West Pharmaceutical Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

West Pharmaceutical Services Bundle

What is included in the product

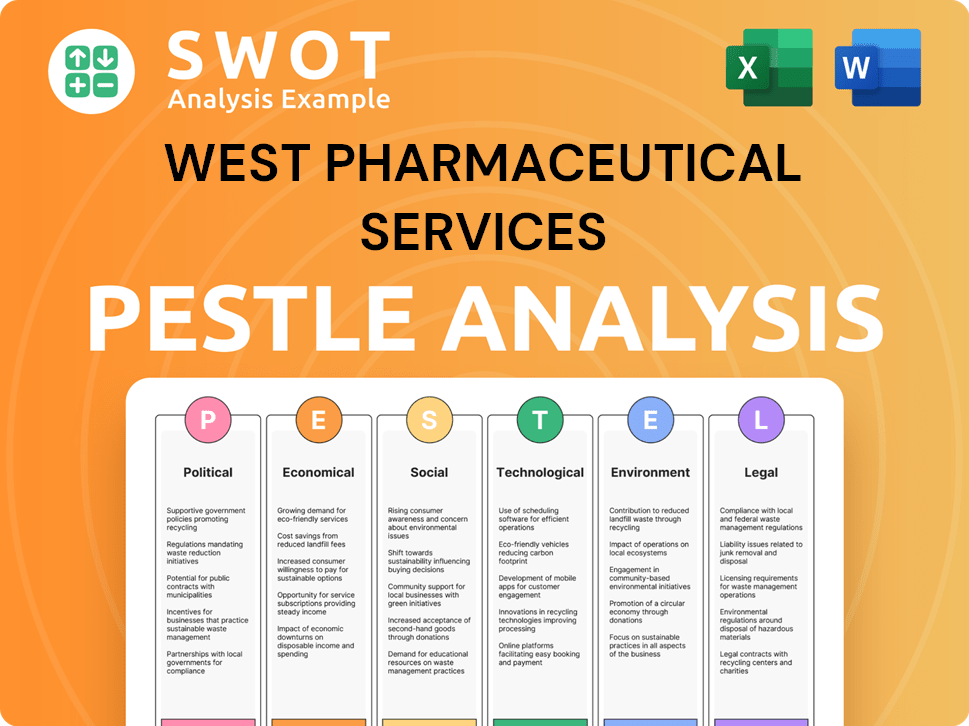

Evaluates macro-environmental forces impacting West Pharmaceutical, offering insights for strategic planning.

A visually segmented analysis allows quick identification of crucial factors.

What You See Is What You Get

West Pharmaceutical Services PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis for West Pharmaceutical Services examines its Political, Economic, Social, Technological, Legal, and Environmental factors.

PESTLE Analysis Template

Navigate the complex landscape impacting West Pharmaceutical Services with our detailed PESTLE Analysis. Explore the political factors shaping the pharmaceutical industry and the economic trends impacting its growth. Understand social shifts affecting patient needs and technology's role in innovation. We've covered legal considerations and environmental sustainability. Download the full report now for crucial insights.

Political factors

Government healthcare policies worldwide directly affect West Pharmaceutical Services' market. Changes in reimbursement rates and healthcare program funding influence demand for its products. Governments' cost-cutting efforts can pressure medical supply pricing. For instance, the global medical device market is projected to reach $613 billion by 2024.

West Pharmaceutical Services faces a stringent regulatory environment. The FDA and international bodies oversee product approvals and manufacturing. Compliance, like with 21 CFR Part 820, is critical. In 2024, regulatory changes affected about 10% of product launches. New interpretations can alter processes and market access.

West Pharmaceutical Services operates globally, facing diverse trade regulations. Import tariffs and export compliance are key considerations. Changes in these policies affect material costs and product pricing. For instance, in 2024, the US-China trade tensions impacted supply chain costs. These factors influence profitability and competitiveness.

