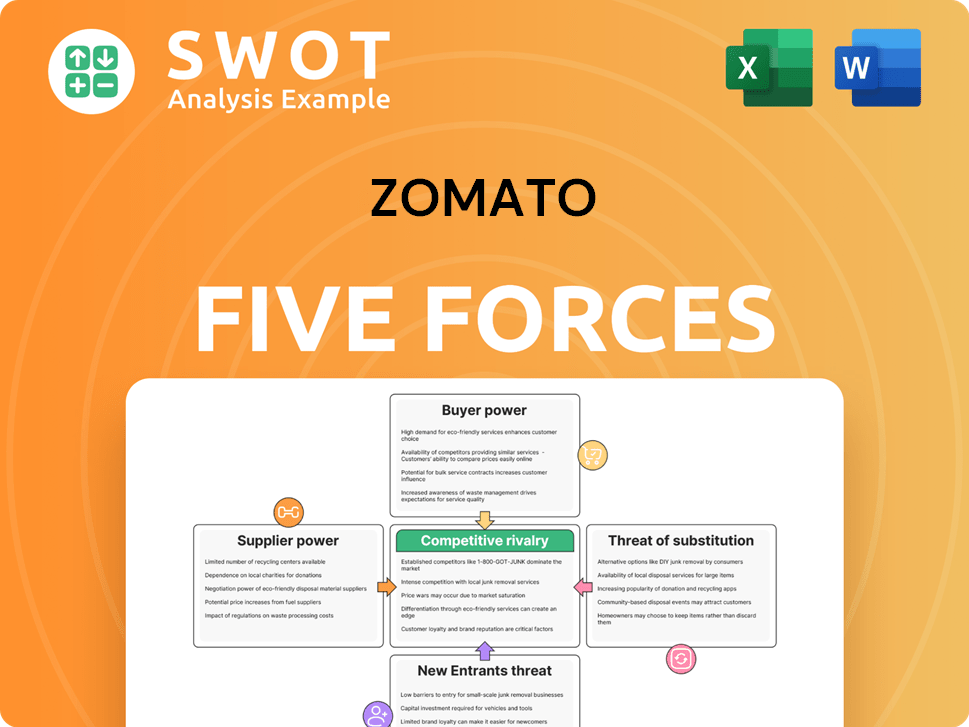

Zomato Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zomato Bundle

What is included in the product

Analyzes Zomato's position, assessing competitive forces, supplier/buyer power, entry/rivalry threats.

Understand pressures instantly: spider/radar charts reveal strategic threats.

What You See Is What You Get

Zomato Porter's Five Forces Analysis

This preview showcases Zomato's Porter's Five Forces analysis document. After purchasing, you'll receive this same detailed, ready-to-use analysis. It provides insights into the competitive landscape affecting Zomato. The document covers industry rivalry, and the power of suppliers and buyers, with substitutes and new entrants. Analyze the document; it's yours instantly after purchase.

Porter's Five Forces Analysis Template

Zomato operates in a dynamic food delivery market, heavily influenced by competitive rivalry, with numerous players vying for market share. Buyer power is substantial, as consumers have many options. Supplier power, particularly from restaurants, is a key factor to consider. The threat of new entrants and substitutes, like in-house delivery services, presents ongoing challenges. Understanding these forces is vital for strategic planning.

The complete report reveals the real forces shaping Zomato’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Restaurant dependence shapes Zomato's supplier power. Those reliant on Zomato for orders face weaker bargaining positions. Restaurants with dine-in or diverse delivery options hold more leverage. This impacts Zomato's costs and supplier relationships. In 2024, Zomato's revenue from food delivery was ₹2,769 crore.

Contractual agreements shape Zomato's relationship with restaurants, impacting supplier bargaining power. Commission rates and exclusivity clauses influence restaurants' ability to negotiate. Payment terms also dictate the power dynamic between Zomato and its suppliers. For instance, Zomato's revenue from food delivery in FY24 reached ₹7,075 crore. Analyzing these terms reveals the power balance.

Zomato indirectly faces supplier power through restaurants. Food distributor price hikes can raise restaurant costs. This impacts their Zomato partnerships. In 2024, food inflation affected restaurant margins. Monitoring the food supply chain is crucial for Zomato's operational stability.

