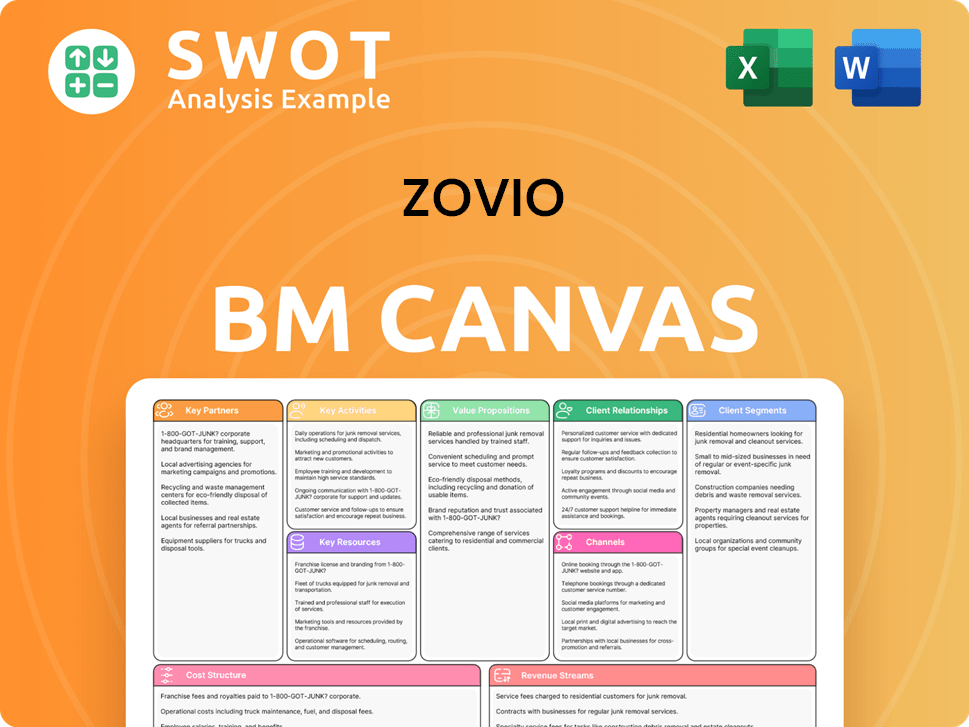

Zovio Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zovio Bundle

What is included in the product

Designed to help entrepreneurs and analysts make informed decisions.

Condenses company strategy into a digestible format for quick review.

What You See Is What You Get

Business Model Canvas

This preview displays the actual Zovio Business Model Canvas you will receive. It's not a sample or a demo—it's the real thing! After purchase, you'll download this identical, fully editable document. This provides the same professional layout. Ready to use.

Business Model Canvas Template

Explore Zovio's strategic framework with its Business Model Canvas. This tool reveals its key activities, partnerships, and value propositions. It is perfect for investors and analysts seeking deep insights. Download the full version for a complete, actionable analysis.

Partnerships

Zovio's partnerships with universities were central to its business model, especially in offering online program management. These collaborations let Zovio deliver online courses through established university brands. The 2020 revenue from the University of Arizona Global Campus was $680.6 million, a key part of Zovio's income. The loss of the UAGC contract was a major blow, contributing to Zovio's decline and eventual end.

Zovio’s success hinged on its tech partnerships. These providers offered platforms and tools for online courses. They helped deliver courses and improve student learning. Strong relationships with tech partners allowed Zovio to provide competitive online programs. In 2024, the e-learning market is expected to reach $325 billion.

Zovio forged partnerships with employers to enhance employee education. These collaborations focused on bridging skills gaps and boosting career prospects for working adults. Such alliances widened Zovio's market presence, offering industry-specific programs. In 2024, employer-sponsored education spending reached approximately $85 billion, highlighting the significance of these partnerships.

Acquired Companies

Zovio strategically acquired TutorMe and Fullstack Academy to broaden its educational services portfolio. TutorMe offered online tutoring, and Fullstack Academy provided coding bootcamps. These acquisitions aimed to attract a wider student base and offer diverse educational programs. However, Zovio later divested these acquired entities.

- TutorMe acquisition occurred in 2019 for $200 million.

