WK Kellogg Co. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WK Kellogg Co. Bundle

What is included in the product

Tailored analysis for WK Kellogg's product portfolio, showcasing investment, holding, and divestiture strategies.

Printable summary optimized for A4 and mobile PDFs, enabling easy review on the go.

What You See Is What You Get

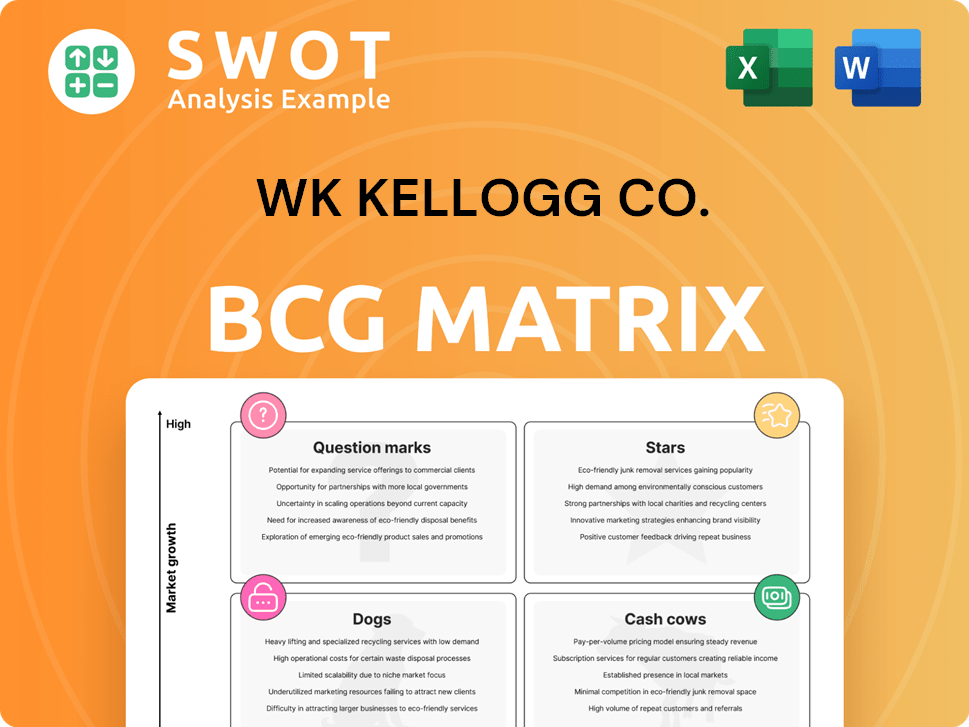

WK Kellogg Co. BCG Matrix

The WK Kellogg Co. BCG Matrix preview mirrors the complete document you'll receive. Upon purchase, you'll get the same ready-to-use strategic analysis, free of watermarks and demo content.

BCG Matrix Template

Uncover the WK Kellogg Co.'s market strategy with a glimpse into its BCG Matrix. See how iconic brands are categorized – Stars, Cash Cows, etc. – reflecting growth potential and market share. This snapshot only scratches the surface of WK Kellogg Co.'s strategic landscape. Purchase the full BCG Matrix for a complete breakdown and strategic insights you can act on.

Stars

Frosted Flakes, part of WK Kellogg Co., is a Star in the BCG Matrix. The brand enjoys high consumer recognition and leadership in the sweet cereal segment. Recent reports highlight its continued success and significant market share. This iconic cereal benefits from robust brand recognition and marketing. Sustaining this position requires ongoing investment in marketing and product innovation.

Raisin Bran, under WK Kellogg Co., shines as a Star in the BCG Matrix due to its robust market growth. The cereal’s appeal to health-conscious consumers and established brand recognition are key. In 2024, the breakfast cereal market generated approximately $30 billion in revenue. To maintain its Star status, WK Kellogg could innovate with new flavors, capitalizing on the demand for healthier options.

Special K, under WK Kellogg Co., is a Star in the BCG Matrix. Its focus on health and wellness resonates with consumers. Special K enjoys a loyal customer base and benefits from consistent marketing. In 2024, the cereal market was valued at $14.6 billion, with Special K holding a significant share. Innovation is key for continued success.

Rice Krispies

Rice Krispies, a staple for WK Kellogg Co., is often seen as a "Star" in the BCG Matrix due to its strong brand recognition and market share. The cereal's enduring appeal keeps sales consistent, especially with families. In 2024, the breakfast cereal market generated approximately $32.3 billion in revenue. To maintain its "Star" status, WK Kellogg might innovate with new flavors or marketing campaigns.

- Market Position: Strong brand recognition.

- Sales: Consistent sales, especially among families.

