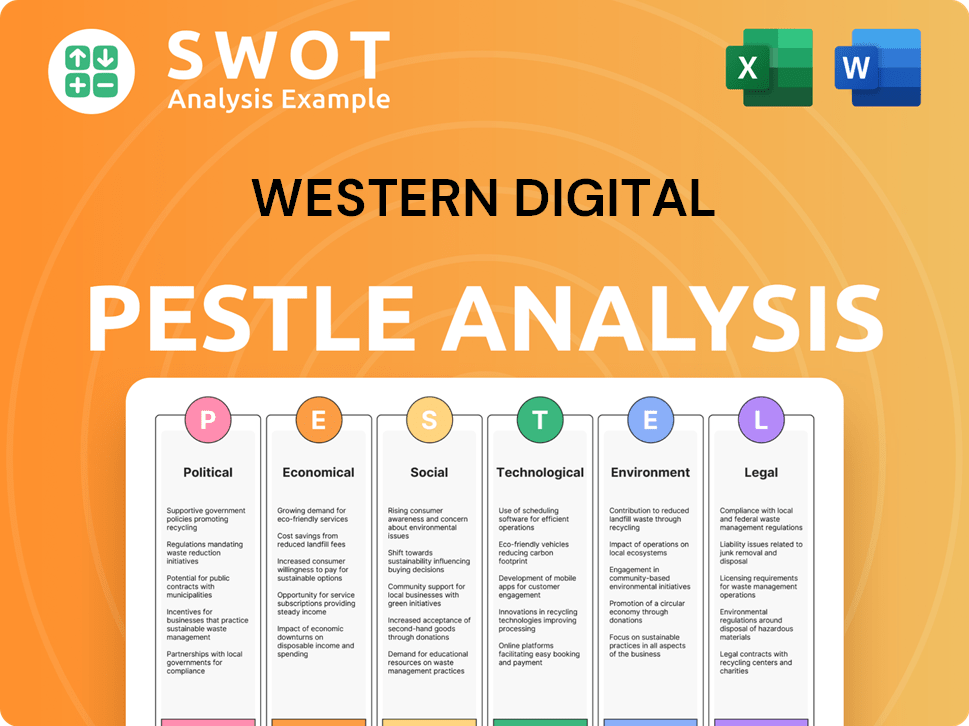

Western Digital PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Western Digital Bundle

What is included in the product

Evaluates how external influences across six factors affect Western Digital, highlighting threats and opportunities.

Helps identify key drivers in market positioning, aiding swift strategic planning.

Same Document Delivered

Western Digital PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This PESTLE Analysis of Western Digital provides a complete view. It analyzes Political, Economic, Social, Technological, Legal, and Environmental factors. No placeholders or partial views – it’s all there. You get the entire document upon purchase.

PESTLE Analysis Template

Explore how Western Digital faces challenges and opportunities in today's dynamic landscape. Our PESTLE analysis delivers critical insights into external factors. Uncover how political, economic, and social forces influence its market position. Understand the technological and legal impacts. Download the full analysis to boost your strategic decisions.

Political factors

Geopolitical tensions, especially US-China, affect Western Digital. Export controls on semiconductors and storage tech may cut revenues and raise costs. The Bureau of Industry and Security (BIS) enforces strict licensing. In 2024, these controls could impact $1 billion in sales. Western Digital is adjusting its supply chains, facing increased operational expenses.

Heightened government emphasis on cybersecurity compliance demands significant financial commitments from data storage firms such as Western Digital. Implementing regulations like the NIST Cybersecurity Framework and FISMA requires substantial capital. Western Digital's cybersecurity spending reached $300 million in 2024, with a projected increase to $350 million by 2025 due to stricter mandates. These investments are crucial for maintaining operational integrity.

Western Digital's global manufacturing, including facilities in Thailand, faces geopolitical risks. Political instability can disrupt production and distribution. Diversifying manufacturing locations is crucial. In 2024, supply chain disruptions impacted various tech firms. Western Digital reported a 10% decrease in revenue in Q1 2024 due to supply chain issues.

Government Investment in Digital Infrastructure

Government investments in digital infrastructure significantly impact Western Digital. Initiatives in data centers and cloud computing boost demand for storage solutions. For instance, the U.S. government allocated $65 billion for broadband expansion in 2021, fueling data growth. These investments create opportunities for Western Digital.

- U.S. broadband expansion: $65 billion allocated in 2021.

- Data center market growth: Projected to reach $517.1 billion by 2030.

