West Pharmaceutical Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

West Pharmaceutical Services Bundle

What is included in the product

Tailored analysis for West Pharmaceutical's product portfolio, highlighting strategic decisions.

Export-ready design for quick drag-and-drop into PowerPoint. This allows seamless integration into executive presentations.

Delivered as Shown

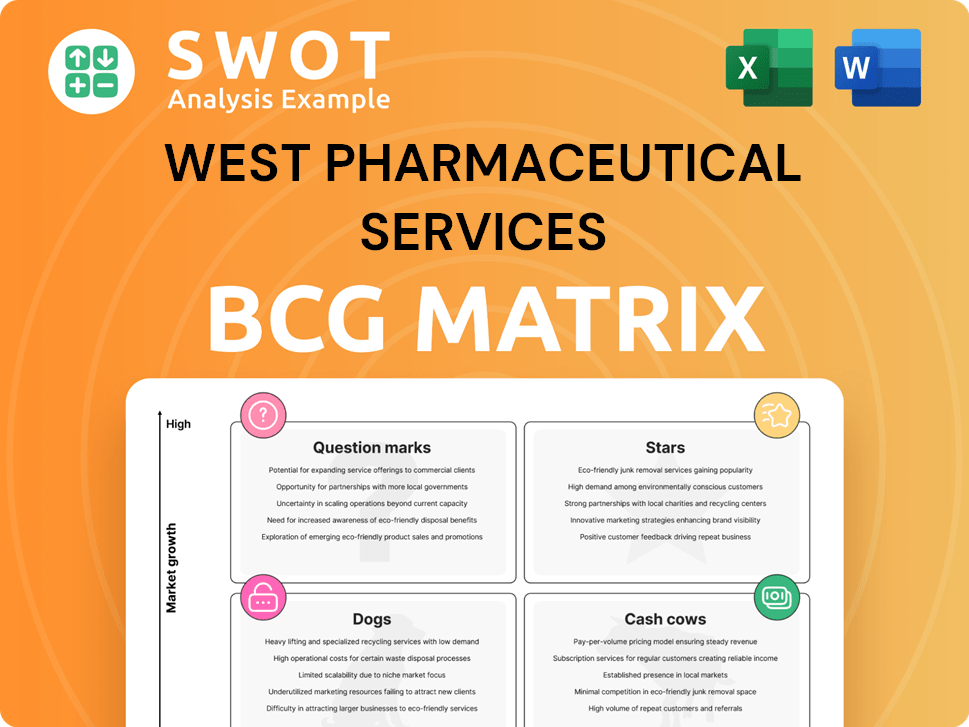

West Pharmaceutical Services BCG Matrix

The preview you see mirrors the final BCG Matrix document for West Pharmaceutical Services after purchase. Get ready to download a fully realized report, complete with strategic insights and actionable data points. Your copy is ready to be deployed for strategic planning. No alterations are needed, just the complete, professional analysis.

BCG Matrix Template

West Pharmaceutical Services' BCG Matrix offers a snapshot of its diverse product portfolio.

Expect to see established cash cows and promising question marks within its offerings.

Analyzing its stars reveals key drivers for future growth and potential investments.

The matrix also highlights the dogs that may be underperforming, requiring attention.

Discover product placement and strategic guidance with the full BCG Matrix report.

Purchase now and gain in-depth market analysis and actionable recommendations.

Get instant access to the complete BCG Matrix for strategic business advantages.

Stars

West Pharmaceutical Services' High-Value Products (HVP), encompassing components and devices, are experiencing robust growth. These HVPs, crucial for sensitive drugs, especially biologics, often boast higher profit margins. In 2024, HVP sales represented a significant portion of West's revenue, increasing by 10% year-over-year. West's strategic capacity expansion for HVPs reflects its commitment to a high-growth segment.

Self-injection device platforms are experiencing high customer demand, fueling growth in West's Proprietary Products segment. These devices are key for delivering medications for chronic conditions like diabetes and obesity. In 2024, this segment saw a revenue increase, reflecting strong market adoption. West's innovative efforts in this area solidify its position as a leader in drug delivery solutions.

The Biologics market unit at West Pharmaceutical Services demonstrates high-single-digit organic net sales growth. This growth, fueled by self-injection device platform sales, is a key driver. In 2023, West's sales in biologics were significant, with self-injectors contributing substantially. West's focus on biologics manufacturers' needs is crucial for future gains.

Annex 1 Compliance

The implementation of EU GMP Annex 1 is boosting West Pharmaceutical Services' growth. Firms are actively seeking ways to comply with these strict rules. West is involved in multiple Annex 1 projects, showing its dedication to helping clients through regulatory shifts. This strategic focus aligns with the growing demand for advanced pharmaceutical packaging and delivery systems. In 2024, West’s revenue grew, reflecting the impact of these initiatives.

