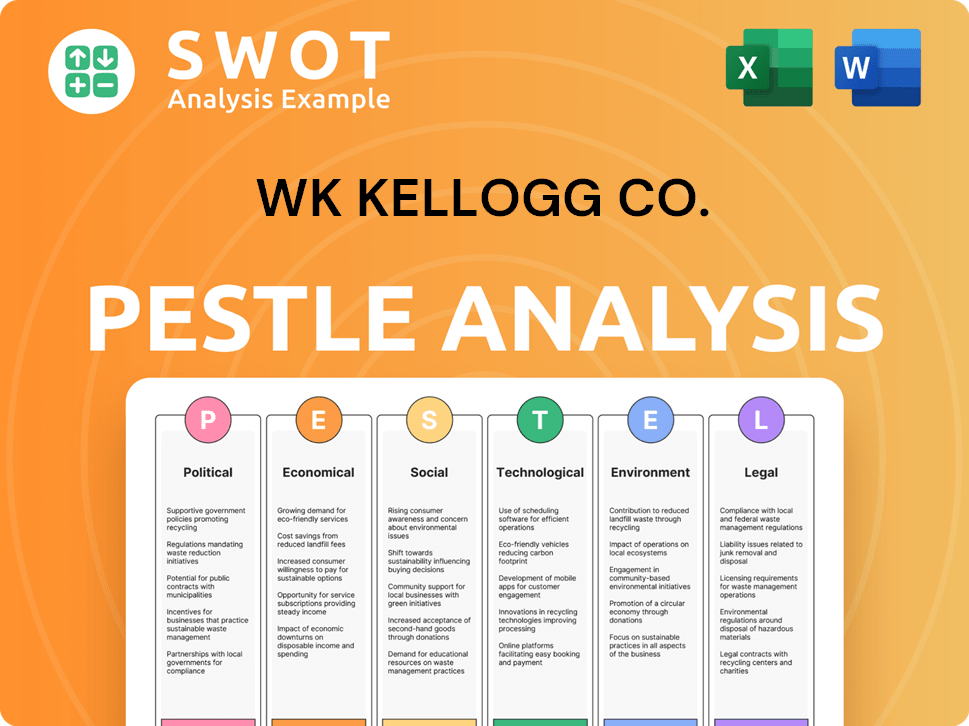

WK Kellogg Co. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WK Kellogg Co. Bundle

What is included in the product

Analyzes the macro-environmental factors impacting WK Kellogg Co., including Political, Economic, and more.

Provides a concise version for quick use in presentations and planning sessions.

Full Version Awaits

WK Kellogg Co. PESTLE Analysis

This preview displays the WK Kellogg Co. PESTLE analysis you'll download. The document you're viewing presents all content. You'll get this comprehensive, formatted analysis right after purchasing.

PESTLE Analysis Template

Navigate the complexities affecting WK Kellogg Co. with our detailed PESTLE analysis. Uncover how political, economic shifts, social trends, technological advancements, legal frameworks, and environmental factors are shaping the company. This report helps identify opportunities and threats, ensuring informed decision-making. Learn about regulatory changes, consumer behavior, and supply chain dynamics. Strengthen your market strategy and stay ahead of the curve. Download the full report now for in-depth insights.

Political factors

The FDA's regulations on food safety and labeling are crucial for WK Kellogg Co. They must follow rules on ingredients, production, and marketing. These regulations affect product development, packaging, and advertising. In 2024, the FDA proposed new rules on added sugars labeling. Changes can lead to higher costs and operational shifts.

Government agricultural policies significantly affect WK Kellogg Co., particularly concerning corn and wheat. Subsidies and tariffs on these ingredients directly influence the company's operational costs. For example, the 2024 Farm Bill could alter subsidy levels. This could impact product pricing and profitability. Changes in these policies can lead to financial fluctuations.

WK Kellogg Co. faces international trade dynamics. NAFTA's successor, USMCA, shapes trade among the US, Canada, and Mexico. Tariffs and trade disputes, like those with the EU (2024), can raise import costs. Understanding these factors is crucial for supply chain and pricing decisions, potentially affecting profit margins.

