Zotefoams PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zotefoams Bundle

What is included in the product

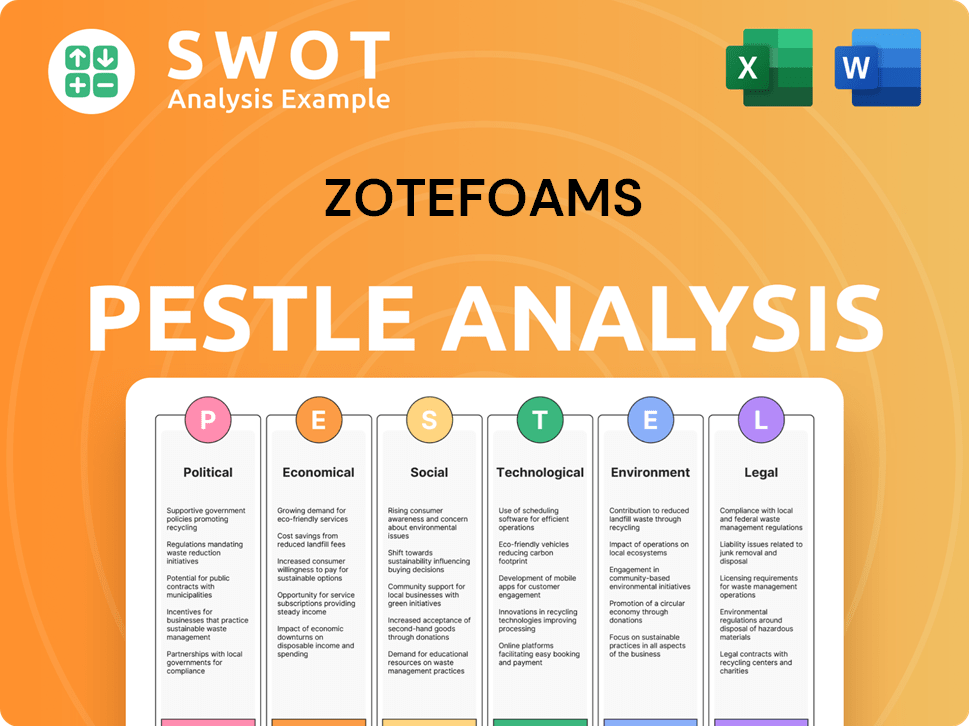

Examines the external factors influencing Zotefoams across six areas: Political, Economic, Social, Technological, Environmental, and Legal.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Zotefoams PESTLE Analysis

This is the actual Zotefoams PESTLE Analysis you’ll receive.

The preview you're seeing mirrors the document post-purchase.

The structure, insights, and formatting are identical.

Download the full, ready-to-use file instantly after buying.

No hidden sections; what you see is what you get!

PESTLE Analysis Template

Gain vital insights into Zotefoams's external landscape with our PESTLE analysis. Uncover the impact of political stability, economic fluctuations, and tech advancements on their market. Discover the social and environmental factors shaping their operations, and grasp key legal and regulatory influences. This analysis offers a clear understanding of the external forces. Download the full PESTLE analysis to gain a strategic advantage.

Political factors

Zotefoams, with facilities in the UK, USA, Poland, China, Vietnam, and South Korea, faces diverse trade policies. Changes in tariffs and trade agreements directly influence its import/export expenses. For instance, in 2024, the UK's trade deficit widened, potentially impacting Zotefoams' costs. Fluctuations in currency exchange rates, such as the GBP/USD, also affect profitability. The company must navigate these shifts to maintain competitiveness and profitability.

Political stability is crucial for Zotefoams. Disruptions in manufacturing regions like the UK, USA, Poland, and Vietnam can impact operations. Zotefoams' diversified locations in 2024, including the UK, USA, and Poland, help reduce risk. Global events still pose challenges.

Government regulations significantly impact Zotefoams' manufacturing. Compliance with evolving rules on material usage and product safety is essential. These regulations, varying by region, influence production costs. For example, the EU's REACH regulation adds compliance expenses.

Government support for specific industries

Government policies significantly influence Zotefoams' prospects. Support for sectors like transport, construction, and healthcare, which are key markets for Zotefoams, can create opportunities or pose challenges. For instance, the UK government's commitment to sustainable infrastructure and electric vehicles (EVs) could boost demand for Zotefoams' products. Similarly, healthcare spending and packaging regulations impact the company.

