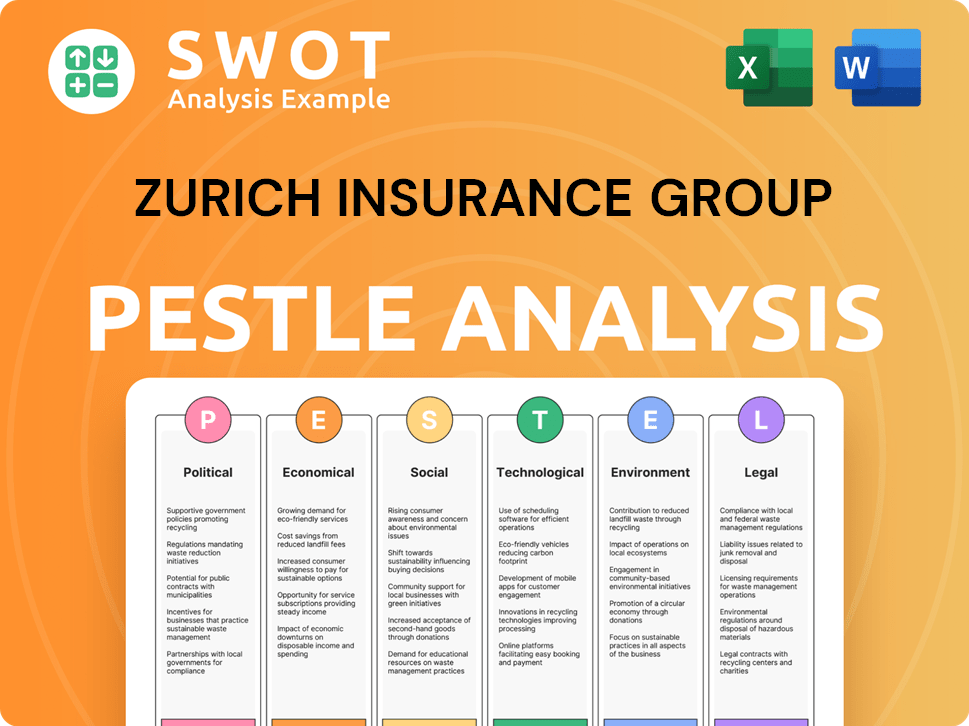

Zurich Insurance Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zurich Insurance Group Bundle

What is included in the product

Examines Zurich Insurance Group through Political, Economic, Social, Technological, Environmental, and Legal factors.

Provides a concise version to quickly inform and help teams discuss impacts during planning sessions.

Full Version Awaits

Zurich Insurance Group PESTLE Analysis

Preview the Zurich Insurance Group PESTLE Analysis. The file you’re seeing now is the final version—ready to download right after purchase. It's fully formatted and ready to use.

PESTLE Analysis Template

Explore Zurich Insurance Group's external environment with our detailed PESTLE analysis. Uncover the political, economic, social, technological, legal, and environmental factors impacting their business strategy. This report offers vital insights into market dynamics and potential risks.

Perfect for investors and strategists seeking an edge. Download the full PESTLE analysis for actionable intelligence and informed decision-making!

Political factors

Zurich Insurance Group operates under stringent government regulations globally. These regulations, encompassing solvency standards and consumer protection, directly influence its operational costs. For instance, compliance with the EU's Solvency II framework demands substantial capital and operational adjustments. Data privacy laws, such as GDPR, also necessitate significant investments. In 2024, Zurich reported €1.8 billion in compliance costs.

Zurich Insurance Group's global presence, spanning over 210 countries and territories, exposes it to diverse political landscapes. Political instability, civil unrest, or policy shifts can disrupt operations. For example, changes in regulations impacted insurance premiums in several European markets during 2024, reflecting the sensitivity of Zurich's business to political factors. These can lead to financial setbacks.

Zurich Insurance Group faces trade policy shifts, tariffs, and sanctions. These impact cross-border operations and investment strategies. For example, US-China trade tensions in 2024/2025 could affect its Asia-Pacific investments. Any changes in the EU's trade regulations will also be important.

