WestRock PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WestRock Bundle

What is included in the product

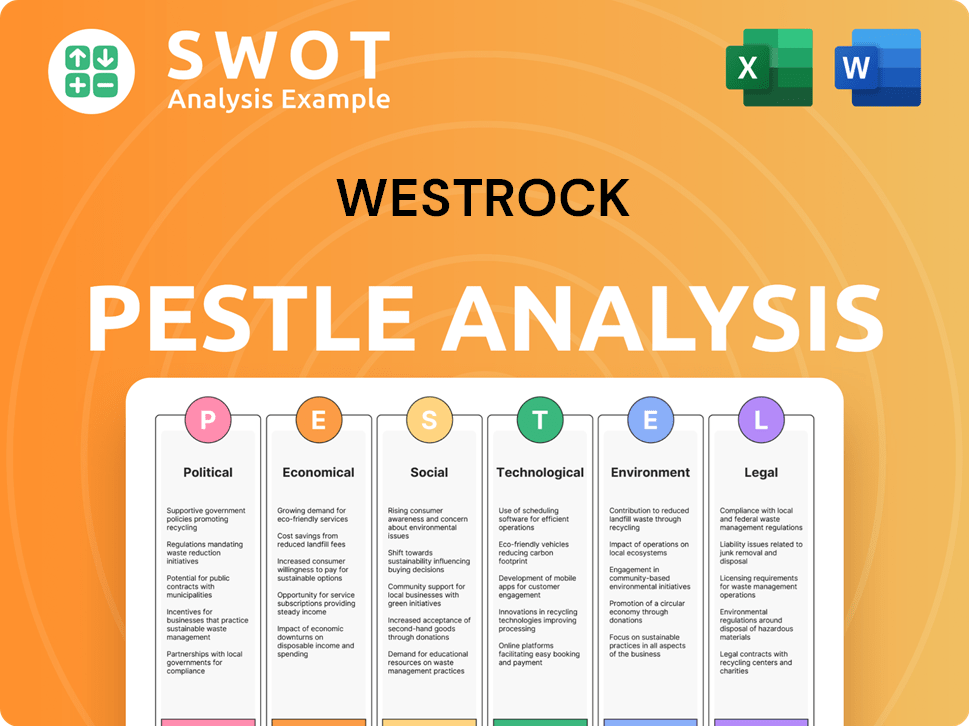

Analyzes WestRock through Political, Economic, Social, Technological, Environmental, and Legal lenses.

Allows users to modify the WestRock analysis by incorporating regional or business specifics.

Preview Before You Purchase

WestRock PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured for the WestRock PESTLE analysis.

This means you'll receive the identical document right after purchase.

The same in-depth analysis and structure are ready to be downloaded instantly.

No alterations or surprises – it’s exactly as displayed here.

Get your copy now!

PESTLE Analysis Template

See how global factors are reshaping WestRock's market! Our PESTLE analysis gives a clear view of key influences like politics, economy, and more. Understand challenges & opportunities WestRock faces in today’s complex world. This analysis is perfect for strategic planning and competitor analysis. Unlock deep insights to drive smart business decisions, all available now! Get the full report.

Political factors

Government regulations and trade policies critically shape WestRock's landscape. Fluctuations in tariffs and trade agreements directly influence material costs and market competitiveness. The Smurfit Westrock merger, spanning 40 countries, amplifies exposure to varied political climates and trade obstacles. For example, in 2024, tariffs on paper products varied significantly across regions, impacting profitability.

WestRock's global footprint exposes it to political risks. Instability can disrupt supply chains and alter regulations. The firm's operations span North America, South America, Europe, and Asia-Pacific. For instance, political shifts in Brazil or China could impact its business. Navigating diverse political landscapes is critical for sustained operations.

Government incentives for sustainable packaging, like tax credits or grants, can boost WestRock's profitability. Policies favoring recycling and renewable materials directly support the demand for WestRock's fiber-based products. In 2024, the U.S. government increased funding for recycling programs by 15%. This creates a favorable market environment. Such incentives reduce costs and increase market share.

Political Action Committees and Lobbying

WestRock, like other major corporations, actively participates in political processes. This is done through political action committees and lobbying. Their aim is to influence legislation and regulations. These can affect the paper and packaging industry. This includes environmental laws, tax policies, and trade rules.

- In 2023, WestRock spent $1.2 million on lobbying efforts.

- The company's PAC contributed $450,000 to various political campaigns.

- Key lobbying areas include sustainability and trade.

International Relations and Geopolitical Events

Geopolitical events significantly impact WestRock's operations. Trade wars or political instability can disrupt supply chains, increasing costs and potentially limiting market access. The ongoing Russia-Ukraine conflict, for example, has affected global paper and packaging markets. WestRock must navigate these challenges to maintain profitability.