- Innovation: Could explore new product variations.

- Market Value: The breakfast cereal market generated $32.3 billion in 2024.

Supply Chain Modernization

WK Kellogg's supply chain upgrades are paying off, boosting productivity and cutting waste, which boosts profitability. Focusing on efficiency and cost control should lift EBITDA margins further. These changes help financially and make Kellogg stronger in the market. In Q1 2024, Kellogg reported a 1.5% increase in net sales, showing the impact of these improvements.

- Improved productivity and reduced waste.

- Enhanced profitability and EBITDA margin growth.

- Strengthened market competitiveness.

- 1.5% increase in net sales in Q1 2024.

Mini Wheats, a star product for WK Kellogg Co., also performs strongly in the market. The brand benefits from its unique positioning as a wholesome cereal. WK Kellogg could capitalize on growing health trends through product innovation and targeted marketing. In 2024, WK Kellogg’s net sales reached $3.9 billion.

| Attribute | Details |

|---|---|

| Market Position | Strong, well-recognized brand |

| Consumer Appeal | Appeals to health-conscious consumers |

| 2024 Net Sales | $3.9 billion |

Cash Cows

Corn Flakes, a WK Kellogg Co. product, is a Cash Cow. It benefits from strong brand recognition and a loyal customer base. Despite market changes, demand remains consistent. In 2024, Kellogg's reported solid sales. Focus on cost efficiency and marketing to keep it profitable.

Froot Loops, a staple for WK Kellogg Co., fits the "Cash Cow" quadrant. It has enduring popularity among children and families, securing steady sales. Its bright branding and distinct taste drive its continued consumer appeal. In 2024, Kellogg's net sales reached approximately $13.5 billion, with a significant portion from established brands like Froot Loops. Focus on efficient production and distribution will optimize this brand.

WK Kellogg Co. benefits from a strong brand heritage built on classic cereals, fostering consumer trust. This allows WK Kellogg to differentiate itself in the competitive market. The company leverages this heritage in marketing, boosting its market position. For example, Kellogg's reported net sales of $3.05 billion in Q3 2023.

North American Market Presence

WK Kellogg Co. demonstrates a strong foothold in the North American market, with its cereal products found in most homes. This extensive reach, coupled with established retail ties, ensures a steady revenue stream. In 2024, Kellogg's North American net sales were approximately $8.3 billion. They can improve by refining their supply chain and marketing efforts to keep their market share.

- Market penetration: Kellogg's products are in most North American households.

- Revenue: North American net sales in 2024 were about $8.3 billion.

- Strategy: Focus on supply chain and marketing for sustained market share.

- Distribution: Strong retail partnerships support widespread product availability.

Cost Management

WK Kellogg Co. has shown improved EBITDA growth, due to its focus on cost management and operational efficiencies. This highlights the company's ability to adapt in a competitive market. Strategic initiatives help streamline processes and cut waste, which is vital for profitability. Prioritizing cost control ensures long-term financial stability and boosts value creation.

- In Q3 2023, WK Kellogg reported a 17% increase in adjusted EBITDA.

- The company's cost-saving initiatives include supply chain optimization and manufacturing improvements.

- WK Kellogg aims for further cost reductions through its "Deploy for Growth" strategy.

Frosted Flakes are a Cash Cow for WK Kellogg Co., benefiting from brand loyalty. They hold a strong position in the market. In 2024, Frosted Flakes contributed to solid sales. Effective marketing and efficient operations sustain their profitability.

| Cash Cow Metrics | Details | 2024 Data (Approx.) |

|---|---|---|

| Brand Strength | High brand recognition and customer loyalty | Significant contribution to overall sales |

| Market Position | Established in the breakfast cereal market | Steady market share |

| Key Strategies | Focus on marketing and operational efficiency | Ongoing cost management |

Dogs

Kashi, part of WK Kellogg Co., faces challenges. Its focus on health may limit its market share. The brand's growth prospects could be hindered. In 2024, the cereal market saw shifts, with niche brands struggling against established ones. Evaluate repositioning or divestment.

WK Kellogg Co.'s innovation in the cereal market underperformed in 2024. New product launches haven't met expectations, signaling a challenge in successful product introductions. The company's growth relies on older brands, highlighting a need to rethink its innovation approach. In 2024, the cereal category saw a 2% decline in sales. WK Kellogg should invest more in consumer research and development.

WK Kellogg's declining net sales in 2024, with a reported 3% decrease, place it in the "Dog" quadrant of the BCG matrix. This signals challenges in a competitive landscape. Despite brand strength, the sales decline raises concerns about market position. Addressing root causes, like shifting consumer preferences, is vital. In 2024, the company's revenue reached $13.5 billion.

