Zomato Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zomato Bundle

What is included in the product

Comprehensive Zomato's BCG Matrix analysis. Identifies investment, holding, and divestment strategies.

Quickly visualize Zomato's portfolio, enabling swift strategic decisions.

What You See Is What You Get

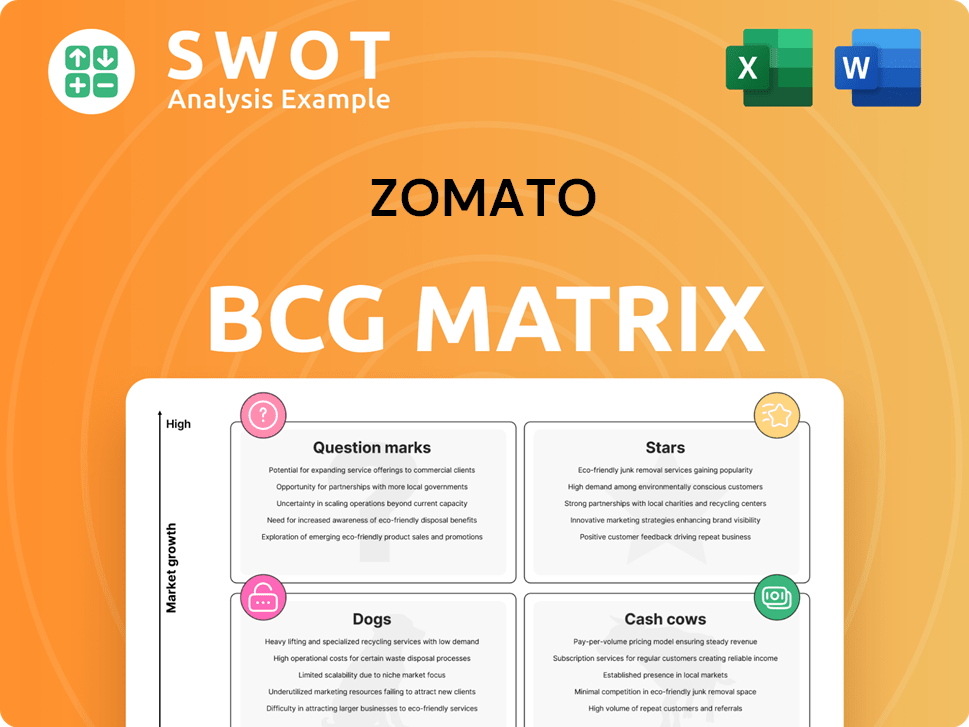

Zomato BCG Matrix

This preview showcases the complete Zomato BCG Matrix report you'll receive instantly upon purchase. There are no hidden sections; the downloadable file is a ready-to-use analysis of Zomato's business units.

BCG Matrix Template

Zomato's BCG Matrix reveals the strategic landscape of its diverse offerings. Explore where each product sits: Stars, Cash Cows, Dogs, or Question Marks. This quick look unveils market positioning and growth potential. Understand resource allocation and optimize your decision-making. Purchase the full BCG Matrix for a comprehensive strategic advantage and unlock detailed insights.

Stars

Zomato's food delivery is a Star, holding a significant market share. It's expanding, particularly in non-metro areas. Unit economics and customer loyalty are key. This segment thrives due to internet growth and lifestyle changes. In 2024, food delivery contributed significantly to Zomato's revenue, showing strong growth.

Blinkit, Zomato's quick commerce venture, has shown strong growth since being acquired. Its ability to quickly deliver groceries caters to rising consumer demand. This rapid expansion of store networks and scalability has significantly boosted Zomato's revenue, with Blinkit contributing substantially. The quick commerce sector is expected to keep growing, giving Blinkit a huge chance to thrive. In fiscal year 2024, Blinkit's GOV grew 105% YoY.

Zomato's dining-out segment, featuring restaurant discovery and reservations, is a "Star" due to its impressive growth. This is fueled by increased outdoor dining preferences. Exclusive offers and partnerships with numerous restaurants boost its attractiveness. In Q3 FY24, Zomato's GOV for dining grew by 20% YoY.

Strategic Partnerships

Zomato's "Stars" category includes strategic partnerships that are crucial for its growth. These collaborations with restaurants, delivery partners, and tech firms boost service offerings and market reach. Such alliances give access to new markets, keeping Zomato competitive. For instance, Zomato's partnership with Blinkit expanded its quick commerce presence.

