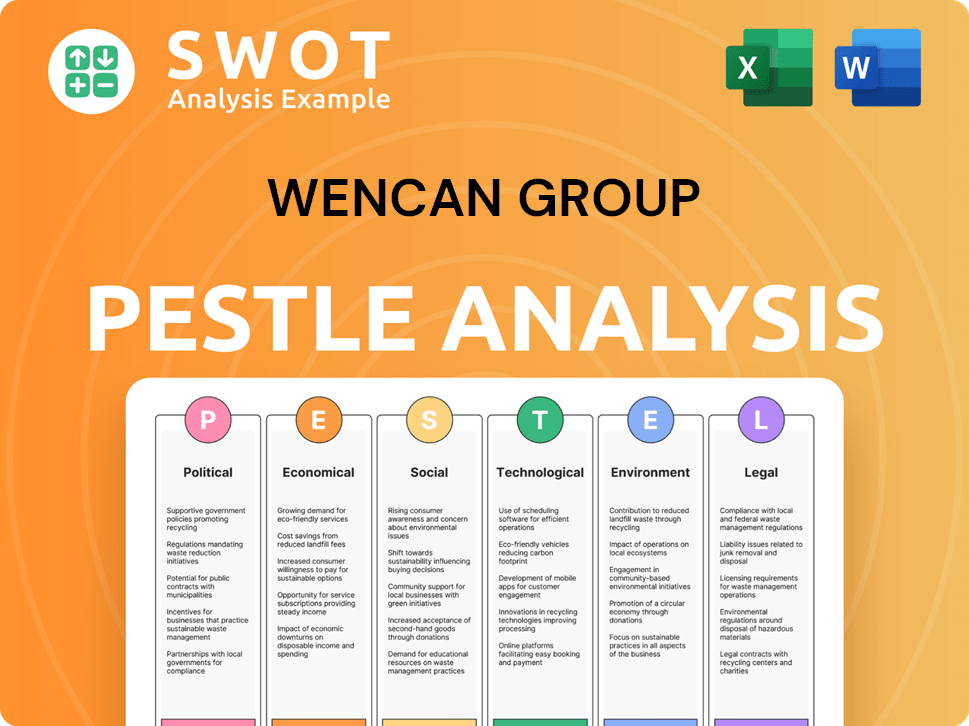

Wencan Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wencan Group Bundle

What is included in the product

Explores external factors uniquely affecting Wencan Group across: Political, Economic, Social, Technological, Environmental, Legal.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview Before You Purchase

Wencan Group PESTLE Analysis

The Wencan Group PESTLE Analysis preview is identical to the file you'll download.

This comprehensive analysis covers political, economic, social, technological, legal, and environmental factors.

All headings, subheadings, and content will appear as displayed.

Enjoy this clear, concise, and ready-to-use document immediately after purchase.

Your file is waiting!

PESTLE Analysis Template

Explore Wencan Group's future with our comprehensive PESTLE Analysis. We delve into the political landscape, revealing opportunities and threats. Analyze the economic factors shaping its performance and spot social trends. Discover how technological advancements impact Wencan Group's strategy. Uncover environmental factors, from sustainability to regulations, that influence the business. Grasp the full picture by purchasing the detailed analysis today!

Political factors

China's manufacturing sector, Wencan Group's home base, benefits from strong government backing. This includes subsidies, tax breaks, and policies promoting industrial growth and tech upgrades. In 2024, the Chinese government invested over $1.2 trillion in manufacturing initiatives. This support can boost Wencan's operations and growth plans.

Changes in international trade policies, including tariffs and trade agreements, can significantly impact Wencan Group's operations. As a global automotive parts supplier, the firm faces risks from shifting trade relations. For example, tariffs on imported aluminum (a key raw material) could raise production costs. In 2024, trade tensions between major economies continue to be a concern.

Wencan Group's global footprint necessitates assessing political stability. Operations span international markets; thus, stability in production and customer regions is critical. Government changes or unrest could severely disrupt their supply chains. For example, a 2024 study showed a 15% supply chain disruption risk in unstable regions.

Automotive Industry Regulations

Governments worldwide heavily regulate the automotive industry, focusing on safety, emissions, and manufacturing. Wencan Group, as a key supplier, must comply with these regulations, impacting its product design and production costs. The EU's Euro 7 emission standards, expected by 2027, will require significant investments in cleaner technologies. In 2024, the global automotive industry faced over $50 billion in regulatory compliance costs.

- Euro 7 standards could increase vehicle production costs by up to 20%.

- Compliance with safety regulations adds approximately 10-15% to the cost of automotive parts.

- China's stricter emission rules led to a 12% increase in R&D spending for manufacturers in 2024.

