XTB Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

XTB Bundle

What is included in the product

Tailored analysis for the featured company's product portfolio

Export-ready design for quick drag-and-drop into PowerPoint

Full Transparency, Always

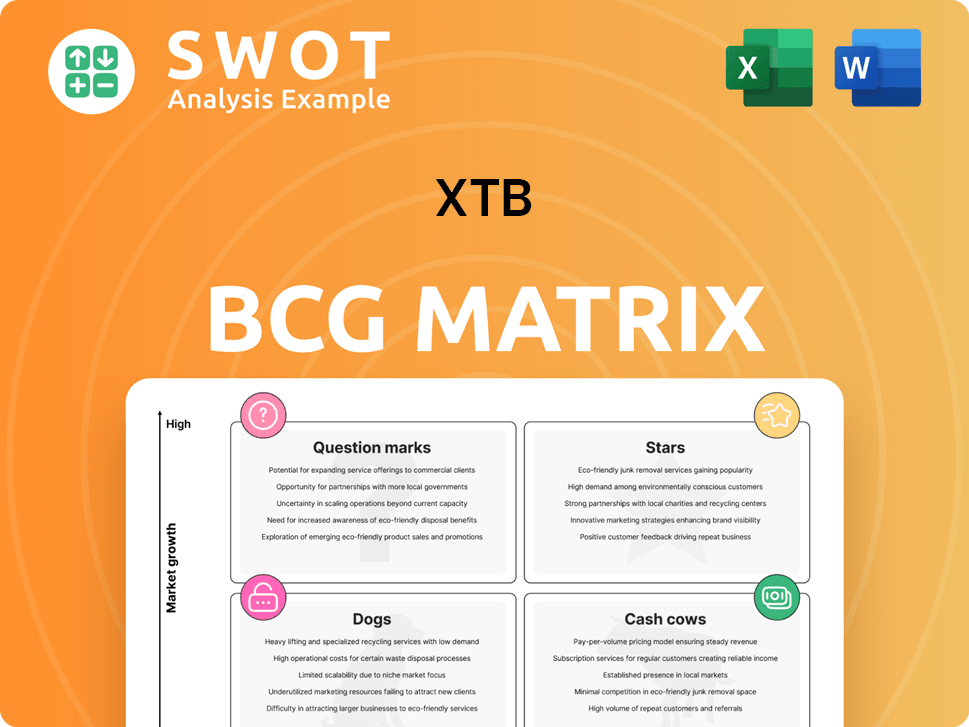

XTB BCG Matrix

The XTB BCG Matrix preview mirrors the downloadable report. This fully formatted document arrives instantly after purchase, ready for your strategic needs. Customize, share, and integrate this professional tool into your business operations immediately.

BCG Matrix Template

XTB's products exist within a dynamic market. The BCG Matrix categorizes them into Stars, Cash Cows, Dogs, and Question Marks. This glimpse highlights key areas and potential growth. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment.

Stars

XTB shines with impressive client acquisition. In 2024, they gained a record 498,438 new clients, a 59.8% year-over-year jump. This growth highlights their solid brand and marketing success. They aim to add 150,000 to 210,000 new clients quarterly in 2025.

XTB's "Stars" category shines with robust growth. The number of active clients surged to a record 658,520 by the end of 2024. This marks a 61.2% increase year-over-year, showing strong user engagement. Client retention and engagement signal long-term sustainability for XTB.

XTB's 2024 financial results highlight its "Stars" status in the BCG Matrix. Consolidated revenues surged by 21.8% year-over-year, reaching EUR 435.3 million. Net profit also grew, increasing by 14.3% to EUR 199.7 million, showcasing strong financial health.

Expansion into New Markets

XTB's aggressive market expansion is a core strategy. In 2024, it obtained regulatory approvals in Indonesia and the UAE. This boosts its global reach and client base potential. This expansion is crucial for its future growth.

- New Markets: Indonesia, UAE.

- Regulatory Approvals: Secured in 2024.

- Strategic Goal: Increase Global Presence.

- Impact: Drive future growth.

