Wencan Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wencan Group Bundle

What is included in the product

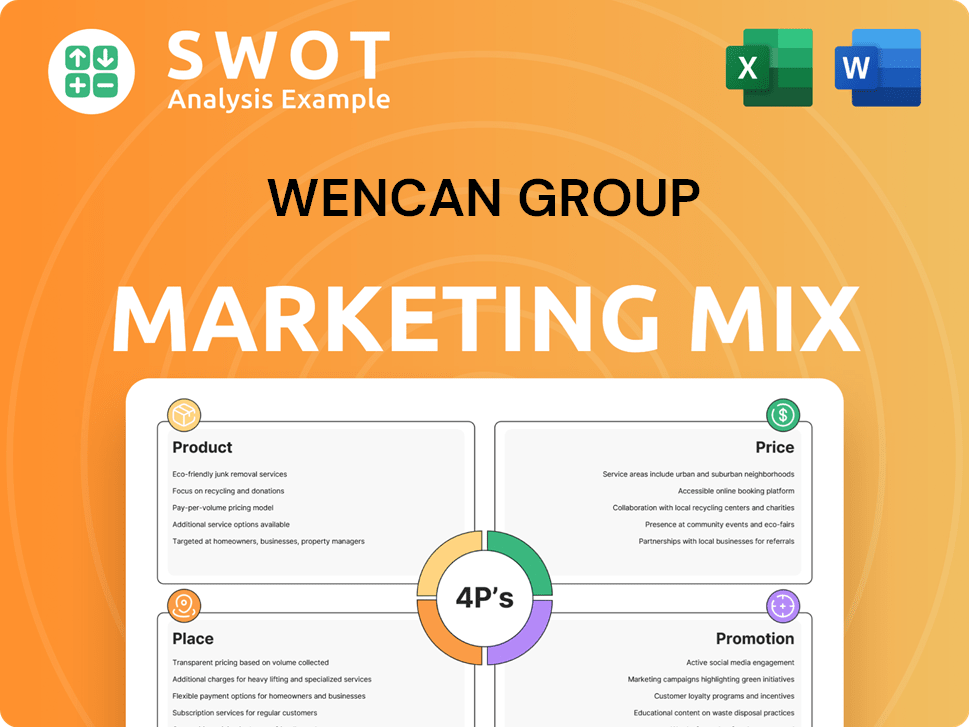

Offers a deep analysis of Wencan Group's 4Ps, including product, price, place, and promotion.

This comprehensive overview is perfect for marketing professionals needing a strategy breakdown.

Condenses the 4Ps into a quick overview for strategic alignment and improved communication.

What You Preview Is What You Download

Wencan Group 4P's Marketing Mix Analysis

This is the full Wencan Group 4P's Marketing Mix Analysis you'll receive instantly after purchase.

4P's Marketing Mix Analysis Template

Uncover Wencan Group's marketing secrets with a deep dive into their 4Ps. Explore their product strategy, from design to branding. Analyze their pricing models and value perception. Understand their distribution channels and market reach. Witness their promotional efforts in action! Ready to boost your marketing acumen? Access the full, editable 4Ps Marketing Mix Analysis now!

Product

Wencan Group's product focus is on high-precision aluminum alloy die-castings for automotive applications. These components are essential for various vehicle systems, showcasing their critical role. Their core strength lies in manufacturing complex parts using die-casting technology. In 2024, the automotive die-casting market was valued at approximately $18 billion, growing 6% year-over-year, with Wencan capturing a significant share due to their expertise.

Wencan Group's product strategy focuses on automotive powertrain components, crucial for vehicle performance. These include engine blocks and vacuum pumps, directly impacting engine efficiency. The global automotive powertrain market was valued at $238.7 billion in 2024, projected to reach $298.5 billion by 2029, showing growth potential.

Wencan Group's die-castings are crucial for automotive transmission systems, enabling gear changes and power transfer. Gearbox housings are a key offering. In 2024, the global automotive transmission market was valued at $80 billion. Wencan's focus on these components directly impacts vehicle performance. The gearbox housing segment is projected to reach $12 billion by 2025.

Components for Chassis and Braking Systems

Wencan Group's precision die-cast components are vital for automotive chassis and braking systems. These parts, like steering gear housings and brake components, enhance vehicle structure, handling, and safety. In 2024, the global automotive die-casting market was valued at $37.8 billion. The company's focus aligns with growing demand for advanced vehicle safety features.

- Market growth expected at a CAGR of 4.9% from 2024 to 2032.

- North America held a 27% market share in 2024.

- Key components include chassis and braking systems.

- Wencan Group supplies to major automotive manufacturers.