Volume Declines

WK Kellogg's "Dogs" status in the BCG matrix is evident as volume declines despite price hikes, indicating waning consumer interest. This suggests difficulties in maintaining demand, potentially due to evolving consumer preferences or competitive pressures. In Q3 2023, the company reported a 2.6% volume decline, despite a 7.6% price/mix increase. To address this, WK Kellogg must analyze these factors to devise effective strategies for revitalizing sales.

- Q3 2023 Volume Decline: 2.6%

- Q3 2023 Price/Mix Increase: 7.6%

- Focus: Understanding and addressing volume decline drivers.

- Goal: Regain market share and drive sales growth.

Challenging Business Environment

WK Kellogg Co. faced a 'challenging business environment' in 2024, impacting sales. This points to external pressures affecting market position, like shifting consumer tastes or stiff competition. The company must closely watch market trends and adjust strategies to stay competitive. For instance, in Q1 2024, Kellogg's North American cereal sales fell.

- Q1 2024: North American cereal sales declined.

- Challenges include changing consumer preferences.

- Increased competition and macroeconomic factors.

- Adaptation of strategies to mitigate impacts.

In 2024, WK Kellogg Co. cereal sales experienced a decline, positioning it as a "Dog" in the BCG matrix. This status highlights decreasing consumer interest and challenges in maintaining market demand. Addressing these issues is crucial for the company's financial health.

| Metric | 2024 Data | Impact |

|---|---|---|

| Net Sales Decline | 3% | Indicates a struggling market position. |

| Q3 2023 Volume Decline | 2.6% | Shows waning consumer interest. |

| Q1 2024 NA Cereal Sales | Decline | Points to challenges in the cereal segment. |

Question Marks

Bear Naked, a WK Kellogg Co. brand, likely fits into the "Question Mark" quadrant of the BCG matrix. This segment of the breakfast market is growing, driven by health trends. However, Bear Naked probably has a smaller market share than major cereal brands.

Eat Your Mouth Off, WK Kellogg's zero-sugar, high-protein cereal for Gen Z, is a "Question Mark" in the BCG matrix. It targets a growing "better-for-you" market, which, in 2024, saw significant expansion, with sales of health-focused cereals increasing by 8%. Currently, its market share is low, reflecting its newness and the competitive cereal landscape. Its success hinges on effective marketing and distribution to capture Gen Z's attention, requiring flexible strategies.

Cocoa Frosted Mini Wheats, a brand extension under WK Kellogg Co., aims to capture new consumers through the popular Mini Wheats brand. This product's success hinges on standing out and attracting chocolate enthusiasts. In 2024, the cereal market was valued at approximately $33 billion, with flavored varieties like Cocoa Frosted Mini Wheats contributing significantly. WK Kellogg should allocate resources to marketing and promotions to boost consumer awareness and encourage trial, potentially increasing its market share, which, as of late 2024, stood at roughly 15%.

Blueberry Bran Crunch

Blueberry Bran Crunch, part of WK Kellogg's Raisin Bran line, aims to capitalize on the trend toward healthier, fruit-flavored cereals. It targets consumers wanting both taste and nutrition. WK Kellogg can boost sales by emphasizing health benefits and flavor. In 2024, the cereal market saw a 3% growth, indicating potential for new product success.

- Target consumers with health-focused marketing.

- Highlight the unique blueberry flavor and crunch.

- Consider promotional offers to increase sales.

- Monitor market trends for flavor preferences.

Granola Platform Expansion

WK Kellogg's expansion into the granola market, with products like Bear Naked Oats & Honey, is a strategic move to tap into the growing consumer demand for granola. This strategy aligns with the broader trend of health-conscious eating, offering a potential growth avenue for the company. Success hinges on innovation and effective marketing to capture market share. WK Kellogg's investment in product development and marketing is crucial for driving growth within its granola portfolio.

- The global granola market was valued at $6.9 billion in 2023.

- It is projected to reach $9.5 billion by 2029.

- WK Kellogg's net sales in 2024 were $3.25 billion.

WK Kellogg's "Question Marks" like Bear Naked and Eat Your Mouth Off face high growth potential but low market share. The company must invest in marketing and distribution to gain traction in the competitive cereal market. Success depends on how effectively these products capture consumer attention and market share.

| Brand | Category | Market Share (2024) |

|---|---|---|

| Eat Your Mouth Off | Cereal | ~2% |

| Bear Naked | Granola | ~7% |

| Cocoa Frosted Mini Wheats | Cereal | ~15% |

BCG Matrix Data Sources

This BCG Matrix leverages credible sources like financial statements, market analyses, and expert forecasts. This approach ensures actionable, insightful evaluations.