Zovio Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zovio Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Clean, distraction-free view optimized for C-level presentation: Easily communicate strategic portfolio decisions.

What You See Is What You Get

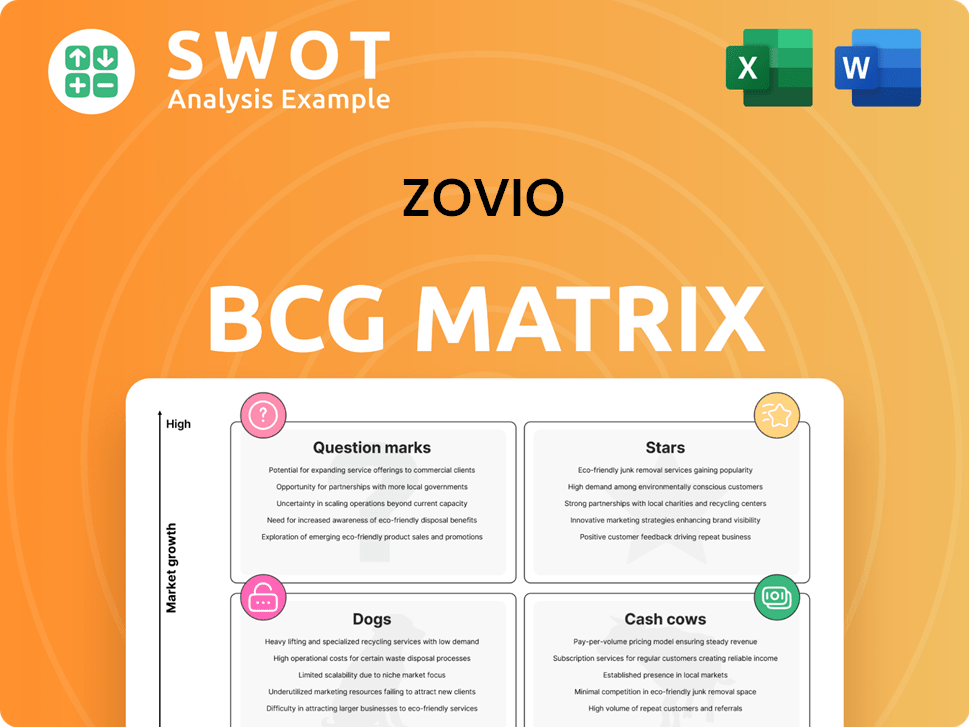

Zovio BCG Matrix

The BCG Matrix preview mirrors the file you receive after purchase. It's a fully functional, professionally designed strategic tool ready for immediate application in your business planning.

BCG Matrix Template

Ever wondered how Zovio's diverse offerings truly stack up? This glimpse into their BCG Matrix gives a snapshot of their Stars, Cash Cows, Dogs, and Question Marks. See which products shine and which need a strategic boost. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Fullstack Academy, providing coding bootcamps, initially looked promising in the expanding tech education market. Its potential for high growth and market share classified it as a Star within Zovio's portfolio. Despite its strong initial position, Zovio's financial struggles significantly limited Fullstack's investments. The liquidation of Zovio ultimately prevented Fullstack from reaching its full potential.

The Online Program Management (OPM) market shows substantial growth potential, with forecasts anticipating significant expansion. Zovio's early entry into OPM, through alliances like the University of Arizona Global Campus (UAGC), placed it in a high-growth sector. Strategic partnerships between OPM providers and universities are crucial, driving market expansion, with the global OPM market valued at approximately $4.5 billion in 2024.

Upskilling programs are pivotal in the edtech landscape, driven by the need for continuous learning. Zovio could have launched specialized programs, requiring investment in curriculum and marketing. The global corporate e-learning market was valued at $127.9 billion in 2023, expected to reach $168.3 billion by 2028. This strategy could have positioned Zovio as a leader in professional development.

AI and Machine Learning Integration

Integrating AI and machine learning was a missed opportunity for Zovio. Had they done so, they could have improved adaptive learning and content personalization, potentially boosting market share. This would have required significant R&D investment. The market for AI in education was estimated at $1.3 billion in 2024.

- 2024 AI in education market: $1.3 billion.

- R&D investment would have been substantial.

- Enhanced adaptive learning capabilities.

- Increased market share potential.

