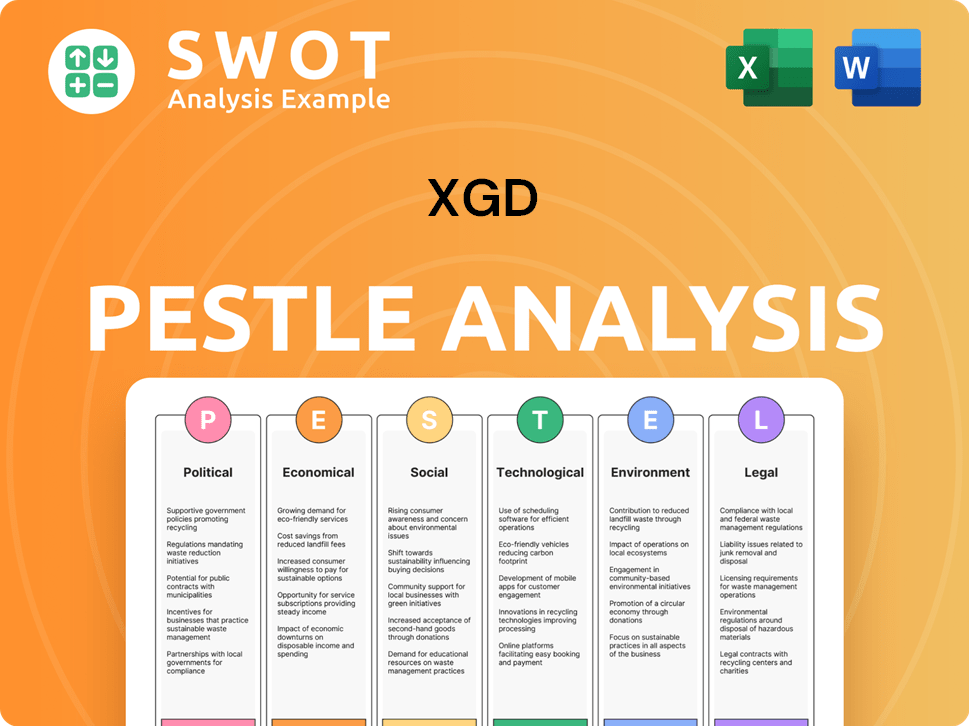

XGD PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

XGD Bundle

What is included in the product

Examines macro-environmental factors affecting XGD using PESTLE dimensions to reveal threats & opportunities.

Allows users to add notes and insights tailored to their specific company strategies and challenges.

Preview the Actual Deliverable

XGD PESTLE Analysis

The XGD PESTLE Analysis preview reveals the complete document. No need to guess; this is what you’ll download instantly.

PESTLE Analysis Template

Uncover how external factors impact XGD's success with our PESTLE Analysis. This detailed report examines political, economic, social, technological, legal, and environmental forces. Gain a clear understanding of market dynamics. Download the full report for actionable strategies to leverage opportunities and mitigate risks. Enhance your strategic planning.

Political factors

Government stances on digital currencies greatly affect their use. The EU's MiCAR sets crypto asset rules, and the US is working on its own. These regulations aim to ensure financial stability and protect consumers. Globally, 2024 saw increased regulatory scrutiny, with the crypto market valued at $2.5 trillion by year-end.

Government policies significantly shape AI and intelligent driving. The EU's AI Act seeks safety and transparency, impacting AI system development. Regulations mandate advanced driver assistance systems, requiring performance monitoring. These policies influence market growth and adoption rates. By 2025, the autonomous vehicle market is projected to reach $62.9 billion.

Cross-border payment regulations are a key political factor. Companies in this sector must comply with various rules globally. For example, firms need an MSO license in Hong Kong. This is essential for international expansion. The cross-border payments market is projected to reach $200 trillion by 2027.

Trade Policies and Tariffs

Changes in trade policies and tariffs significantly affect businesses, especially those in manufacturing and international trade. For example, the US imposed tariffs on $360 billion of Chinese imports, impacting various sectors. Such actions can raise the cost of goods and services, influencing company operations and profitability. Trade tensions and tariff wars can disrupt supply chains.

- US-China trade tensions have led to increased costs for businesses.

- Tariffs can lead to higher consumer prices and reduced trade volumes.

- Companies need to monitor and adapt to changing trade regulations.

Government Spending and Economic Stimulus

Government spending and economic stimulus significantly shape the economic landscape, influencing consumer behavior and investment trends. Increased government expenditure can sometimes correlate with decreased cryptocurrency adoption, as seen in certain periods of economic stability. Conversely, policies fostering digital transformation can spur the adoption of digital payment technologies, potentially benefiting cryptocurrencies. For example, in 2024, the U.S. government allocated $1.2 trillion for infrastructure, potentially impacting financial markets.