- EU GMP Annex 1 adoption fuels West's expansion.

- Customers actively seek compliance solutions.

- West is involved in many Annex 1 projects.

- Revenue growth in 2024 underscores success.

GLP-1 Product Expansion

West Pharmaceutical Services is strategically expanding its operations to meet the rising demand for GLP-1 products, a key focus area. The company is increasing production capacity in facilities such as Grand Rapids and Dublin. This expansion is designed to support the growing market for GLP-1 treatments. West’s focus on GLP-1 positions it to capitalize on market growth.

- West's focus on GLP-1 is aligned with the market's growth, projected to reach billions by 2030.

- Production expansions in facilities like Grand Rapids and Dublin are strategic moves.

- This positions West to benefit from the increasing demand for GLP-1.

- The company is investing in infrastructure to support this growth.

West's High-Value Products and self-injection devices are the Stars, showing high growth. Biologics also boost growth, driven by self-injection platform sales. West’s strategic focus on GLP-1 and EU GMP Annex 1 further fuels expansion and market position.

| Category | Description | 2024 Data |

|---|---|---|

| HVPs | Components & Devices | 10% YoY Revenue Growth |

| Self-Injection Devices | Proprietary Products | Revenue Increase (2024) |

| Biologics | Market Unit | High-single-digit organic sales growth |

Cash Cows

The Proprietary Products segment, a core of West's revenue, functions as a cash cow. This segment includes HVP components, standard products, and HVP delivery devices. In 2024, this segment generated substantial revenue. It benefits from West's strong market standing, ensuring consistent income despite growth variations.

West Pharmaceutical Services' standard products in the pharma market are experiencing mid-single-digit organic net sales growth. This growth is fueled by increased sales of standard and Westar® products. These products are reliable revenue generators for the company. Established relationships with pharma companies ensure a stable foundation. In 2024, West's net sales reached $3.3 billion.

West Pharmaceutical Services' global manufacturing footprint is a key strength. This network ensures efficient production and supply chain operations. Their infrastructure helps meet customer demand, maintaining their market position. In 2024, they invested significantly in expanding manufacturing capacity. This includes new facilities in Asia, reflecting a focus on global reach and timely delivery.

Long-Term Customer Relationships

West Pharmaceutical Services excels in fostering enduring relationships with its pharmaceutical and biotechnology clients. These strong connections ensure a consistent customer base, leading to predictable revenue. In 2024, West reported a revenue of $3.17 billion. Their dependable reputation and top-notch quality make them a sought-after partner in the healthcare sector.

- Consistent Customer Base: Long-term contracts provide stability.

- Recurring Revenue: Predictable income streams from repeat business.

- Strong Reputation: Quality and reliability enhance partnerships.

- 2024 Revenue: $3.17 billion.

Dividend Payouts

West Pharmaceutical Services is a cash cow, and a key aspect is its reliable dividend payouts. The company has a strong track record of consistently paying dividends, showcasing its financial health. West has boosted its dividend every year for more than 20 years. These payouts show West's dedication to shareholders and its capacity to produce steady cash flow.

- Dividend Yield: In 2024, West Pharmaceutical Services' dividend yield was approximately 0.4%.

- Dividend Growth: The company has increased its dividend by about 7% annually over the past five years.

- Payout Ratio: The payout ratio, the proportion of earnings paid out as dividends, is around 15%.

- Historical Context: West initiated its dividend in 1993 and has consistently increased it since 2002.

West Pharmaceutical Services' Proprietary Products segment, including HVP components and delivery devices, acts as a cash cow. These products generated significant revenue in 2024, ensuring consistent income due to strong market positioning. Standard products and Westar® sales experienced mid-single-digit organic growth in 2024, contributing to $3.3 billion in net sales. Furthermore, dividend payouts, like the 0.4% yield in 2024, reflect financial health.

| Aspect | Details | 2024 Data |

|---|---|---|

| Segment | Proprietary Products (HVP components) | Significant Revenue |

| Net Sales | Standard Products, Westar® | $3.3 Billion |

| Dividend Yield | Consistent payouts | Approx. 0.4% |

Dogs

Sales of healthcare diagnostic devices within West's Contract-Manufactured Products segment have been decreasing. This downturn has affected the segment's overall financial performance. West is reallocating resources, aiming for sectors with better growth potential. The Contract-Manufactured Products segment saw a 3.9% organic sales decrease in 2023. West is making strategic moves to boost profitability.

The Generics market unit at West Pharmaceutical Services saw a mid-single-digit organic net sales decrease, influenced by reduced volumes, including FluroTec® products. In 2024, this sector faced destocking and customer-specific challenges, impacting sales. West is focused on addressing these issues to boost performance in the generics market. The company is actively managing these headwinds.

