VTech PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VTech Bundle

What is included in the product

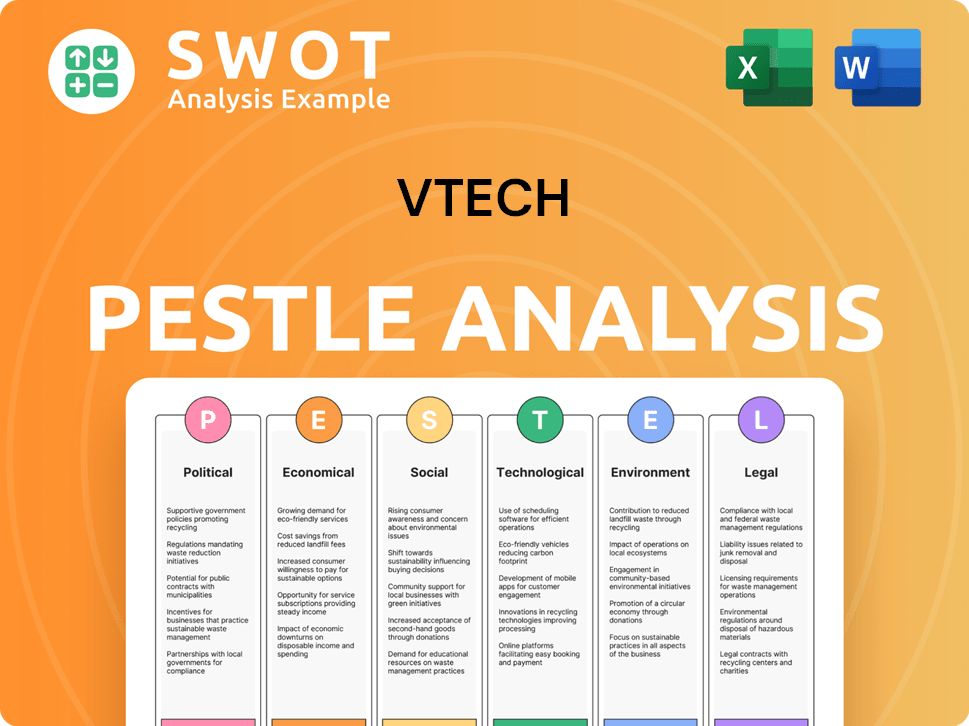

Explores how external factors uniquely affect VTech across six areas: Political, Economic, Social, Technological, Environmental, and Legal.

Allows quick, comparative reviews across the company to highlight regional variations and facilitate global strategic discussions.

What You See Is What You Get

VTech PESTLE Analysis

This preview offers the complete VTech PESTLE Analysis document.

What you're seeing is the finished product—a detailed analysis of external factors.

After purchase, you'll instantly download this same, professionally structured file.

Expect a fully formatted, ready-to-use PESTLE analysis covering various aspects.

No changes! Everything in the preview is part of the purchased document.

PESTLE Analysis Template

Explore the external factors shaping VTech's future with our insightful PESTLE Analysis. This detailed analysis breaks down political, economic, social, technological, legal, and environmental forces impacting the company. Understand the competitive landscape and make informed decisions based on expert-level insights. Access actionable strategies and enhance your market approach—download the full analysis now.

Political factors

VTech's global operations are vulnerable to geopolitical instability. Market volatility, trade policy shifts, and international relations changes can all impact VTech. For example, in 2024, geopolitical tensions increased, affecting supply chains and consumer confidence. This resulted in a 5% decrease in sales in certain regions.

VTech navigates international trade policies, tariffs, and regulations. These factors significantly influence its import/export costs and market access. For example, tariffs on electronic components can increase production expenses. In 2024, trade tensions continue to affect VTech's global supply chain, potentially raising costs.

Government spending on education impacts VTech's electronic learning products; increased funding boosts demand. In 2024, the U.S. government allocated over $75 billion to education. Infrastructure investments, especially in telecommunications, affect VTech's cordless phones. The global telecom market is projected to reach $2.1 trillion by 2025.