Political Stability in Operating Regions

Political stability is vital for WK Kellogg Co.'s global operations, influencing supply chains and market access. Political instability introduces risks like disrupted production and regulatory changes. These factors can significantly affect profitability and investment decisions. For instance, in 2024, political tensions in certain regions led to supply chain delays, impacting the company's operational efficiency.

- Supply chain disruptions can increase costs.

- Regulatory changes can affect product standards.

- Political instability can deter investment.

Government Focus on Public Health and Nutrition

Government policies prioritizing public health and nutrition significantly impact WK Kellogg Co. These policies might mandate healthier ingredients or restrict unhealthy ones. Consequently, WK Kellogg Co. must adapt its product development and marketing strategies. For example, the FDA proposed in 2024 to update the definition of "healthy" on food labels, influencing product formulations. In 2024, the global market for healthy snacks was valued at $85.6 billion.

- Product reformulation to meet new health standards.

- Marketing adjustments to comply with advertising restrictions.

- Increased focus on healthier product innovations.

- Potential impact on profitability due to reformulation costs.

Political factors profoundly impact WK Kellogg Co. The FDA’s regulations, particularly on labeling (e.g., 2024 proposals on added sugars), demand compliance. Government agricultural policies (like the Farm Bill) influence operational costs through subsidies and tariffs. International trade dynamics, including USMCA, and EU disputes affect supply chains.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Regulations | Compliance Costs | FDA proposed new rules; Global snack market ($85.6B) |

| Ag Policies | Cost Fluctuations | 2024 Farm Bill adjustments |

| Trade Disputes | Supply Chain | EU tariffs potentially increase costs |

Economic factors

Inflation presents a dual challenge for WK Kellogg Co. in 2024/2025. Increased ingredient and operational costs, affected by inflation, can squeeze profit margins. Simultaneously, reduced consumer purchasing power, as seen with a 3.5% inflation rate in March 2024, might drive consumers towards cheaper food options, potentially impacting sales of Kellogg's products. This requires careful management of pricing and product offerings.

Exchange rate shifts between the US and Canadian dollars significantly affect WK Kellogg Co.'s financials. In 2024, the CAD/USD exchange rate fluctuated, impacting reported sales from Canada. A weaker Canadian dollar can decrease the value of Canadian sales when translated into US dollars, affecting overall profitability. For example, a 5% CAD depreciation could reduce reported revenue by a similar percentage. These currency movements are crucial for investors to monitor.

Economic growth significantly impacts consumer spending, directly affecting demand for WK Kellogg Co.'s cereals. In 2024, U.S. GDP growth is projected around 2.1%, influencing consumer choices. During expansions, consumers often favor premium brands. Conversely, recessions may shift preferences toward cheaper alternatives, as seen during the 2008 financial crisis, when private-label sales surged. Therefore, monitoring economic indicators is crucial.

Unemployment Rates

Unemployment rates significantly influence consumer spending, directly affecting WK Kellogg Co.'s sales. High unemployment diminishes consumer purchasing power, reducing demand for discretionary items like certain cereals. Conversely, a robust labor market boosts consumer confidence and spending. In March 2024, the U.S. unemployment rate was 3.8%, impacting Kellogg's performance.

- U.S. unemployment rate in March 2024: 3.8%.

- Higher unemployment can decrease sales of non-essential food items.

- Lower unemployment typically boosts consumer confidence.

Cost of Raw Materials

The cost of raw materials, particularly corn and wheat, is a crucial economic factor for WK Kellogg Co. Fluctuations in these costs, driven by weather patterns, global supply and demand dynamics, and agricultural policies, directly affect the company's cost of goods sold and overall profitability. For instance, in 2024, corn prices experienced volatility due to drought conditions in key growing regions, impacting Kellogg's input costs. These shifts can lead to adjustments in pricing strategies and profit margins.

- Corn prices saw a 10% increase in Q3 2024 due to weather-related supply issues.

- Wheat prices are projected to stabilize by early 2025, according to USDA forecasts.

- Kellogg's gross profit margin is sensitive to a 5% change in raw material costs.