- U.S. infrastructure spending: $1.2 trillion (2024)

- EU digital transformation initiatives: €134 billion (2021-2027)

Political factors critically shape XGD. Regulations for digital currencies are evolving globally, impacting market stability; the crypto market was worth $2.5T in late 2024. Government policies influence AI, autonomous vehicles, and trade, affecting company strategies; the autonomous vehicle market will reach $62.9B by 2025. Changes in trade policies and spending shape consumer behavior.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Crypto Regulation | Influences adoption, valuation | Crypto market $2.5T (end-2024) |

| AI/AV Policies | Affects development, market size | AV market $62.9B (2025) |

| Trade & Spending | Shapes costs, investments | US Infrastructure $1.2T (2024) |

Economic factors

The mobile payment market is booming, with forecasts of substantial user and transaction value growth. Experts predict the global mobile payment market will reach $17.47 trillion by 2030. This is driven by increasing adoption of digital payment solutions. In 2024, mobile payment transactions in the US are expected to be $1.5 trillion. This shows a clear shift towards digital payments.

Digital currency adoption is linked to economic factors. Import volumes, population size, labor force, and unemployment impact adoption. Greater electricity access also correlates with higher crypto use. For example, El Salvador's Bitcoin adoption saw effects from these economic variables. As of early 2024, adoption rates vary across countries, reflecting different economic conditions.

Economic conditions significantly influence consumer behavior. Uncertainty and rising interest rates often curb spending. High interest rates can make borrowing more expensive, reducing investments. In 2024, US consumer spending grew, but is expected to slow. The Fed's rate decisions are crucial.

Competition in the Payment Industry

The payment industry is fiercely competitive, featuring diverse players like fintech startups and established financial institutions, all vying for market share. This competition accelerates innovation, with companies continually developing new payment technologies and features. Pricing strategies are also heavily influenced, with businesses needing to offer competitive rates and services to attract and retain customers. In 2024, the global payment processing market was valued at $85.2 billion, and is projected to reach $155.3 billion by 2030, demonstrating the industry's growth and the intensity of competition.

- The market is expected to grow at a CAGR of 9.9% from 2024 to 2030.

- Fintech companies have captured a significant share of the market, around 20% in 2024.

- The trend towards digital payments is a major driver of competition.

Revenue Streams and Profitability

Revenue streams for payment sector companies primarily come from customer fees, influencing profitability. Mobile money providers' success, like M-Pesa, depends on fee structures and market adoption. In 2024, global digital payments hit $8.08 trillion. The adoption rate of mobile money in Sub-Saharan Africa reached 52% by late 2024. These fees are critical to profitability.

- Global digital payments market: $8.08 trillion (2024)

- Sub-Saharan Africa mobile money adoption: 52% (late 2024)

- Key revenue source: Customer fees

- Profitability factor: Fee structure and market adoption

Economic factors drive mobile payment adoption, with the market reaching $1.5T in the US by 2024. Interest rates and spending trends significantly affect the industry. Competition and fee structures influence profitability, impacting sector revenues. In 2024, the digital payment market reached $8.08T, and fintechs hold 20% of the market.

| Metric | Value | Year |

|---|---|---|

| US Mobile Payment Transactions | $1.5 Trillion | 2024 (Est.) |

| Global Digital Payments Market | $8.08 Trillion | 2024 |

| Fintech Market Share | 20% | 2024 (approx.) |

Sociological factors

Consumer preferences are increasingly favoring digital payment methods. Mobile payments and contactless options are gaining popularity, driving the market. In 2024, Statista projects a 15% increase in mobile payment users globally. This shift shows a strong demand for digital payment adoption. This trend is expected to continue in 2025.

Digital literacy impacts digital finance adoption, including digital currencies. Low digital skills limit new payment technology use. In 2024, 77% of U.S. adults used the internet daily, but digital skills vary widely. Initiatives promoting digital literacy are critical for broader financial inclusion and XGD's success.

Social influence and trust heavily influence crypto adoption. Recommendations and public opinion sway investment decisions. A 2024 study showed that 60% of investors trust crypto based on social media opinions. Trust in crypto platforms is crucial for wider adoption.

Demographic Trends and Payment Preferences

Demographic shifts significantly influence payment preferences, creating diverse demands. Younger demographics are increasingly adopting mobile payment solutions, showcasing a shift away from traditional methods. This trend necessitates businesses to optimize payment systems for mobile use. For instance, mobile payment transactions hit $1.6 trillion in 2024.

- Mobile payments are projected to reach $2.1 trillion by the end of 2025.

- Gen Z and Millennials drive mobile payment growth, with 70% using them weekly.

- Older demographics still favor traditional methods, like cash or cards.