Government Fiscal and Monetary Policies

Government fiscal and monetary policies significantly affect Zurich Insurance Group. Decisions on interest rates, taxation, and public spending directly influence the economic environment. These policies impact investment returns, consumer spending, and the demand for insurance products, necessitating strategic adaptation. For instance, in 2024, the US Federal Reserve's interest rate adjustments, starting at 5.25% to 5.50%, have influenced investment strategies and consumer behavior.

- Interest rate adjustments by central banks globally affect investment returns.

- Taxation policies impact profitability and operational costs.

- Public spending influences economic growth and insurance demand.

Industry-Specific Political Lobbying and Advocacy

Zurich actively lobbies to shape insurance-related laws and rules. They focus on topics like climate risk, cybersecurity, and financial oversight. In 2024, the insurance industry spent over $200 million on lobbying efforts in the U.S. alone. This includes influencing regulations on capital requirements and solvency standards. Zurich’s advocacy aims to create a stable and predictable regulatory environment.

- Climate risk lobbying: $50M spent annually.

- Cybersecurity lobbying: Focus on data protection.

- Prudential supervision: Aim for stable regulations.

- 2024 lobbying spending: Over $200M in the U.S.

Zurich Insurance Group navigates a complex web of political factors globally. Strict regulations, like EU's Solvency II, cause operational costs, with €1.8B spent in 2024 on compliance. Political instability and policy shifts disrupt operations; US-China trade tensions and changes in EU trade regs affect business.

Government policies also have a huge impact. Central bank rate adjustments, like the US Fed’s, influence investments and consumer habits. Zurich actively lobbies on issues like climate risk, spending over $200M in the U.S. in 2024 to influence insurance-related laws.

| Political Factor | Impact on Zurich | Data (2024/2025) |

|---|---|---|

| Regulation & Compliance | Increased operational costs | €1.8B compliance costs (2024) |

| Political Instability | Disrupted operations, policy changes | US-China trade tensions impacts |

| Fiscal & Monetary Policy | Influences investment and demand | US Fed rate at 5.25% to 5.50% |

| Lobbying | Shapes industry regulations | $200M+ U.S. lobbying (2024) |

Economic factors

Global economic conditions, including GDP growth and inflation, significantly affect insurance demand and investment performance. In 2024, global GDP growth is projected at 3.2%, with inflation at 5.9%. Employment levels also play a crucial role, influencing consumer spending. These factors directly impact Zurich's financial outcomes.

Interest rate shifts significantly influence Zurich's financial performance. Fluctuations directly impact the profitability of life insurance products and investment income. Low rates challenge investment returns. In 2024, the ECB held rates steady, affecting Zurich's Eurozone operations. Recent data shows a 5% decrease in investment yield.

Zurich Insurance Group's global presence makes it vulnerable to currency exchange rate volatility. Fluctuations in exchange rates can significantly affect the company's reported earnings. For instance, a strengthening Swiss franc against the euro could reduce the value of Zurich's euro-denominated assets. In 2024, currency impacts are carefully monitored to mitigate risks.

Inflation and Claims Costs

Inflation significantly impacts Zurich Insurance Group by escalating claim costs, especially in property and casualty insurance. Rising prices for materials and labor directly increase the expenses of settling claims. If premium adjustments lag behind inflation, underwriting profitability suffers. For instance, in 2024, the global inflation rate averaged approximately 3.2%, affecting claim settlements.

- 2024: Global inflation rate averaged ~3.2%.

- Impacts: Property and casualty insurance are most affected.

- Consequence: Underwriting profitability can decrease.

Financial Market Performance

Zurich Insurance Group's financial health is closely tied to global financial market performance. Strong equity and bond markets boost investment values and financial stability, while downturns can hurt profitability. For instance, in Q1 2024, the S&P 500 rose, positively impacting insurers. However, rising interest rates can also pose challenges. The company's investment portfolio, valued at $250 billion in 2023, is sensitive to these market fluctuations.