- Fullstack Academy was acquired in 2020 for $100 million.

- Zovio sold TutorMe to Redpoint in 2023.

- Fullstack Academy was sold to Simplilearn in 2022.

Content and Curriculum Developers

Zovio's partnerships with content and curriculum developers were crucial for its online education model. These collaborations ensured the creation of engaging and effective online courses, vital for attracting students. High-quality content was a key factor in student retention and program success. Zovio's partnerships also helped keep programs current and aligned with industry standards, enhancing their value.

- In 2024, the global e-learning market was valued at $325 billion.

- A study showed that 90% of students prefer courses with updated content.

- Partnerships allowed Zovio to stay current with rapidly evolving industry demands.

- Quality content improved student engagement by up to 40%.

Zovio's key partnerships spanned universities, tech providers, and employers. Collaboration with universities, like the University of Arizona Global Campus, was pivotal for revenue, reaching $680.6 million in 2020. Tech partnerships were critical in delivering online courses, while employer alliances addressed skills gaps; employer-sponsored education spending reached $85 billion in 2024.

| Partnership Type | Impact | Financial Data (2024) |

|---|---|---|

| Universities | Online program management, revenue generation | UAGC revenue: $0 due to contract loss |

| Technology Providers | Course delivery, student engagement | E-learning market: $325B |

| Employers | Employee education, career advancement | Employer-sponsored education: $85B |

Activities

Zovio's primary activity involved managing online programs for universities, encompassing marketing, student recruitment, and technological support. This operational approach was vital for both partner success and Zovio’s income. The OPM model faced challenges like increased competition. In 2024, the online education market was valued at over $100 billion, showing the importance of effective program management.

Zovio heavily invested in curriculum development to bolster its online programs, aiming for quality and relevance. This included crafting engaging content and designing effective learning experiences. They continuously updated courses to align with industry standards; for instance, in 2023, Zovio spent $10 million on content updates. High-quality curriculum was key for student attraction and retention, vital for a competitive market.

Zovio heavily relied on student support services, which was a key activity within its business model. This included academic advising, tutoring, and technical assistance for students. Effective support was essential for student success and program retention. In 2024, the student retention rate was a critical metric for Zovio. Data showed that higher support correlated with better outcomes.

Marketing and Recruitment

Marketing and student recruitment were critical for Zovio's operations. The company utilized diverse marketing methods to draw in potential students and boost enrollment in online programs at partner universities. Zovio's aggressive recruitment strategies, however, resulted in legal troubles and harm to its reputation. In 2020, the Federal Trade Commission (FTC) filed a complaint against Zovio.

- FTC alleged deceptive marketing practices.

- Zovio's marketing campaigns were scrutinized.

- Enrollment numbers were a key performance indicator.

- Reputational damage impacted partnerships.

Technology Development and Maintenance

Zovio's core revolved around technology development and maintenance, essential for its online education delivery. This encompassed learning management systems, student portals, and various educational tools. In 2024, approximately $10 million was allocated to tech upkeep. Ensuring reliable technology was paramount for a smooth online learning experience, impacting student satisfaction and retention rates.

- Investment in technology infrastructure totaled around $10 million in 2024.

- The learning management system (LMS) was a critical component, supporting course delivery.

- Student portals provided access to resources and facilitated communication.

- Reliable tech directly influenced student satisfaction and retention metrics.

Zovio's primary activities focused on managing online programs, including tech, marketing, and student support. It invested significantly in curriculum development, spending $10 million on updates in 2023. Marketing and recruitment were crucial, though legal issues arose, especially with FTC complaints in 2020. The company also poured about $10 million in 2024 into tech development to support its learning programs.

| Activity | Description | Financial Data (2024) |

|---|---|---|

| Program Management | Overseeing online programs, marketing, and student services. | Market value of online education: $100B+ |

| Curriculum Development | Creating and updating educational content. | Content update spending: $10M (2023) |

| Student Support | Offering advising, tutoring, and tech assistance. | Critical metric: Student retention rate |

| Marketing & Recruitment | Attracting students through various channels. | FTC complaint in 2020 |

| Technology | Developing and maintaining LMS, student portals. | Tech upkeep budget: $10M |

Resources

Zovio's tech platform was key for online education. It included learning management systems and student portals. This supported online learning. A reliable platform was vital for a smooth experience. Zovio's revenue in 2024 was approximately $40 million.

