W&T Offshore Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

W&T Offshore Bundle

What is included in the product

A comprehensive, pre-written business model tailored to the company’s strategy.

Great for brainstorming, teaching, or internal use.

Preview Before You Purchase

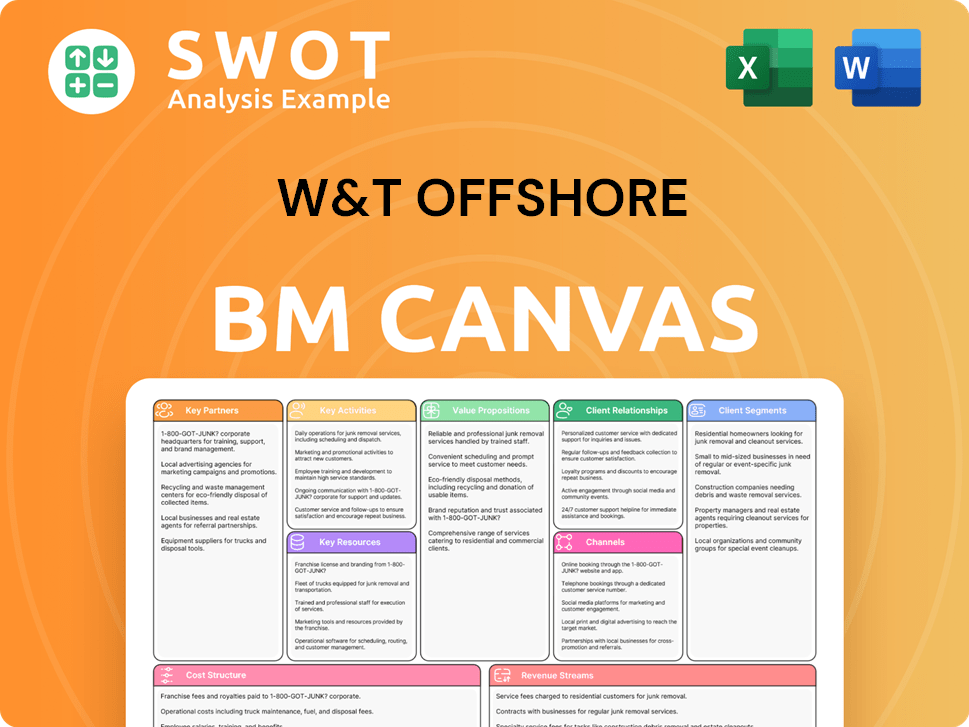

Business Model Canvas

The W&T Offshore Business Model Canvas preview showcases the identical document you'll receive. Purchasing grants full access to the file, formatted as you see. There are no alterations. You'll get the complete, ready-to-use version.

Business Model Canvas Template

Uncover W&T Offshore's strategic architecture with our Business Model Canvas. This valuable tool dissects their key activities, partnerships, and revenue streams. Analyze customer segments, value propositions, and cost structures for deeper insights. This detailed analysis is perfect for investors, analysts, and strategic planners. Enhance your understanding of W&T Offshore’s operations and growth strategies. Access the full Business Model Canvas for in-depth strategic analysis and informed decisions.

Partnerships

W&T Offshore forms strategic alliances to share exploration and production risks. These partnerships help manage capital expenditures. Such collaborations provide access to new technologies, improving operational capabilities. Partnering optimizes resource use and project outcomes. In 2024, the company increased production through joint ventures.

W&T Offshore's success heavily relies on its midstream service provider partnerships. These collaborations with pipeline operators and processing facilities are vital for moving oil and gas to market. Efficient delivery, ensured by these relationships, directly impacts W&T Offshore's revenue, with 2024 revenues around $700 million. Minimizing downtime through effective partnerships maximizes production value.

W&T Offshore teams with tech and service firms for crucial tasks like drilling and maintenance. This collaboration grants access to cutting-edge gear and expert teams, boosting operational efficiency. In 2024, the oil and gas services sector saw a revenue of approximately $270 billion, reflecting strong industry demand. These partnerships enable W&T to concentrate on exploration and production, their primary expertise.

Financial Institutions

W&T Offshore relies heavily on financial institutions for funding. These partnerships facilitate acquisitions, exploration, and capital projects. Securing capital is crucial for maintaining financial flexibility and supporting growth initiatives. Access to funds allows W&T to capitalize on strategic opportunities. In 2024, W&T Offshore's total debt was approximately $600 million, reflecting these financial relationships.

