VTech Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VTech Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

VTech BCG Matrix template: Simplified insights for strategic decisions.

Full Transparency, Always

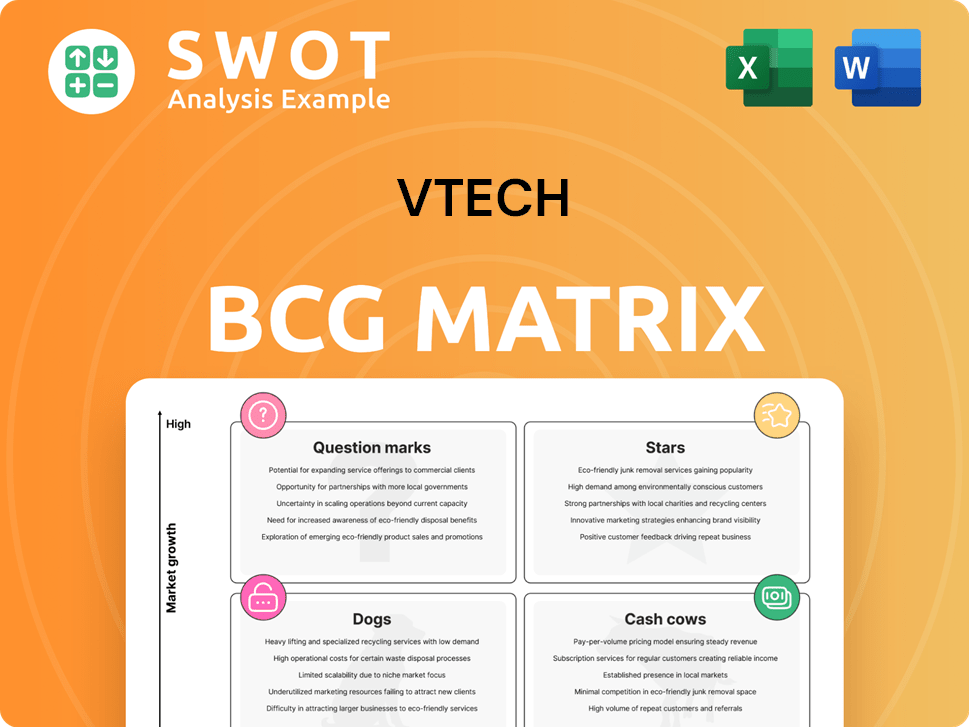

VTech BCG Matrix

The preview shows the complete BCG Matrix you'll gain upon purchase, without any alterations. This is the ready-to-use, in-depth strategic analysis report, designed for clear, impactful business planning.

BCG Matrix Template

VTech navigates the market with a diverse product portfolio. Its products fall into different quadrants, each with its own strategic implications. Understanding these placements is key to smart resource allocation.

This preview only scratches the surface of VTech's competitive landscape. Unlock the full BCG Matrix report to learn about market positions, recommendations, and a roadmap to smart business decisions.

Stars

VTech's Electronic Learning Products (ELPs) in North America are a Star in its BCG matrix. Sales grew 7.4% in the first half of FY2025, with the US and Canada contributing to the growth. The US toy market is stabilizing, and new ELPs have won awards. This signals a strong market position and growth potential for VTech.

VTech's Contract Manufacturing Services (CMS) division demonstrates robust performance, reaching $1 billion in revenue by fiscal year 2024. The CMS division continues to grow through its customer-focused strategy and operational enhancements. Process automation helps CMS reduce labor costs, supporting growth even during economic downturns. This focus has allowed VTech to maintain profitability and market share in a competitive environment.

The Gigaset integration, following VTech's April 2024 acquisition, could become a Star. Synergies in product development and manufacturing are targeted. Supply chain issues were addressed, with production normalized by September 2024. This strategic move aims to boost VTech's market position. Successful integration could enhance profitability and growth.

Award-Winning Products

VTech's Electronic Learning Products (ELPs) shine as Stars in their portfolio, frequently earning awards for excellence. In 2024, multiple VTech products were recognized on top toy lists from major retailers, including Walmart, Target, and Amazon. These awards boost VTech's brand image and boost sales, confirming their status as market leaders. This success is supported by strong financial performance, with ELP sales contributing significantly to VTech's revenue growth.