Partnerships with Employers

Zovio's potential to partner with employers to create programs that matched workforce demands was significant. This strategy could have positioned Zovio to lead in addressing the skills gap by providing tailored training and building strong industry relationships. Unfortunately, Zovio's financial difficulties ultimately prevented it from leveraging these opportunities effectively. In 2024, the skills gap continues to be a significant challenge, with many companies struggling to find workers with the right qualifications.

- The U.S. Bureau of Labor Statistics projects a need for over 11.3 million new jobs by 2032, highlighting the persistent demand for skilled workers.

- According to a 2024 study by McKinsey, 87% of executives reported facing skill gaps in their workforce.

- In 2024, the average cost to employers for employee training is approximately $1,296 per employee.

Stars, in the BCG Matrix, represent high-growth, high-market-share opportunities. Fullstack Academy and early OPM ventures like UAGC were initially Stars for Zovio, reflecting their strong market positions. These ventures required continued investment to maintain and expand their leading roles, but Zovio's financial constraints stunted their growth. The AI market in education was $1.3 billion in 2024, highlighting potential for these Stars.

| Aspect | Zovio's Stars | Impact |

|---|---|---|

| Examples | Fullstack Academy, UAGC partnerships | High growth potential initially. |

| Investment Needs | Substantial R&D, marketing | Required to sustain market position. |

| Market Context (2024) | AI in education $1.3B, OPM expanding | Missed opportunities due to liquidation. |

Cash Cows

The Strategic Services Agreement (SSA) with UAGC initially served as a Cash Cow, generating consistent revenue for Zovio. This agreement, which included marketing and student support, was a stable income source. Zovio's revenue in 2023 was $21.8 million. Unfortunately, the deal's termination reduced its long-term value.

Zovio's Faculty Management System (FMS) aimed to be a Cash Cow. It supported faculty onboarding, scheduling, and development. The system offered a stable service to educational institutions. Unfortunately, due to Zovio's shutdown in 2024, the full potential of FMS wasn't realized. The company's revenue in 2023 was $108 million.

Zovio's curriculum development services, aimed at higher education, might have been a Cash Cow. These services provided steady revenue with low investment in established markets. However, the company's overall decline hurt even its stable offerings. In 2024, Zovio faced significant financial challenges, impacting all its business segments.

Student Retention Advising Services

Student retention advising services could have been a cash cow for Zovio, given the constant demand from higher education. These services aim to boost student success and keep enrollment stable. Despite the potential, Zovio's liquidation prevented it from capitalizing fully on this opportunity. In 2024, the higher education market continues to emphasize retention strategies.

- The average student retention rate in U.S. higher education was around 70-80% in 2024, indicating a persistent need for retention services.

- The market for student success and retention services was estimated to be worth several billion dollars in 2024.

- Institutions increasingly focus on data-driven approaches to improve student outcomes.

Technology and Institutional Support Services

Zovio's technology and institutional support services, including IT and infrastructure management, were once a Cash Cow, providing essential services to educational partners. These services generated stable, recurring revenue streams, crucial for financial stability. However, the termination of the UAGC agreement significantly impacted this revenue source.

- Recurring revenue streams were a key feature.

- Essential services included IT and infrastructure management.

- The UAGC agreement's cancellation hurt this segment.

- These services used to provide a stable financial base.

Cash Cows provide steady revenue with low investment, essential for financial stability. Zovio's services, like the SSA and FMS, aimed to be Cash Cows. However, Zovio's 2024 shutdown prevented capitalizing on these opportunities.

| Service | Description | 2023 Revenue (approx.) |

|---|---|---|

| SSA | Marketing & Student Support | $21.8M |

| FMS | Faculty Management | $108M |

| Curriculum Dev. | Higher Ed Services | Data Not Available |

Dogs

Zovio's past, managing for-profit colleges like Ashford University, turned into a major issue. Stricter rules and a bad reputation for these types of schools made this part of Zovio a "Dog" in business terms. In 2024, the sector faced increased scrutiny. Zovio sold Ashford to the University of Arizona to get out of this business.

TutorMe, Zovio's online tutoring service, operated in a competitive market. The 2022 sale signifies its underperformance as a Dog in the BCG Matrix. Despite the online tutoring market's growth, TutorMe struggled to gain a strong foothold. The platform's inability to differentiate itself led to its strategic repositioning.