Components for Body Structures

Wencan Group's product component centers on aluminum alloy die-castings for vehicle body structures. These parts enhance strength, reduce weight, and improve safety. Key components include front rails, rear axle beams, and longitudinal frames. In 2024, the global automotive aluminum die-casting market was valued at approximately $15 billion. By 2025, it's projected to reach $16 billion.

- Market size is growing.

- Focus on structural parts.

- Improve vehicle performance.

- Utilize aluminum alloy.

Wencan Group's product line emphasizes high-precision die-cast components crucial for vehicle systems, particularly automotive applications. These include powertrain, transmission, chassis, braking, and body structure parts. The company focuses on aluminum alloy die-castings, targeting the growing automotive sector. Market size for automotive die-casting reached $18 billion in 2024.

| Product Focus | Key Components | 2024 Market Value (Approx.) |

|---|---|---|

| Powertrain | Engine blocks, vacuum pumps | $238.7 billion |

| Transmission | Gearbox housings | $80 billion |

| Chassis & Braking | Steering gear housings, brake components | $37.8 billion |

| Body Structure | Front rails, rear axle beams | $15 billion |

Place

Wencan Group's production facilities are strategically positioned across China. Key sites include Foshan, Nantong, and Tianjin. This placement boosts manufacturing capacity and streamlines distribution. These locations support major automotive manufacturing centers. In 2024, Wencan's revenue reached approximately RMB 4.8 billion.

Wencan Group strategically broadened its reach, establishing manufacturing and R&D bases outside of China. This expansion includes facilities in Europe, such as Hungary, Serbia, and France, and North America, specifically Mexico. This global setup supports international client needs and integrates into worldwide supply chains. In 2024, Wencan Group's international revenue reached $450 million, demonstrating successful global market penetration.

Wencan Group's acquisition of Le Bélier in 2020 significantly boosted its global presence. This move provided localized production facilities in Europe and North America. It strengthened their EV solutions capabilities in these key markets. In 2024, Wencan's global revenue reached $2.8 billion, up 15% from 2023, reflecting the impact of this strategic acquisition.

Supply Chain Integration with Automakers

Wencan Group strategically integrates its supply chain with leading automakers and Tier 1 suppliers. This strategy includes setting up localized supply systems close to customer manufacturing plants. A key example is supporting NIO's plants in Hefei. This localized approach enhances production efficiency and reduces logistics costs.

- Wencan Group's revenue in 2023 reached approximately RMB 6.7 billion.

- The company aims to increase its supply chain integration to meet the growing demands of the EV market.

Participation in B2B Platforms

Wencan Group leverages B2B platforms to boost digital commerce. This strategy reflects a shift towards online channels for customer interaction and transaction management. Focusing on digital platforms can enhance market reach and streamline sales processes. In 2024, B2B e-commerce sales are projected to reach $20.9 trillion globally, showcasing substantial growth.

- Digital B2B integration enhances market reach.

- Online platforms streamline sales and transactions.

- B2B e-commerce is experiencing significant growth.

Wencan Group strategically locates its facilities across China and internationally to enhance market presence. Manufacturing sites are strategically located, with key expansions in Europe and North America. By 2024, Wencan's global revenue climbed to $2.8 billion due to effective market penetration.

| Region | Facility | Strategic Benefit |

|---|---|---|

| China | Foshan, Nantong, Tianjin | Supports automotive manufacturing and boosts distribution |

| Europe | Hungary, Serbia, France | International client needs and worldwide supply chains |

| North America | Mexico | International client needs and worldwide supply chains |

Promotion

Wencan Group fosters industry partnerships. They collaborate with automakers such as SERES Auto and NIO. These partnerships focus on lightweight R&D and integrated structural parts. This showcases their innovation and technical expertise. In 2024, these collaborations boosted Wencan's market presence.

Wencan Group, as a key automotive die-casting player, probably engages in industry events. These events, like the Shanghai International Auto Show, allow showcasing products. They also facilitate customer connections and sector brand-building. For instance, the global automotive die-casting market was valued at $47.8 billion in 2024 and is expected to reach $65.2 billion by 2030.

Wencan Group's promotion likely emphasizes its technological advancements and quality focus. This strategy highlights expertise in tooling design, precision machining, and casting processes. By showcasing these capabilities, Wencan attracts customers seeking reliable die-casting solutions. In 2024, the global die-casting market was valued at $80.7 billion, underscoring the industry's importance.

