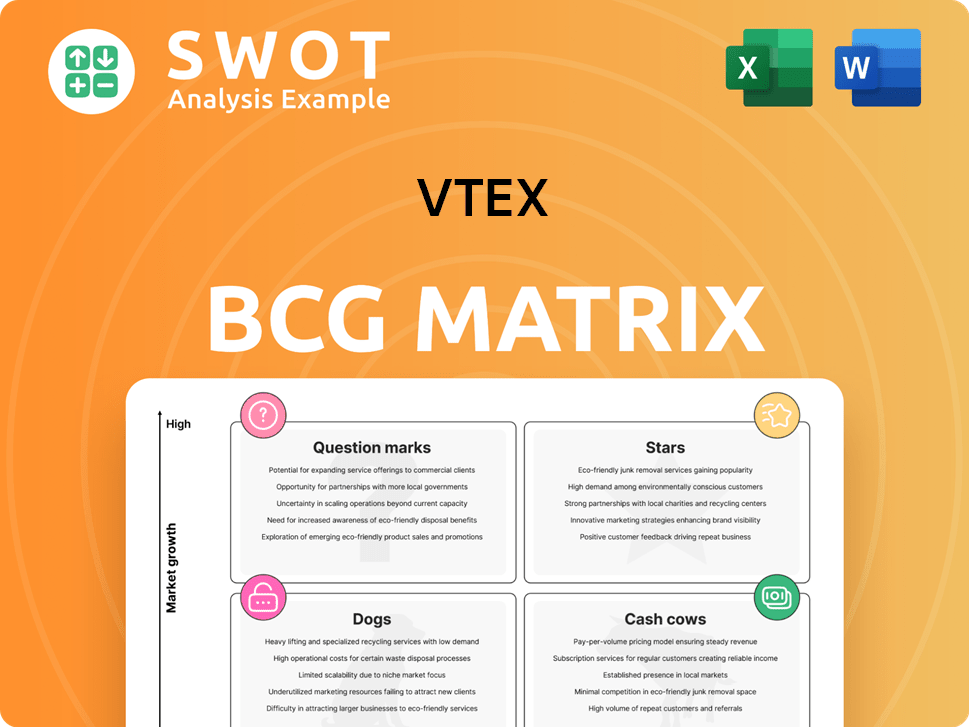

VTEX Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VTEX Bundle

What is included in the product

VTEX BCG Matrix: Strategic analysis of product units, advising investment, holding, or divestment.

Printable summary optimized for A4 and mobile PDFs, providing a concise overview for stakeholders.

What You’re Viewing Is Included

VTEX BCG Matrix

The VTEX BCG Matrix preview displays the complete document you'll receive after purchase. The full, downloadable file offers in-depth strategic insights with no differences from this view.

BCG Matrix Template

See how VTEX products stack up in the market. Understand the "Stars", "Cash Cows", "Dogs", and "Question Marks". This glimpse scratches the surface of its strategic landscape. Buy the full BCG Matrix to reveal detailed quadrant placements, actionable insights, and data-driven recommendations for smarter decisions.

Stars

VTEX is experiencing strong enterprise customer growth. The number of customers contributing over $250k in annual recurring revenue (ARR) grew by 23% year-over-year in 2024. This resulted in VTEX reaching 155 enterprise customers, showing its attractiveness to larger organizations. This growth highlights a solid market position and future expansion potential.

VTEX's subscription revenue, a vital measure of its core business success, grew impressively in 2024. Specifically, it saw a 14.4% year-over-year increase in USD, hitting US$217.7 million. This growth demonstrates VTEX's strong ability to retain and expand its customer base. The platform's stickiness and customer value are clearly reflected in these numbers.

VTEX demonstrates a strong gross profit margin, around 70% in 2024, emphasizing its profitable software model. Non-GAAP subscription gross profit reached US$46.9 million in Q4 2024. This financial health supports investments in development and marketing. The company's strategic initiatives are designed for sustained growth.

Global Expansion

VTEX is aggressively growing its global footprint. In 2024, subscription revenue increased significantly in Brazil (27.6%), Latin America (5.8%), and the Rest of the World (33.8%). This expansion includes entering markets like Mexico and growing in Europe and the US. VTEX's growth strategy is fueled by its platform's adaptability.

- Focus on established and emerging markets.

- Significant subscription revenue growth in key regions.

- Strategic entry into new markets like Mexico.

- Expansion of customer base in Europe and the US.