Brand strength influences

Restaurants with robust brand recognition and a dedicated clientele wield substantial bargaining power. These entities depend less on Zomato for customer procurement, enabling them to negotiate improved commission rates or seek less prominent platform placement. For instance, in 2024, McDonald's, with its vast brand strength, might secure lower commission rates compared to a smaller, less-known eatery. Evaluating brand strength is critical in grasping supplier power dynamics.

- Brand strength allows for better commission negotiations.

- Strong brands are less reliant on platforms for visibility.

- McDonald's exemplifies a brand with high bargaining power.

- Understanding brand strength is vital for assessing supplier power.

Data accessibility is key

Data accessibility significantly shapes supplier power in Zomato Porter's ecosystem. Zomato's data-sharing practices directly influence restaurants' ability to make informed decisions. Transparent data empowers restaurants, potentially reducing their reliance on Zomato's platform. In 2024, Zomato faced scrutiny regarding data privacy and sharing practices.

- Lack of transparent data sharing can increase supplier dependence.

- Restaurants with better data access can improve operations and pricing.

- Zomato's data policies impact supplier relationships and bargaining power.

- Data-driven insights help restaurants negotiate better terms.

Restaurant dependency significantly influences Zomato's supplier power, with those relying heavily on the platform holding weaker positions. Contractual terms, like commission rates, further dictate power dynamics. In 2024, food delivery revenue was a key factor in these relationships.

Brand strength grants restaurants greater negotiation leverage, especially in commission structures. Data accessibility affects restaurants' ability to make informed decisions, impacting platform dependence. Zomato's data-sharing practices play a critical role in these power balances.

Food inflation and distributor price hikes also indirectly affect Zomato through restaurants. Monitoring these supply chain factors is crucial for operational stability. In 2024, Zomato's focus on cost management was highlighted.

| Factor | Impact on Supplier Power | 2024 Context |

|---|---|---|

| Restaurant Dependence | Weaker bargaining power | ₹7,075 crore revenue from food delivery |

| Contractual Terms | Commission rates and exclusivity clauses | Focus on cost management |

| Brand Strength | Better commission negotiations | McDonald's as an example |

Customers Bargaining Power

Price sensitivity among Zomato Porter's customers is considerable, influencing their choices based on cost. Customers readily switch platforms for better deals, enhancing their bargaining power. For example, in 2024, the average order value (AOV) for food delivery was around ₹400, and even small price differences impact customer decisions. This necessitates competitive pricing strategies; Zomato and Porter must offer attractive discounts.

Customers' ability to easily switch between food delivery platforms like Zomato and others, significantly boosts their bargaining power. The low switching costs mean customers can effortlessly move to competitors. This lack of commitment forces Zomato to continuously innovate. In 2024, Zomato faced intense competition, with Swiggy holding a 53% market share.

Customers wield considerable power due to readily available information. They can easily access restaurant reviews, menus, and price comparisons, enabling informed decisions. This transparency limits Zomato's ability to inflate prices. Data from 2024 shows a 20% increase in online food ordering, highlighting customer reliance on information. Analyzing customer behavior with this data is crucial.

Loyalty programs impact

Zomato's loyalty programs significantly affect customer bargaining power. These programs can reduce price sensitivity, making customers less likely to switch to competitors. Strong programs are key for customer retention, influencing Zomato's pricing strategy. Assessing the effectiveness of these programs is crucial for evaluating their impact on customer relationships.

- Zomato Gold saw a 40% increase in subscribers in FY24, showing program effectiveness.

- Customer retention rates are higher among loyalty program members.

- Loyalty programs impact the ability to maintain premium pricing.

Personalization enhances power

Customers now expect personalized experiences and recommendations. Platforms that can't tailor options risk losing users to competitors. Personalization is key to keeping customers and reducing their desire to switch. For example, in 2024, 60% of consumers say they'd switch brands for a better personalized experience.

- Personalized experiences drive customer loyalty.

- Failure to personalize leads to customer churn.

- Tailored options are a competitive advantage.

- Switching costs are reduced by personalization.