The Strategic Services Agreement (SSA) with UAGC, once a cornerstone, transformed into a liability. Zovio's financial struggles, compounded by declining enrollment, forced its termination. This decision eliminated a major revenue source, signaling the arrangement's unsustainability; in 2024, Zovio reported a net loss of $16.4 million.

Zovio's Stock (ZVOI)

Zovio's stock (ZVOI) has struggled, particularly after announcing liquidation. The price saw a short-lived increase thanks to retail investors, but it ultimately fell. This makes it a risky investment. Liquidation plans show a lack of faith in the company's future.

- Stock performance: ZVOI's stock price has shown a significant decline in 2024.

- Liquidation impact: The announcement of liquidation plans negatively impacted investor confidence.

- Retail investor influence: Short-term price rallies were observed due to retail investor activity.

- Investment risk: The overall outlook for Zovio's stock is highly uncertain.

Online Program Management (OPM) Services (Towards the End)

Towards the end, Zovio's Online Program Management (OPM) services struggled significantly. The OPM segment, which once drove revenue, faced declining profitability and increased competition. Zovio's strategic shift led to the divestiture of its OPM business to UAGC in 2024, signaling its diminished viability. This move was likely influenced by financial pressures and market dynamics.

- 2024: Zovio divested its OPM business to UAGC.

- Declining profitability in OPM services.

- Increased market competition.

Zovio's "Dogs" – Ashford University, TutorMe, SSA, and OPM – all underperformed. Each segment faced market challenges, leading to divestitures or closures. The strategic decisions reflected struggles; Zovio reported a net loss of $16.4 million in 2024.

| Segment | Status | Impact |

|---|---|---|

| Ashford University | Sold | Mitigated risk |

| TutorMe | Sold | Underperformance |

| SSA | Terminated | Lost revenue |

| OPM | Divested | Declining profit |

Question Marks

Zovio's personalized learning tech is a Question Mark in its BCG Matrix. The success of these initiatives was uncertain, despite the growing trend. Zovio invested heavily in R&D to gain market share. In 2024, the personalized learning market was valued at $40 billion, with a projected growth rate of 15% annually.

AI-driven educational chatbots represented a Question Mark for Zovio. These tools aimed to boost student engagement and offer customized support. Substantial investment was needed to assess their market success. In 2024, the educational chatbot market was valued at $500 million, with projected growth to $2 billion by 2028.

The use of blockchain for secure academic credentialing was a Question Mark for Zovio. Blockchain provides improved security and transparency. However, adoption in education was still developing. Zovio had to evaluate market demand and growth potential. The global blockchain market in education was valued at $164.3 million in 2023, projected to reach $1.6 billion by 2028.

Expansion into Corporate Training

Zovio's move into corporate training was a Question Mark in its BCG Matrix. This expansion demanded the creation of specific training programs and building connections with corporate clients. Given that the corporate training market was estimated at $96 billion in 2023, this strategy had potential. However, its success hinged on significant investment and market acceptance.

- Market Size: The corporate training market was valued at $96 billion in 2023.

- Investment: Expansion required substantial financial commitment.

- Uncertainty: The success of this venture was not guaranteed.

Virtual and Augmented Reality (VR/AR) in Education

Investing in virtual and augmented reality (VR/AR) for education was a Question Mark for Zovio. VR/AR promised immersive learning, but adoption was uncertain. Market demand and ROI needed careful evaluation. The potential was there, but the path to profitability was unclear. Strategic assessment was crucial.

- VR/AR in education market projected to reach $12.9 billion by 2024.

- Adoption rates varied; early adopters showed positive engagement.

- Zovio needed to balance potential with implementation costs.

- Success depended on user experience and content quality.

Zovio's Question Marks included personalized learning technologies, educational chatbots, blockchain for credentialing, and corporate training. These initiatives required significant investment and faced uncertain market acceptance. The projected global blockchain market in education was $1.6 billion by 2028.

| Initiative | Market Size (2024) | Growth Rate (Projected) |

|---|---|---|

| Personalized Learning | $40 billion | 15% annually |

| Educational Chatbots | $500 million | To $2 billion by 2028 |

| VR/AR in Education | $12.9 billion | Variable based on adoption |

BCG Matrix Data Sources

The Zovio BCG Matrix relies on financial data, market research, and competitive analysis, including company filings and industry reports, to determine business unit placement.