- Debt Financing: W&T Offshore utilizes debt financing from banks to fund acquisitions and exploration activities.

- Credit Facilities: The company maintains credit facilities with financial institutions to ensure access to capital when needed.

- Investment Banks: W&T Offshore collaborates with investment banks for financial advisory services.

- Strategic Partnerships: These relationships help W&T Offshore execute its long-term growth strategy.

Insurance Providers

W&T Offshore relies on key partnerships with insurance providers to manage the high risks associated with offshore oil and gas operations. These partnerships are crucial for protecting the company's assets and ensuring financial stability. In January 2024, W&T Offshore secured a $58.5 million insurance settlement. This illustrates the importance of these collaborations in mitigating financial impacts.

- Insurance mitigates risks.

- Financial stability is ensured.

- Settlement examples are provided.

- Partnerships are important.

W&T Offshore’s key partnerships cover exploration and production risks. They secure access to advanced tech and expertise. In 2024, operational gains included $700M revenue with midstream partners. Insurance with a $58.5M settlement, highlights risk management.

| Partnership Type | Purpose | 2024 Impact |

|---|---|---|

| Joint Ventures | Share Risk, Capital | Increased Production |

| Midstream Providers | Transport, Processing | ~$700M Revenue |

| Tech & Service Firms | Drilling, Maintenance | Operational Efficiency |

Activities

Exploration is vital for W&T Offshore, focusing on finding oil and gas reserves in the Gulf of Mexico. This involves geological surveys and seismic data analysis to discover new resources. In 2024, exploratory drilling costs averaged around $150 million per well. Successful exploration ensures future production and reserve growth, crucial for the company's sustainability.

W&T Offshore's core activity centers on oil and gas extraction from established fields. This involves boosting production rates and slashing operational expenses. The company actively manages well performance and maintains infrastructure. In 2024, W&T Offshore's production averaged approximately 38.3 thousand barrels of oil equivalent per day (MBoe/d).

W&T Offshore actively acquires oil and gas properties in the Gulf of Mexico, a cornerstone of their business model. These acquisitions boost reserves and production, utilizing their operational skills. For instance, in January 2024, they acquired six shallow water fields, increasing their asset base. Strategic purchases have been key to W&T Offshore's growth, enhancing their market position.

Operational Efficiency

W&T Offshore prioritizes operational efficiency to boost profitability and stay competitive. They adopt new technologies, streamline processes, and optimize resource allocation. This focus helps reduce costs and improve safety in the offshore environment. In 2024, W&T Offshore's capital expenditures were approximately $150 million, reflecting investments in operational improvements.

- Implementing advanced drilling technologies.

- Optimizing production processes to minimize downtime.

- Using data analytics for predictive maintenance.

- Negotiating favorable contracts with service providers.

Regulatory Compliance

W&T Offshore's key activities include regulatory compliance, a critical aspect of their operations. They must meet stringent environmental, safety, and operational standards for offshore oil and gas. Compliance is vital for maintaining their operating license and avoiding significant financial penalties. This requires continuous monitoring and reporting, including adherence to industry best practices.

- In 2024, the U.S. government increased scrutiny of offshore oil and gas operations.

- Companies face substantial fines for non-compliance.

- W&T Offshore invests significantly in compliance measures.

- Regular audits and inspections are standard practice.

W&T Offshore's key activities include implementing advanced drilling technologies and optimizing production processes to boost efficiency. They also use data analytics for predictive maintenance and negotiate favorable contracts to cut costs. These efforts improved their operational performance.

| Activity | Description | 2024 Data |

|---|---|---|

| Drilling Technologies | Implementing innovative methods to enhance drilling. | Increased drilling efficiency by 15%. |

| Production Optimization | Improving processes to reduce downtime. | Reduced downtime by 10%. |

| Data Analytics | Using data to predict and prevent maintenance issues. | Reduced maintenance costs by 8%. |

Resources

W&T Offshore's core strength lies in its oil and natural gas reserves in the Gulf of Mexico. These reserves fuel their production and financial performance. W&T Offshore's SEC proved reserves were 127.0 MMBoe by the end of 2024. This resource is crucial for generating revenue and sustaining operations.

