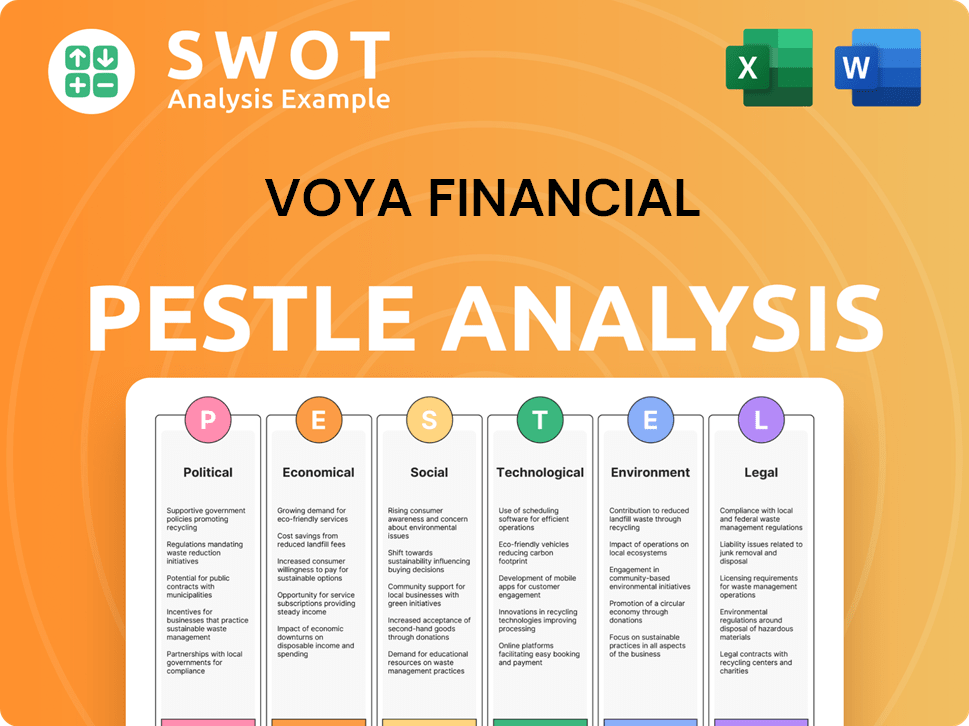

Voya Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Voya Financial Bundle

What is included in the product

Assesses how external factors influence Voya Financial across six areas: Political, Economic, Social, Technological, Environmental, and Legal.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations.

Same Document Delivered

Voya Financial PESTLE Analysis

What you see here is the final Voya Financial PESTLE Analysis.

This document is professionally structured, providing in-depth insights.

It's fully formatted and ready for immediate use upon purchase.

You’ll download this same document—no hidden sections, all content included.

Everything visible here is what you get, ensuring clarity and transparency.

PESTLE Analysis Template

Navigate the complex landscape surrounding Voya Financial with our in-depth PESTLE analysis. We break down critical external factors—political, economic, social, technological, legal, and environmental—impacting the company's strategy. Uncover risks and opportunities to inform your investment or business planning.

Our analysis offers strategic insights, tailored to support smart decisions and thorough risk assessments. Learn about market shifts and their direct influence on Voya's performance and future endeavors. Invest in the full PESTLE analysis for immediate download and a competitive edge.

Political factors

The SECURE Act 2.0, enacted in late 2022, mandates auto-enrollment in 401(k) plans and raises catch-up contribution limits, affecting Voya's product offerings. Changes in retirement account tax treatments could require business model adjustments. The Department of Labor's (DOL) guidance on ESG investing is crucial. Voya's strategies are shaped by the regulatory environment.

Political stability and policy shifts significantly impact Voya Financial. For instance, changes in tax laws, like the 2017 Tax Cuts and Jobs Act, affect investment strategies. The 2024 election results could reshape financial regulations.

Voya Financial, though U.S.-focused, faces risks from global trade and international relations. Market volatility can arise from geopolitical events and policy shifts. For example, in 2024, trade tensions between major economies led to uncertainty. Potential tariffs or sanctions could impact investment performance. These factors necessitate careful risk management.

Government Spending and Fiscal Policy

Government spending and fiscal policies are pivotal for Voya Financial. Economic growth, interest rates, and inflation are impacted by these factors, affecting Voya's investments and product demand. Tax cut extensions, a key policy focus, could influence retirement savings incentives. For instance, in 2024, the U.S. government's spending reached $6.13 trillion.

- Fiscal policy changes can directly affect Voya's profitability.

- Tax policies can change customer savings behavior.

- Interest rate shifts influence investment returns.

Political Contributions and Lobbying

Voya Financial actively engages in political activities and makes contributions to influence policies affecting the financial services sector. Such involvement, as detailed in their reports, demonstrates their strategic efforts to shape the regulatory environment. This approach is crucial for navigating industry changes. Transparency is key.