Geopolitical Events

Geopolitical events significantly affect West Pharmaceutical Services. Acts of war, natural disasters, and health crises can disrupt supply chains. This can impact manufacturing and market stability, potentially affecting revenues. For example, in 2024, supply chain issues caused by global events increased operational costs by an estimated 7%.

- Supply chain disruptions can increase costs and delay product delivery.

- Market instability can lead to decreased demand or changes in pricing.

- Geopolitical risks necessitate proactive risk management strategies.

- West Pharmaceutical Services must adapt to ensure business continuity.

Political Stability in Operating Regions

Political stability is crucial for West Pharmaceutical Services, especially given its global operations. Disruptions in regions with manufacturing or key markets can significantly impact the company. Political instability can lead to supply chain issues and regulatory changes. Recent data from 2024 shows varying political risk levels across West's operational areas.

- Manufacturing facilities in the US face a low political risk, with a score of 10 out of 10.

- Emerging markets like India show moderate risk, around 6 out of 10.

- Political instability could cause delays in product approval.

West Pharmaceutical Services is heavily influenced by political factors such as government healthcare policies and trade regulations. Changes in reimbursement and program funding can impact the demand for its products, as demonstrated by the projected $613 billion market for medical devices in 2024. Geopolitical instability and trade tensions can disrupt supply chains and increase operational costs; for example, geopolitical events increased costs by about 7% in 2024.

Political stability is also critical, as instability can cause delays and impact manufacturing, with recent data indicating varying political risk levels across operational areas. In 2024, US manufacturing facilities showed a low political risk score of 10 out of 10, whereas emerging markets like India presented moderate risk, around 6 out of 10, indicating the necessity for proactive risk management.

| Political Factor | Impact | Data (2024) |

|---|---|---|

| Healthcare Policies | Demand/Pricing | Medical device market $613B |

| Trade Regulations | Supply Chain, Costs | US-China trade impacted supply chain |

| Geopolitical Events | Supply Chain, Stability | Operational cost increase 7% |

Economic factors

Economic conditions significantly affect healthcare spending and investment. High inflation and rising interest rates can curb customer spending. Uncertainties impact inventory and manufacturing, influencing demand for West Pharmaceutical Services' products. The U.S. inflation rate was 3.5% in March 2024, impacting the sector.

West Pharmaceutical Services operates globally, facing currency exchange rate risks. These shifts influence financial results, potentially affecting sales and earnings. In Q1 2024, currency fluctuations negatively impacted net sales by $14.2 million. This highlights the importance of managing currency exposure to stabilize financial outcomes.

West Pharmaceutical Services faces rising raw material, energy, and labor costs, affecting its cost of goods sold. These increases squeeze profitability, demanding operational efficiency. In Q1 2024, the cost of sales increased by 6.8%. The company must manage costs and consider pricing adjustments to maintain margins.

Healthcare Spending and Investment

Global healthcare spending and infrastructure investment are key. This boosts demand for West Pharmaceutical's products, like injectable drug systems. Growing healthcare infrastructure in emerging markets opens new revenue streams. Healthcare spending is projected to reach $11.6 trillion in 2024. This expansion creates opportunities.

- Global healthcare spending is rising.

- Emerging markets are investing in healthcare.

- West Pharmaceutical benefits from this growth.

- New revenue streams are emerging.

Customer Inventory Levels and Manufacturing Plans

Customer inventory levels and manufacturing plans significantly impact West Pharmaceutical Services' sales. Changes in customer demand directly affect the types and quantities of products ordered. For instance, destocking can lead to reduced sales in specific product lines. This requires West to closely monitor customer behavior. In Q1 2024, West reported fluctuations in demand, influencing their production strategies.

- In Q1 2024, West experienced demand fluctuations.

- Destocking by customers can negatively impact sales.

- Customer manufacturing plans influence product mix.