Political Stability in Manufacturing Locations

VTech's manufacturing footprint spans across multiple countries, including China and Malaysia. Political stability in these regions directly affects VTech's operational capabilities. For example, in 2024, China's manufacturing PMI fluctuated, reflecting economic uncertainties that can impact production. Malaysia's political landscape and its labor conditions are also critical. These factors influence production costs and supply chain reliability, which are vital for profitability.

- China's manufacturing PMI in 2024 varied, indicating shifts in economic stability.

- Malaysia's labor conditions and political climate influence operational costs.

- Geopolitical events can disrupt supply chains.

Data Privacy Regulations

Operating globally, VTech faces diverse data privacy regulations. Stricter rules and non-compliance can result in legal costs and reputational harm. Their connected learning products are particularly sensitive. The General Data Protection Regulation (GDPR) fines can reach up to 4% of annual global turnover.

- GDPR fines can be substantial.

- Data breaches can severely impact reputation.

- Compliance requires ongoing investment.

- Regulations vary by region.

VTech's supply chains and sales are impacted by political events and trade policies. Fluctuations in manufacturing PMI and political climates influence operational costs. Geopolitical events and data regulations pose financial and reputational risks.

| Political Factor | Impact on VTech | Data/Example (2024/2025) |

|---|---|---|

| Geopolitical Instability | Disrupts supply chains, impacts sales | 5% sales decrease in certain regions. |

| Trade Policies & Tariffs | Affects import/export costs | Tariffs on electronic components may raise production costs. |

| Government Spending | Influences demand for learning products/infrastructure | U.S. education allocation: $75B+ in 2024. Telecom market forecast: $2.1T by 2025. |

| Political Stability in Manufacturing Regions | Affects production & operational capabilities | China’s manufacturing PMI in 2024; Malaysia’s labor and political climate. |

| Data Privacy Regulations | Incurs legal costs, reputational damage | GDPR fines potentially up to 4% of global turnover. |

Economic factors

VTech's sales hinge on consumer spending, sensitive to inflation, interest rates, and economic growth. Rising interest rates in 2024/2025 could curb demand. For example, in Q1 2024, US retail sales saw a modest increase. Economic downturns in North America or Europe could reduce consumer spending, impacting VTech's revenue.

Currency fluctuations significantly affect VTech. In 2024, a stronger US dollar could reduce the value of sales from other regions. For instance, a 10% depreciation against the USD might lower reported profits. This directly impacts VTech's bottom line.

VTech's manufacturing costs are heavily influenced by material and labor expenses. Stable labor costs in certain areas offer advantages, but rising freight and material costs can squeeze profits. For instance, in fiscal year 2024, VTech reported a 3% increase in production costs due to these factors. This highlights the importance of managing these costs effectively to maintain profitability in 2025.

Market Competition

VTech encounters intense competition across its product lines, especially in baby monitors and telecom devices. This competitive environment affects pricing, market share, and the necessity for ongoing product innovation. According to recent reports, the global baby monitor market is valued at approximately $1.5 billion as of 2024, with VTech holding a significant share. The telecommunications market is also highly competitive, with numerous established brands and emerging players vying for consumer attention.

- Market competition necessitates continuous product updates.

- Pricing strategies are critical for maintaining market share.

- Innovation is essential for staying ahead of rivals.

Global Supply Chain Stability

Global supply chain stability is vital for VTech's production and sales. Past disruptions, like those during the COVID-19 pandemic, showed how material shortages can hurt revenue. For example, in 2022, many companies faced increased costs due to supply chain issues. The Russia-Ukraine conflict has also caused further instability. VTech must manage these risks to ensure smooth operations.

- Shipping costs increased by 20-30% in 2022 due to supply chain issues.

- The Baltic Dry Index, a measure of shipping costs, remains volatile as of early 2024.

- Inflation and economic slowdown in key markets like the US and Europe affect demand.