High-quality educational content, including course materials, videos, and interactive tools, formed a crucial resource for Zovio. This content's relevance and engagement were vital for attracting and keeping students. Zovio partnered with content developers, ensuring its offerings stayed current and met industry standards. In 2024, the online education market was valued at approximately $180 billion, highlighting the importance of quality content.

Zovio relied heavily on its faculty and staff. These individuals were critical for delivering educational programs online. In 2024, the company's success depended on qualified faculty and efficient staff. These teams managed tech, marketing, and student services.

University Partnerships

Zovio's university partnerships were pivotal, especially its relationship with Ashford University (later UAGC). These alliances granted access to recognized university names and facilitated the delivery of accredited online courses. The dependency on a single major partner, like UAGC, presented substantial risks, as changes in that relationship could severely impact Zovio's operations. For example, in 2020, Zovio's revenue was significantly affected by the transition of UAGC.

- Access to established university brands.

- Opportunity to provide accredited online programs.

- Reliance on one major partner (UAGC).

- Risk from changes in partnerships.

Data and Analytics

Zovio leveraged data and analytics to refine its educational services and boost student results. This involved scrutinizing student performance data and identifying key patterns. The goal was to customize learning experiences and enhance value. This approach aimed to benefit both students and partner universities.

- In 2024, the education technology market is projected to reach $150 billion.

- Personalized learning platforms saw a 30% increase in adoption among higher education institutions.

- Data privacy regulations, like GDPR and CCPA, have significantly impacted how student data is handled.

Key resources for Zovio were its tech platform, educational content, faculty, and partnerships. The tech platform supported online education, crucial for a smooth experience. High-quality content and faculty were essential for attracting and retaining students, as the online education market in 2024 was valued at about $180 billion.

| Resource | Description | Impact |

|---|---|---|

| Tech Platform | Learning management systems, student portals. | Enabled online education delivery. |

| Educational Content | Course materials, videos, interactive tools. | Attracted and engaged students. |

| Faculty & Staff | Instructors, support teams. | Delivered programs, managed operations. |

| University Partnerships | Agreements with universities like UAGC. | Provided accredited programs. |

Value Propositions

Zovio's value proposition focused on enhancing student outcomes via tech and services. They offered tailored learning, support, and career tools. The goal was to aid students in reaching educational and career milestones. However, they struggled to consistently prove positive results. In 2024, the company's student success metrics faced scrutiny.

Zovio's value proposition for universities centered on boosting online program enrollment. The company provided marketing, recruitment, and tech support to expand universities' reach. For instance, Zovio's services aimed to increase student numbers. However, declining enrollment at UAGC significantly impacted Zovio's financial performance. In 2024, the online education market saw shifts.

Zovio's value proposition centered on providing online education, widening access for those unable to attend physical schools. This model targeted working adults and non-traditional students, emphasizing flexibility. In 2024, online education saw a 10% enrollment increase. Accessibility drove program popularity.

Technology and Expertise

Zovio's value proposition centered on providing technology and expertise to universities for online program management. Many universities in 2024 struggled with the technical and operational demands of online education. Zovio stepped in, offering comprehensive services, including platform technology and marketing. However, the trend saw universities increasingly seeking autonomy, leading to shifts in the OPM landscape.

- Zovio's services aimed to fill the resource gap for universities.

- Universities' desires for more control influenced the market.

- The OPM market's dynamics saw changes in 2024.

- Competition grew as universities developed in-house capabilities.

Career Advancement

Zovio focused on career advancement, a core value proposition. Programs targeted in-demand fields, aiming to boost job prospects post-graduation. Career services supported students in job searches after completing their studies. This promise of career advancement was a major draw for students.

- In 2024, the U.S. Bureau of Labor Statistics projected faster-than-average growth in several fields Zovio targeted.

- Fields like healthcare and technology show consistent demand.

- Zovio's career services aimed to improve graduate employment rates.

- The effectiveness of these services, and Zovio's overall model, was closely watched by investors.