Political Stability in Key Markets

Political stability significantly impacts Western Digital's market dynamics. Regions with political instability often face economic uncertainty, which can decrease tech spending. For example, in 2024, countries with high political risk saw a 15% drop in IT investments. This affects both consumer and enterprise demand for Western Digital's products.

- Political instability can disrupt supply chains, as seen with the 10% increase in logistics costs in unstable regions in 2024.

- Stable political environments foster investor confidence, critical for Western Digital's expansions.

- Changes in trade policies due to political shifts can impact import/export costs and market access.

Political factors heavily influence Western Digital. Geopolitical tensions, especially US-China trade, pose risks. Government cybersecurity regulations and digital infrastructure investments also affect the company.

| Political Factor | Impact | Data |

|---|---|---|

| US-China Tensions | Export controls and supply chain issues | 2024: $1B sales impact possible. Supply chain disruptions caused 10% revenue decrease Q1 2024. |

| Cybersecurity Regulations | Increased compliance costs | 2024: $300M spent on cybersecurity. Projected $350M by 2025. |

| Digital Infrastructure | Increased demand | U.S. Broadband: $65B allocated in 2021. Data Center market: $517.1B by 2030. |

Economic factors

Global economic health significantly influences demand for data storage. Recessions can reduce consumer and business spending, affecting Western Digital's financials. The International Monetary Fund (IMF) projects global growth at 3.2% in 2024, a slight increase from 2023, potentially boosting demand. Conversely, economic growth generally increases data storage needs.

Western Digital faces currency exchange rate risks due to its global operations. For instance, a stronger USD can decrease the value of international sales. In Q1 2024, currency impacts were a factor in financial performance. Hedging strategies are crucial to mitigate these risks, and protect profitability.

Inflation poses a risk, potentially increasing Western Digital's production costs. In 2024, the U.S. inflation rate fluctuated, impacting manufacturing expenses. Higher interest rates, like the Federal Reserve's moves, could raise borrowing costs for the company. This might curb investments in IT infrastructure. The Federal Reserve maintained rates between 5.25% and 5.50% in late 2024.

Market Demand for Data Storage

Western Digital benefits from the escalating global need for data storage. This demand is fueled by cloud computing, AI, and the Internet of Things. The company can capitalize on this by boosting sales, especially for data center-focused, high-capacity drives. The data storage market is projected to reach $221.5 billion by 2025, growing at a CAGR of 12.6% from 2019 to 2025.

- Global data storage market expected to reach $221.5 billion by 2025.

- CAGR of 12.6% from 2019 to 2025.

- Increased demand from cloud computing, AI, and IoT.

Competitive Pricing Pressure

The data storage market is fiercely competitive, featuring giants like Seagate and Micron. This rivalry creates significant pricing pressure for Western Digital, potentially squeezing profit margins. The commodity-like aspects of certain storage products further intensify this challenge. Western Digital must continuously innovate and manage costs to stay competitive. Intense competition can erode profitability if not managed effectively.

- Seagate's revenue in 2024 reached approximately $7.4 billion.

- Micron's revenue for fiscal year 2024 was around $16.8 billion.

Economic conditions greatly shape Western Digital's performance, affecting demand and costs.

Currency fluctuations present financial risks; for instance, a strong USD can impact international sales negatively.

Inflation and interest rate movements also affect the company's costs and borrowing capabilities, influencing investment decisions.

| Factor | Impact | 2024 Data |

|---|---|---|

| Global Growth | Affects storage demand | IMF projects 3.2% |

| Currency | USD impact sales | Hedging strategies used |

| Inflation | Raises production costs | U.S. rate fluctuated |

Sociological factors

Growing data privacy concerns shape consumer behavior and regulatory demands. This drives the need for secure storage solutions. Western Digital must adapt to evolving privacy standards. The global data privacy market is projected to reach $13.3 billion by 2025. Western Digital's compliance efforts are critical.

The global shift towards remote work has significantly increased the demand for cloud storage. This trend directly boosts the need for reliable storage infrastructure. Western Digital's data center and cloud-focused products are well-positioned to capitalize on this. In Q1 2024, cloud data center spending rose by 18% YoY. This suggests an ongoing demand for WD's offerings.

The shift to digital learning boosts data demand in education. Western Digital can capitalize on this. In 2024, global edtech spending reached $400 billion. The market is projected to reach $600 billion by 2027. This creates demand for data storage.

Popularity of Digital Content

The surge in digital content, especially video, is dramatically increasing data volume, directly benefiting Western Digital. This trend drives higher demand for storage solutions. Video content consumption is expected to continue its rapid growth. The demand for data storage is forecast to rise sharply.

- Global video streaming market was valued at USD 133.05 billion in 2023.

