Western Digital Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Western Digital Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio.

Printable summary optimized for A4 and mobile PDFs of the WD BCG matrix, helps in quick decision-making.

What You See Is What You Get

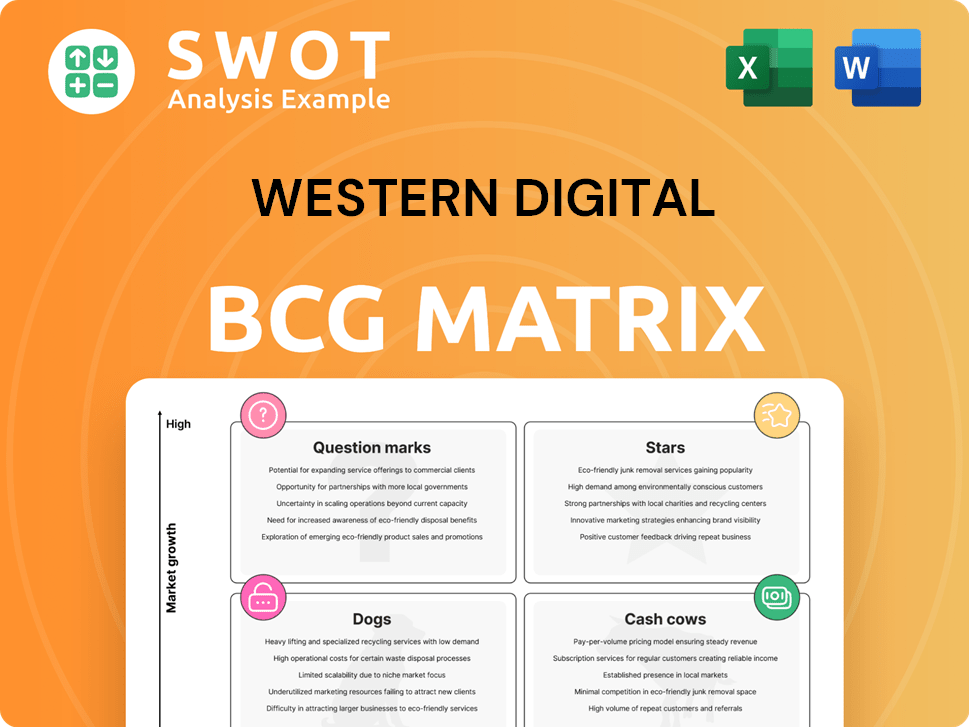

Western Digital BCG Matrix

The preview displays the complete Western Digital BCG Matrix you'll receive. This is the final, ready-to-use document for your strategic analysis, immediately downloadable upon purchase.

BCG Matrix Template

Western Digital's BCG Matrix offers a strategic snapshot of its diverse product portfolio. It helps to understand how different products fare in the market.

This overview touches on the core quadrants, revealing potential growth areas.

Discover which products are stars and which require careful attention.

Uncover cash cows providing stability and dogs needing reassessment.

The full BCG Matrix dives into product placements and strategic recommendations.

Get the complete report for actionable insights into Western Digital's market position and investment strategies.

Purchase now for a complete strategic advantage.

Stars

Western Digital's high-capacity HDDs, especially UltraSMR drives, are strategically placed for the cloud market's expansion. Cloud storage demand, fueled by AI, boosts the need for these drives. In Q1 2024, Western Digital reported data center revenue of $1.4 billion. They're testing HAMR, eyeing leadership.

Enterprise SSDs are a key growth area for Western Digital's Flash business. The data center demand for NVMe SSDs is boosting revenue. In Q1 2024, Western Digital saw a 20% increase in enterprise SSD revenue. Their operational focus and innovation are key. This positions them well for the future.

Western Digital is strategically positioned in the AI-driven storage solutions market. They focus on AI applications, leveraging the increasing demand for data lakes. In 2024, HDD exabyte shipments grew, fueled by AI model growth. Western Digital's scalability and cost-effectiveness support the rise of AI.

UltraSMR Technology

Western Digital's UltraSMR technology is a key growth driver. It has been significantly adopted in nearline HDDs, boosting revenue. This tech enhances storage capacity and performance, providing a strong total cost of ownership. UltraSMR innovation strengthens Western Digital's high-capacity storage leadership.