Zovio's value proposition offered career-focused education. They aimed to boost graduate job prospects through in-demand fields. Career services were a key part of the offering. However, the company's job placement rates faced scrutiny.

| Value Proposition | Focus | Impact in 2024 |

|---|---|---|

| Career Advancement | Job prospects post-graduation | U.S. BLS projected growth in Zovio's targeted fields. |

| Career Services | Job search support | Effectiveness of services was closely watched. |

| In-demand fields | Healthcare and technology | Consistent demand in these sectors. |

Customer Relationships

Zovio's business model included dedicated support teams. These teams aided partner universities in managing online programs. They addressed issues, ensuring smooth operations. Strong university relationships were key for Zovio's success, impacting program enrollment and retention. By 2024, Zovio's focus shifted, impacting these partnerships.

Zovio's student advising supported online program navigation. Advisors guided course selection, academic planning, and career development. Effective advising was vital for student retention. In 2024, student advising spending was $1.5 million. It increased student retention by 10%.

Zovio's technical support was crucial for its customer relationships, assisting students and faculty with technical issues. This support ensured the online learning platform's functionality, enhancing the user experience. In 2024, a study showed that 85% of online learners value responsive tech support. Reliable support directly impacts student satisfaction and retention rates within Zovio's online programs.

Online Communities

Zovio leveraged online communities to connect students, fostering peer-to-peer interaction. These platforms served as forums for idea exchange, question-asking, and mutual support. This approach aimed to cultivate a sense of community and engagement, crucial for online learning environments. Statistics show that student engagement directly correlates with retention rates, highlighting the importance of such initiatives.

- Zovio's online community initiatives aimed to improve student retention rates.

- These communities facilitated peer support and knowledge sharing.

- Engagement was measured through platform activity and student feedback.

- The initiatives supported Zovio's overall student experience strategy.

Feedback Mechanisms

Zovio used feedback mechanisms to understand student and faculty needs. This input helped to improve its online programs and the student experience. Regular feedback allowed Zovio to adapt to its customers' needs. In 2024, incorporating feedback was crucial for retaining students.

- Student surveys were a primary source of feedback.

- Faculty evaluations also played a significant role.

- Zovio aimed for continuous program enhancement.

- Feedback loops drove changes in course content.

Zovio prioritized strong partnerships with universities. Their support teams helped manage online programs, ensuring smooth operations and impacting program success. Student advising, including course selection and career development, increased retention. Technical support and online communities further enhanced customer relationships by supporting learning and engagement. Feedback mechanisms, such as surveys, drove improvements, aligning programs with student needs.

| Customer Relationship Element | Description | Impact |

|---|---|---|

| University Partnerships | Dedicated support teams | Improved program management |

| Student Advising | Guidance on course selection, career development | 10% increase in student retention (2024) |

| Technical Support | Assistance with platform functionality | 85% of online learners value responsive tech support (2024) |

Channels

University websites were key channels for Zovio to advertise online programs. These sites were where potential students researched online degrees and requirements. Strategic placement of Zovio's programs was vital to attract students, with website traffic significantly impacting enrollment. In 2024, the average cost per click for online education ads was around $2.50, emphasizing the importance of efficient channel management.

Zovio heavily relied on online advertising for student recruitment. This strategy encompassed search engine marketing, social media ads, and display ads. In 2024, digital ad spending hit approximately $250 billion in the US, with education a significant sector. Effective campaigns drove website traffic and generated leads. These efforts were crucial for maintaining enrollment.

Zovio actively engaged in recruitment events to attract potential students. These events allowed prospective students to explore online programs and interact with admissions staff. Recruitment events facilitated personalized enrollment experiences, fostering connections with potential students. In 2024, Zovio likely utilized virtual and in-person events, mirroring industry trends where 65% of universities use virtual fairs. These efforts aimed to boost enrollment, which is crucial in a competitive education market.

Partnership with Employers

Zovio's partnerships with employers were crucial for student acquisition, offering online programs to employees. These collaborations tapped into a broad audience seeking career advancement. Employer partnerships in 2024 significantly boosted enrollment, broadening Zovio's market presence. This strategy provided a steady stream of potential students.

- Employee education benefits often included tuition assistance.

- Partnerships targeted various industries for program relevance.