Consumer spending, influenced by inflation and interest rates, directly impacts VTech’s sales performance, particularly in key markets like the US and Europe. The Federal Reserve's moves in 2024/2025, alongside global economic shifts, can lead to either expansion or contraction in consumer demand, influencing VTech's financial outcomes. Currency fluctuations, notably the US dollar's strength, can either boost or hinder VTech’s reported revenue and profits from various international markets.

| Factor | Impact | Data |

|---|---|---|

| Interest Rates | Impact demand | 2024 US Fed rates remain key, affects consumer behavior |

| Currency Fluctuations | Profit impact | A strong USD can affect 2024/2025 profit from other regions |

| Economic growth | Sales trends | US retail sales +1.5% (Q1 2024) |

Sociological factors

Consumer preferences for electronic learning products and telecommunication devices are constantly changing. VTech must adjust to evolving demands, especially the growing interest in smart, connected devices. For example, in 2024, the global market for smart toys was valued at $15.2 billion. Products that provide both entertainment and education are also crucial; the edtech market is projected to reach $181.3 billion by 2025.

Demographic shifts significantly impact VTech. Declining birth rates may reduce demand for baby and preschool products. Conversely, an aging population could decrease demand for residential phones. For example, in 2024, the global birth rate was approximately 18.1 births per 1,000 people. These trends directly shape VTech's market dynamics.

Parental worries regarding child development and current educational shifts significantly affect the electronic learning product market. VTech's dedication to blending educational knowledge with product innovation is key. In 2024, the global educational toys market was valued at $36.8 billion. The market is expected to reach $50.1 billion by 2029, with a CAGR of 6.4%. This approach meets the rising demand for toys that support learning and growth.

Lifestyle Changes and Remote Work

Lifestyle changes and the rise of remote work are reshaping the telecommunications landscape. This shift boosts demand for robust home communication setups and business telephony solutions. In 2024, remote work increased, with around 30% of U.S. employees working from home at least part-time. This trend fuels the need for reliable internet and unified communication platforms.

- Demand for home office tech surged by 15% in 2024.

- Unified Communication as a Service (UCaaS) market projected to reach $70 billion by 2025.

- Increased investment in cybersecurity for remote work environments.

Cultural Differences and Localization

VTech's extensive global presence across 80+ countries highlights the critical need to address cultural nuances. This involves tailoring products, marketing, and features to resonate with local preferences. For example, in 2024, localization efforts boosted sales in Japan by 15% due to culturally relevant product adaptations. Effective localization can substantially increase market penetration and customer satisfaction across diverse regions.

- Product content adaptation

- Marketing strategies tailored to local preferences

- Product features adjusted for regional norms

- Localization boosted sales by 15% in Japan in 2024

Cultural preferences and evolving lifestyles heavily influence VTech's product acceptance. These include adjustments in education and the rise of remote work. Remote work boosted the home office tech demand by 15% in 2024. Cultural nuances in 80+ countries shape product adaptation and sales.

| Sociological Factor | Impact on VTech | 2024/2025 Data |

|---|---|---|

| Changing Consumer Preferences | Adaptation to smart & connected devices is crucial. | Smart toys market: $15.2B (2024); Edtech market: $181.3B (2025 proj.) |

| Demographic Shifts | Affects demand for baby and telecom products. | Global birth rate: ~18.1 births/1,000 (2024) |

| Parental Concerns/Educational Shifts | Demand for educational toys drives product focus. | Edu. toys market: $36.8B (2024), $50.1B by 2029 (6.4% CAGR) |

| Lifestyle and Work Changes | Demand for home communication and business solutions. | 30% U.S. remote workers (2024); UCaaS: $70B by 2025 (proj.) |

| Cultural Nuances and Localization | Need to tailor products to different regions. | Sales up 15% in Japan with product localization (2024) |

Technological factors

Rapid tech advancements significantly shape VTech's electronic learning products. AI integration, improved connectivity, and interactive features are key. In 2024, the global e-learning market reached $325 billion, showcasing growth. VTech's focus on tech ensures its products stay engaging and relevant, driving sales. Their 2024 revenue was approximately $1.6 billion.