- It's projected to reach USD 446.40 billion by 2030.

- The compound annual growth rate (CAGR) is 18.88%.

Diverse User Demographics

Western Digital serves a wide range of users, from everyday consumers to massive corporations. This diversity demands a broad product lineup to meet varied needs. Tailoring products and marketing is crucial for success, focusing on specific user segments. In 2024, the consumer storage market was valued at $60 billion, highlighting the importance of understanding these demographics.

- Consumer storage market value in 2024: $60 billion.

- The company must adapt to different user needs.

- Marketing strategies must be customized.

Sociological factors profoundly impact Western Digital. Data privacy, with a $13.3 billion market by 2025, shapes consumer behavior and regulatory demands. Digital content's surge, driven by a $446.40 billion video streaming market by 2030, boosts storage needs. Understanding diverse consumer segments, reflected in a $60 billion consumer storage market in 2024, is critical.

| Factor | Impact | Data |

|---|---|---|

| Data Privacy | Drives demand for secure storage | Global market projected at $13.3B by 2025 |

| Digital Content | Increases storage needs | Video streaming market at $446.40B by 2030 |

| Consumer Needs | Influences product and marketing | Consumer storage market at $60B in 2024 |

Technological factors

Western Digital faces intense pressure due to advancements in storage tech. Innovations like HAMR and UltraSMR for HDDs are vital. The company must invest in R&D. In Q1 2024, WD's revenue was $2.8 billion, with $33 million spent on R&D. This is essential for maintaining competitiveness.

Cloud computing and AI are boosting demand for data storage. Western Digital's solutions for data centers are key to growth. In Q1 2024, cloud infrastructure spending reached $73.9 billion. AI server revenue grew by 40% YoY in 2023, per IDC. WD's focus on these areas aligns with market needs.

The Internet of Things (IoT) is rapidly expanding, creating massive data streams. This growth fuels demand for data storage solutions. Western Digital's products are crucial for managing this data surge. The global IoT market is forecast to reach $2.4 trillion by 2029, significantly benefiting WD. WD's focus on storage positions them well to capitalize on this trend.

Competitive Landscape and Innovation Pace

Western Digital operates in a highly competitive tech landscape, where technological advancements happen fast. The company faces constant pressure to innovate and release new data storage solutions. This rapid pace of change requires significant investment in research and development to stay ahead. In fiscal year 2024, Western Digital's R&D expenses were approximately $1.5 billion.

- Competition includes companies like Seagate and Samsung.

- Innovation is crucial for maintaining market share.

- Western Digital must invest heavily in R&D.

- The company's future success depends on its technological advancements.

Supply Chain Technology and Automation

Western Digital heavily relies on supply chain technology and automation to stay competitive. This includes using advanced tech to make its manufacturing and supply chain more efficient. The goal is to cut costs and quickly respond to what customers need. Industry 4.0 technologies are key for this transformation.

- In 2024, automation investments in the semiconductor industry are projected to increase by 15%.

- Western Digital's operational efficiency improved by 8% in 2023 due to supply chain optimization.

- Industry 4.0 adoption is expected to boost overall manufacturing productivity by 10-12% by the end of 2025.

Technological advancements significantly impact Western Digital's operations. Intense competition necessitates continuous innovation, including advancements like HAMR for HDDs and cloud-based solutions. WD must increase R&D to remain competitive. WD's R&D expenses were $1.5 billion in fiscal year 2024.

| Technology Factor | Impact | Data |

|---|---|---|

| HAMR/UltraSMR | Storage advancements | Focus on HDD tech |

| Cloud Computing/AI | Data storage demand | Cloud spending $73.9B (Q1 2024) |

| IoT Expansion | Data storage need | IoT market $2.4T by 2029 |

Legal factors

Western Digital heavily relies on its intellectual property, holding numerous patents vital for its operations. The company encounters risks from intellectual property infringement and potential patent litigation. In 2024, legal expenses related to IP disputes amounted to $50 million. Such litigation can be costly, potentially affecting Western Digital's ability to use its technologies.

Western Digital faces increasing legal scrutiny regarding data protection. They must adhere to global standards like GDPR and US state privacy laws. Compliance demands substantial investment, potentially impacting profitability. Non-compliance can result in significant financial penalties, affecting their financial results. In 2024, GDPR fines reached over €1.6 billion, showing the stakes.

Western Digital faces legal hurdles in adhering to export controls and trade regulations. These regulations significantly influence where the company can sell its products. For instance, in 2024, the U.S. government tightened export controls on advanced semiconductors, impacting companies like Western Digital. This could limit sales in specific regions. Compliance costs and potential penalties are significant risks.