Innovative Product Offerings

XTB's "Stars" category highlights its innovative product offerings, crucial for growth. The company consistently expands its platform, introducing new investment options. This strategy aims to attract a broader client base and enhance its market position. For example, XTB saw a 74.1% increase in revenue in Q3 2024.

- Investment plans and IKE/ISA accounts expansion.

- Enhancements to the eWallet and multi-currency card.

- Development of options and physical cryptocurrency trading.

- Focus on providing a comprehensive investment range.

XTB's "Stars" category reflects its strong growth trajectory. Key figures show substantial expansion in revenue and client engagement. The company’s focus on innovative products supports its market position.

| Metric | 2024 Performance | % Change |

|---|---|---|

| Active Clients | 658,520 | +61.2% YoY |

| Consolidated Revenue | EUR 435.3M | +21.8% YoY |

| Net Profit | EUR 199.7M | +14.3% YoY |

Cash Cows

CFDs on commodities are a cash cow for XTB. In 2024, they contributed 48% of total revenue. This was fueled by high profitability from gold, natural gas, and cocoa CFDs. XTB benefits from the volatility and demand in these markets.

CFDs on indices are a key revenue source for XTB. In 2024, they represented 33.3% of the total revenue. The US 100, US 500, and DAX indices are particularly profitable. XTB capitalizes on these popular indices for revenue.

XTB's dominance in Central and Eastern Europe solidifies its "Cash Cow" status within the BCG Matrix. This region generated 63.9% of XTB's revenue in 2024, highlighting its strong market position. Poland is particularly crucial, showing a 26.5% year-over-year revenue increase. This success allows XTB to generate substantial cash flow for reinvestment and growth.

Cost-Effective Trading Platform

XTB's "Cash Cows" status is solidified by its cost-effective trading platform. It attracts traders with competitive commissions and fees, especially those mindful of expenses. Notably, XTB provides commission-free trading for stocks and ETFs up to €100,000 monthly. This is advantageous for active traders.

- Commission-free trading up to €100,000 monthly volume.

- Competitive fees attract cost-conscious traders.

- Enhances profitability for frequent traders.

- Solidifies XTB's market position.

Strong Regulatory Compliance

XTB's robust regulatory compliance is a key strength. It operates under the supervision of entities like the FCA and KNF, ensuring ethical practices. This commitment fosters client trust and a secure trading environment. XTB's adherence to regulations supports its "Cash Cow" status within the BCG matrix.

- FCA regulated firms must adhere to strict financial reporting standards.

- KNF oversees Polish financial institutions, ensuring stability.

- Compliance reduces operational risks.

- Strong compliance boosts investor confidence.

XTB's "Cash Cows" are CFDs on commodities and indices, plus its strong market presence in Central and Eastern Europe. These segments collectively drove significant revenue, with commodities contributing 48% and indices 33.3% in 2024. Cost-effective trading and regulatory compliance solidify this status.

| Revenue Source | 2024 Contribution | Key Markets |

|---|---|---|

| Commodities CFDs | 48% of Total Revenue | Gold, Natural Gas, Cocoa |

| Indices CFDs | 33.3% of Total Revenue | US 100, US 500, DAX |

| Central & Eastern Europe | 63.9% of Total Revenue | Poland (26.5% YoY growth) |

Dogs

XTB's shift away from MetaTrader platforms, including the discontinuation of MT4 support for new clients, presents a challenge. MetaTrader's popularity is evident, with approximately 70% of retail traders using it globally in 2024. This move may deter traders reliant on MT4's tools or those seeking MT5's functionalities. Data from 2024 suggests that MetaTrader users often favor specific features.

XTB's BCG Matrix highlights the absence of copy trading, a feature gaining traction. Competitors like eToro, with 2.5 million copy traders in 2024, benefit. XTB's XTB Social lacks copy trading, potentially limiting its appeal. This absence could hinder XTB's competitiveness in attracting new users.

XTB heavily depends on Contracts for Difference (CFDs), which is a significant revenue source. Regulatory pressures on CFDs pose a risk, potentially impacting profitability. The largest chunk of XTB's revenue in 2024, about 48%, came from commodity CFDs. Changes in regulations could significantly affect XTB's financial health.