Economic factors, like inflation and interest rates, influence healthcare spending and impact West Pharmaceutical Services. Currency fluctuations create financial risks, affecting sales and earnings; for instance, a $14.2 million hit in Q1 2024. Rising costs for materials, energy, and labor also squeeze profits, necessitating effective cost management and pricing strategies.

| Economic Factor | Impact on West Pharmaceutical | Recent Data (2024) |

|---|---|---|

| Inflation | Affects spending and costs | U.S. Inflation Rate (March 2024): 3.5% |

| Currency Fluctuations | Impacts sales and earnings | Net Sales Impact (Q1 2024): -$14.2 million |

| Rising Costs | Squeezes profitability | Cost of Sales Increase (Q1 2024): 6.8% |

Sociological factors

The global population is aging, with a rise in chronic diseases. This trend boosts demand for injectable drugs. It directly benefits West Pharmaceutical Services. For example, in 2024, the 65+ population is projected to reach 77 million in the U.S. alone. The market for drug delivery systems is expected to reach $35.7 billion by 2025.

Growing health awareness globally fuels demand for pharmaceuticals & drug delivery systems. This boosts the need for injectable medicines, benefiting companies like West Pharmaceutical Services. The global pharmaceutical market is projected to reach $1.7 trillion in 2024, reflecting this trend. West Pharmaceutical Services' revenue in 2023 was $2.99 billion, indicating its relevance.

Patient preference is shifting towards self-administration of injectable drugs. This trend, especially for chronic conditions, boosts demand for easy-to-use self-injection devices. West Pharmaceutical Services benefits from this, as its devices saw a 10% sales increase in 2024. The market for self-injection systems is projected to reach $15 billion by 2025.

Lifestyle Changes and Disease Prevalence

Changes in lifestyles, including dietary shifts and decreased physical activity, are significantly impacting disease prevalence. The rise in obesity and diabetes is a major concern, directly influencing demand for injectable therapies. West Pharmaceutical Services benefits from this trend, particularly with self-injection devices. This dynamic highlights how societal shifts shape market opportunities.

- Obesity rates in the U.S. have increased, with over 40% of adults classified as obese in 2024.

- Diabetes prevalence continues to rise, with approximately 11% of U.S. adults diagnosed in 2024.

- West Pharmaceutical Services saw a 10% growth in its self-injection device segment in 2024.

Public Perception and Trust in Healthcare Products

Public perception and trust significantly impact healthcare product success. West Pharmaceutical Services must uphold its reputation for quality. In 2024, over 70% of consumers cited trust as a key factor in healthcare product choices. Maintaining patient and customer confidence is essential for sustained market performance.

- Trust directly influences purchasing decisions.

- Quality and reliability are paramount.

- Reputation management is a core business function.

- Consumer confidence drives market share.

Sociological factors include an aging global population, boosting chronic disease prevalence and thus demand for injectables. Rising health awareness and patient preferences for self-administration further fuel market growth, particularly for West Pharmaceutical Services' devices. Obesity and diabetes, key indicators of lifestyle impacts, drive the need for injectable therapies and impact market dynamics.

| Sociological Trend | Impact | 2024 Data/Projection |

|---|---|---|

| Aging Population | Increased chronic diseases; higher injectable drug demand | U.S. 65+ population: 77M |

| Health Awareness | Demand for pharmaceuticals and delivery systems grows | Global pharma market projected to $1.7T |

| Self-Administration Preference | Demand for self-injection devices increases | West's devices saw 10% sales rise in 2024; self-injection market to reach $15B by 2025. |

| Lifestyle Changes | Rise in obesity/diabetes impacts therapies | U.S. obesity rate: over 40% (2024); diabetes prevalence: ~11% (2024) |

Technological factors

West Pharmaceutical Services faces opportunities and challenges due to advancements in drug delivery and packaging. The company must invest in R&D to provide innovative solutions. In 2024, the global drug delivery market was valued at $1.8 trillion, projected to reach $2.9 trillion by 2029. This growth highlights the need for advanced packaging solutions.

Technological innovation is key for West Pharmaceutical Services. Automation and smart manufacturing can boost efficiency and cut expenses. They are likely investing in tech to maintain their operational excellence. For example, in 2024, they invested $150 million in capital expenditures, which included advanced manufacturing tech.