The telecommunications sector continuously advances with technologies like DECT, Bluetooth, and SIP. VTech, a key player, must innovate to stay competitive. In 2024, the global telecom market was valued at $1.9 trillion. Businesses increasingly adopt VoIP; its market size is projected to reach $47.8 billion by 2025. VTech must adapt its cordless and business phone offerings to cater to these shifts.

VTech's contract manufacturing thrives on Industry 4.0 and automation. These technologies boost efficiency, quality, and lower labor expenses. For example, the global industrial automation market is projected to reach $385.3 billion by 2024. This growth presents opportunities for VTech to integrate advanced manufacturing solutions. Automation reduces costs; in 2023, automated factories saw up to 30% cost reductions.

Data Security and Privacy Technology

VTech's connected products necessitate strong data security and privacy tech, especially for children's devices. Past data breaches underscore the need for enhanced measures. Investing in these technologies is crucial for maintaining customer trust and regulatory compliance. This protects sensitive user data from cyber threats.

- In 2024, the global cybersecurity market was valued at $223.8 billion, projected to reach $345.7 billion by 2029.

- VTech faced a significant data breach in 2015, affecting millions of users.

- GDPR and CCPA regulations increase compliance demands.

Development of Smart and Connected Devices

The rise of smart and connected devices significantly impacts VTech. This trend demands constant innovation in areas like IoT and AI. VTech's offerings, including smartwatches and baby monitors, are directly affected. Staying competitive means investing heavily in R&D and data security. The global smart home market is projected to reach $173.4 billion by 2025.

- IoT device shipments are expected to reach 16.1 billion units by 2025.

- VTech's R&D spending in 2024 was approximately $100 million.

- The cybersecurity market for IoT devices is growing rapidly, estimated at $17.9 billion in 2024.

Technological factors critically influence VTech. AI integration in e-learning and smart devices, with $345.7B cybersecurity market projection by 2029, are key. Focus on R&D, approximately $100M in 2024, and strong data security for competitiveness.

| Technology Area | Market Size (2024) | Projected Growth (by 2025) |

|---|---|---|

| E-learning | $325 billion | N/A |

| Telecom | $1.9 trillion | VoIP market size to $47.8 billion |

| Industrial Automation | $385.3 billion | N/A |

| Cybersecurity | $223.8 billion | IoT device shipments to 16.1 billion units |

| Smart Home | N/A | $173.4 billion |

Legal factors

VTech, as a manufacturer of electronic learning products, must comply with product safety standards like those set by the Consumer Product Safety Commission (CPSC) in the US. These regulations cover aspects like flammability, lead content, and small parts hazards. In 2024, the CPSC issued over $100 million in penalties for safety violations. Compliance ensures consumer safety and prevents product recalls, which can be costly for VTech.

VTech must comply with data protection laws like GDPR and COPPA. These laws are critical for products collecting user data, particularly children's information. In 2023, the average GDPR fine was €300,000. Non-compliance can lead to substantial financial penalties, potentially impacting VTech's profitability.

VTech heavily relies on intellectual property (IP) to safeguard its tech innovations. Securing patents, trademarks, and copyrights for its products is crucial. In 2024, global spending on IP protection reached approximately $1.5 trillion. VTech must also avoid infringing on others' IP rights to mitigate legal risks. IP-related lawsuits cost businesses billions annually; in 2023, over $8 billion in damages were awarded in US patent cases.

Labor Laws and Regulations

VTech, with its global manufacturing footprint, must adhere to diverse labor laws. These regulations, varying by country, dictate wages, working hours, and workplace safety standards. Non-compliance can lead to legal battles and reputational damage, potentially impacting VTech's financial performance. For instance, in 2024, labor disputes cost companies an average of $1.2 million. Moreover, ethical operations are vital for investor confidence and brand loyalty, which is increasingly important to stakeholders.

- Minimum wage laws: These affect labor costs.

- Working hour regulations: Impact production schedules.

- Safety standards: Influence operational expenses.