Urbanization and Technology Adoption

Urbanization and technology adoption significantly shape financial behaviors. Higher population density often correlates with increased use of digital financial services, including cryptocurrency platforms. This trend is evident in regions with advanced technological infrastructure. For instance, peer-to-peer cryptocurrency exchange volumes tend to be higher in urban areas.

- Urban areas typically have better internet access, facilitating digital financial transactions.

- Increased population density supports network effects, boosting the adoption of new technologies.

- Urban populations are generally younger and more tech-savvy, increasing the adoption rate.

Consumer preferences and trust highly influence digital finance adoption. Digital payment usage, like mobile payments, is rising, with 70% of Gen Z using them weekly in 2024. Social media and trust in platforms are crucial, with 60% of investors trusting crypto based on social media opinions. Digital literacy and demographic shifts also shape adoption.

| Factor | Description | 2024 Data |

|---|---|---|

| Digital Payments | Adoption rates and user behavior. | Mobile payment transactions: $1.6T. Gen Z/Millennials use: 70% weekly |

| Trust & Social Influence | Impact of recommendations & public perception | Crypto investors trusting social media opinions: 60% |

| Demographics & Literacy | How age & skill levels influence adoption. | 77% of US adults used the internet daily. |

Technological factors

Continuous innovation in payment terminal tech is vital. Companies must evolve hardware design, features, and security. The global POS terminal market is projected to reach $107.6 billion by 2024, growing at 10.4% CAGR. Security breaches cost businesses an average of $4.45 million in 2023.

Mobile payment platforms have rapidly evolved, with contactless payments and digital wallets becoming standard. In 2024, mobile payment transactions reached $7.7 trillion globally. Integration with financial services offers enhanced user experiences. Adoption rates continue to rise, especially in emerging markets.

The digital currency and blockchain sectors are rapidly evolving. In 2024, the global blockchain market was valued at approximately $20.3 billion. This technology is being applied in many areas. These include supply chain management and data security. Experts project the blockchain market to reach $94.9 billion by 2028.

Progress in Artificial Intelligence

Progress in Artificial Intelligence (AI) is reshaping numerous sectors, including finance and intelligent driving. AI optimizes processes, enhances security, and fuels the creation of innovative products and services, such as AI agent digital products. The global AI market is projected to reach $1.81 trillion by 2030, with a compound annual growth rate (CAGR) of 36.8% from 2023 to 2030. This growth underscores AI's expanding influence.

- AI in finance is expected to grow rapidly, with a market size of $26.3 billion in 2024.

- The AI market in intelligent driving is growing, driven by autonomous vehicle advancements.

- AI-driven cybersecurity solutions are becoming increasingly crucial, with the market size projected to reach $74.9 billion by 2028.

Evolution of Intelligent Driving Systems

The evolution of intelligent driving systems is rapidly changing the automotive landscape. Driver assistance features are becoming standard, and full automation is on the horizon. In 2024, the global autonomous vehicle market was valued at approximately $67.4 billion, with projections to reach $2.3 trillion by 2032. This growth presents both opportunities and challenges for companies.

- Increased investment in AI and sensor technology.

- The need for robust cybersecurity measures.

- Regulatory hurdles and safety concerns.

- Ethical considerations regarding autonomous decision-making.

Technological advancements shape XGD's future significantly. Payment tech, like POS systems, is key, with the market at $107.6B by 2024. Mobile payments hit $7.7T in transactions, boosting user experiences. AI, essential in finance ($26.3B market in 2024) and driving, and blockchain ($20.3B market in 2024) fuel innovation.

| Technology Area | 2024 Market Size (approx.) | Growth Drivers |

|---|---|---|

| POS Terminals | $107.6 billion | Evolving hardware, enhanced security |

| Mobile Payments | $7.7 trillion in transactions | Contactless payments, digital wallets |

| Blockchain | $20.3 billion | Supply chain, data security, fintech |

| AI in Finance | $26.3 billion | Process optimization, cybersecurity |

| Autonomous Vehicles | $67.4 billion | AI advancements, sensor tech |

Legal factors

Payment terminal companies face strict regulations. They must adhere to rules for electronic payment services and bank card licenses. These regulations are crucial for securing payment transactions. In 2024, fines for non-compliance in Europe reached $50 million, highlighting the importance of adherence. The global payment processing market is projected to reach $10.8 trillion by 2025.

Legal frameworks for digital currencies are changing worldwide. Regulations cover issuance, trading, and taxation. Anti-money laundering requirements are also in place. Companies must navigate these complex rules. In 2024, the U.S. increased crypto tax enforcement.

