XGD Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

XGD Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Prioritize business units with a clear, instant visual that clarifies strategic needs.

What You See Is What You Get

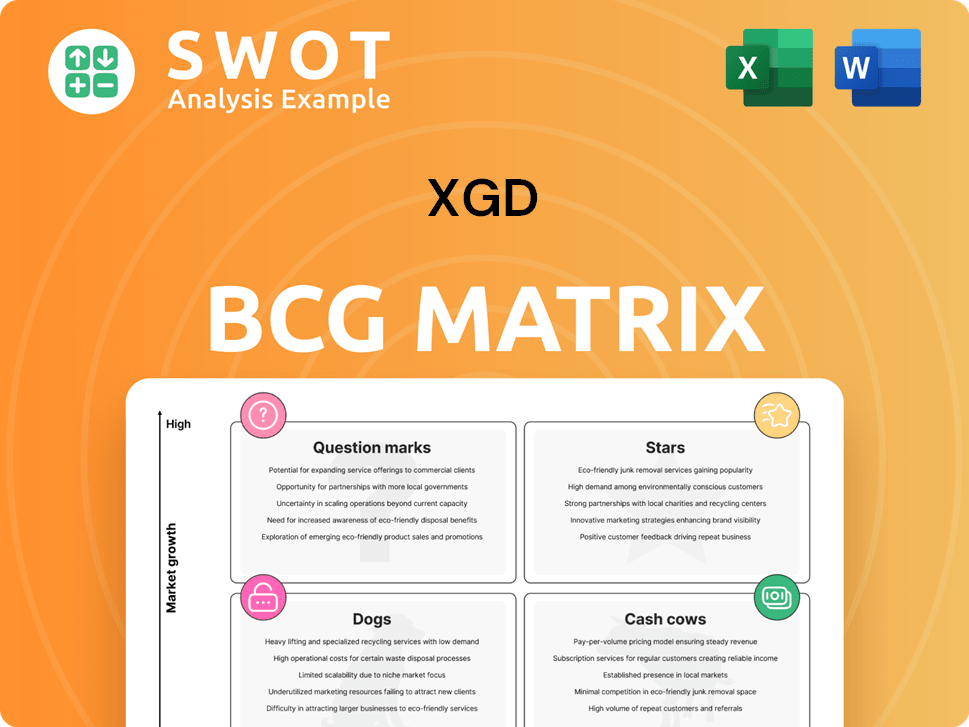

XGD BCG Matrix

The preview you see is the complete XGD BCG Matrix document you'll receive after purchase. It's a ready-to-use file, designed for strategic analysis and clear visualization. Download and apply it directly to your business planning—no extra steps. This version is print-ready and fully editable for your specific needs.

BCG Matrix Template

This glimpse into the BCG Matrix reveals key product placements: Stars, Cash Cows, Dogs, and Question Marks. Understand the company's strategic balance and growth potential. Uncover hidden opportunities and potential risks across its portfolio. Gain a competitive edge with quadrant-specific insights. Don’t just see a snapshot—get the full BCG Matrix and unlock actionable strategies for smarter decisions.

Stars

Mobile payment terminals are a "Star" for XGD Inc., indicating high growth potential. The global mobile payment market is forecasted to surge from $4.97T in 2025. XGD's expertise in payment solutions allows it to benefit from rising smartphone use. This positions XGD well in areas with growing mobile payment adoption.

The outdoor payment terminal (OPT) market is a "Star" for XGD, given its high growth potential. The global OPT market, valued at $1.80 billion in 2024, is projected to reach $4.16 billion by 2034. This represents an impressive CAGR of 8.74% over the next decade. XGD should prioritize contactless payments, especially in North America and Asia, to capitalize on this expansion.

Virtual payment terminals are booming, fueled by the digital payment craze. The market is set to jump from $17.85B in 2024 to $23.48B in 2025, with a 31.5% CAGR. XGD can grab this opportunity with software and services for retail, hospitality, and healthcare.

Blockchain Services

Blockchain services represent a "Star" for XGD, signaling high growth and market share. The global blockchain services market is forecasted to surge, offering significant opportunities. XGD can capitalize on its strengths to deliver secure solutions across sectors. This includes leveraging blockchain for cross-border payments and DeFi.