- Compliance costs: These include audits and training.

Consumer Protection Laws

VTech faces consumer protection laws, crucial for product quality, warranties, and advertising. These laws vary by region, impacting its global operations. For example, in 2024, the EU strengthened its consumer rights directive. Non-compliance can lead to hefty fines and reputational damage. Adherence ensures customer trust and market access.

- EU's New Consumer Rights Directive (2024): Strengthened consumer protection.

- US Consumer Product Safety Commission: Oversees product safety regulations.

- Global Market Variations: Laws differ across countries, affecting VTech's strategies.

VTech's legal landscape is shaped by safety regulations, data protection laws like GDPR/COPPA, and intellectual property rights, with global spending on IP reaching $1.5 trillion in 2024.

Compliance also involves navigating labor laws (average dispute costs $1.2 million in 2024) and consumer protection, which includes EU directives from 2024.

Fines for non-compliance can be steep; for example, the average GDPR fine in 2023 was €300,000.

| Regulation Area | Impact | 2024 Data/Example |

|---|---|---|

| Product Safety | Ensures safe products; prevents recalls | CPSC penalties exceeded $100M |

| Data Protection | Protects user/children's data; avoid fines | Average GDPR fine of €300,000 (2023) |

| Intellectual Property | Protects innovation, avoids infringement | Global IP spend $1.5T, patent damages >$8B (2023) |

Environmental factors

VTech faces environmental regulations in its manufacturing, waste, and product materials. These rules aim to reduce environmental harm and prevent legal problems. In 2024, companies faced rising compliance costs; VTech must adapt. Failure to comply can lead to fines, impacting profitability. Staying compliant is vital for VTech's reputation and sustainability.

Consumers and stakeholders increasingly prioritize environmentally friendly practices. VTech is responding by incorporating sustainable materials. For instance, VTech uses plant-based plastics and FSC-certified wood. The company's commitment to sustainability aligns with growing market demands. In 2024, the sustainable materials market reached $300 billion.

VTech's manufacturing processes and facilities are linked to energy consumption and carbon emissions. The company is actively working towards reducing its carbon footprint. For instance, VTech has established goals to boost its use of renewable energy sources. In 2024, VTech reported a 10% reduction in carbon emissions compared to the previous year.

Waste Management and Recycling

VTech faces environmental scrutiny regarding waste management and recycling of its electronic products and packaging. The company's commitment to these practices influences its brand image and operational costs. VTech's initiatives include consumer-facing electronics recycling programs to manage end-of-life products responsibly. These efforts are crucial, especially as the global e-waste volume continues to rise.

- Global e-waste generation reached 62 million tonnes in 2022, a 82% increase since 2010.

- The EU's WEEE Directive mandates producer responsibility for e-waste.

- Recycling rates for electronics vary, with only about 20% of e-waste formally recycled.

- VTech's recycling programs must comply with these regulations.

Climate Change Impacts and Adaptation

VTech is actively evaluating climate change's effects on its business, crafting strategies to handle related risks and opportunities. Physical risks, like extreme weather disrupting supply chains, are a key concern. Transitional risks, such as changing regulations and consumer preferences, are also under scrutiny. In 2024, the global cost of climate disasters reached $280 billion.

- Supply chain disruptions due to extreme weather.

- Adaptation to new environmental regulations.

- Changing consumer demand for sustainable products.

Environmental factors significantly influence VTech's operations. Regulations drive costs and the need for sustainable practices. Climate change poses risks to supply chains and operational stability. The increasing consumer demand for green products shapes market strategies.

| Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Regulations | Compliance costs, market access | E-waste up, estimated 65 million tons globally by end of 2024 |

| Sustainability | Brand image, operational efficiency | Sustainable market at $310 billion; Plant-based plastics growth |

| Climate | Supply chain, costs of weather disasters | 2024 global cost of disasters reached $280B; Extreme weather rising |

PESTLE Analysis Data Sources

Our VTech PESTLE Analysis uses reliable data from financial institutions, market research, tech forecasts, and governmental sources.