- Partnerships with restaurants can increase order volumes by 15-20%.

- Delivery partner collaborations can improve delivery times by 10-15%.

- Tech partnerships can enhance user experience and app features.

- Zomato's strategic investments and partnerships totaled $1.2 billion in 2024.

Technological Innovation

Zomato's technological advancements are key. The company invests heavily in AI and machine learning. This improves its platform and user experience. These technologies allow for personalized recommendations and route optimization. This keeps Zomato competitive.

- Zomato's tech spending increased by 23% in 2024.

- AI-driven features boosted user engagement by 15%.

- Delivery route optimization reduced costs by 10%.

Zomato's Stars are thriving segments with strong growth potential. They include food delivery, quick commerce (Blinkit), and dining-out. Strategic partnerships and tech innovations further boost their success. Total GOV across all segments increased by 47% YoY in FY24.

| Segment | Key Feature | FY24 GOV Growth |

|---|---|---|

| Food Delivery | Market Leader | Significant |

| Blinkit | Quick Commerce | 105% YoY |

| Dining-Out | Restaurant Discovery | 20% YoY (Q3 FY24) |

Cash Cows

Zomato's restaurant listings offer users detailed eatery information, securing a consistent market share. This segment generates stable revenue with modest growth potential, acting as a dependable income source. In 2024, Zomato's listing revenue grew, yet expansion was limited. It's a key part of Zomato's strategy, even with moderate growth.

Zomato Pro membership, a cash cow, provides discounts and benefits, boosting customer loyalty. This generates consistent revenue and encourages repeat orders. Zomato Pro strengthens its market position by offering perks. In Q3 FY24, Zomato's revenue grew 71% YoY.

Zomato's advertising revenue from restaurants is a cash cow. Restaurants pay to promote offerings on the platform, a segment with strong growth potential. In Q3 FY24, Zomato's advertising revenue grew, indicating its success. The company leverages its platform for additional income. This strategy is effective and lucrative.

Hyperpure

Hyperpure, Zomato's B2B venture, acts as a cash cow within its BCG matrix. It supplies restaurants with kitchen essentials, creating a dependable revenue stream. Hyperpure boosts Zomato's core business by ensuring quality ingredients and reliability. This segment contributes significantly to Zomato's overall financial health.

- Hyperpure's revenue grew by 68% YoY in Q3 FY24.

- Hyperpure's gross order value (GOV) increased by 45% YoY in Q3 FY24.

- Hyperpure's contribution margin improved to 3.4% in Q3 FY24.

- Hyperpure expanded its services to more cities in 2024.

Food Rescue Initiative

Zomato's Food Rescue initiative, launched in November 2024, exemplifies a "Cash Cow" strategy within its BCG Matrix. This program allows customers to buy canceled food orders at reduced prices, directly addressing food waste. It generates extra revenue and bolsters Zomato's brand image. The initiative benefits restaurants, delivery partners, and customers alike.

- Launched in November 2024.

- Reduces food waste through discounted sales.

- Generates additional revenue streams.

- Enhances Zomato's brand image.

Zomato's cash cows provide steady income and market stability. These segments, including restaurant listings, Zomato Pro, and advertising, drive revenue growth. Key initiatives like Hyperpure and Food Rescue enhance financial health. In Q3 FY24, Hyperpure’s revenue rose significantly.

| Cash Cow | Description | 2024 Performance |

|---|---|---|

| Restaurant Listings | Stable revenue with modest growth. | Listing revenue growth. |

| Zomato Pro | Boosts loyalty, repeat orders. | Revenue growth (71% YoY, Q3 FY24). |

| Advertising | Restaurant promotions on the platform. | Revenue growth in Q3 FY24. |

| Hyperpure | Supplies kitchen essentials to restaurants. | Revenue grew 68% YoY (Q3 FY24). |

| Food Rescue | Reduces food waste, additional revenue. | Launched November 2024. |

Dogs

Zomato's international expansion faces challenges in some markets. Intense competition and regulatory hurdles lead to underperformance. These regions may need substantial investment with low returns. Turnaround strategies might prove ineffective. Re-evaluation or divestiture could be necessary; in 2024, Zomato's international revenue was 8.6% of total revenue.

Zomato Originals, the video content initiative, has struggled to attract viewers and generate revenue. This segment's performance has not been substantial, potentially draining resources. In 2024, Zomato's focus should be on its core business. This could involve reevaluating or divesting from the video content segment.