- Market size in 2024: $6.63 billion.

- Projected market size in 2029: $40.95 billion.

- Compound Annual Growth Rate (CAGR): 44.1%.

- Key industries: BFSI, supply chain.

AI-Powered Payment Solutions

AI-powered payment solutions represent a "Star" for XGD, offering high growth potential. The integration of AI can significantly improve payment processing. The global AI market is expected to surge, with a compound annual growth rate (CAGR) of 19.20% from 2024 to 2034, starting from $638.23 billion in 2024. This opens up opportunities for XGD to expand in the payment terminal market.

- Enhance fraud detection and transaction speed.

- Personalize customer experiences.

- Benefit from the rapid AI market growth.

- Drive growth in the payment terminal market.

Stars represent high-growth, high-share businesses for XGD. These include mobile, outdoor, and virtual payment terminals, along with blockchain and AI services. XGD should invest to maintain its market position and capitalize on rapid expansion across these sectors. This strategy helps boost profitability and market share.

| Star Category | Market Size (2024) | Projected Market Size |

|---|---|---|

| Mobile Payments | $4.97T (2025) | Ongoing Growth |

| Outdoor Terminals | $1.80B | $4.16B (2034) |

| Virtual Terminals | $17.85B | $23.48B (2025) |

| Blockchain | $6.63B | $40.95B (2029) |

| AI-Powered Payments | $638.23B | Ongoing Growth |

Cash Cows

Traditional payment terminals are a cash cow for XGD, offering stable revenue. The POS terminal market is growing, with a 7.5% CAGR expected from 2024-2032. XGD's expertise ensures a steady income stream. The global POS market should hit USD 624 billion by 2029, growing at a 39.3% CAGR.

Contactless payment functionality is increasingly popular, driven by convenience and security. The market for contactless payment terminals is projected to hit USD 46.29 billion in 2025. It is expected to grow to USD 96.88 billion by 2030, with a CAGR of 15.92%. XGD can capitalize on this trend using its current infrastructure.

Financial POS terminals, especially those handling bank card payments, are still a key area for XGD, acting as a cash cow. Although XGD's overall revenue growth slowed in 2024, the electronic payment sector in China shows promise for recovery. Maintaining a strong position in this market is vital for XGD's financial health.

Hardware Components

Hardware components for payment terminals, such as biometric and POS systems, provide consistent revenue. The hardware segment of the AI market is expanding; in 2024, it is valued at $154.22 billion. XGD must prioritize innovation and cost-efficiency to stay competitive. This ensures a stable financial performance within the cash cow category.

- Steady revenue from payment terminal hardware.

- AI hardware segment projected at $154.22B in 2024.

- Focus on innovation and cost-effectiveness.

- Maintain competitiveness in the market.

Payment Processing Solutions

Payment processing solutions represent a "Cash Cow" for XGD, benefiting from robust market expansion fueled by digital payment adoption. The global market is forecasted to hit USD 161.9 billion by 2030, with a 12.6% CAGR from 2024. XGD can capitalize on this, offering secure, scalable solutions for e-commerce and retail.

- Market Growth: The payment processing market is booming, driven by digital payments.

- Projected Size: USD 161.9 billion by 2030.

- CAGR: 12.6% from 2024.

- XGD Opportunity: Provide scalable and secure solutions.

XGD's cash cows include payment terminals and processing, delivering stable revenue. The POS terminal market is expanding, with a 7.5% CAGR by 2032. Contactless payments are growing; the market could reach $96.88B by 2030. Hardware and financial POS terminals contribute, with AI hardware valued at $154.22B in 2024.

| Cash Cow | Market Value (2024) | CAGR |

|---|---|---|

| POS Terminals | $624B (by 2029) | 7.5% (2024-2032) |

| Contactless Payments | $46.29B (2025) | 15.92% (by 2030) |

| Payment Processing | $161.9B (by 2030) | 12.6% (from 2024) |

Dogs

XGD's biometric products face uncertainty, potentially fitting the 'Dog' category. Recent sales were CNY 701.33 million, down from CNY 782.67 million. Net income also decreased, at CNY 156.42 million versus CNY 220.77 million previously. A strategic review is crucial for this segment.