- In 2023, Voya Financial's political action committee (PAC) contributed approximately $100,000 to federal candidates and committees.

- Voya has increased its lobbying spending to around $1 million annually to influence financial regulations.

- The company's focus includes advocating for retirement savings and investment policies.

Voya Financial's operations are significantly affected by political factors like regulatory changes and fiscal policies. The SECURE Act 2.0 impacts its products and strategies. Also, political contributions are important for policy influence, with Voya's PAC contributing about $100,000 in 2023.

| Factor | Impact | Recent Data |

|---|---|---|

| Regulatory Changes | Affects product offerings, compliance costs | SECURE Act 2.0 auto-enrollment, 2024 election implications |

| Tax Policies | Influences investment strategies, customer savings | 2017 Tax Cuts, potential changes in retirement tax treatments |

| Political Influence | Shapes regulatory environment | 2023 PAC contributions of $100K, $1M lobbying annually |

Economic factors

Interest rate shifts orchestrated by the Federal Reserve significantly influence Voya's investment earnings and the appeal of its financial offerings. Anticipation surrounding rate adjustments can cause bond yield fluctuations. For instance, in 2024, the Fed held rates steady, impacting Voya's fixed-income product performance. In Q1 2024, the 10-year Treasury yield varied, affecting Voya's investment portfolio returns.

Voya Financial's performance is intricately linked to market volatility. Equity and bond market fluctuations directly impact Voya's assets under management and investment returns. For instance, in Q1 2024, the S&P 500 rose 10.2%, boosting asset values. Increased volatility can decrease investor confidence and product demand.

Inflation significantly impacts financial planning, eroding the value of savings and investments. In 2024, the U.S. inflation rate hovered around 3%, influencing consumer behavior. Robust economic growth, like the projected 2.1% for 2024, boosts employment and spending. This growth typically increases demand for financial products, such as retirement plans and insurance.

Employment and Labor Market Conditions

Employment and labor market conditions significantly impact Voya Financial. A robust labor market, characterized by low unemployment and rising wages, boosts individuals' capacity to save and invest, thus increasing demand for retirement and insurance products. According to the Bureau of Labor Statistics, the unemployment rate in March 2024 was 3.8%, indicating a relatively healthy labor market. This positive trend supports contributions to retirement plans and the demand for employee benefits, directly benefiting Voya Financial's business model.

- Unemployment Rate (March 2024): 3.8%

- Wage Growth: Positive, supporting increased savings.

- Impact: Increased demand for retirement and insurance products.

- Benefit: Supports contributions to retirement plans.

Consumer Spending and Confidence

Consumer spending and confidence are key drivers for Voya Financial. High consumer confidence, reflecting economic security, boosts demand for investment and retirement solutions. Increased spending often correlates with greater investment in financial products. For instance, in Q4 2023, consumer spending rose, signaling potential growth in Voya's core markets.

- Consumer spending growth in Q4 2023: ~2.8% (Real GDP)

- Consumer confidence index (Jan 2024): ~114.8 (University of Michigan)

- Projected growth in retirement assets (2024): ~5-7% (Industry estimates)

Economic factors significantly affect Voya Financial's performance. The Federal Reserve's actions, like holding rates in 2024, impact investment earnings. Market volatility, exemplified by the S&P 500's 10.2% Q1 2024 increase, also plays a crucial role. Furthermore, inflation and consumer behavior shape the financial planning landscape.

| Economic Factor | Impact on Voya | Data (2024) |

|---|---|---|

| Interest Rates | Influences investment earnings and product appeal | Fed held rates steady (Q1-Q2 2024) |

| Market Volatility | Affects assets under management and investment returns | S&P 500 up 10.2% (Q1) |

| Inflation | Impacts savings and consumer behavior | Inflation ~3% (2024) |

Sociological factors

Aging populations and increased life expectancies drive demand for retirement solutions and long-term care. In 2024, the U.S. saw over 55 million people aged 65+, increasing the need for financial planning. Voya must adapt to a diverse customer base. The firm needs to tailor services for varied retirement goals.

Financial literacy affects how people understand financial products and plan. Voya offers financial wellness programs and educational tools. A 2024 study showed that only 49% of U.S. adults feel knowledgeable about personal finance. Voya's initiatives aim to bridge this knowledge gap and improve customer engagement.

Consumer preferences are shifting towards digital and personalized financial services. Voya must adapt to meet customer expectations for user-friendly online platforms. Data from 2024 shows a 20% increase in digital interaction. Socially responsible investments (SRI) are growing.

Workplace Trends and Employee Benefits

Workplace dynamics are changing. The gig economy's growth and evolving employee expectations influence demand for retirement plans and insurance. Voya must adapt its offerings. Data from 2024 shows a 20% rise in gig workers. Flexible benefits are key.

