WestRock SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WestRock Bundle

What is included in the product

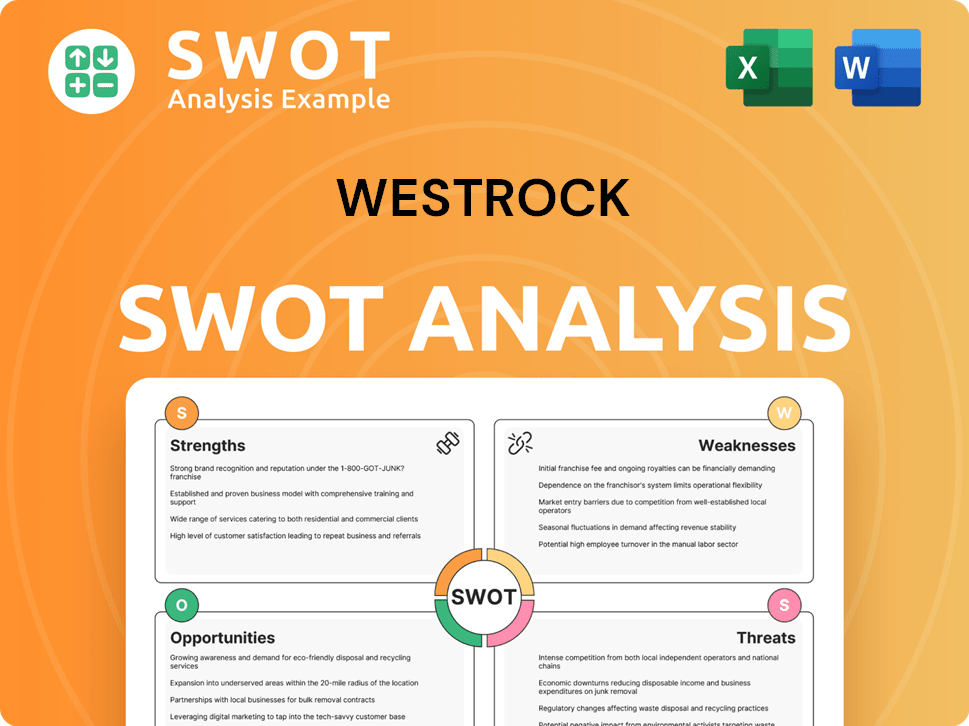

Analyzes WestRock’s competitive position through key internal and external factors.

Ideal for executives needing a snapshot of strategic positioning.

Preview the Actual Deliverable

WestRock SWOT Analysis

The preview you see mirrors the full WestRock SWOT analysis you'll receive.

It offers the exact information, structure, and depth found in the complete purchased document.

There's no "lite" version here; you're getting the real deal.

Unlock the full analysis for instant access post-purchase!

Expect thorough, professional insights.

SWOT Analysis Template

This WestRock analysis reveals key strengths, like its packaging solutions and established market presence, alongside vulnerabilities such as raw material price fluctuations. Weaknesses in the SWOT include potential supply chain issues and debt management challenges. Opportunities encompass e-commerce growth and sustainability initiatives, balanced against threats like competition and economic shifts.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

The merger with Smurfit Kappa created Smurfit Westrock, a global leader in sustainable packaging. This strategic move provides WestRock with increased scale and a broader geographic footprint. The combined entity now boasts a substantial presence across North America, South America, and Europe. The deal, finalized in July 2024, significantly boosts the company's market share and operational capacity.

WestRock's strength lies in its extensive product portfolio. This includes corrugated packaging, consumer packaging, and displays. Serving diverse markets, such as food and beverage, e-commerce, and healthcare, WestRock generated approximately $18.5 billion in revenue in fiscal year 2024.

WestRock's commitment to sustainability is evident through its Raíz Sustainability program, ensuring ethical sourcing practices. The company has made significant investments in sustainable manufacturing processes. WestRock aims to have 100% responsibly sourced coffee and tea by the close of 2025. This focus enhances its brand image and appeals to environmentally conscious consumers.

Innovation and Technology

WestRock's commitment to innovation in packaging design and its use of technology are key strengths. The company leverages automation and digital capabilities in its new facilities to boost efficiency. This focus leads to improved customer satisfaction and supports sustainability efforts. WestRock's investment in technology is evident in its capital expenditures, which totaled $633 million in the first quarter of fiscal year 2024.

- Digital solutions improve supply chain management and reduce waste.

- Automation enhances production speed and accuracy.

- Sustainable packaging innovations meet consumer demand.

- Investments in new technologies are ongoing.