Labor Laws and Regulations

Western Digital (WDC) faces legal obligations regarding labor laws across its global operations. These laws dictate working conditions, wages, and employee rights, impacting operational costs and employee relations. Ethical labor practices are crucial for WDC's reputation and compliance. Any violations can result in legal penalties and reputational damage. For instance, the U.S. Department of Labor reported over 850,000 wage and hour violations in 2024.

- Compliance with international labor standards is essential.

- WDC must adhere to local employment laws in each country.

- Ethical sourcing and fair labor practices are critical.

- Legal risks include potential fines and lawsuits.

Antitrust and Competition Laws

Western Digital operates within a landscape shaped by antitrust and competition laws globally, which are designed to prevent anti-competitive practices. These laws are crucial because they directly affect the company's ability to conduct business and maintain market share. Violations can lead to significant penalties, including hefty fines and potential legal battles, as seen with other tech giants. Western Digital must carefully monitor its business practices to comply with these regulations. The company's compliance efforts are ongoing, given the dynamic nature of these laws.

- In 2024, the EU fined several tech companies billions for antitrust violations.

- Western Digital's market share in 2024 was approximately 30% in the HDD market.

- The U.S. Department of Justice and FTC actively investigate tech mergers.

Western Digital navigates IP litigation, spending $50M on disputes in 2024. Data protection compliance is crucial; GDPR fines hit €1.6B that year. Export controls, like those in 2024, and labor laws impact operations. Antitrust laws also shape their market strategies. In 2024, its HDD market share was about 30%.

| Legal Area | Risk | Impact in 2024 |

|---|---|---|

| Intellectual Property | Infringement lawsuits | $50M in litigation costs |

| Data Protection | Non-compliance | GDPR fines exceeded €1.6B |

| Export Controls | Sales restrictions | U.S. export rules tightened |

| Labor Laws | Violations and penalties | US DoL reported 850k+ wage violations |

| Antitrust | Competition restrictions | HDD market share approx 30% |

Environmental factors

Western Digital faces pressure to enhance environmental sustainability. This involves reducing energy use and waste. In 2024, the company aimed for a 20% reduction in greenhouse gas emissions. It also focuses on using fewer hazardous substances. The company's 2023 Sustainability Report highlights these efforts.

Responsible sourcing of materials, including critical minerals, is key for Western Digital. This involves evaluating supplier practices and addressing environmental and social impacts. Western Digital has set goals for sustainable sourcing. In 2024, they reported progress on these initiatives.

Western Digital faces mounting pressure regarding e-waste and product lifecycle management. The company must address the environmental impact of its products, focusing on recyclability and responsible disposal. Implementing take-back programs could significantly reduce waste. According to the EPA, in 2024, only 15% of e-waste was recycled.

Climate Change and Carbon Reduction Goals

Western Digital's environmental strategy is heavily influenced by climate change and carbon reduction targets. The company actively works to decrease its greenhouse gas emissions, aligning with global sustainability efforts. For instance, Western Digital aims to achieve net-zero emissions by 2050. This commitment is crucial as investors increasingly prioritize environmentally responsible companies.

- Western Digital’s 2023 Sustainability Report highlights progress in reducing its carbon footprint.

- The company's initiatives include energy efficiency programs and the use of renewable energy.

- These efforts reflect a broader trend of corporate environmental responsibility.

Energy Consumption of Data Centers

Data centers, crucial for Western Digital's drive sales, are energy-intensive, posing an environmental challenge. The industry must prioritize energy-efficient storage solutions to mitigate this. In 2024, data centers consumed roughly 2% of global electricity. Western Digital's innovation in energy-efficient drives directly addresses this concern.

- Data centers' energy use is about 2% of global electricity in 2024.

- Western Digital focuses on energy-efficient storage.

Western Digital concentrates on boosting environmental sustainability to cut emissions and waste. In 2024, they sought a 20% reduction in greenhouse gases, emphasizing renewable energy. The company aims for net-zero emissions by 2050 and manages product lifecycle with initiatives for e-waste reduction.

| Environmental Factor | Impact | Western Digital's Response |

|---|---|---|

| Climate Change | Rising GHG emissions. | Net-zero emissions goal by 2050. |

| E-waste | Significant disposal issues. | Product recyclability programs. |

| Energy Use | High in data centers. | Focus on energy-efficient drives. |

PESTLE Analysis Data Sources

Western Digital's analysis uses data from financial reports, industry publications, and government databases. These sources help assess political, economic, social, tech, legal & environmental factors.