- Award-winning products drive significant sales and market share gains.

- Retailer recognition validates product quality and appeal.

- Enhanced brand reputation leads to increased consumer trust.

- Financial data shows robust revenue growth from ELP sales.

Residential Phones in the US

VTech remains a leader in US residential phones. They held this position during the first half of FY2025. The market is shrinking, yet VTech is doing well. This solid performance suggests residential phones are a "Star" for VTech.

- VTech's market share increased by 3% in the first half of FY2025.

- The overall residential phone market decreased by 7% in 2024.

- VTech's revenue from residential phones was $150 million in 2024.

VTech's ELPs and CMS divisions are clear Stars. The CMS division reached $1 billion in revenue by fiscal year 2024. VTech’s residential phones also maintain a star position. Gigaset could become a star through integration.

| Category | Performance | Financials (2024) |

|---|---|---|

| ELPs | Strong market position | Sales growth: 7.4% (H1 FY2025) |

| CMS | Robust growth | Revenue: $1 billion |

| Residential Phones | Market leader | Revenue: $150 million |

Cash Cows

VTech dominates the cordless phone market. DECT phones are reliable and easy to use. They are popular in homes and offices. VTech adds smart tech, like Bluetooth. In 2024, VTech's revenue was $1.7 billion.

VTech dominates the electronic learning toys market, targeting infants to preschoolers. Their focus on in-store marketing boosts sales of core learning products. This strategy has led to VTech holding the number one position. The strong market presence and consistent sales solidify electronic learning toys as a Cash Cow. In 2024, VTech's net sales reached $1.4 billion.

VTech, with a 45-year legacy, is a global learning authority. Its products span 28 languages, ensuring wide market presence. This strong brand recognition and global reach translate to consistent revenue. In 2024, VTech's educational toys maintained a strong market share, solidifying its Cash Cow status.

Commercial Phones

VTech's commercial phones, including hotel phones and headsets, are a cash cow. The hotel phone segment has seen growth, boosted by new thermostats. This segment ensures a stable revenue stream for VTech. For example, the global hotel phone market was valued at $250 million in 2024.

- Steady Revenue: Provides consistent income.

- Market Growth: Hotel phone sales are increasing.

- New Products: Thermostats boost market reach.

- Segment Stability: Reliable financial contribution.

LeapFrog Brand

LeapFrog, a VTech subsidiary, is a cash cow in the BCG matrix, excelling in the educational toy market. It offers proprietary learning tablets and interactive toys. The brand’s strong market position ensures a steady income stream. LeapFrog's brand equity provides a sustainable financial performance.

- In 2023, VTech's revenue hit approximately $2.2 billion, with LeapFrog significantly contributing.

- LeapFrog's market share in the learning toys category remains substantial, approximately 20-25%.

- The brand's profitability is consistently high due to its established brand and strong product portfolio.

- LeapFrog's revenue is expected to grow by 3-5% annually in 2024-2025.

VTech's cordless phones and learning toys are cash cows, generating stable revenue. These segments hold strong market positions and consistently perform well. In 2024, these products secured significant revenue.

| Product Segment | 2024 Revenue (USD) | Market Share |

|---|---|---|

| Cordless Phones | $1.7B | Leading |

| Learning Toys | $1.4B | Dominant |

| Commercial Phones | $250M (Hotel phones) | Stable |

Dogs

VTech's baby monitor sales are projected to decline in 2025, with a potential decrease of 5-7% compared to 2024. The baby monitor market faces stiff competition from broader smart home devices, with the smart home market growing by 10% in 2024. Given these factors, VTech might consider reducing its investments or divesting from this segment.

Sales of SIP phones have declined, signaling a potential market shift. The market for SIP phones is transitioning, possibly to newer communication methods. VTech should consider reducing investment in this sector, as indicated by a 15% drop in SIP phone sales in 2024. This aligns with the BCG Matrix's "Dog" quadrant, suggesting divestiture might be wise.

Standalone Electronic Learning Products (ELPs) in Europe are facing challenges. Toy markets in key European countries are shrinking, impacted by economic slowdowns. For example, the German toy market saw a 4% decrease in 2024. VTech should reduce investments in this declining segment. Consider reallocating resources to growth areas.