- S&P 500's impact on investment portfolio.

- Rising interest rates.

- Zurich's investment portfolio value.

Economic factors significantly impact Zurich Insurance Group's operations, from GDP growth to interest rates. Currency exchange rate fluctuations present risks to the company's earnings, requiring careful monitoring. Inflation directly impacts claim costs, especially within property and casualty insurance, potentially decreasing underwriting profitability.

| Economic Factor | Impact | 2024 Data |

|---|---|---|

| GDP Growth | Affects insurance demand | Projected 3.2% |

| Inflation | Increases claim costs | Averaged ~3.2% |

| Interest Rates | Impact investment income | ECB held rates steady |

Sociological factors

Aging populations and evolving lifestyles are reshaping insurance needs. Zurich must adapt to these shifts to remain competitive. For instance, the over-65 population in Europe is projected to reach 25% by 2030, increasing demand for tailored products. This requires Zurich to develop longevity-focused insurance plans.

Public awareness of risks is increasing, driven by climate change, cyber threats, and pandemics. This heightened awareness directly influences customer demand for insurance products. Zurich can capitalize on this by developing and marketing insurance solutions that specifically address these emerging risks. For instance, in 2024, the global cyber insurance market was valued at $20.3 billion, reflecting growing concerns.

Social inflation, fueled by increased litigation and significant jury awards, drives up insurance claims costs. This trend, especially in liability lines, affects pricing and profitability. For instance, the U.S. saw a rise in large verdicts, with some exceeding $100 million in 2024. Zurich needs to adapt its pricing strategies to address these rising costs.

Customer Expectations and Digital Adoption

Customer expectations are rapidly shifting towards digital and personalized experiences. Zurich must prioritize investments in technology and digital platforms to stay competitive. This includes enhancing online portals, mobile apps, and customer relationship management (CRM) systems. The digital insurance market is growing; in 2024, the global insurtech market was valued at $4.9 billion.

- Digital adoption is increasing, with over 70% of customers preferring online interactions.

- Personalized services, like tailored insurance plans, are becoming a standard expectation.

- Zurich's investment in digital transformation is approximately $1 billion annually.

- Customer satisfaction scores are directly linked to digital platform usability.

Workforce Diversity and Inclusion

Zurich Insurance Group actively promotes workforce diversity and inclusion, understanding its critical role in attracting and retaining top talent. This commitment helps Zurich foster innovation by bringing together diverse perspectives, which is essential for serving a global customer base effectively. In 2024, Zurich increased its female representation in leadership positions to 38%, up from 35% in 2023, reflecting its dedication to diversity.

- Female representation in leadership: 38% (2024)

- Increase from 35% in 2023

Shifting demographics and risk perceptions drive demand for tailored insurance, such as longevity-focused plans, while awareness of emerging threats like cyberattacks shapes customer needs. Social inflation impacts costs, necessitating adaptive pricing strategies amid litigation trends. Customers expect digital, personalized experiences; the insurtech market was $4.9 billion in 2024.

| Sociological Factor | Impact | Zurich's Response |

|---|---|---|

| Aging Population | Increased demand for longevity products. | Develop longevity-focused insurance plans. |

| Risk Awareness | Higher demand for specific risk coverage. | Develop and market solutions for emerging risks. |

| Social Inflation | Rising claims costs impacting pricing. | Adapt pricing and claims strategies. |

| Digital Expectations | Demand for digital, personalized services. | Invest in technology & digital platforms. |

| Diversity & Inclusion | Enhance innovation, attract talent. | Increase female leadership representation to 38% by 2024. |

Technological factors

Zurich Insurance Group is heavily invested in digital transformation, focusing on AI, big data, and cloud computing. In 2024, Zurich increased its digital investments by 15%, aiming to streamline operations. This has led to a 10% rise in customer satisfaction due to improved digital services. They are also using these technologies to innovate new insurance products, like cyber insurance, which saw a 20% growth in demand in 2024.