- UltraSMR HDDs are crucial for Western Digital's nearline storage solutions.

- This technology helps Western Digital compete in the high-capacity storage market.

- UltraSMR's success is reflected in increased sales of nearline HDDs.

- The technology's value proposition focuses on capacity and cost-effectiveness.

ePMR Technology

Western Digital's ePMR technology is a strategic asset. It's a key component in their CMR HDDs, ensuring long-term value. This innovation supports a predictable economic transition for clients. The company's focus on technologies like ePMR and UltraSMR aims for maximum data center value.

- ePMR offers improved areal density compared to older technologies.

- UltraSMR enhances storage capacity, reducing costs.

- Western Digital aims to lead in storage solutions, including HAMR.

- These technologies help customers scale efficiently.

Western Digital's Stars include UltraSMR HDDs and Enterprise SSDs. They drive revenue growth, especially in data centers. In Q1 2024, data center revenue hit $1.4B. Strong position for AI-driven demand.

| Product | Key Feature | Q1 2024 Impact |

|---|---|---|

| UltraSMR HDDs | High Capacity, Cost-Effective | Boosted nearline HDD sales |

| Enterprise SSDs | NVMe, Performance | 20% revenue increase |

| Data Center | AI Driven Storage | $1.4B Revenue |

Cash Cows

Nearline HDDs are a cash cow for Western Digital, crucial for cloud and enterprise storage. These drives provide consistent cash flow due to high capacity and cost efficiency. Western Digital's UltraSMR tech strengthens their market position. In Q1 2024, HDDs generated $1.4B in revenue.

WD Gold SATA HDDs cater to system integrators, offering reliable storage for enterprises. These drives manage heavy workloads, ensuring continuous performance. The 26TB WD Gold HDDs provide a robust storage solution. In 2024, enterprise storage demand grew by 10%, reflecting the need for dependable solutions.

Traditional HDDs remain a cash cow for Western Digital, despite SSD competition. In 2024, HDDs still capture a significant market share in data centers and enterprise storage. Western Digital leverages its strong brand for consistent sales and cash flow. The company's 2024 revenue reached $12.3 billion. They focus on sustainable storage solutions.

Client HDDs

Client HDDs, a cash cow for Western Digital, generate consistent revenue despite market shifts. Although facing a decline, these HDDs still contribute significantly. In the recent quarter, HDD revenue remained stable. The Client segment accounted for 29% of total revenue.

- Steady revenue stream.

- Client segment contribution: 29%.

- HDD revenue stability.

Consumer HDDs

Consumer HDDs remain a cash cow for Western Digital, generating steady revenue even with SSDs gaining popularity. In Q1 2024, a slight HDD growth offset a Flash decline due to weaker consumer demand. Year-over-year, lower shipments in both Flash and HDD decreased revenues, although pricing improved. Western Digital's focus on high-capacity HDDs helps maintain profitability.

- Q1 2024 HDD revenue offset Flash decline.

- Year-over-year decrease due to shipment volumes.

- Improved pricing in both HDD and Flash.

Western Digital's HDDs consistently generate revenue, crucial for cloud and enterprise. Despite market shifts, consumer and client HDDs remain significant contributors. In Q1 2024, HDDs generated $1.4B.

| Segment | Contribution | Q1 2024 Revenue |

|---|---|---|

| Nearline HDDs | Cloud/Enterprise | $1.4B |

| Client HDDs | 29% of Total | Stable |

| Consumer HDDs | Steady | Offset Flash Decline |

Dogs

Small capacity HDDs are struggling against SSDs, which offer better performance. This is a tough spot for Western Digital. In 2024, SSDs captured a larger market share. These HDDs have limited growth, potentially classifying them as dogs. Western Digital should consider reducing investment in these areas.

Consumer flash memory, including USB drives and SD cards, is under pressure due to declining bit shipments and price competition. Western Digital's flash and HDD bit shipments decreased, although pricing improved. The company might need to rethink its approach in this area. In 2024, the consumer flash memory market saw fluctuating prices and demand.

Legacy storage products, such as older HDDs, are categorized as "dogs" in Western Digital's BCG matrix. These products have low market share and limited growth potential. In Q4 2023, Western Digital's legacy products saw declining revenue, reflecting their position. Western Digital should consider divestiture to focus on more promising areas.