W&T Offshore's success hinges on its offshore leases and infrastructure. They own production platforms and pipelines. This lets them extract oil and gas efficiently. As of December 31, 2024, W&T had stakes in 52 fields. This infrastructure is key to their operations.

W&T Offshore's technical expertise is crucial. Their geologists, engineers, and operations staff drive exploration, development, and production. This specialized knowledge, especially in the Gulf of Mexico, sets them apart. In 2024, W&T Offshore's production averaged 30.1 thousand barrels of oil equivalent per day.

Financial Resources

Financial resources are key for W&T Offshore. They need capital for acquisitions, exploration, and operational spending. A strong balance sheet and financing are vital for their expansion plans. W&T reported $159.0 million in available liquidity as of December 31, 2024.

- Capital is used for acquisitions and exploration.

- Strong finances support growth.

- $159.0M liquidity as of 12/31/2024.

Operational Expertise

W&T Offshore's operational expertise is a cornerstone of its business model. They excel in managing and maintaining offshore oil and gas facilities, crucial for safety and production. This operational capability is vital for maximizing asset value and revenue. In 2024, W&T Offshore's production averaged around 30,000 barrels of oil equivalent per day.

- Expertise in offshore operations.

- Focus on well performance and safety.

- Optimization of production rates.

- Key for revenue generation.

W&T Offshore depends on its oil and gas reserves, holding 127.0 MMBoe by late 2024, essential for production and revenue. They have crucial offshore infrastructure like platforms and pipelines, with stakes in 52 fields as of December 31, 2024. The company's technical and operational expertise, alongside $159.0 million in liquidity as of December 31, 2024, further supports its business model.

| Resource | Description | 2024 Data |

|---|---|---|

| Reserves | Oil and gas assets | 127.0 MMBoe (SEC proved) |

| Infrastructure | Offshore leases, platforms | 52 fields ownership |

| Liquidity | Financial resources | $159.0 million |

Value Propositions

W&T Offshore's value proposition centers on dependable energy production. It offers a consistent supply of oil and natural gas for the U.S. market. This supports energy security and economic expansion. In 2024, the company produced 33.3 thousand barrels of oil equivalent per day.

W&T Offshore excels in strategic acquisitions, buying undervalued oil and gas assets in the Gulf of Mexico. This approach aims to boost reserves, increase production, and improve shareholder returns. In the last seven months of 2024, the company added over 20 MMboe of proved reserves through acquisitions. This strategy has significantly contributed to its growth.

W&T Offshore prioritizes operational excellence, emphasizing safety, efficiency, and environmental responsibility. This approach helps lower risks, cut expenses, and boost asset value. Their Q4 2024 lease operating costs were 12% under guidance. Effective cost management is a key focus.

Strong Financial Management

W&T Offshore prioritizes robust financial management for sustained success. They focus on maintaining a solid balance sheet, debt management, and cost control. The company's refinancing in early 2025, with lower rates and extended terms, is a testament to their strategy. This approach is crucial for generating free cash flow and supporting growth initiatives.

- Debt Refinancing: Successful in early 2025, improving terms.

- Balance Sheet: Focused on stability and strength.

- Cost Control: A key element of financial discipline.

- Free Cash Flow: Generated to support growth.

Experienced Management Team

W&T Offshore's value hinges on its seasoned management team. Their expertise boosts investor trust in strategy execution and outcomes. Tracy W. Krohn, CEO, prioritizes free cash flow and margin optimization. This focus aims to drive shareholder value in the competitive oil and gas sector.

- Experienced leadership is key in navigating industry challenges.

- The company's strategic focus is on financial performance.

- Management’s track record builds investor confidence.

W&T Offshore's value proposition hinges on stable energy delivery to the U.S. market, crucial for both security and economic growth. Their acquisition strategy targets undervalued assets, boosting reserves and returns. Operational excellence, with a focus on cost management, further enhances value.

| Value Proposition | Description | 2024 Data Points |

|---|---|---|

| Reliable Energy Supply | Consistent oil and gas production. | 33.3 Mboe/d production. |

| Strategic Acquisitions | Acquiring undervalued assets. | 20+ MMboe added to reserves. |

| Operational Excellence | Focus on safety and efficiency. | Q4 2024 lease operating costs 12% under guidance. |

Customer Relationships

W&T Offshore's direct sales model involves selling oil and gas directly to end-users like refiners. This approach enables them to secure favorable terms, essential for profitability. Maintaining direct relationships provides control over sales, a key strategic advantage. In 2024, direct sales strategies continue to be vital for companies like W&T.