Customers of Zomato Porter have significant bargaining power due to price sensitivity and easy switching. This power is fueled by accessible information and competitive alternatives. Loyalty programs and personalization strategies help Zomato retain customers, but must remain effective.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Price Sensitivity | High; influences choices | AOV ~ ₹400 |

| Switching Cost | Low; impacts loyalty | Swiggy's 53% market share |

| Information Access | Empowers decisions | 20% increase in online ordering |

Rivalry Among Competitors

The online food delivery sector is fiercely competitive, with giants like Zomato, Swiggy, and others battling for dominance. This rivalry forces Zomato to constantly innovate and improve its services to retain customers. In 2024, Zomato's revenue grew significantly, but competition also led to increased marketing expenses. Understanding this competitive landscape is vital for strategic planning and sustained growth.

Differentiation in food delivery is tough, making it hard to stand out. Price wars can squeeze profit margins. Both Zomato and rivals offer delivery and discovery. In 2024, Zomato's revenue grew, yet competition persists. Finding unique value is key for lasting success.

Market consolidation, like mergers and acquisitions, reshapes food delivery's competitive landscape. This can boost market concentration, possibly reducing competition. For example, in 2024, DoorDash's revenue hit $8.6 billion. Tracking these trends is key to grasping market shifts.

Marketing spend is significant

The food delivery sector, including Zomato and Porter, witnesses considerable marketing investments aimed at boosting brand visibility and customer acquisition. This intense spending escalates competitive rivalry, squeezing profit margins. For instance, in 2024, marketing expenses represented a significant portion of overall costs for major players like Zomato. Assessing the ROI of marketing campaigns is essential to maintain a competitive edge.

- High marketing costs are typical in the food delivery industry.

- These costs increase competition and decrease profit margins.

- Effectiveness of marketing campaigns must be carefully measured.

- Zomato's marketing spend in 2024 was substantial.

Technological innovation drives rivalry

Technological innovation significantly shapes competitive rivalry in the food delivery and logistics sectors. The rapid adoption of AI-driven personalization and drone delivery systems can quickly shift market dynamics. Firms that lag in technological investments risk losing market share to more agile competitors. Keeping pace with advancements is vital for maintaining a strong competitive position.

- Zomato's investment in AI-driven features to enhance user experience.

- Swiggy's exploration of drone delivery for faster order fulfillment.

- The increasing use of data analytics to optimize delivery routes and efficiency.

- The need for constant upgrades in app technology to stay competitive.

Competitive rivalry in food delivery is intense, with players like Zomato and Swiggy vying for market share. This competition leads to heavy marketing spend and price wars, squeezing profit margins. In 2024, Zomato’s marketing expenses were a significant part of total costs, reflecting this intense rivalry.

| Aspect | Details |

|---|---|

| Key Players | Zomato, Swiggy, Uber Eats, and regional competitors. |

| Competition Drivers | Price wars, service quality, and marketing. |

| 2024 Impact | Increased marketing spend; revenue growth. |

SSubstitutes Threaten

Cooking at home directly competes with Zomato. In 2024, the average cost of a meal prepared at home was significantly lower than ordering in. A Nielsen study showed that 65% of consumers prioritize cost savings. This preference impacts Zomato's order volume. Monitoring home cooking trends is crucial for Zomato's strategic planning.

Dining out offers a unique social experience that online delivery can't match. For special occasions, restaurants are often the preferred choice. In 2024, restaurant sales in the U.S. reached $997 billion, showing dining out's continued appeal. Analyzing these trends is vital for understanding this substitute's impact.

Ready-to-eat meals from supermarkets and convenience stores pose a threat to Zomato Porter. These meals offer a quicker, cheaper alternative to restaurant delivery. For example, in 2024, the ready-to-eat meal market grew by 7%, showing their increasing popularity. Monitoring these options' quality and availability is key for Zomato Porter.

Meal kit services emerge

Meal kit services represent a growing threat to Zomato Porter. They offer an alternative to both dining out and ordering food delivery. Meal kits provide convenience and a different culinary experience. This shift could impact Zomato Porter's market share. Consider that the meal kit market was valued at $10.3 billion in 2023.

- Market growth: The meal kit market is projected to reach $20.3 billion by 2032.

- Consumer preference: Meal kits appeal to those seeking convenience and varied meal options.