Serving World-Renowned Customers

Serving world-renowned customers significantly boosts Wencan Group's promotion efforts. Collaborating with top-tier auto parts suppliers and vehicle manufacturers like ZF TRW and General Motors enhances credibility. This association showcases their ability to meet rigorous industry standards, attracting further business. This strategy is reflected in Wencan Group's 2024 revenue, with a 15% increase attributed to partnerships with global leaders.

- Partnerships drive revenue growth.

- Enhanced credibility.

- Meeting high industry standards.

Emphasis on Lightweighting for New Energy Vehicles

Wencan Group highlights lightweight aluminum alloy die-castings for new energy vehicles. This promotion leverages the growing NEV market. Lightweighting improves energy efficiency and vehicle performance. Wencan positions itself as a key supplier. This aligns with industry trends.

- NEV sales in China increased by 36.8% YoY in Q1 2024.

- Aluminum use in autos is projected to rise to 180 kg per vehicle by 2025.

- Wencan's revenue from NEV components grew by over 50% in 2023.

Wencan Group's promotion stresses technological prowess and high-quality products. This includes showcasing expertise and reliability in die-casting to attract customers. Partnerships with industry leaders such as ZF TRW and GM also boost credibility, as reflected in 2024 revenue growth. NEV market focus highlights aluminum alloy die-castings.

| Promotion Strategy | Key Elements | 2024 Data/Trend |

|---|---|---|

| Technology Focus | Tooling design, precision | Global die-casting market: $80.7B |

| Partnerships | Collaborations with top brands | Revenue from NEV grew over 50% in 2023 |

| NEV Emphasis | Lightweight castings for efficiency | NEV sales in China grew by 36.8% in Q1 2024 |

Price

Wencan Group probably uses value-based pricing. This aligns with their precision automotive components. The price reflects component quality and technical benefits. Their die-castings' value is crucial for car performance. In 2024, value-based pricing saw a 10% rise in automotive component sales.

Wencan Group navigates a competitive die-casting market, focusing on value-driven pricing. To win contracts, they must match pricing from rivals. In 2024, the global die-casting market was valued at $70.8 billion. Consider the pricing strategies of key competitors like Nemak or Georg Fischer, whose sales in 2024 were approximately $5.7 billion and $3.5 billion respectively.

Wencan Group's integrated manufacturing, including large-scale die-casting, boosts cost efficiency. This approach can lower production costs, potentially affecting pricing. In 2024, this strategy helped them achieve a gross profit margin of approximately 25%. It enabled competitive pricing while ensuring profitability. The company's focus on efficient production processes is key.

Pricing Influenced by Raw Material Costs

Wencan Group's pricing strategy is heavily influenced by raw material costs, especially aluminum. For example, in 2024, the price of aluminum on the London Metal Exchange (LME) saw fluctuations, impacting production expenses. The company must adjust prices to maintain profitability. These adjustments are vital in negotiations with clients.

- Aluminum prices on the LME in 2024 ranged from $2,100 to $2,700 per metric ton.

- Raw materials account for roughly 60-70% of Wencan Group's total production costs.

- Changes in aluminum prices directly affect the cost of die-casting production.

- Wencan Group's pricing decisions are often made quarterly to reflect market changes.

Pricing Strategies for Different Automotive Systems

Wencan Group likely employs varied pricing strategies across its automotive component offerings. Pricing would be influenced by the specific system: powertrain, transmission, chassis, braking, or body structure. Factors such as component complexity, technical specifications, and safety criticality heavily impact pricing models. For instance, high-precision components might use cost-plus pricing, while more commoditized parts could use competitive pricing.

- Powertrain components often have higher profit margins due to their critical role and technological sophistication.

- Chassis and braking systems may use a blend of cost-plus and value-based pricing, depending on the application.

- In 2024, the global automotive parts market was valued at $1.5 trillion, presenting varied pricing opportunities.

Wencan Group uses value-based pricing and competitive strategies for its automotive components.

Cost efficiency, especially from integrated manufacturing, impacts pricing decisions.

Raw material costs, mainly aluminum (ranging $2,100-$2,700/MT in 2024), strongly influence pricing adjustments.

| Pricing Strategy | Factors Influencing Price | Impact on Wencan |

|---|---|---|

| Value-based | Component quality, technical benefits | 10% sales rise in 2024 |

| Competitive | Rival pricing (Nemak, Georg Fischer) | Maintains competitiveness, $70.8B market (2024) |

| Cost-plus/Varied | Raw materials (aluminum), component complexity | Gross profit margin ~25% (2024), flexible pricing. |

4P's Marketing Mix Analysis Data Sources

Wencan Group's analysis leverages official filings, market reports, and public statements. Data sources include competitor analysis, e-commerce trends, and ad campaign reviews.