The pharmaceutical industry constantly evolves with material science advancements. Bio-based polymers and other eco-friendly alternatives are gaining traction. West Pharmaceutical Services invests in sustainable packaging, targeting reduced environmental impact. In 2024, the global market for sustainable packaging was valued at $340 billion, with expected growth to $475 billion by 2028.

Digitalization and Automation

West Pharmaceutical Services is significantly impacted by digitalization and automation. These technologies are revolutionizing supply chain management, production processes, and quality control within the pharmaceutical sector. Implementing digital solutions enhances efficiency and ensures better traceability of products. In 2024, the global pharmaceutical automation market was valued at $6.8 billion and is projected to reach $10.5 billion by 2029, growing at a CAGR of 9.1%.

- Increased automation in manufacturing can reduce operational costs by up to 20%.

- Digitalization can improve supply chain visibility by 30%.

- AI-driven quality control systems can increase defect detection by 40%.

Emerging Technologies in Healthcare

Emerging technologies in healthcare, like telehealth and remote patient monitoring, are reshaping how healthcare is delivered. These innovations could influence the demand for drug delivery systems. West Pharmaceutical Services must keep an eye on these trends to adjust its product lineup, ensuring relevance. For instance, the telehealth market is projected to reach $263.5 billion by 2028, growing at a CAGR of 24.6% from 2021.

- Telehealth market projected to reach $263.5 billion by 2028.

- CAGR of 24.6% from 2021.

West Pharmaceutical Services must harness tech to stay competitive. R&D investment is crucial for advanced drug delivery solutions. Automation and digitalization enhance efficiency, with pharmaceutical automation expected at $10.5B by 2029.

| Technology Area | Impact | 2024-2029 Growth |

|---|---|---|

| Drug Delivery Market | Need for Advanced Packaging | Projected to $2.9 Trillion |

| Sustainable Packaging | Reduce Environmental Impact | $340B to $475B |

| Pharmaceutical Automation | Boost Efficiency | CAGR 9.1% to $10.5B |

Legal factors

West Pharmaceutical Services faces stringent regulations for its pharmaceutical packaging and medical devices across different nations. Adherence to cGMP is essential. In 2024, the FDA issued 483s for manufacturing issues. These regulations impact product development and market entry. Legal compliance is critical for operations and financial health.

West Pharmaceutical Services, as a supplier of drug delivery components, is exposed to product liability risks. Litigation could arise if their products are found defective or cause harm. High-quality standards are essential to reduce these liabilities. In 2024, the pharmaceutical industry saw an increase in product liability lawsuits by 12%.

West Pharmaceutical Services relies heavily on intellectual property protection, particularly patents, to safeguard its innovative drug delivery solutions. Legal strategies for IP vary globally. In 2024, the company spent $100.5 million on R&D, reflecting its commitment to innovation. Patents are key to maintaining its market edge. The company's IP portfolio includes over 3,500 patents and patent applications worldwide as of late 2024.

Changes in Laws and Regulations

West Pharmaceutical Services faces legal hurdles due to evolving healthcare regulations, manufacturing standards, and environmental laws. The company must comply with stringent FDA guidelines and international trade agreements, like those impacting pharmaceutical exports. They also navigate environmental regulations, with potential impacts on manufacturing processes and waste disposal. Compliance costs are significant, and non-compliance can lead to penalties or operational disruptions. In 2024, the FDA issued over 1,500 warning letters to pharmaceutical companies.

- FDA Inspections: Frequent inspections and audits.

- Trade Agreements: Compliance with international trade laws.

- Environmental Laws: Adherence to environmental regulations.

- Compliance Costs: Significant costs for legal and regulatory compliance.

Securities and Corporate Governance Regulations

West Pharmaceutical Services, as a public entity, must adhere to strict securities regulations and corporate governance rules. In 2024, the company faced scrutiny over its financial disclosures. Any investigations into practices can lead to major legal and reputational damage. The SEC can impose fines and penalties.