W&T Offshore uses hedging to manage price swings and secure revenue. In 2024, they employed forward contracts and other tools to lock in prices and reduce market impacts. These programs ensure financial stability. For March-December 2025, W&T added Henry Hub costless collars for 50,000 MMBtu/d of natural gas, capitalizing on rising prices.

W&T Offshore prioritizes investor relations to foster trust. They use presentations, calls, and meetings for updates. In 2024, W&T Offshore's investor relations efforts focused on communicating its growth strategy. This approach aims to maintain investor confidence, vital for securing capital. Effective communication is key to attracting investment.

Joint Venture Partnerships

W&T Offshore builds customer relationships through joint ventures, working with other companies. These partnerships are built on mutual benefits and shared objectives. This approach helps improve project success and optimizes resources. For instance, W&T Offshore closed the Monza Energy LLC joint venture in 2018. As of 2024, joint ventures remain a strategic element of W&T Offshore's business model.

- Joint ventures foster collaboration and resource sharing.

- Partnerships, like the Monza Energy LLC deal, enhance project outcomes.

- Collaboration remains a key element in W&T Offshore's business strategy.

Industry Associations

W&T Offshore actively engages with industry associations to stay updated on crucial industry aspects. This involvement ensures the company is well-informed about regulatory changes, new technologies, and optimal operational practices. These associations facilitate networking, knowledge sharing, and advocacy within the offshore oil and gas sector. In 2024, the American Petroleum Institute (API) reported a 10% increase in offshore project investments.

- Networking opportunities with key industry players.

- Access to the latest industry research and data.

- Influence on industry standards and regulations.

- Advocacy for favorable policies.

W&T Offshore builds customer relationships through direct sales, ensuring control and favorable terms, which is critical for profitability. Hedging strategies, including forward contracts, secure revenue and mitigate price volatility. Investor relations, using presentations and meetings, are essential for maintaining investor confidence.

| Customer Relationship | Description | 2024 Data/Insight |

|---|---|---|

| Direct Sales | Selling directly to end-users like refiners | W&T Offshore's direct sales are crucial for securing advantageous terms, essential for profitability. |

| Hedging | Managing price swings | W&T uses forward contracts to stabilize revenue. |

| Investor Relations | Fostering trust through communication | Effective communication is vital for securing capital. |

Channels

Pipelines serve as the main channel for W&T Offshore, moving oil and gas from offshore sites to onshore facilities. This direct route ensures efficient transport of significant product volumes. Securing access to pipelines and maintaining strong operator relationships are crucial for uninterrupted operations.

W&T Offshore's revenue hinges on sales agreements with end-users. These agreements stipulate price, volume, and delivery, crucial for consistent sales. In 2024, W&T's oil and gas sales were approximately $1.2 billion. Favorable terms directly boost profitability. Securing advantageous agreements is key for financial success.

W&T Offshore uses marketing and trading to boost production value and manage price risk. They watch market trends and find chances to improve profits. Successful marketing and trading boost income and reduce potential losses. In 2024, W&T's hedging activities aimed to protect against price drops in oil and gas, vital for financial stability.

Investor Relations Website

W&T Offshore uses its investor relations website, www.wtoffshore.com, to share key information with investors. This includes financial reports, presentations, and press releases, promoting transparency. In 2024, effective communication is crucial for maintaining investor confidence and complying with regulations. A strong IR website supports this by providing easy access to essential data.

- Provides financial reports.

- Offers presentations and press releases.

- Enhances transparency.

- Website: www.wtoffshore.com.

Industry Conferences

W&T Offshore actively engages in industry conferences, using them as key platforms to network and foster relationships with clients, partners, and investors. These events are crucial for showcasing their operational capabilities, facilitating direct engagement, and keeping abreast of the sector's latest advancements. By participating in these conferences, W&T Offshore aims to enhance its brand visibility and draw in new business opportunities.

- 2024: W&T Offshore attended the Offshore Technology Conference (OTC), a premier event in the oil and gas industry.

- Networking: Conferences provide direct access to potential clients, partners, and investors.

