Zotefoams Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zotefoams Bundle

What is included in the product

Zotefoams BCG Matrix assessment revealing strategic moves for growth and profitability.

Printable summary optimized for A4 and mobile PDFs, allowing efficient sharing and review.

Full Transparency, Always

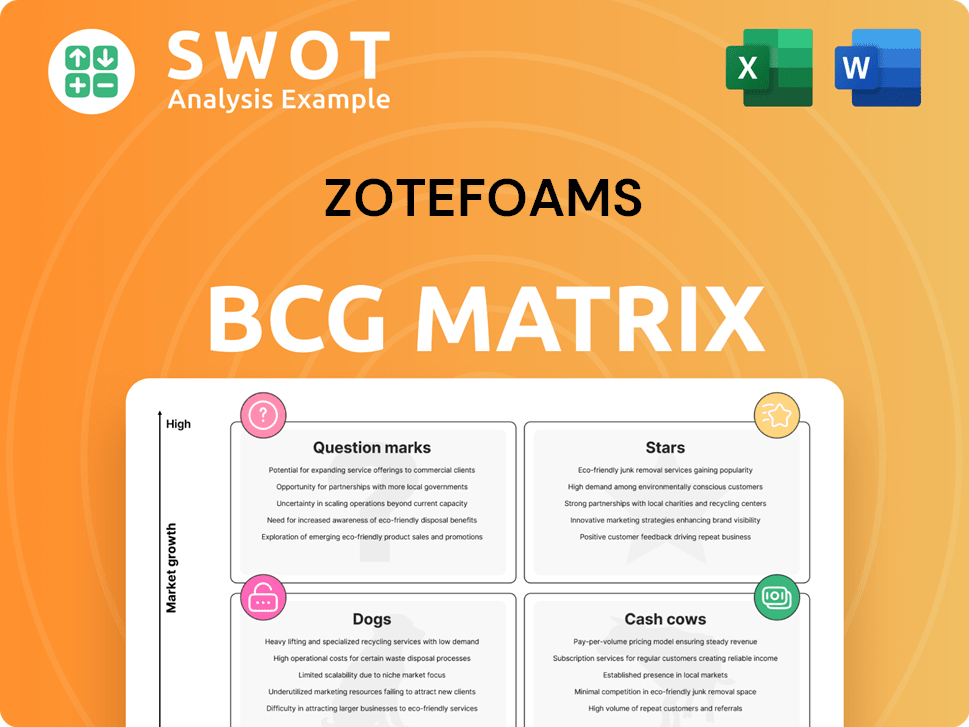

Zotefoams BCG Matrix

This preview is the complete Zotefoams BCG Matrix you'll receive after purchase. It's a fully editable, ready-to-use document, optimized for strategic decision-making. The downloaded file will mirror this preview, ensuring instant access for immediate implementation. Purchase gives you full access to the analysis and presentation-ready formats.

BCG Matrix Template

Zotefoams' products, like its cellular foams, likely occupy different positions in the market. Some may be "Stars," enjoying high growth and market share. Others could be "Cash Cows," generating strong profits with less growth. The matrix also clarifies "Dogs," needing strategic attention, or "Question Marks," with uncertain futures. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

High-Performance Products (HPP) like footwear and ZOTEK foams are experiencing robust growth. In 2024, sales hit £79.6 million, surpassing Polyolefin Foams. This growth is fueled by the running shoe market and demand for technical insulation. Investing in HPP can strengthen market leadership and boost revenue.

The footwear segment, especially specialist midsole materials, saw remarkable growth. Sales reached £66.1 million in 2024, a 46% increase. This success is fueled by Zotefoams' partnership with Nike, extended to 2029. Expansion in Asia further supports long-term growth potential.

ZOTEK® technical foams, including fluoropolymer foams and T-FIT technical insulation, are a Star in Zotefoams' BCG Matrix. These foams are crucial for high-value applications like aerospace and medical. In 2024, the HPP segment saw robust growth, with revenues increasing by 15%. Innovation and customization will boost market reach.