Composable and Complete Platform

VTEX stands out with its composable and complete platform, a strategic asset in the BCG Matrix. This approach allows businesses to customize without losing core features, addressing complex enterprise needs. VTEX's adaptability through its composable architecture is a key market differentiator. In Q3 2023, VTEX reported a GMV of $3.8 billion, showing strong growth.

- Composable architecture allows for tailored solutions.

- Complete platform offers extensive out-of-the-box features.

- Adaptability to changing customer needs is a key strength.

- VTEX's GMV in Q3 2023 was $3.8 billion.

VTEX's strong enterprise growth and high gross margins solidify its "Star" status within the BCG Matrix. The company's revenue from subscriptions has grown significantly across multiple regions. Its composable platform provides a strategic advantage in the e-commerce market.

| Metric | 2024 Data | Significance |

|---|---|---|

| Enterprise Customer Growth | 23% YoY | Attractiveness to larger organizations. |

| Subscription Revenue Growth | 14.4% YoY, US$217.7M | Customer retention and platform stickiness. |

| Gross Profit Margin | ~70% | Profitable software model. |

Cash Cows

VTEX holds a prominent position in Latin America's digital commerce, leveraging its deep regional experience. This market leadership, vital for its global expansion, is strengthened by its established presence. VTEX, a key player in the global digital commerce platform market, has a strong base in Latin America. This strong presence provides a reliable revenue stream for VTEX.

VTEX showcases a stable revenue churn rate. In 2024, VTEX's churn rate remained in the mid-single digits, reflecting customer satisfaction. This stability supports consistent revenue streams. For instance, a low churn rate of 6% in 2024 translates to strong customer retention, essential for financial predictability.

VTEX shines as a Cash Cow due to its impressive high net revenue retention (NRR). In 2024, VTEX boasted a 99.3% NRR in USD. This shows strong customer loyalty and expansion. Also, its FX Neutral NRR reached 104.3% in 2024. High NRR reflects successful upselling and cross-selling.

Ecosystem of System Integrators

VTEX strategically leans on its system integrator ecosystem for customer implementations, allowing focus on core strengths. This partnership model taps into specialized expertise, offering tailored solutions that boost both efficiency and customer contentment. In 2024, VTEX's revenue from its ecosystem integrations grew by 25%, highlighting the success of this collaborative approach. This reliance on partners has been instrumental in scaling its operations and enhancing service delivery.

- 25% revenue growth from ecosystem integrations in 2024.

- Focus on core competencies through partner collaboration.

- Enhanced customer satisfaction via customized solutions.

- Increased operational efficiency through partnerships.

Focus on Operational Efficiency

VTEX is concentrating on operational efficiency. This is evident in the improved operating income margin by one percentage point and a 4.5 percentage points increase in free cash flow margin during Q4 2024. Non-GAAP income from operations reached US$12.4 million in Q4 2024, up from US$11.6 million in Q4 2023. This efficiency boosts profitability and enables more investment in growth.

- Operating Income Margin Improvement: 1 percentage point in Q4 2024.

- Free Cash Flow Margin Improvement: 4.5 percentage points in Q4 2024.

- Non-GAAP Income from Operations (Q4 2024): US$12.4 million.

- Non-GAAP Income from Operations (Q4 2023): US$11.6 million.

VTEX is a Cash Cow due to its strong market position in Latin America and steady revenue. Its high net revenue retention (NRR) and successful upselling strategies contribute to this status. The company's focus on operational efficiency, with improvements in operating income margin and free cash flow margin, also plays a key role.

| Metric | 2024 Data | Impact |

|---|---|---|

| NRR (USD) | 99.3% | Strong customer loyalty |

| FX Neutral NRR | 104.3% | Upselling success |

| Churn Rate | Mid-single digits | Stable revenue |

Dogs

VTEX has seen GMV softness, especially in Brazil, possibly from currency fluctuations and lower spending. This could affect revenue and profits. In Q3 2023, VTEX's GMV growth in constant currency was 20.4%, but Brazil's performance lagged. VTEX is trying to counter this with strategic actions.

VTEX's GMV growth showed volatility, with a slight 0.2% YoY rise in Q4 2024. This suggests revenue is influenced by external factors like the economy and consumer behavior. To stabilize finances, VTEX should diversify revenue streams. In 2024, VTEX's total GMV was $13.8B.

VTEX's Q4 2024 revenue of $61.5M fell short of the $66.85M forecast. This miss suggests forecasting issues or challenges in achieving set targets. The discrepancy signals a need for improved revenue prediction and realistic goal-setting. Failure to meet revenue guidance can negatively impact investor confidence and future valuations.