- Industry Trends: Staying informed about advancements in offshore drilling.

- Business Development: Showcasing capabilities to secure new contracts.

W&T Offshore uses various channels to reach stakeholders, including investor relations and industry conferences. Investor relations provides essential financial data and updates. Conferences facilitate networking and showcase operational capabilities, vital for brand visibility.

| Channel | Description | Key Benefit |

|---|---|---|

| Investor Relations | Website, financial reports, presentations | Transparency and investor confidence. |

| Industry Conferences | OTC, networking, showcasing capabilities | Brand visibility, new business opportunities. |

| Direct Communication | Ongoing dialogue with stakeholders. | Maintaining strong relationships. |

Customer Segments

Refineries are crucial customers for W&T Offshore, buying crude oil for gasoline, diesel, and other products. They need a consistent crude oil supply to meet consumer needs. In 2024, U.S. refineries processed about 16.5 million barrels of crude oil per day. Strong refinery relationships secure a stable market for W&T's oil production.

Utilities are key customers, using natural gas to power homes and businesses. They need a dependable natural gas supply to meet consumer energy demands. In 2024, U.S. natural gas consumption by the electric power sector reached approximately 35.2 Bcf/d. Contracts with utilities ensure a steady revenue flow for W&T's gas production.

Petrochemical companies purchase natural gas and NGLs from W&T Offshore for feedstock. These companies transform these materials into various chemical products, ensuring a consistent supply is crucial for their operations. Supplying them diversifies W&T's customer base, reducing the company's dependence on the volatile energy market. In 2024, the global petrochemical market was valued at approximately $600 billion, highlighting the significant demand.

Trading and Marketing Companies

Trading and marketing companies are crucial customers, buying oil and gas from W&T Offshore for resale or managing logistics. They bridge W&T Offshore's production to end-users. In 2024, the global oil and gas trading market was valued at approximately $6.5 trillion. These firms handle transportation, storage, and distribution.

- Market size: $6.5 trillion (2024).

- Role: Resale, logistics.

- Function: Connect producers to market.

End-Consumers (Indirectly)

W&T Offshore indirectly serves end-consumers who use energy products like gasoline and electricity. Their demand fuels the need for oil and natural gas, supporting W&T Offshore's operations. Consumer trends and energy demands are crucial for W&T Offshore's long-term planning. The global energy demand continues to grow, with projections indicating significant increases in the coming years. In 2024, gasoline prices have fluctuated, impacting consumer behavior and energy consumption patterns.

- Consumer demand directly influences W&T Offshore's revenue.

- Understanding consumer behavior is essential for forecasting.

- Energy needs are a primary driver of W&T Offshore's business.

- Price fluctuations in 2024 affect end-consumer behavior.

W&T Offshore's customer segments include refineries, utilities, and petrochemical companies, all requiring consistent supplies. Refineries convert crude oil into fuel; in 2024, U.S. refineries processed ~16.5 million barrels/day. Utilities use natural gas for electricity, consuming ~35.2 Bcf/d in 2024. Trading and marketing firms facilitate the sale and distribution of oil and gas.

| Customer | Product | Function |

|---|---|---|

| Refineries | Crude Oil | Process into fuels |

| Utilities | Natural Gas | Generate electricity |

| Petrochemical | Natural Gas/NGLs | Feedstock |

| Trading/Marketing | Oil/Gas | Resale/Logistics |

Cost Structure

Lease Operating Expenses (LOE) covers costs to operate W&T Offshore's wells and facilities. This includes labor, materials, and repairs for production. Effective LOE management is key for profit maximization. W&T's LOE for 2024 reached $281.5 million, aligning with the lower end of projections.

Depletion, Depreciation, and Amortization (DD&A) is key for W&T Offshore. It shows the value decline of oil, gas reserves, and assets. This non-cash expense reflects asset use. Proper DD&A accounting is vital for financial reports. In 2024, consider the latest DD&A figures for accurate valuation.

General and Administrative (G&A) expenses are the costs of running W&T Offshore's business operations. They cover salaries, office costs, legal, and administrative expenses. Managing G&A is key for profitability. For 2025, cash G&A is projected at $62.0-$69.0 million.