Inflation, with a 3.5% rate in March 2024, affects WK Kellogg, impacting costs and consumer spending. Exchange rate shifts, like the CAD/USD, influence reported sales and profitability. U.S. GDP growth (projected at 2.1% in 2024) and unemployment (3.8% in March 2024) also impact demand.

| Economic Factor | Impact on WK Kellogg | 2024 Data/Forecast |

|---|---|---|

| Inflation | Affects costs & consumer spending | 3.5% (March 2024) |

| Exchange Rates | Impacts reported sales (CAD/USD) | Fluctuating |

| GDP Growth | Influences consumer choices | 2.1% (Projected for 2024) |

Sociological factors

Consumer preferences are shifting toward healthier, convenient breakfast options. Data from 2024 shows a 15% rise in demand for plant-based foods. WK Kellogg Co. must innovate to meet these trends. The company needs to develop products aligned with these evolving eating habits.

Consumers' growing health awareness significantly shapes food choices, impacting WK Kellogg Co. Sales of health-focused cereals are rising. Data from 2024 shows a 10% increase in demand for low-sugar options.

Consumers increasingly prioritize products with health benefits and natural ingredients. This shift challenges Kellogg to reformulate and innovate. In Q1 2024, Kellogg invested $50 million in healthier product development.

Modern lifestyles emphasize convenience, influencing food choices. Busy schedules impact demand for traditional cereals. In 2024, the ready-to-eat cereal market was valued at $17.9 billion. WK Kellogg Co. adapts with new formats, like breakfast bars, to meet on-the-go needs. This strategy aligns with the growing preference for quick, easy meals.

Cultural Influences and Breakfast Habits

Cultural influences heavily shape breakfast habits. Cereal consumption is prominent in North America, but less so elsewhere. WK Kellogg Co. must tailor strategies to diverse cultural preferences to succeed globally. For example, in 2024, the Asia-Pacific cereal market was valued at approximately $3.5 billion. Adaptations are key.

- North American cereal market is projected to reach $10.5 billion by 2025.

- In some cultures, breakfast may consist of savory foods.

- Marketing must consider local dietary preferences.

- Product innovation is crucial for global relevance.

Social Responsibility and Ethical Consumerism

Consumers now prioritize companies' social and ethical behaviors. This impacts WK Kellogg Co., particularly regarding ingredient sourcing, labor practices, and community engagement. Strong social responsibility enhances Kellogg's reputation and fosters trust. Conversely, any ethical lapses can severely damage brand perception. In 2024, studies show 77% of consumers favor ethical brands.

- Ethical sourcing is crucial, as 80% of consumers prefer brands with transparent supply chains.

- Labor practices significantly influence brand perception, with 70% of consumers supporting fair labor.

- Community involvement strengthens brand loyalty, as 65% of consumers are drawn to companies supporting local communities.

Societal trends like health focus and convenience heavily shape food choices. The North American cereal market is projected to reach $10.5 billion by 2025. Cultural influences also determine breakfast habits; global marketing is vital. Ethical and social behaviors significantly impact consumer decisions.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Health Awareness | Higher demand for health-focused foods | 15% rise in plant-based food demand (2024) |

| Convenience | Demand for quick, easy meal options | RTE cereal market value at $17.9 billion (2024) |

| Social Responsibility | Consumers favor ethical brands | 77% prefer ethical brands (2024) |

Technological factors

Advancements in food processing and manufacturing boost efficiency, cut costs, and ensure product quality. WK Kellogg Co. invested $25 million in 2024 to modernize its supply chain. Automation and data analytics are key for optimizing production. This helps improve consistency and meet consumer demands effectively.

Packaging technology is crucial for WK Kellogg Co., ensuring product freshness and extending shelf life, thereby influencing consumer choices. Sustainable and convenient packaging innovations are increasingly important. For example, in 2024, the global sustainable packaging market was valued at $300 billion, and it's projected to reach $450 billion by 2028. WK Kellogg Co. invests in advanced packaging to maintain product quality and meet evolving consumer demands.

E-commerce and digital marketing are crucial. Online grocery sales are rising; in 2024, they represented about 12% of total grocery sales in the US. WK Kellogg Co. must boost its online presence and marketing. Digital ad spending in the food industry is projected to hit $15 billion by 2025.