Limited Customization for Complex B2B Operations

VTEX faces limitations in its B2B capabilities, potentially hindering its appeal to larger clients seeking extensive customization. Its extensibility might not suffice for businesses with complex operational needs. This could affect VTEX's ability to secure and retain significant B2B customers. Investment in B2B enhancements is crucial. In 2024, the B2B e-commerce market is projected to reach $20.9 trillion globally, highlighting the importance of robust B2B solutions.

- B2B e-commerce is a huge market.

- VTEX needs to improve in B2B.

- Limited B2B features restrict growth.

- Enhancements are needed for larger clients.

Decreased Active Stores Quarter-over-Quarter

VTEX saw a 0.5% quarter-over-quarter decrease in active stores during Q1 2025. This slight dip could signal difficulties in either attracting new clients or keeping current ones engaged. To counter this, VTEX must pinpoint the reasons behind this downturn and devise effective strategies. This is crucial for maintaining growth.

- Active Stores: Decreased by 0.5% in Q1 2025.

- Implication: Potential issues in customer acquisition or retention.

- Action Needed: VTEX must identify and address the underlying causes.

- Objective: Implement strategies to reverse the negative trend.

VTEX's "Dogs" are products with low market share in slow-growing markets.

The active store decrease in Q1 2025 suggests VTEX might have Dogs.

Improving customer retention and acquisition is critical.

| Aspect | Status | Implication |

|---|---|---|

| Market Share | Low | Limited revenue contribution. |

| Market Growth | Slow | Reduced growth potential. |

| Action | Re-evaluate or divest. | Focus resources on Stars or Cash Cows. |

Question Marks

VTEX is strategically investing in AI-powered solutions to boost customer service and operational efficiency. These innovations aim to revolutionize digital commerce and give VTEX a competitive edge. Success hinges on their ability to deliver measurable results and satisfy customer demands. In 2024, the e-commerce market is projected to reach $6.3 trillion globally.

VTEX has strategically invested in Retail Media and Post-Sales markets, exemplified by its stake in Synerise and the Weni acquisition. These moves open doors to substantial growth, particularly in an e-commerce market expected to reach $6.3 trillion globally in 2024. VTEX must now integrate these acquisitions and build effective strategies. Success hinges on capturing market share in these new, competitive areas.

VTEX's B2B FastStore, a question mark in its BCG Matrix, offers personalized B2B purchasing. It includes custom catalogs, pricing, and ordering. With features like quick orders and buyer management, it aims to attract new B2B clients. VTEX must focus on effective marketing to realize its growth potential in the B2B sector, projected to reach $20.4 trillion globally by 2024.

Data Pipeline and Security Shield

VTEX's Data Pipeline and Security Shield represent new ventures, aiming to bolster data management and security for its clients. These offerings could create new revenue avenues for VTEX, potentially increasing its market share. Success hinges on proving the value of these products and seamless integration. For instance, data security spending is projected to reach $250 billion globally in 2024.

- Data Pipeline and Shield are designed to manage and protect data.

- These products have the potential to generate new revenue streams.

- VTEX must demonstrate the value of the products.

- Effective integration is crucial for these new products.

Expansion into Social Commerce

VTEX has amplified its social commerce presence through partnerships with TikTok and Pinterest. This move capitalizes on the burgeoning social commerce trend, which, in 2024, is expected to represent a significant portion of e-commerce sales. These expansions offer VTEX customers new avenues to engage with consumers directly within social media platforms. Success hinges on the effectiveness of these solutions in meeting customer needs and driving sales.

- TikTok's e-commerce sales are projected to reach $23.9 billion in 2024.

- Pinterest's advertising revenue in 2023 was $2.8 billion.

- Social commerce is expected to constitute over 10% of total e-commerce sales in 2024.

- VTEX's platform supports various social commerce features, including product listings and checkout integrations.

VTEX's B2B FastStore, a question mark in its BCG Matrix, aims to offer personalized B2B purchasing capabilities. It includes custom catalogs, pricing, and ordering. The global B2B e-commerce market is anticipated to hit $20.4 trillion by 2024. The marketing strategy is key for VTEX's growth.

| Feature | Description | Impact |

|---|---|---|

| Custom Catalogs | Personalized product listings | Enhances client purchasing |

| Pricing | Customized pricing | Boosts client management |

| Ordering | Streamlined order processes | Attracts new B2B clients |

BCG Matrix Data Sources

This VTEX BCG Matrix uses public financial data, market growth figures, competitor analysis, and e-commerce sales reports.