Potential for Increased Operating Expenses

XTB's "Dogs" status in the BCG Matrix highlights concerns about escalating operating expenses. In 2024, operating expenses surged by 27%, signaling a trend of rising costs. The company forecasts a potential 40% increase in total expenses for 2025, which could strain profitability. Aggressive marketing plans, with an 80% spending increase, are driving these cost pressures.

- Rising Expenses: A 27% increase in 2024.

- Projected Surge: Possible 40% rise in 2025 expenses.

- Marketing Push: 80% increase in marketing spend.

- Profitability Pressure: Cost management is crucial.

Decline in Transaction Volume in CFDs

The "Dogs" quadrant for XTB highlights a concerning trend: a 7.5% year-over-year decline in CFD transaction volume in 2024, despite overall revenue growth. This suggests that while XTB is attracting new clients, existing ones are trading less actively, which could signal issues with client engagement or market conditions. Maintaining profitability requires XTB to address this decline through strategic initiatives. The company needs to analyze the reasons behind this volume decrease to preserve and enhance revenue streams.

- CFD transaction volume decreased by 7.5% in 2024.

- This decline poses a risk to future revenue growth.

- XTB needs to understand the reasons for the decrease.

- Strategic actions are required to revitalize trading activity.

In XTB's BCG Matrix, "Dogs" represent declining performance. Rising operating expenses, up 27% in 2024, signal a problem. Despite revenue growth, CFD transaction volume fell by 7.5% in 2024, increasing pressure.

| Metric | 2024 | 2025 (Projected) |

|---|---|---|

| Operating Expenses | +27% | +40% |

| CFD Volume Change | -7.5% | N/A |

| Marketing Spend | Significant Increase | 80% Increase |

Question Marks

XTB eyes options trading, a potential growth area. This could draw new traders and boost revenue. However, success hinges on partnerships and regulatory approvals. In 2024, options trading volume hit record highs. XTB's move aligns with market trends.

XTB plans to let users trade cryptos, including spot cryptocurrencies. This move aims to capitalize on crypto's rising popularity. Cryptocurrency trading volumes in 2024 have shown a significant increase. A key factor for this is the MiCA Regulation. The launch depends on Poland aligning with MiCA.

XTB's Asian expansion, facilitated by a new license, is a promising venture. Asia's online trading market is booming, presenting substantial growth prospects. Successful market entry hinges on tailoring products to Asian traders' preferences. In 2024, online trading in Asia saw a 15% increase in user activity.

Development of eWallet Service

XTB's eWallet development is ongoing, offering instant fund access and merging investments with payments. This integration simplifies finance management for clients. The eWallet is currently accessible to XTB clients in Europe. This strategic move enhances user experience and could boost platform engagement.

- The eWallet service provides immediate fund access.

- It integrates investments with payment functionalities.

- The service aims to streamline financial management.

- Currently available across Europe.

Social Trading Platform

XTB's social trading platform is a potential "Star" in its BCG matrix, presenting a high-growth, high-market-share opportunity. This platform will enable users to observe and potentially mimic the strategies of successful investors, which is a feature that can attract new clients. The platform will offer rankings and categorizations based on risk profiles, enhancing user experience. The platform will also offer real-time notifications about trading activities.

- Attracting new clients and increasing engagement.

- Ranking and categorization based on risk profiles.

- Real-time notifications about trading activities.

- Potential for high growth and market share.

Question Marks in XTB's BCG matrix represent high-growth potential but low market share, requiring strategic investment. XTB’s options trading, crypto trading, and Asian expansion fit this category. Success hinges on successful market penetration and efficient execution. In 2024, the trading sector saw significant growth, highlighting the risks and potential of these ventures.

| Feature | Details | Implication for XTB |

|---|---|---|

| Options Trading | High growth market. | Requires strategic partnerships. |

| Cryptocurrency Trading | MiCA regulation. | Depends on regulatory approvals. |

| Asian Expansion | 15% user activity rise in 2024. | Tailor products to market. |

BCG Matrix Data Sources

XTB's BCG Matrix leverages financial statements, market analysis, industry research, and expert opinions to determine quadrant positioning.