Sustainable Products

Zotefoams is experiencing rising demand for sustainable, lightweight, and durable products. In 2024, 89% of its revenue came from 'green' products. This positions Zotefoams well to capitalize on the eco-friendly trend. Focusing on sustainable materials and processes is key.

- Revenue from 'green' products was 89% in 2024.

- Focus on sustainable materials is crucial.

- Lightweight and durable products are in demand.

Expansion in Asia

Zotefoams is strategically expanding in Asia. New facilities in Vietnam and South Korea are planned. This expansion aims to cut costs and boost sustainability. The regional operating model, effective from early 2025, will improve customer service. This is supported by a 2024 increase in Asian sales, representing 18% of total revenue.

- Manufacturing expansion in Vietnam and South Korea.

- Focus on cost reduction and sustainability.

- New regional operating model from early 2025.

- Asian sales contributed 18% of total revenue in 2024.

ZOTEK® technical foams are categorized as Stars in Zotefoams' BCG Matrix, crucial for high-value sectors. The HPP segment saw a 15% revenue rise in 2024, showing robust growth. Innovation and customization will drive further market expansion for these foams.

| Category | 2024 Revenue | Growth Rate |

|---|---|---|

| HPP Segment | £79.6M | 15% |

| Footwear | £66.1M | 46% |

| Asian Sales | 18% of Total | Increased |

Cash Cows

AZOTE® polyolefin foams, a key part of Zotefoams, saw a slight 1% dip in sales during 2024, reaching £66.9 million. These foams are well-established in sectors like transport and construction. The focus is on boosting efficiency and strategic projects. Maintaining profitability is key for this segment.

Zotefoams' North American polyolefin foams business showed steady performance, with a slight growth in 2024. They have facilities in Kentucky and Oklahoma. This business area serves the construction market. Investment in the region is crucial. This will leverage demand for packaging and automotive materials.

T-FIT® technical insulation, vital in sectors like semiconductors and pharmaceuticals, falls under Zotefoams' HPP segment. Despite representing 7% of HPP sales in 2024, it is still a strong product. Expansion into high-margin areas such as aviation and medical fields could boost T-FIT's growth potential. This strategic focus aligns with Zotefoams' goal of enhancing profitability and market presence.

UK Market Resilience

The UK market is a cash cow for Zotefoams, displaying resilience. In 2024, revenue grew by 4%, fueled by solid average selling prices and new ventures in construction and industrial sectors. This stability offers a strong foundation for Zotefoams to capitalize on high-value applications.

- 2024 UK revenue growth: 4%

- Key drivers: strong average selling prices, new projects

- Focus area: high-value applications, customer partnerships

Manufacturing Efficiencies

Zotefoams' manufacturing approach balances local production in North America and Europe with a Chinese facility serving global markets. Investments in new capacity and tech, like the South Korean innovation center, aim to boost efficiency and cut costs. Streamlining operations and optimizing resources will further improve profitability. In 2024, Zotefoams saw a 5% increase in production efficiency across its global facilities.

- Global production network.

- Technology investments.

- Operational streamlining.

- Improved profitability.

The UK market serves as a cash cow for Zotefoams. In 2024, revenues grew by 4%, driven by solid selling prices and new ventures. The focus is on high-value applications.

| Metric | 2024 | Notes |

|---|---|---|

| UK Revenue Growth | 4% | Driven by strong prices |

| Key Drivers | Avg. Selling Prices | New Construction Projects |

| Focus | High-Value App | Customer Partnerships |

Dogs

Zotefoams' decision to wind down its MuCell Extrusion (MEL) business, including ReZorce® technology, was finalized in December 2024. The MEL business saw a significant loss of £21.6 million in 2024, a stark contrast to the £5.5 million loss in 2023. This strategic shift allows Zotefoams to concentrate on its core foams business units. The move reflects a focus on more profitable areas.

ReZorce® circular packaging, an award-winning innovation, hasn't reached commercial success. Zotefoams halted ReZorce® investments, retaining IP for future possibilities. This strategic shift prioritizes core supercritical foam ventures. In 2024, Zotefoams' focus is on high-growth areas within its core business, reflecting a strategic realignment.