WD Branded SSDs

Western Digital's SSDs, including the Black, Blue, Green, and Red series, are transitioning. SanDisk is now the primary brand for solid-state drives. This strategic shift is part of a broader restructuring within the company.

- SanDisk's market share in the SSD market was approximately 15% in 2024.

- Western Digital's overall revenue in fiscal year 2024 was around $12.5 billion.

- The SSD market is projected to reach $100 billion by 2026.

- This move could streamline product offerings and improve operational efficiency.

Low-Capacity SSDs

Low-capacity SSDs are under pressure due to intense competition and price declines. Western Digital could struggle to maintain margins in this area. The company might need to rethink its approach to boost profits or explore selling this part of its business.

- Price erosion in the SSD market has been significant, with average selling prices (ASPs) decreasing by 10-15% in 2024.

- Competition from Chinese manufacturers has increased, putting further pressure on pricing.

- Western Digital's gross margins in the low-capacity SSD segment are likely below the company average.

Dogs represent products with low market share and growth. Legacy storage and small HDDs fit this category. Western Digital should reduce investment in these areas, such as divesting to focus on more profitable segments.

| Product | Market Share | Growth Potential |

|---|---|---|

| Legacy HDDs | Low | Limited |

| Small Capacity HDDs | Declining | Negative |

| Consumer Flash Memory | Fluctuating | Moderate |

Question Marks

HAMR technology is a Question Mark for Western Digital in its BCG Matrix. It aims to boost HDD capacity and performance, crucial in the data storage market. Western Digital is testing HAMR drives with key clients, signaling potential growth. The company's strategy combines current tech with HAMR, ensuring a smooth customer transition. In 2024, the global HDD market was valued at approximately $20 billion.

Computational storage, a nascent technology, embeds processing within storage devices. Western Digital has allocated over $2 billion to R&D, including computational storage. Despite being in its infancy, it could transform data handling. Western Digital's 2024 revenue was approximately $12.3 billion, suggesting a significant investment impact.

Enterprise SMR HDDs, key in Western Digital's BCG Matrix, offer up to 32TB capacities. These HDDs support cost-effective deep content storage, crucial for scalability. They boast up to 257 MiB/s performance and consume just 5.5W idle power. This makes them perfect for warm and cold data tiers.

Data Center Solutions

Data center solutions represent a "Question Mark" in Western Digital's BCG matrix. The global data center hardware market was worth USD 74.6 billion in 2024. It's expected to grow to USD 157.5 billion by 2033, with an 8.7% CAGR. This sector's growth is driven by more hyperscale data centers and demand for faster processing.

- Market size in 2024: USD 74.6 billion.

- Projected market size by 2033: USD 157.5 billion.

- CAGR (2025-2033): 8.7%.

- Growth drivers: Hyperscale data centers, need for fast processing.

QLC SSDs

QLC (Quad-Level Cell) SSDs represent a new direction in the storage market, offering more affordable storage options. PCIe 5.0 SSDs deliver lightning-fast system performance. The enterprise SSD market is driven by NAND flash technology and PCIe/NVMe interfaces. Major players like Western Digital are constantly innovating to improve endurance.

- QLC SSDs provide cost-effective storage solutions, appealing to budget-conscious consumers and businesses.

- PCIe 5.0 SSDs offer significantly faster data transfer speeds, enhancing overall system responsiveness.

- NAND flash technology advancements, such as those by Western Digital, are crucial for increasing storage capacity and performance.

- The enterprise SSD market is competitive, with companies constantly striving to improve product endurance and reliability.

Flash storage plays a critical role in Western Digital's strategy. The global flash memory market was valued at $63.8 billion in 2024, with significant growth projected. Demand is driven by advancements in NAND technology, and the rising use of SSDs. Western Digital's investment in QLC and PCIe 5.0 SSDs shows its innovative approach.

| Market Size in 2024 | ||

|---|---|---|

| Flash Memory Market | $63.8 billion | |

| Enterprise SSD Market | Growing due to NAND and PCIe/NVMe. | |

| QLC SSDs | Offer cost-effective solutions. |

BCG Matrix Data Sources

Our BCG Matrix uses publicly available financial statements, market research, and industry publications to deliver strategic insights.