Table reservations, as a standalone service, likely struggles to compete. In 2024, its revenue contribution would have been minimal compared to core offerings. Integration with delivery is key; without it, user engagement remains low. This lack of synergy likely places it firmly within the 'Dog' category.

Certain loss-making partnerships

Certain Zomato partnerships are underperforming, causing financial strain. These ventures must be assessed, with unprofitable ones dissolved. Zomato reported a consolidated loss of ₹351 crore in FY24. Prioritizing profitable collaborations is crucial for financial stability. Ending these partnerships can improve Zomato's financial health.

- Financial losses from specific partnerships hinder Zomato's profitability.

- Resource allocation is negatively impacted by underperforming collaborations.

- Strategic termination of non-performing partnerships is recommended.

- Focusing on profitable partnerships improves overall financial health.

Geographic regions with low market penetration

Zomato's presence in some areas faces challenges, possibly due to established local rivals or low brand recognition. These regions could demand considerable spending on advertising and attracting customers, with results that are not guaranteed. In 2024, Zomato's expansion into new markets required significant marketing expenditure. A strategic choice to either heavily invest or exit these areas might be needed.

- Low penetration often correlates with higher customer acquisition costs.

- Marketing campaigns need to be tailored for specific regions.

- Competition analysis is crucial before investing.

- Withdrawal might be considered if returns are unfavorable.

Underperforming ventures and partnerships strain Zomato's resources, contributing to financial losses. In FY24, Zomato's consolidated loss was ₹351 crore, highlighting the impact. These "Dogs" demand strategic reevaluation or termination to improve profitability. Prioritizing profitable collaborations is key for Zomato's financial well-being.

| Category | Description | Impact |

|---|---|---|

| Partnerships | Underperforming collaborations | Financial losses, resource drain |

| Table Reservations | Standalone service | Low engagement, minimal revenue |

| International Expansion (Some Regions) | Intense competition, regulatory issues | Low returns, potential for divestiture |

Question Marks

Zomato can grow significantly by entering new, unserved markets. This strategy involves substantial investment, but offers high growth potential, especially in developing nations. Success hinges on forming partnerships with local entities and running targeted marketing efforts. In 2024, Zomato's international presence is still limited, indicating room for expansion. For example, Zomato's revenue from its international business was approximately $10.5 million in Q3 2024.

Zomato might consider diversifying into nutraceuticals, a high-growth market. This move would involve investments in product development and marketing. Entering this market could boost profitability and reduce reliance on food delivery. The global nutraceuticals market was valued at $457.4 billion in 2023.

Contactless dining highlights Zomato's focus on innovation. It has high growth potential, needing tech investment. Customer satisfaction and efficiency gains justify the investment. Contactless dining is a strategic move. In 2024, Zomato's revenue increased, showing growth.

Zomato Everyday

Zomato Everyday, featuring home-style meals, represents a new venture with an unproven market response. This service could draw in a fresh customer base, yet demands substantial marketing to gain momentum. Its triumph hinges on standing out from current food delivery services. In 2024, Zomato's food delivery segment saw a 10% increase in order volume.

- Launched in late 2023, Zomato Everyday is still in its early stages.

- Success hinges on the ability to capture a share of the growing home-cooked meal market.

- Needs to compete with established food delivery platforms and home-chef services.

- Requires effective marketing to build brand awareness and customer adoption.

Zomato Live (Events and Ticketing)

Zomato's foray into live events and ticketing is a "question mark" in its BCG matrix, representing a high-growth, potentially high-risk venture. This segment requires substantial investment to gain market share against established competitors. Success hinges on effective partnerships and marketing strategies to drive consumer engagement and revenue generation.

- Zomato's move into events targets a market with a projected value of $1.8 billion in India by 2024.

- Competition includes BookMyShow, which had a revenue of $100 million in FY23.

- Zomato needs to invest in tech and marketing; R&D expenses were ₹194.8 Cr in Q3 FY24.

Zomato's live events and ticketing business is a question mark. This high-growth venture requires major investment to compete. The Indian events market is projected at $1.8 billion in 2024.

| Aspect | Details |

|---|---|

| Market Size | $1.8B (India, 2024) |

| Competitor Revenue | BookMyShow ($100M, FY23) |

| Zomato R&D (Q3 FY24) | ₹194.8 Cr |

BCG Matrix Data Sources

The Zomato BCG Matrix relies on company financials, market analysis reports, competitor benchmarks, and growth forecasts to determine strategic recommendations.