Strategic Merger Synergies

The merger of WestRock and Smurfit Kappa aims to unlock substantial synergies. This strategic move is projected to boost operational efficiencies, cutting costs across the board. The combined entity is expected to achieve annual pre-tax synergies of at least $400 million by the end of the first full year after the deal closes. This integration is designed to fortify their market presence, leading to a stronger competitive edge.

- Cost Savings: $400 million in annual pre-tax synergies expected.

- Market Position: Enhanced competitive advantage.

WestRock's merger with Smurfit Kappa formed a global packaging leader, significantly boosting scale and market share. Its diverse product portfolio, including corrugated packaging, caters to various markets. Strong commitment to sustainability and innovative packaging designs are major assets. Investments in technology and the aim to generate $400 million in synergies in a year drive operational efficiency.

| Strength | Description | Financial Impact |

|---|---|---|

| Global Leader | Combined entity post-merger with Smurfit Kappa. | Increased market share and broader geographic reach. |

| Diverse Portfolio | Wide range of packaging solutions for diverse markets. | Generated approximately $18.5B in revenue in FY2024. |

| Sustainability Focus | Commitment to ethical sourcing and eco-friendly practices. | Aims to have 100% responsibly sourced coffee and tea by end of 2025. |

Weaknesses

Merging WestRock and Smurfit Kappa presents integration hurdles. This could disrupt daily operations, especially in the initial phases. Successfully integrating these entities is crucial to achieve the expected synergies. The merger faces the challenge of harmonizing different company cultures. Careful management is vital for a smooth transition and to capture value.

WestRock's performance is linked to economic cycles. During downturns, demand for packaging often decreases, affecting sales. For instance, in 2023, the packaging sector saw fluctuations tied to economic uncertainty. This can squeeze profit margins. In Q1 2024, WestRock's net sales were $5.06 billion.

WestRock's net income decline is a key weakness, reflecting financial challenges post-merger. Recent reports indicate net losses, despite boosted net sales. This decline raises concerns about profitability. In Q1 2024, WestRock reported a net loss of $24 million.

Operational Disruptions

WestRock's operations face vulnerabilities, as demonstrated by past production outages due to cyberattacks and other disruptions. Such incidents can lead to significant financial losses, including lost revenue and increased operational costs. These disruptions highlight the need for robust cybersecurity measures and business continuity plans. The company's ability to mitigate these risks directly impacts its financial performance and market stability.

- Ransomware attacks have previously caused production halts.

- Disruptions can lead to revenue loss and increased expenses.

- Cybersecurity measures are crucial to protecting operations.

- Business continuity plans are key for mitigating risks.

Competitive Pressures

WestRock’s market position is challenged by strong rivals, necessitating constant adaptation. Competitive pressures demand ongoing innovation and cost-cutting to safeguard profitability. The packaging sector is highly competitive, affecting pricing and profit margins. WestRock must invest in advanced technologies to stay ahead. In 2024, the packaging industry's growth rate was approximately 2.5%.

- Intense competition from major packaging companies.

- Need for continuous innovation and efficiency gains.

- Impact on market share and profit margins.

- Investment in technology to remain competitive.

WestRock's weaknesses include integration issues from mergers, potential vulnerability to economic downturns, and reported net losses in Q1 2024. Operations are susceptible to cyberattacks, and competition in the packaging industry is fierce. To stay competitive, constant innovation and cost management are crucial.

| Weakness | Description | Impact |

|---|---|---|

| Integration Challenges | Merging with Smurfit Kappa poses integration risks | Operational disruptions, financial inefficiencies. |

| Economic Sensitivity | Demand fluctuations due to economic cycles. | Reduced sales and profit margins. |

| Financial Performance | Reported net losses in Q1 2024. | Decreased profitability, investor concerns. |

| Operational Risks | Production outages due to cyberattacks. | Financial losses, damage to reputation. |

| Competitive Pressure | High competition within packaging market | Pressure on pricing, market share losses |

Opportunities

WestRock can capitalize on the rising demand for eco-friendly packaging. The global sustainable packaging market is projected to reach \$435.3 billion by 2027. This shift aligns with WestRock's strength in fiber-based solutions. They can attract environmentally conscious clients and boost revenue.

WestRock can tap into emerging markets for expansion, currently focused on North America and Europe. This strategy could boost revenue and diversify its geographic footprint. For example, the packaging market in Asia-Pacific is projected to reach $290 billion by 2025. Such growth provides significant opportunities.

WestRock can unlock further value through operational and commercial synergies. For example, streamlining supply chains and integrating sales teams. In 2024, WestRock aimed to achieve $1 billion in synergies. Further integration could drive additional cost savings and revenue growth. This could improve profitability and shareholder returns.