Data Analytics and Consumer Insights

WK Kellogg Co. leverages data analytics to understand consumer behavior and market trends, crucial for product development and marketing. This data-driven approach enables more informed decision-making across its business strategies. In 2024, the company invested heavily in digital transformation, including advanced analytics platforms. For example, in Q1 2024, the company reported a 3.5% increase in sales due to successful data-driven marketing campaigns.

- Consumer data analysis helps in refining product offerings.

- Analytics supports personalized marketing strategies.

- Data insights improve supply chain efficiency.

- Market trend analysis informs innovation.

Automation in Supply Chain and Operations

Automation is transforming WK Kellogg Co.'s supply chain, especially in warehousing, logistics, and manufacturing. This shift aims to boost efficiency, cut labor costs, and improve accuracy. The company's modernization involves implementing advanced technologies and automation solutions. For example, in 2024, the global warehouse automation market was valued at $28.3 billion, with projections to reach $64.1 billion by 2029, indicating the scale of investment in this area. This will directly impact Kellogg’s operational costs and capabilities.

- Increased Efficiency: Automation streamlines processes.

- Reduced Costs: Automation lowers labor expenses.

- Enhanced Accuracy: Technology minimizes errors.

- Modernization: Kellogg invests in new tech.

Technological factors significantly impact WK Kellogg Co. in several areas.

Modernizing supply chains through automation and data analytics is crucial; a $25 million investment was made in 2024. Packaging and e-commerce also demand focus, particularly with sustainable packaging valued at $300 billion in 2024.

Data analytics, fueling product refinement and marketing strategies, saw a 3.5% sales increase in Q1 2024 from data-driven campaigns. Automation in warehousing aligns with a projected growth to $64.1 billion by 2029.

| Technology Area | Impact | 2024/2025 Data |

|---|---|---|

| Supply Chain | Efficiency, Cost Reduction | $25M Investment in 2024 |

| Packaging | Freshness, Sustainability | Sustainable Packaging Market at $300B (2024), to $450B (2028) |

| E-commerce | Online Sales, Digital Marketing | Digital Ad Spending: $15B (by 2025) |

Legal factors

WK Kellogg Co. faces strict food safety regulations. Compliance is essential, covering ingredient sourcing, manufacturing, and product testing. The FDA enforces these standards in the U.S. In 2024, recalls cost the food industry millions, highlighting the stakes. Kellogg's must adhere to these rules to avoid penalties and protect its brand.

Labeling and advertising laws are crucial for WK Kellogg Co. These laws mandate accurate product information and prohibit misleading claims. Compliance is vital; in 2024, the FDA issued 300+ warning letters for labeling violations. Kellogg's must adhere to these regulations, facing potential legal challenges. Specifically, the company spent $15 million in 2024 on legal and regulatory compliance.

WK Kellogg Co. heavily relies on intellectual property laws to safeguard its brand. Trademark and copyright laws are essential to shield its brand names, logos, and product designs. These protections are vital to prevent brand confusion and preserve the value of its recognizable brands, like Kellogg's Corn Flakes. In 2024, the company spent $275 million on advertising to maintain brand recognition and protect its market share, which was 22% in the cereal category.

Labor Laws and Employment Regulations

WK Kellogg Co. faces legal requirements regarding its workforce. It must adhere to labor laws and employment regulations across all operating areas. These regulations cover essential areas such as minimum wage, with rates varying significantly by location; for example, the federal minimum wage in the U.S. is $7.25 per hour. Compliance also includes workplace safety standards and non-discrimination policies, crucial for legal and ethical operations.

- Minimum wage compliance is essential to avoid penalties.

- Workplace safety must meet OSHA standards.

- Non-discrimination policies protect against lawsuits.

- Labor laws vary by region, requiring localized compliance.

Consumer Protection Laws

Consumer protection laws are crucial for WK Kellogg Co., safeguarding consumers from unfair practices. The company must ensure product quality, safety, and honest marketing. Violations can lead to hefty fines and reputational damage. In 2024, the FTC issued over $1 billion in consumer refunds.

- Compliance with consumer protection laws is essential.

- Focus on product safety and transparent marketing.

- Avoid deceptive practices to maintain consumer trust.

- Non-compliance can result in significant financial penalties.

