VTEX Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VTEX Bundle

What is included in the product

Tailored exclusively for VTEX, analyzing its position within its competitive landscape.

Visually assess competitive forces with a dynamic spider chart, revealing critical pressure points.

What You See Is What You Get

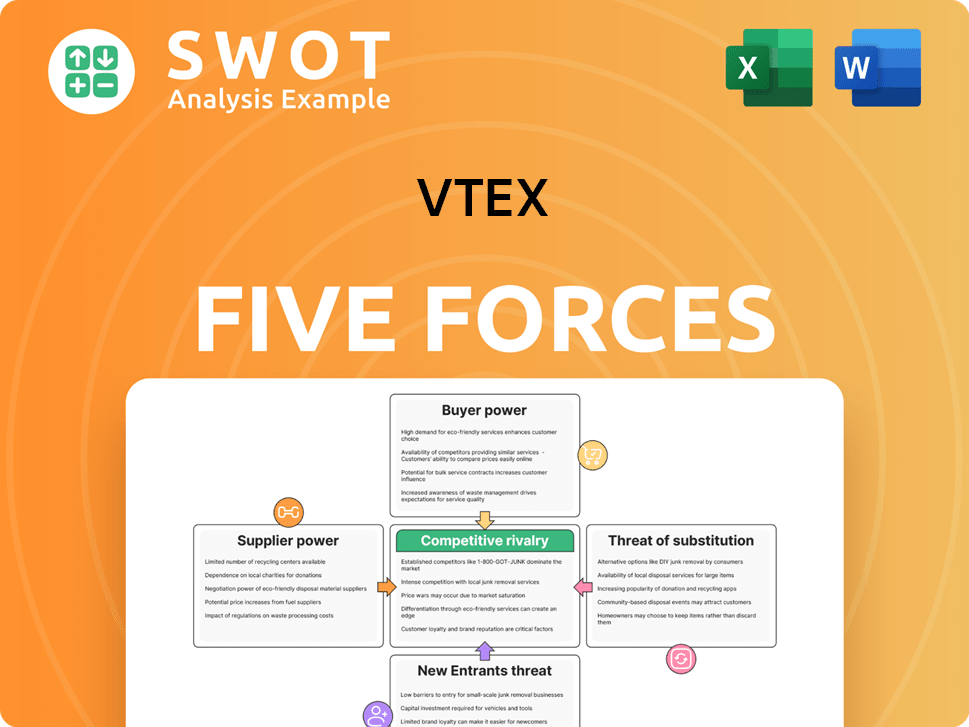

VTEX Porter's Five Forces Analysis

This VTEX Porter's Five Forces analysis preview mirrors the final document. You're seeing the complete, ready-to-use analysis now. Upon purchase, you get immediate access to this identical, professionally formatted file. There are no hidden parts or alterations; what you see is what you get. This ensures clarity and saves you time.

Porter's Five Forces Analysis Template

VTEX's competitive landscape is shaped by the interplay of five key forces. Bargaining power of buyers impacts pricing strategies and customer retention. The threat of new entrants considers scalability, industry barriers, and market growth. Supplier power influences the cost of goods and potential supply chain disruptions. Substitute products and services challenge VTEX's market share with alternative solutions. Competitive rivalry assesses the intensity of the existing player's competition.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore VTEX’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

VTEX's reliance on specialized tech suppliers, like cloud service providers, gives them negotiation power. The e-commerce platform market is concentrated, with key players such as Shopify and Magento. This concentration limits VTEX's options, reducing its bargaining leverage. For instance, in 2024, the top 5 cloud providers controlled over 70% of the market share.

VTEX depends on cloud infrastructure providers like AWS, Azure, and Google Cloud. AWS is a key supplier, accounting for a major part of VTEX's infrastructure. This reliance gives cloud providers substantial bargaining power. Recent data shows AWS's cloud revenue reached $24.2 billion in Q4 2023.

VTEX's substantial investments in platform technologies, like R&D and infrastructure, heighten its dependence on specific tech vendors. In 2024, the company allocated a significant portion of its revenue to technology, with around 15% dedicated to R&D. This financial commitment strengthens the position of these vendors, potentially increasing their bargaining power over VTEX.

