

Capital Management

Voya Financial's capital management strategy is key to boosting shareholder value, primarily through share repurchases and dividends. In 2024, Voya allocated $800 million to return capital to its shareholders. The company anticipates higher excess capital generation in 2025, fueled by expansion in its core business. This growth is also expected to be driven by the acquisition of OneAmerica.

- Share repurchases and dividends are used to enhance shareholder value.

- $800 million of capital returned to shareholders in 2024.

- Increased excess capital generation is expected in 2025.

- Growth expected from the OneAmerica acquisition.

Voya's Wealth Solutions and Investment Management segments are highlighted as "Stars" due to their strong performance and growth potential. Wealth Solutions benefits from expanding fee-based revenues and successful acquisitions. Voya Investment Management is fueled by net inflows and strategic market moves. In 2024, both segments drove significant revenue.

| Segment | Key Drivers | 2024 Performance Highlights |

|---|---|---|

| Wealth Solutions | Fee-based revenues, acquisitions | $438M pre-tax earnings in Q3; $387B AUM |

| Investment Management | Net inflows, strategic moves | Nearly $340B AUM |

| Digital Capabilities | Tech investment, user experience | 15% increase in digital platform usage |

Cash Cows

Voya Financial's retirement plan services, like 401(k) and 403(b) plans, are a stable source of income. As of 2024, they serve a large customer base. Voya is a leading retirement plan provider in the U.S., with around 39,000 employers and over 7 million participants. These services consistently bring in revenue and cash flow for Voya.

Voya Financial's stable value products provide steady returns in a market. These offer reliable income, with low promotional investment. They're key for a stable financial base. In 2024, these products generated a solid revenue stream, supporting Voya's financial stability.

Voya Financial leads in its large market segment, managing substantial recordkeeping assets. This segment is a major revenue source, though growth is moderate compared to newer markets. In 2024, Voya's assets under management reached $826 billion. Sustaining this leadership is key for consistent cash flow generation. The company focuses on maintaining its strong position in this established market.

Fee-Based Revenue Growth

Voya Financial's capacity to increase fee-based revenue within Wealth Solutions and Investment Management is a major advantage. This income stream is boosted by net inflows, favorable capital markets, and performance fees. For instance, in 2024, Voya's Investment Management segment saw positive net flows. Expense management is also critical. This approach boosts profitability.

- Positive Net Flows: Investment Management segment in 2024.

- Fee-Based Revenue: Wealth Solutions & Investment Management growth.

- Expense Management: Enhances profitability.

Strong Commercial Momentum

Voya Financial's Investment Management arm shows robust commercial momentum, solidifying its cash cow position. This is evident through consistent net inflows, reflecting strong investor confidence. Positive flows within Retail and ongoing growth in the Insurance channel further bolster this trend. Strategic partnerships broaden Voya's distribution reach, supporting continued growth.

- Net inflows in Investment Management indicate strong commercial success.

- Growth in Insurance and Retail channels supports overall momentum.

- Strategic partnerships improve distribution capabilities.

Voya Financial's Cash Cows are core business areas generating consistent revenue and cash. They are characterized by high market share in a stable or slow-growing market, ensuring reliable profitability. Key examples include retirement services, stable value products, and Investment Management. These segments provide Voya with a solid financial base for future growth and investments.

| Segment | Key Feature | 2024 Data |

|---|---|---|

| Retirement Plans | Large customer base | 39,000 employers |

| Stable Value Products | Reliable returns | Generated solid revenue |

| Investment Management | Consistent net inflows | $826B assets under management |

Dogs

Given the shifting market and Voya's priorities, its older long-term care policies might be viewed as "Dogs" in its BCG Matrix. These policies likely have restricted growth prospects and could be capital-intensive. For instance, in 2024, the long-term care insurance market saw a 10% decrease in new policy sales. Divesting or reducing these could free up capital.

Variable annuities could be seen as a "Dog" within Voya Financial's BCG Matrix. Consumer preference shifts towards simpler products and stricter regulations, like those in 2024, could lead to declining demand. Data from 2023 shows a drop in variable annuity sales. Reassessing their strategic fit is thus crucial.

Certain legacy insurance products at Voya Financial might be considered Dogs in its BCG Matrix. These older products likely have a low market share and face limited growth. For example, in 2024, Voya aimed to reduce its exposure to certain legacy products. Focusing on newer, more competitive offerings is key for future success.