- Supply Chain Disruptions: Increased costs and logistical challenges.

- Market Access: Potential limitations due to sanctions or trade barriers.

- Operational Costs: Fluctuations in raw material prices.

Political factors significantly impact WestRock through regulations and trade. Fluctuations in tariffs and trade agreements affect material costs and market access. Lobbying efforts, such as the $1.2 million spent in 2023, are critical.

| Political Aspect | Impact on WestRock | Data Point |

|---|---|---|

| Trade Policies | Affects material costs | Tariff variations across regions in 2024 |

| Political Instability | Disrupts supply chains | Russia-Ukraine conflict impact on global markets |

| Government Incentives | Boosts profitability | U.S. increased funding for recycling by 15% in 2024 |

Economic factors

WestRock's performance hinges on global economics and consumer spending. Recessions, inflation, and income changes impact packaging demand. In 2024, consumer spending growth slowed, affecting packaging volumes. WestRock's net sales are driven by volume, pricing, and costs. For example, in Q1 2024, WestRock's net sales were $5.06 billion.

WestRock faces fluctuating raw material costs, particularly for wood fiber and energy, which directly affect production expenses. Global supply dynamics, geopolitical events, and environmental factors heavily influence these costs. For instance, wood pulp prices saw volatility in 2024, impacting margins. Managing these input costs is crucial for WestRock's profitability, as seen in its financial reports.

WestRock operates in a competitive paper and packaging market, facing pressure from domestic and international rivals. Limited market growth and competitors' price cuts intensify competition. In 2024, the industry saw a 3% average price decrease due to oversupply. WestRock's success hinges on innovation and superior service.

E-commerce Growth and Packaging Demand

E-commerce's expansion fuels WestRock's packaging demand. Online sales surge, increasing the need for shipping packaging. This boosts corrugated packaging sales, a key WestRock product. Efficient, innovative packaging is crucial for e-commerce success.

- E-commerce sales grew by 7.4% in Q4 2023, indicating sustained growth.

- Corrugated packaging demand is expected to rise with e-commerce volume.

- WestRock's focus on sustainable packaging aligns with e-commerce trends.

Currency Exchange Rates

WestRock, a multinational entity, faces currency exchange rate risks. Fluctuations impact raw material costs and export competitiveness. Favorable rates can offset sales declines. For instance, the USD's strength versus the Euro can affect European operations. Currency volatility requires hedging strategies to manage financial outcomes.

- Currency fluctuations can alter profitability.

- Hedging strategies are crucial for risk management.

- Exchange rate impacts are a key consideration.

Economic shifts greatly influence WestRock's financial performance and strategic planning.

Changes in consumer spending, driven by inflation and recession, directly affect packaging demand. WestRock's net sales heavily depend on volume, pricing, and operational expenses influenced by these economic factors. Understanding the market's economic health is crucial for effective decision-making.

Global economic conditions and currency fluctuations impact profitability, necessitating active risk management.

| Factor | Impact | 2024 Data |

|---|---|---|

| GDP Growth | Packaging Demand | US GDP grew 1.6% in Q1 2024, influencing demand. |

| Inflation | Cost & Pricing | CPI: 3.5% March 2024; Affects raw materials. |

| Interest Rates | Investment & Costs | Federal Funds Rate: 5.25%-5.50%, impacting WestRock's costs. |

Sociological factors

Consumer preferences are shifting towards sustainable packaging. There's a growing demand for eco-friendly options, impacting WestRock. Recyclable, compostable, and reusable packaging are now prioritized by consumers. This trend drives change in the industry, favoring WestRock's fiber-based products. The global sustainable packaging market is projected to reach $435.8 billion by 2027, per Grand View Research.

Changing lifestyles significantly influence packaging demands. The rise of online shopping necessitates packaging suitable for e-commerce and home delivery. Consumers increasingly seek convenience, boosting demand for ready-to-drink beverages and single-serve options. WestRock Coffee is adapting to this trend, focusing on cold brew and RTD products, which saw sales of $260 million in Q1 2024.

WestRock actively pursues social equity via partnerships, like sustainable forestry. Their community engagement boosts local economies. In 2024, WestRock invested $1.5M in community programs. This commitment reflects rising expectations for positive social impact. Their philanthropic efforts support various initiatives.

Workforce Demographics and Labor Availability

Demographic shifts and labor availability are crucial for WestRock's manufacturing. The packaging industry faces the challenge of building its future workforce. Attracting and retaining skilled labor is essential. WestRock must adapt to changing demographics. Labor shortages could impact production.

- In 2024, the manufacturing sector faced a skills gap, with approximately 800,000 unfilled jobs.