Vendor Lock-in Risk

VTEX could encounter vendor lock-in risks through its software and infrastructure, which elevates supplier bargaining power. Switching these crucial components can be complex and expensive, particularly for large-scale enterprise migrations. This lock-in complicates and increases the cost of changing suppliers, giving current vendors more control. This is particularly relevant given the increasing costs of cloud services. For example, the average cost of cloud services increased by 18% in 2024, according to Flexera's 2024 State of the Cloud Report.

- High switching costs can make it difficult to change vendors.

- Cloud service costs are rising, increasing vendor leverage.

- Enterprise migrations are complex and costly.

- Vendor lock-in gives current vendors more power.

Specialized Service Providers

VTEX, as an e-commerce platform, depends on specialized service providers like payment gateways and logistics companies. The platform integrates with numerous providers to facilitate transactions and deliveries for its users. If these providers offer unique services, they can exert more influence over VTEX.

This dependence can impact VTEX's operational costs and service offerings. For example, in 2024, VTEX processed over $12 billion in gross merchandise volume (GMV) through its platform. This reliance means changes in pricing or service quality by providers can directly affect VTEX's profitability and customer satisfaction.

The bargaining power of suppliers is critical. VTEX must manage relationships strategically to mitigate risks.

- Integration with diverse payment solutions is key for VTEX's global reach.

- Logistics partnerships are essential for timely and efficient order fulfillment.

- The cost of these services directly influences VTEX's profitability.

VTEX faces significant supplier power due to dependence on key tech vendors like cloud providers, particularly AWS, whose revenue hit $24.2B in Q4 2023. High switching costs, vendor lock-in, and rising cloud service costs, up 18% in 2024, enhance this power.

Integration with specialized service providers, such as payment gateways, is crucial, influencing operational costs and service quality. VTEX's 2024 GMV of $12B highlights the impact of provider pricing changes on profitability. Strategic management of these relationships is therefore vital to mitigate risks.

| Supplier Type | Impact on VTEX | 2024 Data |

|---|---|---|

| Cloud Providers | Infrastructure & Costs | AWS Q4 Revenue: $24.2B, Cloud cost increase: 18% |

| Payment Gateways | Transaction Processing | VTEX GMV: $12B |

| Logistics | Order Fulfillment | Dependence on partners |

Customers Bargaining Power

VTEX benefits from a dispersed customer base, which limits customer bargaining power. In 2024, the largest customer contributed a small portion to VTEX's revenue. The top customers collectively account for a similarly modest percentage. This distribution prevents any single client from excessively influencing pricing or terms, securing VTEX's position.

VTEX's subscription model, with fixed and variable fees, gives customers, especially larger ones, some bargaining power. VTEX's revenue in Q3 2024 was $43.5 million, with subscription revenue being a key component. Customers, contributing significant transaction volumes, might negotiate pricing. In 2024, the subscription model's flexibility is a key selling point.

VTEX focuses on building lasting customer relationships, but switching costs impact customer power. High costs, like those for data migration, reduce customer bargaining power. Research indicates that platform migrations can cost businesses an average of $50,000 to $100,000. Low switching costs increase customer options. In 2024, the average contract length for e-commerce platforms is 2 years, influencing switching decisions.

Customer Verticals

VTEX's customer base spans diverse verticals like apparel, electronics, and home appliances, affecting customer bargaining power. Price sensitivity varies; for example, electronics customers might be more price-conscious than those in apparel. Understanding these nuances is key for VTEX to customize its approach. In 2024, the e-commerce market in home appliances grew by 12%, showing a different dynamic compared to the 8% growth in apparel. This impacts how VTEX structures its deals and services.

- Apparel: Lower price sensitivity, higher brand loyalty.

- Electronics: Higher price sensitivity, influenced by tech specs.

- Home Appliances: Moderate price sensitivity, influenced by features and brand.

- VTEX adjusts strategies based on vertical demands.

Customer Recommendations

Customer recommendations significantly influence customer bargaining power for VTEX. High customer satisfaction, reflected in recommendation rates, suggests less price sensitivity. This positions VTEX favorably in negotiations and reduces customer leverage. Satisfied customers are less likely to seek discounts or exert undue pressure.

- In 2024, approximately 85% of VTEX customers would recommend the platform.

- This high satisfaction rate limits individual customer bargaining power.

- Positive reviews further bolster VTEX's market position.

- Customer loyalty reduces the need for significant concessions.