Government Investment in Infrastructure

Government infrastructure spending significantly affects Wencan Group's operations. Investments in transportation networks, such as roads and railways, can streamline logistics, potentially lowering transportation costs. Reliable energy supply, another infrastructure component, is crucial for manufacturing efficiency. For instance, in 2024, China's infrastructure investment reached approximately $3.9 trillion, impacting various sectors.

- Reduced transportation costs due to better roads.

- Increased operational efficiency with a stable energy supply.

- Enhanced logistics capabilities.

- Overall improved profitability.

Wencan Group's political environment hinges on government support and global trade dynamics. In 2024, Chinese manufacturing received $1.2T in government investment. Trade tensions and tariffs pose risks to the company.

| Political Factor | Impact on Wencan | 2024 Data |

|---|---|---|

| Government Support | Subsidies, tax breaks | China's manuf. investment: $1.2T |

| Trade Policies | Tariffs, agreements | Trade tensions remain. |

| Political Stability | Supply chain risk | 15% supply chain risk (unstable regions) |

Economic factors

Wencan Group faces commodity price volatility, especially for aluminum alloy. In 2024, aluminum prices fluctuated, impacting production costs. A 10% price swing can shift profit margins. The company actively hedges to mitigate risks. For 2025, forecasts suggest continued volatility, requiring proactive cost management.

The demand for Wencan Group's automotive parts is highly sensitive to global economic trends. Strong global economic growth, particularly in major automotive markets like China and the US, fuels vehicle production and component demand. Conversely, economic slowdowns or recessions can significantly decrease automotive sales. For example, in 2024, global automotive sales are projected to reach approximately 88 million units.

Inflation significantly affects Wencan's operational expenses, particularly labor, energy, and raw materials. Rising inflation can squeeze profit margins if cost increases can't be transferred to consumers. The latest data shows China's CPI at 0.3% in March 2024, potentially impacting manufacturing costs. Wencan must monitor inflation closely.

Exchange Rate Fluctuations

As Wencan Group engages in international trade and operates overseas, exchange rate fluctuations pose a significant risk. Changes in currency values can directly impact the costs of imported materials and the revenue from exported goods. For example, the USD/CNY exchange rate has shown volatility, affecting profitability. In 2024, the CNY has experienced fluctuations against major currencies.

- Impact on profit margins due to currency conversions.

- Risk of hedging strategies to mitigate exchange rate risk.

- Effect on the competitiveness of exports.

Interest Rates and Access to Capital

Interest rate fluctuations directly affect Wencan's capital expenditure decisions. Higher rates increase borrowing costs, potentially delaying investments in areas like advanced manufacturing. Conversely, lower rates make capital more accessible, supporting expansion plans. Affordable capital is crucial for Wencan's growth strategy. Recent data indicates the People's Bank of China maintained its prime loan rate at 3.45% in April 2024.

- Interest rate changes impact borrowing costs for Wencan.

- Access to affordable capital is vital for growth.

- China's prime loan rate was 3.45% in April 2024.

Economic factors significantly influence Wencan Group's profitability and strategic decisions. Commodity price volatility, particularly for aluminum alloy, impacts production costs. Economic growth, especially in key automotive markets, fuels demand, with global sales expected to reach ~88 million units in 2024. Inflation, like China's CPI at 0.3% in March 2024, and exchange rate fluctuations also pose considerable risks.

| Factor | Impact | Data |

|---|---|---|

| Aluminum Price Volatility | Affects production costs and profit margins. | 10% price swing impacts profit. |

| Economic Growth | Drives demand for automotive parts. | Global automotive sales ~88M in 2024. |

| Inflation | Impacts operational expenses. | China's CPI at 0.3% (March 2024). |

Sociological factors

Consumer preferences are shifting, with a rise in electric vehicles (EVs). This change impacts Wencan Group, as demand for EV-related parts grows. Lightweight aluminum alloy castings, a Wencan specialty, are key for EVs. In Q1 2024, EV sales rose by 15% globally, driving demand.

Urbanization continues globally, with over 56% of the world's population residing in urban areas as of 2023, a trend projected to reach 68% by 2050. This shift alters mobility needs. Wencan Group should consider how these changes will affect demand for their products. Adapting offerings, like electric vehicle components, could be vital to stay competitive.

The availability of a skilled workforce significantly impacts Wencan Group's operations. The company depends on skilled labor for its precision die-casting processes. As of 2024, the manufacturing sector faces a skills gap; however, Wencan's strategic locations help mitigate this. Labor costs and availability fluctuations directly influence production capacity and overall costs. Wencan's ability to adapt to these changes is crucial for maintaining competitiveness.