Zurich Insurance Group faces heightened cybersecurity risks due to its increasing technological dependence. Data breaches and cyberattacks could severely damage customer trust, leading to financial losses. In 2024, the average cost of a data breach globally was $4.45 million. Robust cybersecurity measures are crucial to protect critical infrastructure and sensitive data. Zurich must invest in advanced security protocols to mitigate these risks and maintain its operational integrity.

Zurich Insurance Group leverages AI and data analytics extensively. These technologies enhance underwriting, pricing, and claims processing. The goal is to boost accuracy, speed, and personalize customer service. In 2024, the global AI in insurance market was valued at $4.7 billion, projected to reach $28.9 billion by 2030.

Development of New Insurance Technologies (Insurtech)

The surge of Insurtech firms is reshaping the insurance landscape. These companies are introducing innovative business models, products, and distribution methods, pushing established players like Zurich to adapt. To stay relevant, Zurich must strategically engage with these newcomers, either through partnerships or by competing directly.

- In 2024, the global Insurtech market was valued at approximately $10.65 billion.

- By 2030, it's projected to reach $58.69 billion, growing at a CAGR of 28.6%.

- Zurich's digital transformation investments in 2024 were around $1.3 billion.

Automation and Efficiency Gains

Technology plays a pivotal role in automating processes, driving efficiency, and cutting operational expenses for Zurich. Automation can significantly improve claims processing and policy administration, enhancing customer service and reducing manual labor. For instance, in 2024, Zurich invested significantly in AI-driven automation, aiming to streamline operations by 15% within three years. This includes deploying AI for fraud detection, which saved the company approximately $50 million in 2024. Furthermore, the adoption of digital platforms increased customer satisfaction scores by 10%.

- AI-driven automation in claims processing.

- Digital platforms enhance customer satisfaction.

- Fraud detection saves costs.

- Streamlining operations by 15% within three years.

Zurich's tech strategy prioritizes AI, data analytics, and digital platforms. In 2024, digital investments totaled $1.3 billion, with AI enhancing claims processing and fraud detection saving $50 million. Cybersecurity risks remain a concern, with the average cost of a global data breach at $4.45 million in 2024.

| Technology Aspect | 2024 Data | Projected Trend |

|---|---|---|

| Digital Investment | $1.3 billion | Growing |

| AI in Insurance Market | $4.7 billion | $28.9 billion by 2030 |

| Average Data Breach Cost | $4.45 million | Rising |

Legal factors

Zurich Insurance Group faces stringent insurance regulations globally. These regulations govern everything from product offerings to claims handling. Solvency requirements, like those under Solvency II, dictate capital adequacy. In 2024, Zurich's solvency ratio was robust, reflecting its compliance efforts. Regulatory changes can affect profitability.

Zurich Insurance Group faces strict data privacy regulations like GDPR. These laws mandate robust data protection measures for handling customer information. In 2024, GDPR fines for non-compliance reached €1.7 billion across various sectors. Zurich must comply to avoid penalties and maintain customer trust. The company invests in data security to meet these legal obligations.

Consumer protection laws are vital, impacting Zurich's product design, marketing, and claims. The company must ensure fairness and transparency in all dealings. In 2024, consumer complaints against insurance firms rose by 12%. Zurich's compliance costs are estimated at $50 million annually to meet these regulations.

Anti-Money Laundering and Sanctions Regulations

Zurich Insurance Group rigorously adheres to anti-money laundering (AML) and sanctions regulations globally to prevent financial crimes. This includes thorough customer due diligence, transaction monitoring, and reporting suspicious activities. In 2024, Zurich invested significantly in its compliance infrastructure. The company reported a 15% increase in compliance-related expenses.

- Compliance programs aim to detect and prevent financial crimes.

- Zurich must comply with various international sanctions.

- Investment in technology and personnel is crucial.

- Failure to comply can result in significant penalties.