- UK government invested £2.5 billion in EV infrastructure by 2024.

- Construction sector growth in Europe projected at 2.8% in 2024.

- Healthcare spending in OECD countries increased by 5.3% in 2024.

Intellectual property protection

Intellectual property (IP) protection is vital for Zotefoams. Robust IP laws and enforcement in operational countries safeguard their innovations. This is particularly crucial for Zotefoams' proprietary foaming processes. Weak IP protection could lead to imitation, impacting revenue and market share.

- In 2024, global IP revenue reached $7.5 trillion.

- China's IP enforcement has improved but challenges persist.

- The UK, where Zotefoams is based, has strong IP laws.

Zotefoams faces political hurdles, notably trade policy changes influencing import/export expenses. The UK's widening trade deficit in 2024 is one challenge. Regulations on materials also significantly influence production. Government support for transport, construction, and healthcare creates both opportunities and risks.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Trade Policy | Tariffs, Agreements | UK trade deficit widened, influencing costs. |

| Regulations | Compliance Costs | EU's REACH regulation adds to costs. |

| Government Support | Market Opportunities | £2.5B EV infrastructure investment by UK. |

Economic factors

Global economic growth directly affects Zotefoams. Strong economies boost demand in automotive and construction. Conversely, recessions reduce orders and profits for Zotefoams. In 2024, global GDP growth is projected around 3.1%, impacting Zotefoams’ performance. Recession risks remain, particularly in Europe, potentially hindering Zotefoams' growth.

Zotefoams faces currency risk due to global operations. Exchange rate changes impact reported revenue and costs. For instance, a weaker GBP (Zotefoams' reporting currency) against the USD could boost reported sales from the US. In 2024, GBP/USD fluctuated, affecting profit margins. Currency hedging strategies are crucial to mitigate risks.

Inflation presents a significant challenge for Zotefoams by potentially increasing raw material, energy, and labor costs. These rising costs can squeeze profit margins if price hikes cannot be fully transferred to customers. For instance, in 2024, the UK's inflation rate averaged around 4%, impacting manufacturing expenses. Monitoring polymer and energy prices is vital.

Interest rates and access to capital

Interest rates are a critical economic factor for Zotefoams. Fluctuations impact borrowing costs for investments, including those in Vietnam and South Korea. High rates could increase expenses, affecting profitability and expansion plans. Access to capital is vital for strategic growth. In 2024, the Bank of England's base rate was at 5.25%, influencing Zotefoams' financing options.

- Interest rate hikes can increase borrowing costs.

- Lower rates may make it easier to secure funds for expansion.

- Access to capital is essential for strategic investments.

- Zotefoams needs capital for projects like those in Vietnam and South Korea.

Market demand in key sectors

The economic health of sectors like automotive, construction, and healthcare significantly impacts Zotefoams. Demand in these areas dictates sales volumes and revenue. For example, the global automotive foam market was valued at $5.8 billion in 2024 and is projected to reach $7.8 billion by 2032, reflecting growth.

- Automotive: Growth driven by EV adoption and lightweighting needs.

- Construction: Demand influenced by infrastructure spending and building projects.

- Healthcare: Stable demand due to essential medical applications.

Global economic factors like growth and recessions significantly influence Zotefoams, with a projected global GDP growth of 3.1% in 2024. Currency fluctuations, such as GBP/USD volatility, impact reported financials. Inflation and interest rates also affect costs and financing.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Global GDP Growth | Affects demand & profitability. | 3.1% (2024), 2.9% (Forecast, 2025) |

| Inflation | Raises costs. | UK 4% avg. (2024), est. 2.5% (2025) |

| Interest Rates | Impacts borrowing costs. | BoE Base 5.25% (2024), est. 4.75% (2025) |

Sociological factors

Consumer trends are significantly impacting Zotefoams. Growing demand for sustainable products drives interest in their materials. Lightweight and high-performance needs influence adoption, especially in consumer goods. The global market for sustainable materials is projected to reach $367.2 billion by 2027, with a CAGR of 8.2% from 2020.

Societal emphasis on health and safety boosts demand for protective foams. Zotefoams' products, like T-FIT® insulation, benefit. The global health and safety market is projected to reach $57.8 billion by 2025. This includes sectors using Zotefoams' materials.