Companies in the AI sector must navigate evolving legal landscapes. The EU's AI Act, for example, mandates transparency and risk management. Failure to comply could lead to significant financial penalties. Recent data indicates that non-compliance fines can reach up to 4% of global annual turnover. This regulatory scrutiny impacts strategic decisions.

Regulations for Intelligent Driving Technologies

Regulations for intelligent driving technologies are stringent, focusing on vehicle safety, performance, and data handling. Compliance is crucial, with varying standards across regions. For instance, the EU's GDPR impacts data collection by autonomous vehicles. In 2024, the global autonomous vehicle market was valued at $100 billion, with expected growth to $600 billion by 2030, highlighting the need for regulatory clarity.

- EU's GDPR impacts data collection by autonomous vehicles.

- Global autonomous vehicle market was valued at $100 billion in 2024.

- Expected growth to $600 billion by 2030.

Data Protection and Privacy Laws

Data protection and privacy laws are critical for businesses. They must comply with regulations like GDPR. These laws impact how companies manage financial and personal data. Breaches can lead to significant fines. The global data privacy market is projected to reach $13.3 billion by 2025.

- GDPR fines reached €1.6 billion in 2023.

- The average cost of a data breach is $4.45 million.

- Compliance requires robust cybersecurity measures.

Legal factors for XGD companies are varied, spanning payments, digital currencies, AI, and autonomous driving. Regulatory landscapes are evolving globally, with a strong focus on compliance and data protection. Companies must navigate complex rules to avoid significant financial penalties and maintain operational integrity.

| Regulatory Area | Impact | 2024/2025 Data |

|---|---|---|

| Payment Processing | Compliance with payment regulations | EU fines reached $50 million (2024), global market projected to $10.8T by 2025 |

| Digital Currencies | Regulations on issuance, trading, and taxation | U.S. increased crypto tax enforcement (2024) |

| AI | Adherence to the AI Act (EU), risk management | Non-compliance fines can reach up to 4% of global turnover |

Environmental factors

The production and operation of payment terminals contribute to environmental concerns. Manufacturing these devices involves resource extraction and energy-intensive processes. For instance, the global e-waste from electronics, including payment terminals, reached 57.4 million tonnes in 2021. Efforts to mitigate this include extending device lifespans.

Digital technologies, including data centers, significantly impact energy consumption. Data centers alone used about 2% of global electricity in 2022. The energy demand is rising with the growth of digital payments and blockchain, increasing their environmental footprint. In 2024, experts forecast a continued rise in energy use. This necessitates sustainable practices.

Sustainability is increasingly vital in manufacturing, especially for tech like payment terminals. Companies are adopting eco-friendly methods, aiming to cut waste and boost product recyclability. For example, the global market for green technologies in manufacturing is projected to reach $650 billion by 2025.

Reducing Carbon Footprint of Payments

The payments industry is under growing pressure to decrease its carbon footprint. This involves tackling the environmental effects of hardware, energy consumption, and processes like printing receipts. According to a 2024 report, the digital payments sector's carbon emissions are significant and rising. For example, the manufacturing of a single payment card can generate up to 1 kg of CO2e. Initiatives include promoting digital receipts and energy-efficient data centers.

- Transitioning to renewable energy sources for data centers.

- Encouraging the use of virtual cards to reduce plastic waste.

- Developing more sustainable hardware manufacturing processes.

- Implementing carbon offsetting programs for payment transactions.

Shift Towards Sustainable Practices

Environmental considerations are significantly influencing business strategies. A global shift towards sustainability is evident, with companies integrating eco-friendly practices. Regulatory bodies worldwide are tightening environmental standards, impacting operational costs and strategies. The trend is fueled by consumer demand and investment in sustainable alternatives. For example, in 2024, investments in renewable energy reached $350 billion globally.

- Increased adoption of ESG (Environmental, Social, and Governance) criteria in investment decisions.

- Growing consumer preference for sustainable products and services.

- Stringent environmental regulations and carbon pricing mechanisms.

- Technological advancements in renewable energy and waste reduction.

Environmental factors are increasingly critical for XGD's PESTLE analysis. Production processes, including manufacturing payment terminals, impact the environment significantly, driving companies to seek eco-friendly manufacturing. A major focus is reducing carbon emissions and adopting renewable energy sources, like data centers transition. These efforts are shaped by both rising consumer demand and more stringent global regulations.

| Environmental Aspect | Impact | Example/Data |

|---|---|---|

| E-waste | Resource depletion & Pollution | 57.4 million tonnes of e-waste generated globally in 2021 |

| Energy Consumption | High carbon footprint | Data centers used 2% of global electricity in 2022 |

| Sustainability Initiatives | Eco-friendly practices | Green tech market projected at $650B by 2025 |

PESTLE Analysis Data Sources

Our XGD PESTLE draws data from governmental bodies, industry publications, and research institutions for a comprehensive view.