Safety and Labor Practices

Societal expectations and regulations significantly impact Wencan's manufacturing operations. Maintaining robust workplace safety and ethical labor practices is crucial for its public image. Compliance with these standards is essential for attracting and retaining employees, and for avoiding legal issues. In 2024, the manufacturing sector saw a 15% increase in safety regulations. This highlights the increasing importance of these factors.

- Employee relations are key.

- Reputation is at stake.

- Legal compliance is a must.

- Safety regulations are increasing.

Social Responsibility and Community Impact

Wencan Group faces increased scrutiny regarding its social responsibility, particularly in its local communities. Stakeholders assess job creation, community involvement, and ethical conduct. For instance, in 2024, Wencan Group invested $2 million in local community projects. This commitment is critical for maintaining a positive reputation.

- 2024: $2 million investment in local projects

- Focus: Job creation, ethical practices

Wencan's success hinges on strong employee relations, vital for workforce stability. Public perception and ethical conduct, impacting its brand. As per 2024 data, compliance with escalating safety rules is crucial. Wencan's social responsibility is further examined.

| Factor | Impact | Data |

|---|---|---|

| Employee Relations | Crucial for production. | 2024: Key to stability. |

| Reputation | Impacts market presence | Brand image at stake |

| Compliance | Required for legality | Safety reg up 15% in 2024 |

Technological factors

Technological advancements in die-casting, like integrated die-casting, boost Wencan's efficiency. New aluminum alloy formulations improve product quality and reduce costs. Staying current is vital for competitiveness in 2024. Wencan's R&D spending in 2023 was approximately RMB 200 million, showing their commitment to tech.

Automation and Industry 4.0 are pivotal for Wencan. Embracing these enhances productivity, lowers labor costs, and refines quality control. In 2024, the global industrial automation market is projected at $200B. Investing in these technologies is crucial for Wencan's competitiveness. For example, in 2024, investments in automation increased by 15% within the automotive component sector.

Wencan Group should track advancements in materials like composites. Lightweight materials could reduce demand for aluminum die castings, Wencan's core business. In 2024, the global composites market was valued at approximately $98 billion. Diversification into new materials is crucial for Wencan's long-term competitiveness. This includes understanding the cost and performance trade-offs.

Technological Integration in Vehicles

The automotive industry's shift towards advanced technologies significantly impacts Wencan Group. The growing integration of ADAS, and sophisticated infotainment systems drives demand for precision components, potentially increasing Wencan's market opportunities. This technological evolution influences the design, manufacturing processes, and material requirements for Wencan's products. As of late 2024, the global ADAS market is valued at approximately $30 billion, with projections indicating substantial growth by 2025.

- ADAS market growth expected to reach $50 billion by 2027.

- Increasing demand for high-precision casting and machining.

- Focus on lightweight materials and enhanced durability.

Intellectual Property and R&D

Protecting intellectual property (IP) is vital for Wencan Group, particularly concerning its die-casting processes and product designs. This protection ensures a competitive edge in the market. Wencan must continue investing in research and development (R&D) to drive innovation and stay ahead. According to the 2024 financial reports, R&D spending increased by 12% year-over-year, signaling their commitment.

- Intellectual Property protection is crucial for Wencan's competitive edge.

- Ongoing R&D investments are vital for innovation.

- In 2024, R&D spending rose by 12%.

Wencan Group's tech focus includes advanced die-casting and material upgrades. Automation and Industry 4.0 adoption are crucial for boosting efficiency and reducing costs. Protecting intellectual property through robust R&D investments, up 12% in 2024, is key.

| Aspect | Details | Impact |

|---|---|---|

| R&D Spending (2024) | Increased 12% YoY | Drives innovation, maintains competitive edge. |

| Global Composites Market (2024) | Valued ~$98B | Necessitates material diversification. |

| ADAS Market Value (late 2024) | $30B | Boosts demand for precision components. |

Legal factors

Wencan Group faces stricter environmental rules on emissions, waste, and hazardous materials. These increase operational costs and demand investments in pollution control tech. For example, in 2024, compliance costs rose 10% due to new regulations. Companies in China, like Wencan, are increasingly scrutinized.

Wencan Group must adhere to labor laws and employment regulations. This covers working hours, wages, and benefits. In 2024, China's minimum wage ranged from 1,480 to 2,690 yuan monthly. Workplace safety standards are also crucial for compliance. Non-compliance can lead to legal penalties and reputational damage.

As a supplier of automotive parts, Wencan Group faces product liability laws. Strict adherence to quality and safety standards is vital to prevent legal problems and protect its reputation. In 2024, product liability lawsuits in the automotive sector increased by 15%, highlighting the importance of robust compliance. This includes rigorous testing and quality control to minimize risks. Failure to comply can lead to costly recalls and significant financial penalties.