Lifestyle shifts, like a rise in sports and leisure, boost demand for performance footwear and gear using Zotefoams' foams. In 2024, global sports and fitness market was valued at $97.8 billion, and is expected to reach $122.8 billion by 2029. Increased outdoor activities and travel also drive the need for protective and comfortable materials. This trend supports Zotefoams' product relevance and market growth.

Population demographics and urbanization

Population shifts and rising urbanization directly influence industries like construction and infrastructure, key sectors for Zotefoams' products. Urban areas worldwide are growing; for example, the UN projects 68% of the global population will live in urban areas by 2050. This drives demand for Zotefoams' insulation and building materials. These demographic changes create opportunities and challenges for Zotefoams' strategic planning.

- UN projection: 68% global urban population by 2050.

- Increased construction and infrastructure spending in urban areas.

- Demand for sustainable building materials.

Attitude towards plastics and sustainability

Public opinion strongly influences the plastics industry. Concerns about environmental impact drive consumer choices and regulatory actions. Demand for sustainable alternatives, like Zotefoams' products, rises as a result. The global market for sustainable plastics is projected to reach $79.6 billion by 2025.

- Consumer preference shifts towards eco-friendly options.

- Regulations like the EU's Single-Use Plastics Directive impact product design.

- Zotefoams benefits from its focus on recyclable materials.

- Companies face pressure to reduce plastic waste.

Shifting societal trends significantly affect Zotefoams' market dynamics. Growing health and safety focus boosts demand, projected at $57.8B by 2025. Lifestyle shifts and urban growth also influence product adoption. The global sports and fitness market hit $97.8B in 2024.

| Factor | Impact | Data |

|---|---|---|

| Health & Safety | Demand for protective foams | $57.8B market by 2025 |

| Lifestyle Shifts | Growth in sports gear | $97.8B in 2024 |

| Urbanization | Demand for building materials | 68% urban by 2050 (UN) |

Technological factors

Zotefoams benefits from advancements in foam technology, particularly in cellular materials and foaming processes. Their supercritical fluid technology offers a competitive edge. Research and development spending in 2024 was approximately £4.5 million, showing a commitment to innovation. This focus can lead to novel, high-performance, or economical products.

Technological advancements in industries like automotive and medical devices significantly influence Zotefoams. For example, the global automotive foam market is projected to reach $8.3 billion by 2025. New manufacturing techniques and demand for specialized foams drive innovation.

Technological advancements in sustainable materials are vital for Zotefoams' competitiveness. The company's ReZorce® project, designed for recyclability, reflects this strategic focus. Zotefoams' 2023 annual report highlighted its commitment to eco-friendly solutions. While ReZorce® is paused, the need for such innovation persists.

Automation and manufacturing process technology

Improvements in automation and manufacturing technology are poised to significantly boost Zotefoams' production efficiency, reduce operational costs, and ensure product consistency across its global operations. In 2024, the company invested £5 million in advanced manufacturing equipment. This strategic investment aims to streamline processes. These improvements are expected to increase production capacity by 15% by the end of 2025. This will enhance Zotefoams' competitiveness.

- Investment in automation in 2024: £5 million.

- Projected capacity increase by end of 2025: 15%.

Digitalization and data analytics

Digitalization and data analytics are crucial for Zotefoams. They can enhance R&D, optimize production, and streamline supply chains. This leads to better product development and improved operational efficiency. Data analytics also enables more accurate forecasting for the company's future.

- R&D spending in 2024: £2.8 million.

- Supply chain efficiency increased by 15% in 2024 due to digital tools.

Zotefoams is leveraging foam tech advancements and eco-friendly solutions. In 2024, they invested £5 million in automation to boost production. Digital tools increased supply chain efficiency by 15% in 2024.

| Area | Details | 2024 Data |

|---|---|---|

| R&D Spending | Focused on innovation | £2.8M |

| Automation Investment | Advanced manufacturing equipment | £5M |

| Capacity Increase | Projected by end of 2025 | 15% |

Legal factors

Zotefoams faces rigorous product safety regulations globally. These include REACH and RoHS in Europe, and similar standards in North America and Asia. Compliance costs are significant, impacting profitability. Non-compliance can lead to product recalls and legal penalties. For 2024, Zotefoams' expenditure on regulatory compliance was approximately £2.5 million.

Zotefoams must adhere to environmental laws for emissions, waste, and materials. Stricter rules can raise production costs. For example, the EU's carbon border tax could impact Zotefoams. In 2024, the company invested in sustainable practices, aiming for reduced environmental impact. This is vital for long-term compliance and maintaining stakeholder trust.