VTEX manages customer bargaining power through a dispersed client base, ensuring no single customer heavily impacts pricing. In 2024, top clients represent a small fraction of revenue, protecting VTEX's negotiating position. The subscription model offers some leverage, especially for high-volume users, affecting pricing flexibility.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Customer Base | Reduces bargaining power | Largest customer: <5% of revenue |

| Subscription Model | Allows some power | Q3 Revenue: $43.5M |

| Customer Satisfaction | Limits price sensitivity | 85% would recommend |

Rivalry Among Competitors

The e-commerce platform market is fiercely competitive, with many companies fighting for dominance. VTEX competes with giants like Shopify and Adobe Commerce (Magento). This rivalry can trigger price wars, higher marketing costs, and a need for constant innovation. For instance, in 2024, Shopify reported a 23% increase in revenue, showing the intensity of the competition.

VTEX, a Challenger in Gartner's Magic Quadrant, aims to disrupt the digital commerce landscape. This strategy intensifies competition, putting pressure on established players. VTEX's revenue grew by 22.6% in 2023, showcasing its market ambitions. This growth fuels rivalry.

VTEX faces intense rivalry, forcing continuous innovation. In 2024, VTEX invested heavily in R&D, with 15% of revenue allocated to new features. This included enhanced AI-driven tools, increasing competition. The drive for innovation is fueled by competitors like Shopify, who also invest heavily in new features.

Pricing Strategies

VTEX faces intense price competition in the e-commerce platform market. Rivals might use aggressive pricing to gain market share, which could squeeze VTEX's profits. To stay competitive, VTEX may need to lower prices, which could cut into its profit margins. Keeping a close eye on what competitors charge is key for VTEX. In 2024, e-commerce platform pricing saw an average decrease of 3-5% due to increased competition.

- Competitor pricing strategies directly impact VTEX's profitability.

- VTEX's margins are sensitive to competitive price adjustments.

- Continuous monitoring of competitor pricing is essential.

- Market data from 2024 shows a 3-5% average price decline in e-commerce platforms.

Mergers and Acquisitions

Mergers and acquisitions (M&A) significantly influence the competitive landscape, as businesses aim to strengthen their market presence. VTEX has pursued acquisitions like Weni in 2023, to boost customer service capabilities, which is a strategic move. These actions reshape the competitive environment, prompting VTEX to adjust its strategies to maintain its position. This includes integrating new technologies and services.

- VTEX acquired Weni in 2023 to enhance customer service.

- M&A activities can change the competitive landscape.

- VTEX adapts its strategy to maintain its market position.

- These acquisitions can lead to a more consolidated market.

VTEX battles fierce rivals like Shopify, leading to price wars and innovation sprints. This aggressive competition demands constant investment in new features and competitive pricing. In 2024, e-commerce platforms saw price drops of 3-5%, showing the pressure. VTEX’s M&A, such as Weni in 2023, reshapes the market.

| Metric | 2023 | 2024 (Projected/Actual) |

|---|---|---|

| VTEX Revenue Growth | 22.6% | 20% (Projected) |

| R&D Spending (as % of Revenue) | 13% | 15% |

| Average Price Decline in E-commerce | N/A | 3-5% |

SSubstitutes Threaten

VTEX faces a substantial threat from substitute e-commerce platforms. Shopify, BigCommerce, and others provide similar services. In 2024, Shopify's revenue reached approximately $7.1 billion, highlighting strong competition. Customers can readily switch platforms, increasing the pressure on VTEX to remain competitive.

Open-source platforms like Magento and WooCommerce present a threat to VTEX. These offer businesses more control and customization for their online stores. In 2024, WooCommerce powered approximately 29% of all online stores. Businesses seeking flexibility might choose open-source alternatives.

Larger enterprises can build their e-commerce solutions internally, lessening their dependence on VTEX. This allows complete control and customized features. However, in 2024, in-house development costs averaged $500,000-$2,000,000+ depending on complexity. This option suits companies with ample technical resources and budget.

Headless Commerce Solutions

Headless commerce solutions pose a threat to traditional platforms like VTEX by offering greater flexibility and potentially substituting their services. This shift allows businesses to create unique customer experiences across various touchpoints, breaking free from platform limitations. The market for headless commerce is expanding; it was valued at $1.2 billion in 2023 and is projected to reach $4.9 billion by 2029, indicating significant growth and adoption. This trend enables businesses to better tailor their online presence, potentially impacting VTEX's market share.