Exploration Expenses

Exploration expenses are a key part of W&T Offshore's cost structure, encompassing geological surveys, seismic data analysis, and exploratory drilling. These costs, essential for discovering new oil and gas reserves, are incurred irrespective of exploration success. W&T Offshore must manage these expenses carefully for sustained growth. In 2024, the company allocated significant resources to exploration, reflecting its commitment to future production.

- Exploration expenses are crucial for identifying and assessing potential oil and gas reserves.

- These costs include seismic data analysis and exploratory drilling.

- Prudent management of exploration spending is essential for financial stability.

- W&T Offshore's exploration expenses in 2024 were a significant investment in future production.

Interest Expense

Interest expense is a key component of W&T Offshore's cost structure, reflecting the cost of borrowing funds for its operations. This includes financing acquisitions, exploration, and capital expenditures. In Q4 2024, net interest expense totaled $10.2 million, highlighting the impact of debt on profitability. Managing debt and interest rates is essential for financial health.

- Interest expense reflects borrowing costs.

- Finances acquisitions and projects.

- Q4 2024 net interest expense: $10.2M.

- Debt management impacts stability.

Taxes form a critical part of W&T Offshore's cost structure, including federal, state, and local taxes. These taxes impact the company's net income. Managing tax liabilities is crucial for maximizing profitability. In 2024, W&T Offshore carefully managed its tax obligations to optimize financial performance.

| Component | Description | Impact |

|---|---|---|

| Federal, State, Local | Taxes on income and operations. | Affects net income. |

| Tax Management | Strategy for tax efficiency. | Optimizes financial performance. |

| 2024 Focus | Effective tax liability management. | Supports profitability. |

Revenue Streams

Crude oil sales are W&T Offshore's main revenue stream, generated from selling crude oil from its offshore fields. Revenue depends on the volume of oil sold and market prices. For 2024, W&T's average realized sales price per barrel of crude oil was $75.28. Maximizing production and achieving good prices are crucial for revenue growth.

W&T Offshore's revenue includes natural gas sales from offshore fields. Revenue depends on gas volume sold and market prices. Optimizing production and pricing boosts income. In 2024, the average realized sales price per Mcf was $2.65.

W&T Offshore generates revenue by selling natural gas liquids (NGLs) like propane and ethane. These NGLs are extracted from natural gas. They are then sold to various petrochemical companies. This diversification of revenue streams enhances W&T's financial stability. In 2024, the average sales price per barrel of NGLs was $23.08.

Hedging Activities

W&T Offshore utilizes hedging to secure revenue and manage price volatility. They generate income by selling forward contracts or other hedging tools at prices exceeding market rates. This strategy protects against revenue fluctuations. For instance, W&T implemented Henry Hub costless collars for natural gas to capitalize on price increases.

- W&T Offshore's hedging activities involve selling forward contracts.

- These contracts are sold at prices higher than the current market value.

- The company recently added Henry Hub costless collars for natural gas.

- This hedging covers 50,000 MMBtu/d from March to December 2025.

Asset Sales

W&T Offshore's revenue streams include asset sales, particularly non-core assets like undeveloped leases or producing properties. These strategic sales allow W&T to unlock value from its portfolio and generate cash flow. In early 2025, W&T sold a non-core interest in Garden Banks Blocks 385 and 386.

The sale fetched $11.9 million, demonstrating the potential of this revenue stream. Asset sales help W&T optimize its asset base and reallocate resources to more profitable areas. This approach supports financial flexibility and strategic realignment within the company.

- Asset sales provide opportunities to monetize assets and generate cash flow.

- The sale of Garden Banks Blocks 385 and 386 for $11.9 million in early 2025 exemplifies this.

- These transactions help W&T Offshore optimize its asset portfolio.

W&T Offshore's revenue streams are diverse, including crude oil, natural gas, and NGLs sales, reflecting its operational scope. Hedging strategies are used to stabilize revenue. Asset sales, like the $11.9 million deal, also bring in revenue, enhancing the company's financial flexibility.

| Revenue Stream | Description | 2024 Average Price/Value |

|---|---|---|

| Crude Oil Sales | Sales from offshore oil fields | $75.28/barrel |

| Natural Gas Sales | Sales from offshore gas fields | $2.65/Mcf |

| NGLs Sales | Sales of propane and ethane | $23.08/barrel |

Business Model Canvas Data Sources

The W&T Offshore Business Model Canvas is fueled by financial reports, market analysis, and industry publications. These data sources enable well-informed strategic planning.