The Contract-Manufactured Products segment, a "Dog" in West Pharmaceutical Services' BCG matrix, has seen its share of difficulties. For instance, the company exited the continuous glucose monitoring business to streamline its focus. This move aligns with prioritizing higher-value, more sustainable opportunities. In 2024, this segment accounted for a smaller portion of overall revenue, reflecting these strategic shifts.

Products Facing Destocking

Some West Pharmaceutical Services products are experiencing destocking, which affects sales volumes. Destocking's impact is easing, but it remains a short-term hurdle. In Q3 2023, West reported a 4% organic sales decline, partly due to this. The company actively manages inventory to lessen destocking's effects.

- Destocking impacts sales, causing volume fluctuations.

- The influence of destocking is expected to lessen.

- West is adjusting strategies to mitigate destocking effects.

- Q3 2023 showed a 4% organic sales decrease.

Areas with Margin Compression

West Pharmaceutical Services faces margin compression, impacting profitability. Gross profit margin decreased to 41.8% in 2023, down from 43.7% in 2022. This decline, alongside increased operating expenses, pressures earnings and investor confidence. To combat this, West focuses on boosting operational efficiency.

- Gross profit margin at 41.8% in 2023.

- Operating margin faces similar pressures.

- Focus on operational efficiency improvements.

- Rising costs are a key challenge.

The Contract-Manufactured Products segment, categorized as a "Dog," faced a 3.9% organic sales decrease in 2023, and a smaller portion of overall revenue in 2024. West exited some businesses to focus on higher-value opportunities. This strategic shift aims to improve financial performance.

| Segment | 2023 Organic Sales Change | Strategic Action |

|---|---|---|

| Contract-Manufactured Products | -3.9% | Exited specific businesses |

| Generics | Mid-single-digit decline | Addressing destocking and customer issues |

| Overall | Q3 2023: -4% organic sales decline | Managing inventory and operational efficiency |

Question Marks

West Pharmaceutical Services is strategically expanding into drug handling solutions, a move that presents a new service opportunity. This expansion is anticipated to yield higher margins and require less capital. This strategic shift aligns with West's goal of leveraging existing assets to drive growth and broaden its service offerings. In 2024, West's services segment saw significant growth, reflecting the success of these initiatives. The company’s focus on innovative solutions has helped increase market share.

West Pharmaceutical Services' joint venture with Corning, with its initial products slated for 2026, is categorized as a Question Mark in the BCG matrix. This venture is a potential growth area, expected to gradually impact West's financial performance. The company projects that these new products will contribute to revenue growth. Specifically, in 2024, West's total revenue was approximately $3.28 billion, and this joint venture aims to boost that figure in the future.

HVP components are currently stars, but their future growth is uncertain. West anticipates mid-single-digit revenue growth for HVP components in 2025, a decrease from earlier forecasts. The company must innovate to stay ahead. In 2024, West's HVP sales were strong, but the market is evolving.

Expansion in Dublin Facility

West Pharmaceutical Services' Dublin facility expansion is a strategic move. This expansion boosts manufacturing solutions and drug delivery services to meet rising demand. The success hinges on effective management and capitalizing on growth prospects. This reflects West's commitment to innovation and market responsiveness.

- Investment: In 2024, West invested significantly in expanding its Dublin facility.

- Demand: The expansion addresses the increasing need for drug delivery solutions.

- Growth: Effective management is key to realizing the facility's growth potential.

- Strategic: This move aligns with West's long-term growth strategy.

Emerging Markets

Emerging markets pose both opportunities and challenges for West Pharmaceutical Services. These regions require careful evaluation due to varying regulatory landscapes and competitive dynamics. Success hinges on developing tailored strategies to meet specific market needs. West needs to assess market potential and adapt its approach accordingly.

- Market Entry: Requires thorough market research and regulatory compliance.

- Competitive Analysis: Understanding local competitors and their strategies is crucial.

- Product Adaptation: Tailoring products to meet regional requirements.

- Growth Potential: Emerging markets offer significant growth prospects.

The joint venture with Corning, planned for 2026, is a Question Mark in West's BCG matrix. These new products are anticipated to boost revenue. West's 2024 total revenue was approximately $3.28 billion.

| Category | Details | 2024 Data |

|---|---|---|

| Joint Venture | With Corning, products launching in 2026 | Revenue boost expected |

| Revenue | West's total revenue | $3.28 billion |

| Classification | BCG Matrix | Question Mark |

BCG Matrix Data Sources

Our West Pharmaceutical Services BCG Matrix leverages annual reports, market share data, competitor analysis, and industry projections for accurate assessments.