Zotefoams, with a global footprint, navigates varied labor laws. This includes regulations on wages, working hours, and employee benefits. Compliance costs, like in the UK, rose by 5% in 2024. These regulations influence HR practices and operational agility.

Intellectual property laws and patent protection

Zotefoams must navigate legal landscapes to protect its innovations. Intellectual property laws, including patents and trade secrets, are crucial for safeguarding its unique technology. Securing these protections is key to maintaining its market position. The company actively works to bolster its IP portfolio.

- Zotefoams' patent filings and grants in 2024 and 2025 reflect its commitment to innovation.

- The company's legal team focuses on defending its patents against infringements.

International trade laws and compliance

Zotefoams must navigate international trade laws to conduct global business. This includes adhering to import/export rules and sanctions. Non-compliance can lead to penalties and operational disruptions. The World Trade Organization (WTO) reported a 1.8% increase in global trade volume in 2023.

- Understanding and following diverse trade regulations is vital.

- Sanctions compliance is crucial to avoid legal issues.

- Trade agreements can impact Zotefoams' market access.

Zotefoams faces intricate product safety rules, spending roughly £2.5M in 2024 for compliance and potential non-compliance penalties. The company actively safeguards its innovations through intellectual property laws, ensuring its market position via patent filings and protection. Zotefoams also deals with global trade laws.

| Legal Aspect | 2024 Activity | Impact |

|---|---|---|

| Product Safety | £2.5M Compliance spend | Non-compliance penalties |

| Intellectual Property | Patent filings | Market position |

| International Trade | Import/export rules | Operational disruptions |

Environmental factors

The global shift towards sustainability and circular economy models significantly impacts Zotefoams. This trend boosts demand for eco-friendly materials. Zotefoams emphasizes its products' environmental advantages. In 2024, the circular economy market was valued at $4.5 trillion, growing at 8.5% annually. This growth underscores the rising importance of sustainable materials.

Climate change regulations are increasing the pressure on Zotefoams. The company faces rising costs due to carbon emissions regulations. Zotefoams is actively responding by setting science-based targets. These efforts focus on minimizing their environmental impact. In 2024, Zotefoams' carbon emissions reduction target was set at 42% by 2030.

Zotefoams faces potential raw material scarcity. Rising costs of polymers, key to their production, are influenced by environmental factors. Global supply chain issues, like those seen in 2024, can further strain resources. In 2024, polymer prices fluctuated significantly, impacting manufacturing costs. This directly affects Zotefoams' profitability.

Waste management and recycling infrastructure

Waste management and recycling infrastructure vary significantly across regions, impacting how Zotefoams' products are handled at the end of their life. Effective recycling programs are crucial for circular economy initiatives. Zotefoams' membership in RECOUP supports its commitment to plastics recycling. According to a 2024 report, the UK's recycling rate for plastics is around 45%, while the EU aims for 50% by 2025.

- UK plastic recycling rate is approximately 45% (2024).

- EU aims for 50% recycling by 2025.

- RECOUP membership supports Zotefoams' recycling efforts.

Energy consumption and efficiency

Environmental regulations and rising energy costs significantly affect Zotefoams. These factors push the company to enhance energy efficiency across its operations. In 2024, the UK, where Zotefoams has a significant presence, saw a 15% increase in industrial energy prices. This highlights the financial impact of energy use.

- Energy efficiency investments are crucial for reducing operational expenses.

- Zotefoams must comply with stricter environmental standards.

- The company may need to adopt renewable energy sources.

Environmental factors significantly influence Zotefoams through sustainability trends, carbon regulations, and raw material costs. The circular economy, valued at $4.5 trillion in 2024, drives demand for eco-friendly materials, with recycling rates differing across regions. UK's recycling is at ~45%, while the EU targets 50% by 2025; rising energy costs impact operational expenses.

| Factor | Impact | Data (2024) |

|---|---|---|

| Sustainability | Increased demand for eco-friendly materials. | Circular economy: $4.5T, growth 8.5%. |

| Carbon Regulations | Rising costs & need for emission reduction | Carbon emissions reduction target 42% by 2030 |

| Energy Costs | Higher operational expenses. | UK industrial energy prices +15%. |

PESTLE Analysis Data Sources

Zotefoams's PESTLE is based on industry reports, government data, and economic forecasts.