Products with High Operational Costs

Products with high operational costs and low returns are "Dogs" in Voya Financial's BCG matrix. These offerings consume significant resources without generating substantial profits, negatively impacting overall profitability. For example, in 2023, Voya's Individual Life segment saw a 3.5% decrease in net income due to rising operational expenses. Streamlining operations or divesting these underperforming products is crucial for improving efficiency and freeing up capital.

- High operational costs paired with low returns define "Dogs."

- They drain resources and decrease profitability.

- Streamlining operations can boost efficiency.

- Divesting can free up capital.

Segments with Declining Revenue

In Voya Financial's BCG matrix, "Dogs" represent segments with declining revenue and low market share. These areas often need significant intervention or divestiture. The company's 2023 results showed that certain segments faced headwinds. Regular reviews are crucial to address these challenges effectively.

- Review segments with persistent revenue declines.

- Assess market share performance in each segment.

- Consider strategic options like turnaround or divestiture.

- Conduct regular performance evaluations.

In Voya's BCG, Dogs have low market share and growth, like certain legacy products. They might need significant capital for marginal returns. In 2024, reducing exposure to underperforming segments was a priority.

| Category | Definition | Voya Examples |

|---|---|---|

| Characteristics | Low market share, low growth, potential capital drain | Older long-term care, legacy insurance, products with high operational costs and low returns |

| Strategic Actions | Divestiture, operational streamlining, turnaround plans | Focus on newer offerings, reduce exposure to underperforming segments |

| 2024 Metrics | 10% decrease in new long-term care sales, reduced exposure plans | Individual Life segment saw a 3.5% decrease in net income in 2023 |

Question Marks

Voya Financial's Health Solutions, especially Stop Loss, struggles with high loss ratios. The health solutions market shows growth potential, but low profitability places it as a Question Mark. To improve, strategic moves and rate increases are crucial. In 2024, the Stop Loss segment faced a challenging environment.

Voya's foray into emerging markets is a Question Mark. These segments boast high growth potential, yet demand substantial investment for market share. Consider the Asia-Pacific's insurance market, projected to reach $1.4T by 2024. Effective penetration and customer acquisition strategies are critical. Success hinges on navigating volatility and competition.

Voya's financial wellness software is a Question Mark in its BCG Matrix. The market is expanding, with a projected value of $1.3 billion by 2024. Voya faces strong competition, requiring significant investment to gain market share. Strategic alliances and innovative features are vital for Voya's success in this arena.

Voluntary Benefits Products

Voya Financial's voluntary benefits products are currently Question Marks in their BCG matrix, signaling potential but requiring strategic execution. These offerings, which include supplemental health and life insurance, need aggressive marketing to capture market share. Targeted campaigns and employer partnerships are crucial for converting these products into Stars. Success hinges on increasing adoption and demonstrating strong growth potential within the market.

- In 2024, the voluntary benefits market is projected to reach $100 billion.

- Voya's market share in this segment is approximately 5%.

- Effective partnerships could increase sales by 15% annually.

- Focus on digital marketing can boost customer acquisition by 20%.

Innovative Retirement Solutions

Innovative retirement solutions represent Question Marks in Voya Financial's BCG matrix, particularly initiatives like the dual Qualified Default Investment Alternative (QDIA). These solutions aim to capture market share but currently require substantial investment with uncertain returns. Voya's success hinges on these innovations proving their value and attracting a significant client base to evolve into Stars.

- Voya Financial's focus on QDIA reflects the industry's shift towards providing better default investment options.

- The retirement market is highly competitive, with firms like Fidelity and Vanguard holding significant market share.

- Continuous innovation and adaptation to evolving market needs are crucial for Voya to compete.

- The success of these solutions will be determined by their ability to generate substantial returns and attract clients.

Voya's QDIA and other retirement solutions are Question Marks, requiring investment. The retirement market is competitive, with firms like Fidelity. Success relies on attracting clients and generating returns.

| Metric | Data |

|---|---|

| Retirement Market Growth (2024) | 8% |

| Voya's Retirement Assets Under Management (2024) | $600B |

| Average QDIA Fees | 0.6% |

BCG Matrix Data Sources

The Voya Financial BCG Matrix uses company financial statements, market research, and analyst reports for accurate positioning.