- The median age of manufacturing workers is increasing, highlighting the need for workforce development.

- WestRock's success depends on its ability to recruit and retain a skilled workforce.

Public Perception and Brand Reputation

Public opinion significantly shapes WestRock's success. Perceptions of the packaging industry, particularly regarding sustainability, directly impact consumer trust. Negative views on environmental impact or labor practices can lead to decreased sales. WestRock actively works to build trust through transparent communication and eco-friendly initiatives.

- In 2024, consumer concern for sustainable packaging increased by 15%.

- WestRock's sustainability reports show a 10% reduction in carbon emissions.

- Positive brand perception correlates to a 7% increase in sales.

Societal trends toward sustainability and eco-consciousness influence WestRock. Consumer demand for sustainable packaging, expected to hit $435.8B by 2027, is key. WestRock's ability to address these shifts is essential.

| Sociological Factor | Impact | Data (2024/2025) |

|---|---|---|

| Consumer Preferences | Demand for eco-friendly packaging | Sustainable packaging market forecast to reach $435.8B by 2027 |

| Lifestyle Changes | Rise of e-commerce, convenience needs | WestRock Coffee's RTD sales $260M in Q1 2024 |

| Public Opinion | Brand perception and trust | Consumer concern for sustainability increased by 15% in 2024 |

Technological factors

Automation and manufacturing tech advancements are pivotal for WestRock. These technologies boost efficiency and cut costs. For instance, in 2024, WestRock allocated $150 million to upgrade its manufacturing facilities, focusing on automation. This investment enhances production and reduces waste. WestRock's strategic plan includes ongoing investments in advanced automation to boost operational excellence.

WestRock can boost efficiency by enhancing digital tools and using real-time data analytics. This helps with demand forecasting and inventory control. AI in retail is set to boom; the global AI in retail market was valued at $5.1 billion in 2023, and is expected to reach $24.7 billion by 2028. This tech also helps cut unplanned downtime.

Technological advancements drive packaging innovation, enhancing design and functionality. WestRock leverages these advancements for sustainable and protective packaging. In 2024, the global sustainable packaging market was valued at $310 billion, with expected growth. WestRock's focus includes eco-friendly materials and smart packaging. This approach improves customer experience and product protection.

Supply Chain Technology and Traceability

WestRock leverages technology to boost supply chain efficiency and product traceability. This is crucial for ensuring ethical sourcing and quality control. Using blockchain can enhance transparency, allowing consumers to track products from origin to retail. In 2024, the global supply chain management market was valued at $20.1 billion.

- Blockchain technology adoption in supply chains is projected to grow significantly by 2025.

- WestRock's investment in supply chain tech aligns with broader industry trends.

- Traceability enhances WestRock's brand reputation and consumer trust.

Sustainable Technology in Production

WestRock is focusing on sustainable technology to minimize its environmental impact. This involves using technologies that boost energy efficiency, cut water use, and lower emissions. For example, the company's new facilities are designed to be more sustainable. In 2024, WestRock's sustainability initiatives included a 10% reduction in water usage across its operations.

- Energy efficiency projects reduced energy consumption by 8% in 2024.

- WestRock aims for a 20% reduction in greenhouse gas emissions by 2025.

- Investment in new recycling technologies is projected to increase recycling rates by 15% by 2026.

Technological factors significantly impact WestRock's operations, driving automation and efficiency improvements. WestRock invests in advanced technologies like AI and data analytics. Sustainability initiatives involve eco-friendly materials and supply chain tech.

| Technological Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Automation | Boosts efficiency, cuts costs | $150M allocated to automation in 2024; 8% energy reduction in 2024 |

| Digital Tools | Improves demand forecasting and inventory | AI in retail market expected to reach $24.7B by 2028 |

| Sustainable Tech | Reduces environmental impact | 10% water usage reduction in 2024; aims for 20% emission cut by 2025 |

Legal factors

WestRock faces environmental regulations on emissions, waste, and forestry, crucial for its operations. Compliance costs are substantial, impacting profitability. They must adapt to changing environmental laws, such as those related to carbon emissions. In 2024, environmental compliance spending was approximately $100 million. This figure is expected to rise in 2025 due to stricter regulations.

WestRock must adhere to stringent product safety and packaging regulations. These rules affect how WestRock designs and produces its packaging. Compliance with food safety regulations is vital, especially concerning materials that touch food. For 2024, the packaging industry faced increased scrutiny regarding recyclability and sustainability, influencing material choices. In 2023, the FDA updated its food contact substance regulations.

WestRock faces legal obligations tied to labor laws across its global operations. These laws dictate wages, working conditions, and employee rights, affecting labor costs. For instance, in 2024, minimum wage hikes in the U.S. and Europe increased operating expenses. Compliance is crucial to avoid penalties and maintain a positive reputation. Changes in these regulations necessitate adjustments in human resources strategies.