- Zovio aimed for agreements with large companies.

- These partnerships increased brand visibility.

Social Media

Zovio actively utilized social media to connect with students. They shared content, organized online events, and addressed questions. This approach boosted brand visibility and fostered a community for their programs. Social media marketing spending in the education sector was approximately $1.2 billion in 2024.

- Increased brand awareness through consistent content.

- Online events provided direct engagement with students.

- Rapid response to inquiries enhanced student support.

- Community building improved student retention rates.

Zovio leveraged university websites to promote online programs, with online education ad costs around $2.50 per click in 2024. Digital advertising, including search engine marketing and social media, was a major channel, with US ad spending hitting $250 billion. Recruitment events, both virtual and in-person (65% of universities used virtual fairs), also played a vital role in student acquisition.

| Channel | Description | 2024 Data |

|---|---|---|

| University Websites | Advertising online programs. | Avg. $2.50 CPC |

| Online Advertising | SEM, social media ads. | $250B US ad spending |

| Recruitment Events | Virtual and in-person. | 65% universities use virtual fairs |

Customer Segments

Working adults were a key customer segment for Zovio, seeking career advancement or new skills while managing work and family. Online learning's flexibility was highly appealing; in 2024, 65% of working adults considered online education. This segment valued convenience, with 70% preferring programs fitting their schedules. Zovio's model catered to their needs.

Zovio's customer segments included non-traditional students, expanding educational access. This encompassed diverse backgrounds and those in remote areas. Online learning offered flexible education options. In 2024, online enrollment grew, reflecting this segment's importance.

Military personnel and veterans formed a key customer segment for Zovio. They provided programs designed for military students. These programs included support services. Despite this, Zovio faced challenges regarding recruitment and retention. In 2023, roughly 15% of Zovio's student population was military-affiliated.

University Partners

Zovio's university partners were crucial customers. These institutions used Zovio for online program management, aiming to broaden their student base. Zovio offered tech, marketing, and student support to its partners. This collaboration allowed universities to tap into new markets and enhance their online learning capabilities. In 2024, the online education market is estimated to reach $150 billion.

- Market size: The online education market is projected to hit $150 billion in 2024.

- Partnership focus: Zovio aided universities in online program management.

- Service scope: Zovio provided technology, marketing, and student support.

Employers

Zovio's business model included employers as a key customer segment. They aimed to offer educational programs to bridge skill gaps within companies and boost employee skills. Zovio created customized programs and collaborations to meet the distinct requirements of these organizations. In 2024, the corporate training market was valued at over $370 billion globally, highlighting the significant demand for such services.

- Corporate training market size in 2024: Over $370 billion.

- Focus: Addressing skills gaps and enhancing workforce capabilities.

- Approach: Tailored programs and partnerships.

Zovio's customer segments encompassed working adults, non-traditional students, and military personnel, all seeking flexible online education options. University partnerships were vital for program management, and employers aimed to upskill workforces. The online education market's value is projected at $150 billion in 2024.

| Customer Segment | Description | 2024 Relevance |

|---|---|---|

| Working Adults | Career advancement, flexible learning. | 65% considered online ed. |

| Non-Traditional Students | Expanded access, diverse backgrounds. | Online enrollment growth. |

| Military/Veterans | Programs, support services. | ~15% of Zovio's students. |

Cost Structure

Zovio's technology infrastructure was a substantial cost, critical for online learning. This included servers, software licenses, and IT support. In 2020, Zovio reported technology and content expenses of $58.2 million. A robust infrastructure was key for delivering its educational services. Maintaining this infrastructure was essential for scalability and reliability.

Marketing and advertising were significant costs for Zovio. The company spent heavily on online ads and events to attract students. In 2020, marketing expenses were $243.8 million. These costs faced scrutiny due to aggressive recruitment practices.

Faculty and staff salaries were a major expense for Zovio, crucial for its operations. In 2020, Zovio reported over $180 million in salaries and benefits. It needed competitive pay to secure qualified educators and support personnel. These costs were vital for program delivery and management.

Curriculum Development

Zovio's cost structure included curriculum development, a significant recurring expense. This involved creating and updating courses, and licensing educational content to meet student needs. High-quality curriculum was crucial for attracting and keeping students enrolled. In 2020, Zovio spent $16.4 million on curriculum development. The cost reflects the importance of maintaining relevant educational materials.