- Gig economy workers grew by 20% in 2024.

- Employee demand for flexible benefits is increasing.

- Voya needs to offer adaptable solutions.

Social Responsibility and ESG Awareness

Societal trends significantly impact Voya Financial. Growing ESG awareness influences investment decisions, with ESG assets projected to reach $50 trillion by 2025. Voya's ESG offerings attract customers prioritizing ethical investments. Embracing social responsibility strengthens Voya's market position.

- ESG assets may constitute over 50% of all professionally managed assets by 2025.

- Voya Financial's ESG-focused funds saw increased inflows in 2024.

- Consumer surveys reveal a rising preference for sustainable investment options.

Growing ESG interest affects investments. ESG assets may hit $50T by 2025. Voya's ESG offerings meet ethical demands. These boost market position.

| Factor | Impact on Voya | 2024-2025 Data |

|---|---|---|

| ESG Awareness | Attracts ethical investors | Projected $50T in ESG assets by 2025; Voya's ESG funds see increased inflows in 2024 |

| Digital Preferences | Requires digital platforms | 20% rise in digital interaction in 2024 |

| Gig Economy | Influences retirement plans | 20% rise in gig workers in 2024 |

Technological factors

Voya Financial must enhance digital platforms due to the rise of digital tech and online financial service needs. The company's focus on digital transformation has led to increased online interactions. Voya's investment in technology reached $100 million in 2024, targeting improved customer experiences and operational efficiency. This includes mobile apps and online tools.

Voya Financial must prioritize cybersecurity to protect sensitive customer data. The financial sector saw a 285% rise in cyberattacks in 2023. Cybersecurity spending is projected to reach $10.2 billion by 2025. Strong data protection is vital for regulatory compliance and maintaining customer trust.

Automation and AI are pivotal for Voya Financial. They boost efficiency, personalize customer interactions, and refine risk management. For 2024, Voya is actively integrating AI in customer service. This includes using AI to improve its investment products and services.

Technology Infrastructure and Innovation

Voya Financial heavily relies on its technology infrastructure for operational efficiency and innovation. The company continuously invests in technology to stay competitive, with IT expenses representing a significant portion of its budget. In 2023, Voya allocated approximately $300 million to technology initiatives, including cybersecurity and digital platform enhancements. This investment supports product development and scalability.

- IT expenses reached $300 million in 2023.

- Focus on cybersecurity and digital platforms.

- Supports product development and scalability.

Data Analytics and Big Data

Voya Financial can leverage data analytics and big data to gain insights into customer behavior, market trends, and investment performance. This enables more informed decision-making and personalized service offerings. For example, in 2024, the global big data analytics market was valued at approximately $300 billion, with projections indicating continued growth.

- Personalized Financial Products: Tailoring products based on customer data.

- Risk Management: Improving the accuracy of risk assessments.

- Operational Efficiency: Streamlining processes through data-driven insights.

- Investment Strategies: Enhancing investment decisions.

Voya Financial uses digital tech to enhance platforms, reflected in its $100M tech investment in 2024. Cybersecurity is crucial, with spending projected at $10.2B by 2025 due to rising cyberattacks. AI and automation are key for efficiency and customer personalization.

| Tech Factor | Details | Financial Impact (2024-2025) |

|---|---|---|

| Digital Platforms | Enhance digital services; improve user experience. | $100M Investment in tech. |

| Cybersecurity | Protect data; comply with regulations. | Projected $10.2B spending by 2025. |

| Automation/AI | Increase efficiency, personalize services. | AI integration in customer service in 2024. |

Legal factors

Voya Financial operates under stringent financial regulations at both federal and state levels, covering securities, insurance, and retirement products. Compliance is crucial to avoid penalties and maintain operational licenses. In 2024, the financial services industry faced increased regulatory scrutiny, leading to higher compliance costs. Voya's ability to navigate these complex regulations directly impacts its financial performance and market access. The company must continuously adapt to evolving legal standards to protect its stakeholders.

Consumer protection laws are crucial for Voya Financial. These laws dictate how Voya interacts with customers. They cover marketing, sales, and data handling. Compliance is key to avoid legal problems and maintain trust. For example, the CFPB has fined financial firms millions for consumer protection violations; in 2023, penalties totaled over $1 billion.

Changes in tax laws significantly affect Voya's operations. For example, the SECURE 2.0 Act of 2022 altered retirement savings rules. Corporate tax adjustments, such as the 2017 Tax Cuts and Jobs Act, impact Voya's profitability. Adapting to these shifts is crucial for maintaining competitiveness and ensuring compliance.