Anti-trust and Competition Laws

As a major player in the paper and packaging industry, WestRock faces scrutiny under anti-trust and competition laws. The company's strategic moves, like the Smurfit Kappa merger, undergo rigorous regulatory reviews to prevent anti-competitive practices. These reviews are crucial, with regulatory clearances being a mandatory step for such significant business combinations. The Federal Trade Commission (FTC) and other global bodies examine these deals.

- The FTC and other regulatory bodies scrutinize mergers and acquisitions.

- Regulatory clearance is a prerequisite for large transactions.

- Anti-trust laws aim to ensure fair market competition.

Trade Regulations and Tariffs

Trade regulations and tariffs are crucial legal factors for WestRock, influencing its international operations. These regulations, including tariffs and trade barriers, directly affect the company's import and export activities. For example, in 2024, the U.S. imposed tariffs on certain paper products, potentially affecting WestRock's costs. The company continuously monitors and assesses the impacts of evolving trade policies, such as new tariffs or trade agreements, to adjust its strategies. These adjustments are essential for maintaining competitiveness and market access.

- U.S. tariffs on paper products can increase costs.

- WestRock monitors trade policies to maintain competitiveness.

- Changes in trade agreements impact market access.

WestRock’s legal landscape includes environmental, product safety, and labor regulations. Compliance costs are significant, with environmental spending around $100 million in 2024, set to increase in 2025. Anti-trust reviews, like the Smurfit Kappa merger scrutiny, and trade regulations, such as tariffs, also affect WestRock's operations and market access.

| Regulation Type | Impact | Example/Data |

|---|---|---|

| Environmental | Compliance Costs | $100M in 2024, rising |

| Anti-Trust | Merger Reviews | Smurfit Kappa merger |

| Trade | Tariffs & Trade Barriers | U.S. tariffs on paper |

Environmental factors

WestRock's operations heavily depend on wood fiber, which underscores the importance of sustainable forestry. The company actively manages forests and sources fiber from responsibly managed areas. WestRock's environmental stewardship includes certifications such as FSC and PEFC. In 2024, WestRock reported that 98% of its fiber was from certified or recycled sources. This commitment supports long-term resource availability.

Water is crucial for paper and packaging manufacturing. WestRock, a major player, uses substantial water in its operations. The company prioritizes responsible water use and management to reduce its environmental footprint. They actively recycle water within their facilities, a key sustainability strategy. In 2024, WestRock reported a 10% increase in water recycling across its plants.

WestRock prioritizes reducing greenhouse gas emissions, targeting Scope 1, 2, and 3 reductions. The company uses virtual power purchase agreements and renewable energy projects. In 2023, WestRock reported a 10% decrease in Scope 1 and 2 emissions. Climate change presents operational risks.

Waste Management and Recycling

WestRock prioritizes effective waste management and recycling to boost environmental performance. The company recycles materials and uses recycled fiber in its products, supporting a circular economy. A key goal is reducing manufacturing waste, especially in new facilities. In 2024, WestRock reported a 78% waste recycling rate across its operations.

- Recycled Fiber Usage: Over 70% of fiber used in WestRock's paper products is recycled.

- Waste Reduction Targets: Aiming for a 10% reduction in landfill waste by 2026.

- Recycling Rate: Achieved a 78% recycling rate across all facilities in 2024.

Biodiversity Protection and Ecosystem Health

WestRock's operations touch upon biodiversity and ecosystem health through land management and fiber sourcing. Sustainable forestry is key, and the company actively works to protect biodiversity in managed forests. This is a growing environmental focus. In 2024, WestRock reported that 98% of its fiber supply was from certified sources.

- 98% of fiber supply from certified sources (2024).

- Focus on sustainable forestry practices.

- Commitment to protecting biodiversity.

WestRock emphasizes sustainable forestry, ensuring certified fiber sourcing, which hit 98% in 2024. Water management is a priority, boosting recycling efforts by 10% in 2024. The company targets emissions reduction, showing a 10% decrease in Scope 1 & 2 emissions by 2023. They also focus on waste management, achieving a 78% recycling rate by 2024, showcasing its commitment to environmental stewardship.

| Environmental Aspect | Details | 2024 Data |

|---|---|---|

| Fiber Sourcing | Certified or Recycled | 98% |

| Water Recycling | Increase | 10% |

| Emissions Reduction (Scope 1 & 2) | Decrease | 10% (2023) |

| Waste Recycling Rate | Across all operations | 78% |

PESTLE Analysis Data Sources

WestRock's PESTLE Analysis uses data from industry reports, economic databases, and government resources, ensuring reliable and relevant insights.