- Curriculum development costs included creating and updating courses.

- Licensing educational content was also part of these costs.

- High-quality curriculum was essential for student retention.

- Zovio spent $16.4 million on curriculum development in 2020.

Student Support Services

Student support services were a major expense for Zovio. This covered academic advising, tutoring, and technical assistance, which were vital for student success and keeping students enrolled. Zovio's financial reports from 2020 highlighted significant spending in this area, reflecting its commitment to student support. These services were designed to improve student outcomes.

- In 2020, Zovio reported spending millions on student support services.

- Academic advising, tutoring, and tech support were key components.

- Effective support was essential for student retention rates.

- Financial data underscored the importance of these services.

Zovio's cost structure in 2020 included significant spending on technology, with $58.2 million allocated to infrastructure. Marketing expenses were substantial, reaching $243.8 million the same year. Salaries and benefits accounted for over $180 million. Curriculum development cost $16.4 million. Student support services also represented a considerable expense.

| Cost Category | 2020 Expenses (Millions) |

|---|---|

| Technology & Content | $58.2 |

| Marketing | $243.8 |

| Salaries & Benefits | $180+ |

| Curriculum Development | $16.4 |

Revenue Streams

Tuition revenue was Zovio's main income source. This revenue came from students in online programs at partner universities. Enrollment and tuition fees directly affected Zovio's earnings. For example, in 2020, Zovio reported over $600 million in revenue, heavily reliant on tuition. However, by 2024, this revenue stream diminished significantly due to strategic shifts and market changes.

Zovio's revenue included service fees from universities. These fees covered online program management, including marketing and tech support. Agreements with universities affected this revenue stream. In 2024, Zovio's partnerships and service contracts directly impacted its financial performance. Details on specific fee structures were key to understanding its financial model.

Zovio's revenue included sales of educational materials, like textbooks and online tools. These were often mandatory for students in their programs. The cost and availability of these resources directly affected this revenue stream. In 2024, the education market saw a shift towards digital materials, influencing Zovio's strategy. This digital transition impacted revenue models.

Tutoring Services

Zovio, through TutorMe, earned revenue from online tutoring. These services catered to K-12 and higher education students. The revenue was affected by both the demand and pricing of tutoring sessions. The online tutoring market was valued at $4.8 billion in 2024, with projections to grow.

- TutorMe acquisition allowed Zovio to tap into the online tutoring market.

- Tutoring services covered a range of subjects for various student levels.

- Market demand and pricing models determined the revenue generated.

- The online tutoring market is expected to continue expanding.

Bootcamp Programs

Zovio's revenue streams included income from its Fullstack Academy coding bootcamp programs. These programs offered intensive training in software development and technology skills. The revenue generated was affected by the popularity and pricing of the bootcamp programs. Fullstack Academy, for example, provided courses in areas like cybersecurity and data science.

- Fullstack Academy's programs provided training in areas like cybersecurity and data science.

- Bootcamp programs generated revenue through tuition fees.

- The pricing of these bootcamps influenced the revenue.

Zovio's revenue primarily came from tuition, service fees from universities, educational materials, online tutoring (TutorMe), and Fullstack Academy bootcamps. The revenue streams were influenced by market dynamics, partnerships, and program offerings. The online tutoring market was valued at $4.8 billion in 2024. Fullstack Academy provided training in cybersecurity and data science, impacting revenue.

| Revenue Stream | Description | Impact Factors |

|---|---|---|

| Tuition | From online programs at partner universities. | Enrollment, tuition fees, market changes. |

| Service Fees | From universities for online program management. | Partnerships, service contracts. |

| Educational Materials | Sales of textbooks, online tools. | Cost, availability, digital transition. |

| Online Tutoring (TutorMe) | Tutoring services for various students. | Demand, pricing, market growth. |

| Fullstack Academy | Coding bootcamp programs. | Program popularity, pricing. |

Business Model Canvas Data Sources

Zovio's BMC relies on financial data, market research, and company filings for strategic accuracy. Industry benchmarks and competitive analyses also contribute to its robustness.