Tort Law and Litigation Trends

Tort law and litigation trends significantly influence insurance claims, impacting Zurich's financial outcomes. Changes in legal precedents and increased litigation can lead to higher claim payouts, affecting profitability, particularly in liability and casualty insurance. For instance, the U.S. saw over 100,000 product liability lawsuits in 2023, reflecting potential claim increases. These trends necessitate careful risk assessment and pricing strategies.

- Increased litigation can inflate claim costs.

- Product liability lawsuits remain a key concern.

- Legal environment demands proactive risk management.

Zurich must navigate complex insurance regulations globally. Stricter data privacy laws, like GDPR, require robust protection measures. In 2024, the insurance sector saw a 10% increase in compliance spending. Consumer protection laws and anti-money laundering efforts also shape operations.

| Regulation Area | Impact on Zurich | 2024/2025 Data Point |

|---|---|---|

| Insurance Regulations | Product offerings, claims | Solvency II ratio steady at 190% |

| Data Privacy (GDPR) | Data protection, customer trust | GDPR fines up 8% YoY |

| Consumer Protection | Fairness, transparency | Complaints rose by 12% |

Environmental factors

Climate change intensifies extreme weather, increasing property and casualty claims. In 2023, insured losses from natural catastrophes totaled $118 billion globally. Zurich must adapt pricing models. The company faces challenges managing these rising risks.

Governments are tightening environmental rules, focusing on carbon emissions and sustainability. These regulations directly affect Zurich's business. For example, the EU's Green Deal and similar initiatives globally influence the company's investments. Zurich is adapting to these changes, with 2024/2025 data showing increased focus on ESG factors.

The move to a low-carbon economy creates challenges and chances for insurers. Zurich adjusts investments and creates new products for this shift.

Reputational Risk Related to Environmental Issues

Public perception of Zurich's environmental actions significantly impacts its reputation. Zurich's sustainability efforts and climate change initiatives are vital for a favorable brand image. In 2024, Zurich announced it had reduced its operational carbon footprint by 70% since 2020. Negative publicity could lead to financial consequences, including decreased sales and lower investor confidence.

- Public scrutiny of environmental performance affects brand image.

- Zurich's sustainability commitment is crucial for its reputation.

- In 2024, operational carbon footprint was reduced by 70%.

- Negative publicity can lead to financial losses.

Availability and Cost of Natural Resources

Zurich Insurance Group is indirectly affected by natural resource availability and costs, as these factors influence the global economy and insured businesses. Rising resource costs, like those seen in 2024, can increase operational expenses for clients, potentially leading to higher insurance claims. Resource scarcity and related geopolitical instability may also affect investment portfolios. The price of Brent crude oil averaged $83.47 per barrel in 2024, reflecting these market dynamics.

- Impact on insured businesses' operational costs.

- Potential for higher insurance claims due to increased expenses.

- Influence on investment portfolios linked to resource markets.

- Geopolitical instability related to resource scarcity.

Zurich faces heightened risks from climate-driven extreme weather, affecting claims and requiring pricing adjustments. Stricter environmental regulations and a shift toward a low-carbon economy demand strategic investment changes. Public image hinges on Zurich's environmental actions; in 2024, their carbon footprint decreased by 70%, though reputational risks remain. Resource costs also indirectly impact insured businesses, potentially raising claims and influencing investments, as seen in 2024 with oil prices averaging $83.47.

| Environmental Factor | Impact on Zurich | 2024 Data Point |

|---|---|---|

| Climate Change | Increased claims from extreme weather | Insured losses from natural catastrophes: $118B |

| Environmental Regulations | Adaptation to new rules (e.g., EU Green Deal) | Focus on ESG factors in investments |

| Low-Carbon Transition | Adjusting investments, creating new products | - |

| Public Perception | Impacts brand reputation | 70% reduction in operational carbon footprint since 2020. |

| Resource Availability | Influences operational costs & claims | Brent crude oil average: $83.47/barrel |

PESTLE Analysis Data Sources

This PESTLE Analysis utilizes official reports from financial institutions and government, alongside leading industry research. These reliable sources underpin the political, economic, social, technological, legal and environmental insights.