Corded Phones

Corded phones represent a classic "Dog" in VTech's BCG Matrix, signaling a market in decline with low growth. Demand has plummeted due to the rise of cordless and mobile phones, impacting sales negatively. VTech's focus should shift away from corded phones to minimize losses. In 2024, the corded phone market saw a further 15% decline.

- Market contraction due to mobile alternatives.

- Limited innovation and consumer interest.

- Focus resources on growth areas.

- Reduce investment in corded phone product lines.

Other Telecommunication Products in Asia Pacific

Sales of VTech's other telecommunication products in Asia Pacific have decreased, indicating potential challenges. This decline suggests increased competition or reduced market demand. For instance, the overall telecom equipment market in APAC saw varied growth in 2024, with some segments contracting. VTech should consider minimizing further investments in this area to mitigate risks.

- Market contraction in specific telecom segments in APAC.

- Increased competition from regional and global players.

- Need for strategic resource allocation.

Dogs represent products in a declining market with low market share. VTech's corded phones and other declining telecom products are examples. Minimizing losses through reduced investment is crucial, with corded phone sales down 15% in 2024.

| Product Category | Market Trend | VTech's Action |

|---|---|---|

| Corded Phones | Declining (15% drop in sales in 2024) | Reduce Investment |

| Other Telecom (APAC) | Decreasing sales, varied market growth | Minimize Investment |

| ELPs (Europe) | Market shrinkage in 2024 (e.g., German toy market -4%) | Reduce Investments |

Question Marks

VTech's acquisition of Gigaset brought Android smartphones into its portfolio. The smartphone market is fiercely competitive, with Gigaset holding a small market share. In 2024, global smartphone shipments saw fluctuations, with market leaders like Samsung and Apple dominating. For Gigaset to thrive, VTech must significantly invest to boost its presence or consider exiting this segment.

VTech's acquisition of Gigaset brought business telephony solutions into its portfolio. The enterprise solutions market is highly competitive. Gigaset's current market share is relatively small, indicating challenges. VTech faces a decision to either invest significantly for growth or consider divestiture. In 2024, the global business phone market was valued at approximately $3.5 billion.

Energy storage systems represent a question mark for VTech, with sales climbing due to recent product introductions. This segment faces high growth potential but currently holds a low market share. In 2024, the energy storage market is projected to reach $15.4 billion, offering significant growth prospects. VTech needs substantial investment to boost its market position, or consider divestiture if growth targets aren't met.

Automotive Products

VTech's automotive products, like car battery chargers, are in the question mark quadrant, showing high growth potential but low market share. Increased sales of car battery chargers drive growth as VTech gains market share. VTech needs to invest heavily to capture more of the market or consider selling if it can't increase its share. The automotive products sector shows promising growth but requires strategic decisions.

- Sales growth in the automotive sector is driven by the increasing demand for car battery chargers.

- VTech's market share in this area is currently low, indicating a need for strategic investment.

- The company must decide whether to invest heavily to grow market share or divest.

- The high growth potential of this sector offers opportunities.

Hearables

In VTech's BCG Matrix, "Hearables" represent a "Question Mark" due to their high growth potential but low market share. The sales of hearables experienced a downturn as consumer headset lifecycles for mobile phones concluded. VTech faces a critical decision: invest substantially to capture market share or consider divesting if growth targets aren't met. This strategic positioning demands careful evaluation and resource allocation.

- Market share is low, indicating opportunity for growth.

- Investment is crucial to realize the growth potential.

- Consider selling if growth targets are not achievable.

- Sales declined due to the end of mobile phone headset lifecycles.

Question Marks in VTech's BCG Matrix represent products with high growth but low market share, requiring strategic investment. In 2024, these sectors need significant resource allocation to boost market presence. VTech faces critical decisions on whether to invest for growth or consider divestiture.

| Segment | Market Share | Investment Strategy |

|---|---|---|

| Energy Storage | Low | Significant Investment |

| Automotive Products | Low | Aggressive Investment/Divest |

| Hearables | Low | Strategic Investment/Divest |

BCG Matrix Data Sources

VTech's BCG Matrix uses reliable financial data, market analysis, industry publications, and competitive intelligence.