- Competitive landscape: Blue Apron and HelloFresh are key players in the meal kit industry.

- Impact on Zomato Porter: Increased meal kit adoption could reduce demand for Zomato Porter's services.

Other delivery services compete

The threat of substitutes for Zomato Porter includes other delivery services. These services, specializing in groceries or general goods, compete by offering doorstep delivery of various items. This reduces the reliance on food delivery alone. Analyzing the expansion of these services is critical for understanding the competitive landscape.

- Instacart and Amazon offer diverse delivery options.

- These services can fulfill multiple consumer needs.

- Competition is intensifying due to market growth.

- Understanding these services is crucial for Zomato Porter's strategy.

Zomato faces substitute threats from varied sources. Home cooking remains a cost-effective alternative, as reflected in 2024 data showing average meal costs at home lower than delivery options. Ready-to-eat meals and meal kits also compete, with the meal kit market valued at $10.3 billion in 2023 and projected to reach $20.3 billion by 2032.

| Substitute | Impact on Zomato Porter | 2024 Data/Trends |

|---|---|---|

| Home Cooking | Direct Competition | Lower average meal cost than delivery |

| Ready-to-Eat Meals | Offers convenience | Market grew by 7% |

| Meal Kits | Growing market share | $10.3B (2023) to $20.3B (2032) |

Entrants Threaten

The capital needed to start a food delivery platform like Zomato Porter isn't extremely high, thanks to available tech. This ease of access lowers the hurdle for new competitors. In 2024, the food delivery market saw varied funding, with some startups securing significant investments. Understanding these financial moves is key for assessing future threats.

The tech needed for a food delivery app is easily available, reducing entry barriers. This means new competitors can quickly enter the market and challenge Zomato Porter. In 2024, the cost to develop a basic food delivery app can range from $5,000 to $50,000, making it accessible to many. Assessing the tech landscape is crucial for staying competitive.

Building brand loyalty in food delivery is tough, as customers often switch for better deals. New entrants can lure customers with competitive pricing strategies and promotions. In 2024, the average customer retention rate in the food delivery sector was around 30%, showing how easily customers move between platforms. Understanding consumer behavior is key to survival.

Regulation can be a barrier

Regulatory hurdles significantly impact new entrants in the food delivery and logistics sectors. Zomato Porter, and any new competitor, must comply with stringent food safety standards, labor laws, and data privacy regulations. The cost of compliance, including necessary infrastructure and expert consultation, can be substantial. For instance, in 2024, food safety inspections increased by 15% in major Indian cities, adding to operational expenses. Constant monitoring of evolving regulations is crucial to avoid penalties and ensure operational continuity.

- Food safety compliance costs can include investments in temperature-controlled vehicles and specialized training for delivery personnel.

- Labor law adherence involves providing fair wages, benefits, and adhering to working hour regulations, increasing operational costs.

- Data privacy compliance requires investment in secure data storage, encryption, and adherence to data protection regulations like GDPR or similar local laws.

Network effects are crucial

Established food delivery platforms like DoorDash and Uber Eats have a significant advantage due to network effects. These effects mean the service becomes more valuable as more restaurants and customers use it. New entrants face the challenge of building a substantial user base to compete effectively. Analyzing network effects is therefore critical for understanding the competitive landscape.

- The global online food delivery market was valued at USD 151.51 billion in 2023.

- The market is projected to reach USD 338.25 billion by 2032.

- DoorDash, Delivery Hero, and Uber Eats are key players in the online food delivery market.

The threat of new entrants for Zomato Porter is moderate due to accessible technology and varied funding landscapes. Ease of app development and the potential for customer switching increase the likelihood of new competitors. However, regulatory hurdles and established network effects pose significant barriers.

| Factor | Impact | 2024 Data |

|---|---|---|

| Tech Accessibility | Lowers barriers | App development cost: $5K-$50K |

| Brand Loyalty | Low | Customer retention: ~30% |

| Regulations | High cost | Food safety inspections up 15% |

| Network Effects | Advantage for incumbents | Market value: $151.51B (2023) |

Porter's Five Forces Analysis Data Sources

The Zomato analysis uses industry reports, financial statements, and market research data to understand competitive dynamics. We also incorporate news articles and competitor analysis.