Zotefoams's 2024 results revealed an increased inventory provision for slow-moving HPP foams. This suggests difficulties in aligning production with demand. Effective inventory management could boost profits, as seen in similar industries where optimized stock levels reduced holding costs by up to 15%.

EMEA Region Sales Decline

In 2024, Zotefoams' EMEA region experienced a 3% sales decline, signaling market weakness in Europe and the Middle East. This downturn necessitates strategic adjustments to regain momentum. Focusing on specific markets and optimizing the product mix is crucial. Implementing these changes can help steer the EMEA region towards growth.

- Sales Decline: A 3% decrease in 2024.

- Market Impact: Reflects weaker conditions.

- Strategic Focus: Targeted strategies and improved mix.

- Goal: Reverse the sales decline.

Products with Limited Market Reach

Zotefoams has products with limited reach within the £4 billion polyolefin foams market. The company's addressable market has been historically limited to £800 million. A market mapping study was conducted in collaboration with a global market research organization. This aimed to better understand market dynamics.

- Limited market reach for certain products.

- Addressable market historically at £800m.

- Market mapping study with global research firm.

- Focus on specific segments within the £4bn market.

Dogs in Zotefoams’ portfolio likely show low market share and growth, indicating poor performance. The EMEA sales decline and inventory issues point to challenges. These products may require divestiture or strategic repositioning.

| Category | Details | Impact |

|---|---|---|

| Sales Decline | EMEA region, 3% in 2024 | Market weakness, strategic focus needed |

| Inventory | Increased provision for HPP foams | Inefficiency, potential profit impact |

| Market Reach | Limited within £4bn market | Need for targeted strategies |

Question Marks

Zotefoams is seeing strong growth in EV battery applications, especially in the Far East. The need for light, strong EV materials is a big chance for Zotefoams to grow. Investing more in this area can boost future sales. In 2024, the EV market in Asia is expected to reach $200 billion.

Zotefoams sees a market opportunity in aerospace, with its materials found in window seals and seating. They are launching Ecozote® PE/R LD24 FR, a sustainable seating material. The aviation industry is focused on lower-carbon solutions. The global aerospace market was valued at $838.3 billion in 2023, a 20.3% increase from 2022.

The medical foam market is expanding, fueled by rising healthcare spending and tech innovations. Zotefoams' clean, biocompatible foams can boost its medical presence. In 2024, the global medical foam market was valued at $7.8 billion. Strategic partnerships and innovation are key for segment growth.

D3O Partnership

The D3O partnership signifies a "Question Mark" in Zotefoams' BCG matrix, representing high-growth potential but uncertain market share. This collaboration focuses on impact protection solutions for defense and law enforcement. Leveraging ZOTEK® NC, the partnership targets sectors with growing demand. Further success hinges on effective product development and market penetration.

- Exclusivity agreement with D3O for impact protection solutions.

- Utilizes ZOTEK® NC in body armor and helmet systems.

- Aims to capture opportunities in defense and law enforcement.

- Success depends on product development and market adoption.

Sustainable Packaging Solutions

Zotefoams' focus on sustainable packaging aligns with rising regulatory demands for recycled content. Their capacity to use recycled materials and cut the carbon footprint of packaging products meets market trends and customer expectations. This strategic shift can drive future growth by addressing the increasing consumer and regulatory demand for eco-friendly options. Investing in sustainable innovation will be key for Zotefoams.

- Regulatory pressure for sustainable packaging is increasing globally.

- Zotefoams can capitalize on this by innovating with recycled materials.

- This approach meets both market needs and customer preferences.

- Investing in sustainability can generate long-term growth for the company.

Zotefoams' partnership with D3O, a "Question Mark" in its BCG matrix, targets impact protection solutions for defense and law enforcement, with growth prospects. The collaboration uses ZOTEK® NC. In 2024, the global body armor market is valued at $3.5 billion.

| Category | Details | 2024 Value |

|---|---|---|

| Partnership | D3O | N/A |

| Product | Impact Protection | N/A |

| Market | Body Armor | $3.5B |

BCG Matrix Data Sources

The Zotefoams BCG Matrix utilizes financial statements, market research, and industry reports to fuel strategic decisions. We analyze performance data alongside sector forecasts.