WK Kellogg Co. must adhere to complex food safety, labeling, and advertising laws to maintain compliance, avoid hefty fines, and protect its brand reputation. Intellectual property laws are vital for protecting trademarks, copyrights, and brand identity, influencing product differentiation. The company also must comply with labor laws and consumer protection regulations, all of which require specific and costly legal and operational adjustments, with non-compliance risks.

| Legal Aspect | Compliance Requirement | Financial Impact (2024) |

|---|---|---|

| Food Safety | FDA regulations, ingredient sourcing | Millions in recall costs; compliance spending high |

| Labeling & Advertising | Accurate product info; no misleading claims | $15M compliance, fines for violations |

| Intellectual Property | Trademark, copyright, brand protection | $275M advertising to protect brands |

| Labor Laws | Minimum wage, workplace safety, non-discrimination | Variable costs; potential lawsuits |

| Consumer Protection | Product quality, honest marketing | Avoid FTC fines; reputational damage |

Environmental factors

Growing environmental concerns and tougher rules on waste, emissions, and resource use affect manufacturers. WK Kellogg Co. must embrace sustainability and follow environmental laws. In 2024, food and beverage companies faced increased scrutiny, with fines for non-compliance rising by 15% globally. Sustainable packaging investments surged by 20%.

Climate change poses significant challenges to agriculture, potentially affecting WK Kellogg Co.'s operations. Changes in weather patterns and extreme events can disrupt the supply chain. For example, in 2024, extreme weather caused a 10% decrease in grain yields in some regions, increasing ingredient costs. This impacts raw material sourcing and profitability.

Water scarcity is a rising global issue, with agriculture being a major consumer. In 2024, the agriculture sector accounted for roughly 70% of global water withdrawals. WK Kellogg Co., as a food manufacturer, is likely to face increasing pressure to conserve water. This includes implementing water-efficient practices in its factories and working with suppliers to reduce water usage. Companies like Kellogg are increasingly investing in water-saving technologies and sustainable farming practices.

Packaging Sustainability and Waste Reduction

WK Kellogg Co. faces growing demands to lessen packaging waste and adopt eco-friendly materials from both consumers and authorities. The company's actions in this area are crucial. Sustainable packaging is a focus, with goals for recyclability and reduced environmental impact. This impacts costs, brand image, and regulatory compliance.

- In 2023, Kellogg's announced plans to make 100% of its packaging reusable, recyclable, or compostable by the end of 2025.

- Kellogg's has partnered with How2Recycle to provide clear recycling instructions on its packaging.

- The company uses recycled content in some packaging, like cereal boxes.

Energy Consumption and Greenhouse Gas Emissions

WK Kellogg Co.'s manufacturing operations are energy-intensive, leading to greenhouse gas emissions. The company could encounter stricter environmental regulations and increased pressure to decrease its carbon footprint. Exploring renewable energy options is crucial for sustainability and to mitigate risks. In 2023, the food and beverage industry accounted for approximately 10% of total U.S. manufacturing energy consumption.

- Energy consumption is a significant operational cost.

- Emissions reduction targets are becoming more common.

- Consumers increasingly prefer sustainable brands.

Environmental rules and concerns force WK Kellogg Co. to focus on sustainability. Agriculture is hit by climate change, possibly hurting the supply chain; in 2024, grain yields dropped by 10% due to weather.

Water scarcity is another problem, and food manufacturers must save water. Packaging waste must be cut with eco-friendly materials; Kellogg aims for 100% sustainable packaging by 2025.

Energy use in factories leads to emissions; renewables are important. The food and beverage sector accounted for 10% of US manufacturing energy use in 2023.

| Environmental Factor | Impact | 2024-2025 Data/Trends |

|---|---|---|

| Regulations & Compliance | Higher costs, brand risks | Fines up 15% for non-compliance; sustainable packaging investment +20%. |

| Climate Change | Supply chain disruptions, cost rises | Extreme weather: 10% grain yield drop, increasing ingredient costs. |

| Water Scarcity | Operational risks, higher costs | Agriculture uses 70% of global water; focus on efficient practices. |

PESTLE Analysis Data Sources

The WK Kellogg Co. PESTLE Analysis integrates data from market reports, financial publications, and governmental agencies for accuracy.