- SEC investigations can lead to significant legal consequences.

- Reputational damage can impact investor confidence.

- Compliance costs are a significant factor.

West Pharmaceutical Services navigates a complex legal landscape. Regulatory compliance, particularly with FDA and international standards, is crucial for market access. Litigation risks, especially product liability, present financial challenges. Strong intellectual property protection is essential for innovation, with over 3,500 patents and applications by late 2024.

| Legal Factor | Impact | Data (2024/2025) |

|---|---|---|

| Product Liability | Risk of lawsuits due to defective products. | Industry saw a 12% rise in lawsuits. |

| Regulatory Compliance | Costly; includes FDA, international, & environmental rules. | FDA issued over 1,500 warning letters. |

| IP Protection | Protects innovations like drug delivery tech. | Spent $100.5M on R&D in 2024; 3,500+ patents. |

Environmental factors

Environmental sustainability is a growing concern, impacting all sectors, including healthcare. West Pharmaceutical Services is responding with green initiatives. For example, West aims to use 100% renewable electricity by 2025, reducing its carbon footprint. In 2024, West's sustainability efforts included waste reduction programs across its global operations. These actions align with increasing investor and consumer demand for eco-friendly practices.

Proper waste management and recycling are crucial, with West Pharmaceutical Services actively reducing operational waste. The company has set landfill diversion targets, reflecting a commitment to sustainability. In 2024, West reported a 10% reduction in waste sent to landfills. They also collaborate with customers on sustainable packaging solutions. This includes exploring eco-friendly materials to minimize environmental impact.

The rising demand for eco-friendly packaging significantly impacts West Pharmaceutical Services. They are actively researching and developing sustainable materials like bio-based polymers. In 2024, the sustainable packaging market was valued at $350 billion, projected to reach $500 billion by 2027. This shift influences their material sourcing and product development strategies.

Energy Consumption and Greenhouse Gas Emissions

West Pharmaceutical Services prioritizes reducing energy consumption and greenhouse gas emissions. They focus on improving energy intensity and boosting renewable electricity use. In 2023, Scope 1 and 2 emissions totaled 33,900 metric tons of CO2e. The company aims to reduce these emissions.

- Emissions Reduction: Targeting lower emissions.

- Renewable Energy: Expanding renewable electricity use.

- Energy Intensity: Striving for improved energy efficiency.

Supply Chain Environmental Practices

West Pharmaceutical Services is increasingly focused on the environmental impact of its supply chain. This involves assessing Scope 3 emissions, which cover a wide range of indirect emissions. The company is actively creating strategies to lower these emissions, reflecting a commitment to sustainability. This proactive approach is becoming more common in the pharmaceutical industry.

- Scope 3 emissions typically account for the largest portion of a company's carbon footprint.

- West Pharmaceutical Services is likely using tools like lifecycle assessments to evaluate its supply chain's environmental impact.

- In 2024, the pharmaceutical industry saw a 10% increase in companies setting Scope 3 emissions reduction targets.

West Pharmaceutical Services is committed to environmental sustainability, using renewable electricity and cutting emissions. In 2024, the sustainable packaging market reached $350 billion. The company aims for 100% renewable electricity by 2025.

Waste reduction and efficient energy use are crucial focuses for the company, which reported a 10% landfill waste reduction in 2024. They are researching and developing sustainable packaging to minimize the environmental impact. West is actively managing its supply chain emissions, aiming to reduce its environmental footprint.

| Initiative | Details | 2024 Status |

|---|---|---|

| Renewable Energy | Target: 100% by 2025 | Expanding use, aiming for 100% |

| Waste Reduction | Landfill Diversion | 10% waste reduction |

| Sustainable Packaging | Bio-based polymers | Market at $350 billion, growing |

PESTLE Analysis Data Sources

Our analysis is based on industry reports, financial news, government databases, and global organizations data. These sources inform our assessment of West Pharmaceutical Services.