- Market size of headless commerce was $1.2 billion in 2023.

- Projected to reach $4.9 billion by 2029.

- Offers greater flexibility and unique customer experiences.

- Businesses can customize online presence.

Social Commerce

Social commerce poses a growing threat to platforms like VTEX. Platforms such as Facebook, Instagram, and TikTok are now viable sales channels. These platforms allow direct-to-consumer sales, potentially reducing reliance on traditional e-commerce platforms. The rise of social commerce reflects shifting consumer behavior and the ease of purchasing through social media feeds.

- In 2024, social commerce sales in the US are projected to reach $100 billion.

- TikTok's e-commerce revenue grew by over 200% in the last year.

- Facebook Marketplace has over 1 billion monthly active users.

- Instagram's shopping features are used by millions of businesses globally.

VTEX confronts a notable threat from various e-commerce alternatives, including Shopify and BigCommerce. The flexibility of open-source platforms like WooCommerce also poses a risk.

Headless commerce and social commerce further challenge VTEX, with the market for headless commerce projected to surge by 2029. The rise of social commerce also signifies evolving consumer behavior and sales channels.

Businesses can choose different platforms, which increases the pressure on VTEX to remain competitive and adapt to new industry trends, like headless commerce.

| Substitute | Description | Impact on VTEX |

|---|---|---|

| Shopify, BigCommerce | Similar e-commerce platforms | Direct competition |

| WooCommerce, Magento | Open-source platforms | Offers flexibility and control |

| Headless Commerce | Flexible, customizable solutions | Growing market, threatens traditional platforms |

| Social Commerce | Sales via social media (Facebook, Instagram) | Shifting consumer behavior, alternative sales channels |

Entrants Threaten

The SaaS e-commerce market's rapid expansion makes it a magnet for new competitors. Projections indicate substantial growth, fueled by the demand for scalable software solutions. This creates opportunities for new businesses to enter and gain market share. The global e-commerce market is expected to reach $8.1 trillion in 2024, attracting many entrants.

The e-commerce platform market faces a growing threat from new entrants due to low barriers. Cloud computing and accessible e-commerce tools have significantly reduced the costs and complexities of launching a platform. In 2024, the cost to start a basic e-commerce site can be as low as $29 per month. This ease of entry allows startups to quickly compete with established firms, intensifying competition.

New entrants could zero in on specific niches, challenging VTEX's broad market presence. They might specialize in areas like B2B e-commerce or mobile commerce to meet unique customer demands. For instance, a new player could focus on the fashion industry, which in 2024, generated over $800 billion in online sales. This targeted approach allows them to compete more effectively.

Technological Innovation

Technological innovation significantly threatens VTEX by enabling new entrants to disrupt the e-commerce landscape. Emerging technologies, such as AI and blockchain, can be utilized to create competitive platforms. These innovations can offer advanced features, potentially attracting VTEX's customer base. For example, in 2024, e-commerce sales are projected to reach $6.3 trillion globally, indicating the high stakes involved.

- AI-driven personalization and recommendation engines can attract users.

- Blockchain can enhance security and transparency in transactions.

- Augmented reality can revolutionize the shopping experience.

- New entrants can offer specialized e-commerce solutions.

Venture Capital Funding

The threat from new entrants to VTEX is amplified by venture capital (VC) funding. Access to VC allows new companies to rapidly expand, intensifying competitive pressure. In 2024, e-commerce VC funding remained robust, with significant investments flowing into the sector. This funding enables new entrants to invest in product development, marketing, and sales.

- VC funding allows startups to scale quickly, challenging incumbents.

- Significant VC investments in 2024 fueled e-commerce innovation.

- New entrants leverage funding for aggressive marketing and sales.

- VTEX faces increased competition due to well-funded rivals.

VTEX faces a considerable threat from new e-commerce platform entrants. The market's growth, with $8.1T projected in 2024, draws new competitors. Low entry barriers, like cloud computing, make it easier for startups to launch, increasing competition. The availability of venture capital further fuels this threat.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Market Growth | Attracts entrants | $8.1T e-commerce market |

| Entry Barriers | Reduced costs | Basic site: $29/month |

| VC Funding | Accelerates growth | Robust investments |

Porter's Five Forces Analysis Data Sources

The analysis incorporates financial reports, market research, and competitor analysis to evaluate rivalry, supplier/buyer power, and threats.