Acquisition and Merger Regulations

Voya Financial's acquisitions, like the OneAmerica deal, face strict regulatory hurdles. These include approvals from bodies like the Department of Justice and the Federal Trade Commission. They scrutinize these mergers to ensure fair competition and prevent monopolies. Delays or rejections can significantly impact Voya's strategic plans and financial projections. In 2024, the M&A market saw increased regulatory scrutiny.

- Regulatory approvals can take months or even years.

- Antitrust concerns are a primary focus for regulators.

- Voya must comply with various state and federal laws.

- Failure to comply can result in hefty fines or deal terminations.

Litigation and Legal Disputes

Voya Financial, like all major financial entities, is exposed to litigation risks. These can arise from various aspects of its business. Such as product offerings, service delivery, or general operational practices. The company must actively manage legal risks to protect its financial health and reputation. This includes compliance with complex regulations and the potential for costly legal battles.

- In 2023, the financial services sector saw a significant increase in litigation.

- Voya's legal and regulatory expenses were $100 million in 2023.

- The company must maintain robust compliance programs to reduce legal exposure.

Legal factors significantly affect Voya Financial through regulations, consumer protection, and tax laws. Compliance with evolving standards is essential to avoid penalties. Acquisitions face regulatory hurdles like antitrust reviews, which can delay or halt deals. Litigation risks pose ongoing financial and reputational threats; Voya allocated $100 million for legal expenses in 2023.

| Aspect | Impact | Data Point |

|---|---|---|

| Regulations | Compliance Costs | Financial services saw increased compliance costs in 2024 |

| Consumer Protection | Penalties | CFPB fines totaled over $1 billion in 2023 |

| Litigation | Legal Expenses | Voya’s legal expenses were $100 million in 2023 |

Environmental factors

Climate change escalates natural disaster frequency, impacting Voya's insurance arm with rising claims. For example, the U.S. experienced 28 separate billion-dollar disasters in 2023. This poses investment risks for portfolios linked to susceptible sectors or regions. Voya’s 2023 annual report noted increased climate-related financial risks. Adaptation strategies are vital.

Environmental regulations and policies, although indirectly, influence Voya's operations and investments. The company assesses environmental risks in its investment portfolios, considering factors like climate change. For example, in 2024, the SEC enhanced climate-related disclosures, impacting financial firms. Voya's sustainability reports outline its environmental strategies and impact assessments. These factors are crucial for long-term financial stability.

Voya Financial is responding to increasing customer and investor demand for sustainable practices. This includes integrating environmental considerations into operations and expanding sustainable investment offerings. In 2024, sustainable assets under management (AUM) grew, reflecting this trend. For example, in Q1 2024, Voya's ESG-focused funds saw notable inflows.

Physical Risks to Infrastructure

Voya Financial faces physical risks from extreme weather, impacting its infrastructure and operations, necessitating robust business continuity plans. Climate change increases the frequency and severity of events like hurricanes and floods. These events can disrupt office locations, data centers, and communication networks. The company needs to invest in resilient systems to minimize downtime and financial losses. In 2024, the insurance industry saw over $100 billion in insured losses from natural disasters, underscoring the financial impact.

- 2024 saw over $100 billion in insured losses from natural disasters in the insurance industry.

- Extreme weather events can disrupt office locations and data centers.

- Voya must invest in resilient systems to minimize downtime.

Reputational Risk related to Environmental Performance

Voya Financial's standing is tied to how well it manages environmental issues. Stakeholders, including investors and customers, are paying closer attention to companies' environmental practices. A strong environmental record can boost Voya's image, while shortcomings can lead to negative publicity and reputational damage. In 2024, companies with high ESG ratings saw increased investor interest. In 2025 this trend is expected to continue.

- ESG ratings are increasingly influencing investment decisions.

- Companies with poor environmental records may face investor backlash.

- Commitment to environmental responsibility can enhance brand value.

Environmental factors significantly affect Voya Financial, primarily through climate-related risks like natural disasters, as the U.S. experienced 28 billion-dollar disasters in 2023.

Voya is responding by integrating environmental considerations and expanding sustainable investment options. ESG-focused funds saw inflows in Q1 2024, indicating growing demand.

The company faces physical risks like extreme weather, requiring resilient business continuity plans. The insurance sector reported over $100 billion in insured losses in 2024 due to disasters.

| Environmental Aspect | Impact on Voya | Data Point (2024/2025) |

|---|---|---|

| Climate Change | Increased Insurance Claims | Over $100B insured losses in 2024. |

| Regulations & Policies | Operational & Investment Adjustments | SEC enhanced climate disclosures in 2024. |

| Sustainability Demand | Growth in ESG Funds | ESG funds saw inflows in Q1 2024. |

PESTLE Analysis Data Sources

This Voya Financial PESTLE analysis relies on data from financial reports, regulatory filings, market research, and government publications. It ensures accuracy and reliability through reputable sources.