Technological Advancements

Technological advancements offer WestRock significant opportunities. Investing in automation and digital solutions can boost efficiency and cut costs. For example, in 2024, WestRock allocated $150 million to upgrade its manufacturing tech. Enhanced tech also improves product offerings and customer satisfaction. This strategic move is expected to increase operational efficiency by 10% by 2025.

- Automation adoption can reduce labor costs by up to 15%.

- Digital solutions improve supply chain management.

- Enhanced tech boosts product innovation.

- Increased customer satisfaction with new tech.

Strategic Partnerships and Acquisitions

WestRock can boost growth by forming strategic partnerships and making acquisitions. These moves can broaden its product offerings, extend its market presence, and increase its overall market share. In fiscal year 2024, WestRock completed the acquisition of Parago, enhancing its packaging capabilities. As of December 31, 2024, WestRock's net sales were $14.4 billion. Strategic acquisitions can help WestRock to grow and adapt to market changes.

- Acquiring Parago in 2024 expanded WestRock's packaging capabilities.

- WestRock's net sales for fiscal year 2024 were $14.4 billion.

- Partnerships support innovation and market expansion.

WestRock can capitalize on sustainable packaging demand, projected to reach $435.3B by 2027. Expansion into emerging markets offers substantial growth potential, like the $290B Asia-Pacific market by 2025. Operational synergies and tech advancements are crucial for cost savings and enhanced efficiency, with automation possibly cutting labor costs up to 15%.

| Opportunity | Details | 2024/2025 Data |

|---|---|---|

| Sustainable Packaging | Capitalize on eco-friendly packaging trends | Market to reach $435.3B by 2027 |

| Market Expansion | Tap into emerging markets for revenue growth | Asia-Pacific market: $290B by 2025 |

| Operational Synergies | Streamline supply chains and integrate sales | WestRock aimed for $1B in synergies in 2024. |

Threats

WestRock faces fierce competition in the packaging industry, potentially leading to price wars and squeezed profit margins. The market is dominated by large players and new entrants. In 2024, the packaging industry saw a 3-5% decrease in profit margins due to intense competition. Aggressive strategies from rivals threaten WestRock's market share and profitability.

WestRock faces threats from rising input costs, including raw materials, energy, labor, and transportation. These fluctuations directly impact profitability. For instance, in Q1 2024, WestRock reported increased costs in several areas. Specifically, the company experienced higher expenses related to fiber and energy, which led to margin pressures. The price of recycled fiber increased by 10% in the first quarter of 2024.

Cybersecurity threats are a major concern. WestRock faces risks like ransomware, which can halt operations. A 2024 report shows cyberattacks cost businesses billions. These attacks lead to financial losses and harm the company's image. WestRock must invest in strong cybersecurity measures to protect itself.

Regulatory Changes

WestRock faces threats from evolving environmental laws, particularly concerning sustainability and waste management. Regulations related to food safety can affect packaging materials and production processes, increasing compliance costs. Potential tariffs and trade restrictions could disrupt sourcing and market access, impacting profitability. These regulatory shifts demand proactive adaptation and investment in compliance to mitigate risks. For example, in 2024, the EPA finalized regulations on PFAS, potentially affecting packaging materials.

- Environmental regulations are constantly changing.

- Food safety standards have to be met.

- Tariffs and trade restrictions pose a risk.

- Compliance requires investment and adaptation.

Economic Uncertainty

Economic uncertainty poses a significant threat to WestRock, primarily stemming from macroeconomic factors. Inflation and shifts in consumer spending habits can create volatile market conditions. This volatility directly impacts the demand for packaging products, potentially leading to decreased sales volumes. For instance, in Q1 2024, WestRock's revenue decreased by 10% due to lower demand.

- Inflationary pressures can increase production costs.

- Changes in consumer behavior can reduce demand for packaged goods.

- Economic downturns can lead to project delays.

- Interest rate hikes can affect investment decisions.

WestRock contends with intense competition and price pressures, evident in recent margin declines. Rising input costs, from raw materials to labor, also squeeze profitability, with recycled fiber prices up. The company battles cybersecurity threats and evolving environmental regulations that raise costs and compliance challenges. Economic volatility, fueled by inflation and shifting consumer demand, adds further risk.

| Threat Category | Impact | Data Point |

|---|---|---|

| Competition | Price Wars/Margin Squeeze | Industry margins down 3-5% in 2024. |

| Input Costs | Increased Expenses | Recycled fiber up 10% Q1 2024. |

| Cybersecurity | Financial Losses/Disruption | Cyberattacks cost billions. |

SWOT Analysis Data Sources

This analysis uses data from financial reports, market analysis, expert opinions, and industry publications for accuracy and reliability.