Traditional credit reporting is challenged by alternative scoring and data analysis. Digital payments and data availability drive advanced credit models. In 2024, Experian reported a 10% increase in alternative data use. XGD must innovate, as the global credit scoring market is estimated at $28.3 billion.

Leasing financial POS terminals can be less appealing in a fast-changing market. Businesses often favor buying to avoid long contracts and get the latest tech. XGD needs to check if its leasing model is profitable and competitive. Around 20% of POS transactions involved leased terminals in 2024.

SMS Payments

SMS payments are losing ground. They're less popular due to better mobile options. Digital wallets, banking apps, and QR codes are favored. XGD should shift away from SMS. This move aligns with market trends.

- Mobile payments grew 25% in 2024.

- SMS usage dropped by 15% in the same period.

- Digital wallets now handle 40% of all transactions.

- XGD could save 10% by stopping SMS.

Direct Carrier Billing

Direct carrier billing (DCB) is declining as a payment method, especially for digital services. This is due to security issues and the rise of alternatives like digital wallets. DCB's global transaction value decreased by 8% in 2024. XGD should assess DCB demand, given its declining use.

- DCB's global transaction value decreased by 8% in 2024.

- Security concerns and alternative payment methods are key factors.

- XGD should consider alternatives for reliability.

In XGD's BCG matrix, "Dogs" represent underperforming segments. Biometric products face uncertainty, with recent sales at CNY 701.33 million, down from CNY 782.67 million. A strategic review is essential for such segments.

| Category | Sales (2024) | Change |

|---|---|---|

| Biometric Products | CNY 701.33M | -10.3% |

| Net Income | CNY 156.42M | -29.1% |

| Market Growth | Low | - |

Question Marks

Digital currency technical services are a question mark for XGD. The blockchain market is forecasted to reach $216.82B by 2029, with a 44.9% CAGR. Cryptocurrency's volatility presents both risk and opportunity. XGD could offer services for digital currency payments, but needs strategic investment. Cryptocurrency ownership continues to rise.

AI services represent a high-growth opportunity, but XGD's position is uncertain. The global AI market hit USD 638.23 billion in 2024 and is projected to surge. Intense competition demands strategic investment and unique AI solutions for XGD. A CAGR of 19.20% from 2025 to 2034 underscores the urgency.

XGD's blockchain initiatives, including bank card payment tech, are still developing. The company's financial POS terminals and biometric products face market challenges. In 2024, the global blockchain market was valued at $16 billion, growing fast. XGD's success in this area depends on its ability to compete. Its focus on domestic and overseas markets is crucial.

Intelligent Driving

Intelligent driving presents a complex scenario for XGD within the BCG Matrix. The autonomous vehicles market is booming, expected to hit USD 3.9 trillion by 2034, growing at an 8.6% CAGR. XGD must evaluate its standing in this high-growth sector. The AI in self-driving cars market is also set for substantial growth, driven by technology and demand.

- Market size forecasts are revenue-based.

- 2024 serves as the base year for market analysis.

- XGD's position is uncertain.

- Autonomous vehicles market to reach USD 3.9 trillion by 2034.

Mobile Payment Platforms

XGD's mobile payment platform is categorized as a 'Question Mark' in the BCG matrix, as it competes in a rapidly growing but highly competitive market. The global mobile payment market reached USD 3.84 trillion in 2024.

Success hinges on XGD's ability to gain market share against established platforms like Apple Pay and Google Pay.

The mobile payment market is projected to reach USD 4.97 trillion in 2025.

This requires strategic investment and a clear competitive advantage to achieve growth.

- Market size in 2024: USD 3.84 trillion.

- Projected market size in 2025: USD 4.97 trillion.

- CAGR (2025-2032): 27.0%.

XGD's mobile payment platform faces a competitive landscape, classified as a "Question Mark." The global mobile payment market was $3.84T in 2024, projected to $4.97T in 2025. Success requires strategic investment to gain market share.

| Feature | Details |

|---|---|

| Market Size (2024) | $3.84 trillion |

| Market Size (2025) Projection | $4.97 trillion |

| CAGR (2025-2032) | 27.0% |

BCG Matrix Data Sources

XGD's BCG Matrix uses sales figures, market shares, and industry growth projections, derived from financial statements and market research.