International Trade Laws and Agreements

Wencan Group's global ventures are significantly shaped by international trade laws and agreements, demanding meticulous adherence for seamless operations. The World Trade Organization (WTO) agreements, for instance, impact tariffs and trade practices, with China's role being pivotal. In 2024, China's trade surplus reached approximately $823 billion, highlighting the scale of its international trade activities. Navigating these regulations is critical for Wencan to avoid legal complications and ensure efficient cross-border transactions.

- WTO rules govern trade practices and dispute resolution.

- China's trade surplus in 2024 was around $823 billion.

- Compliance is key to avoiding legal issues.

- Understanding these laws ensures smooth cross-border operations.

Corporate Governance Regulations

Wencan Group, as a public entity, is strictly governed by corporate governance regulations in the regions it operates. These regulations dictate how the company is managed and reported, impacting its operational transparency. Compliance with these rules is crucial for maintaining investor trust and avoiding legal penalties. For example, in 2024, the average fine for non-compliance with corporate governance regulations in China was approximately $1.5 million, underscoring the importance of adherence.

- Compliance with the Shanghai Stock Exchange's Corporate Governance Guidelines.

- Regular audits and financial reporting as mandated by regulatory bodies.

- Adherence to anti-corruption laws and ethical business practices.

Legal factors greatly affect Wencan Group's operations, focusing on environmental, labor, product liability, and trade laws. Strict adherence to these laws is crucial. China's regulatory landscape continues to evolve.

| Area | Regulation | Impact |

|---|---|---|

| Environment | Emission Standards | Increased Compliance Costs |

| Labor | Minimum Wage | Affects Wage Expenses |

| Trade | WTO Agreements | Shapes Cross-Border Trade |

Environmental factors

The automotive industry is under pressure to boost sustainability and cut emissions. This trend boosts demand for lightweight parts like aluminum die-castings, improving fuel efficiency. For example, in 2024, the push for EVs saw aluminum use in vehicles rise by 15%.

Wencan Group faces environmental pressures regarding raw material sourcing, particularly aluminum. Sustainable sourcing practices and the use of recycled materials are increasingly vital. The global aluminum market was valued at $188.2 billion in 2023 and is projected to reach $260.5 billion by 2030. This growth underscores the need for responsible sourcing to mitigate environmental impacts.

Waste management and recycling are pivotal for Wencan Group. Effective recycling programs and waste reduction targets are essential for environmental compliance. In 2024, the global recycling rate for aluminum, a key material for Wencan, was approximately 60%. Companies face increasing pressure to minimize waste.

Energy Consumption and Efficiency

Wencan Group's manufacturing, particularly die-casting, demands significant energy. Its environmental impact hinges on energy use, efficiency, and renewable energy adoption. In 2024, the company invested $5 million in energy-efficient equipment. This aligns with China's push for green manufacturing, aiming for a 13.5% reduction in energy intensity by 2025.

- $5M invested in 2024 for energy-efficient equipment.

- China's goal: 13.5% energy intensity reduction by 2025.

Climate Change and Extreme Weather

Climate change poses significant risks to Wencan Group. Extreme weather events could disrupt operations and supply chains. Assessing and mitigating these environmental risks is crucial. For example, in 2024, the World Bank estimated that climate change could cost the global economy up to $1.6 trillion annually.

- Disruptions to manufacturing plants due to flooding or storms.

- Increased insurance premiums due to climate-related risks.

- Changes in raw material availability due to droughts or other events.

- Impacts on transportation networks, affecting supply chains.

Wencan Group confronts environmental challenges through resource sourcing, particularly aluminum, and must emphasize sustainable sourcing. Waste management and recycling, crucial for compliance, are gaining importance, with a 60% aluminum recycling rate in 2024. Energy use in manufacturing and climate change effects pose significant risks, driving the need for efficient practices.

| Environmental Aspect | Impact on Wencan Group | Data/Statistics |

|---|---|---|

| Raw Material Sourcing | Risks in aluminum supply from sustainability concerns and fluctuating prices | Global aluminum market expected to reach $260.5B by 2030. |

| Waste Management | The necessity of recycling programs and waste reduction to stay compliant with standards | Aluminum recycling rate ~60% in 2024. |

| Energy Consumption | High use and reliance on efficiency and adoption of renewables | $5M invested in 2024 in energy-efficient equipment; China aims for a 13.5% reduction in energy intensity by 2025. |

PESTLE Analysis Data Sources

Wencan Group's PESTLE relies on diverse data, including financial reports, government statistics, and market analysis for each category.