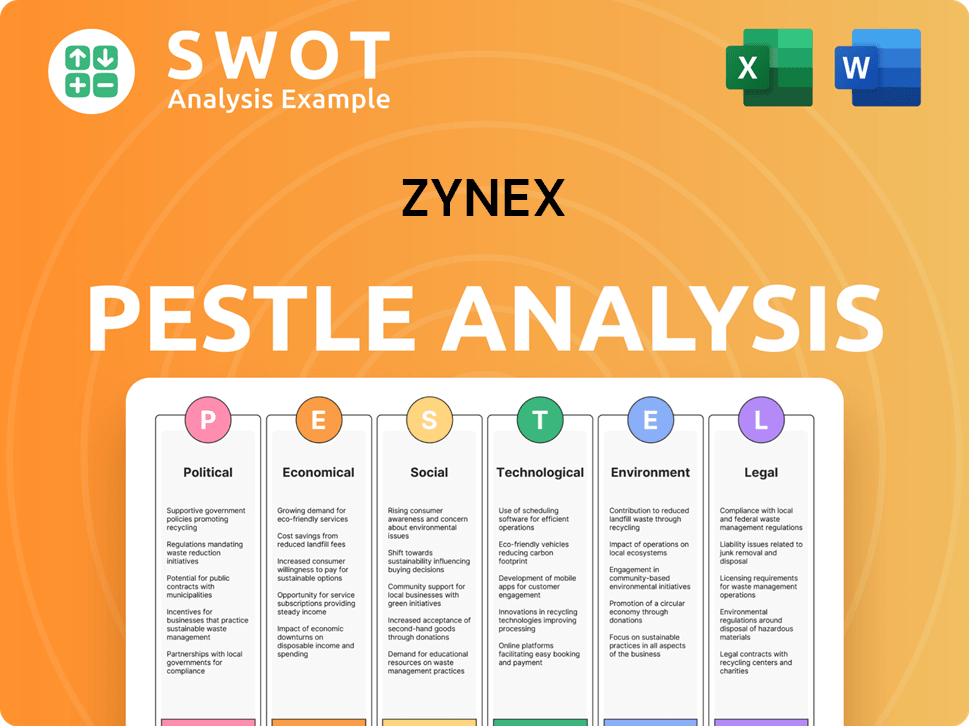

Zynex PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zynex Bundle

What is included in the product

Evaluates the Zynex by examining political, economic, social, tech, environmental, & legal aspects.

Offers an easily shareable summary for quick alignment across teams, enhancing team performance.

Preview the Actual Deliverable

Zynex PESTLE Analysis

The file you're seeing now is the final version—ready to download right after purchase. This preview showcases the Zynex PESTLE analysis, illustrating key factors.

Each section detailing political, economic, social, technological, legal, and environmental aspects. The structure is ready-to-use. Get this complete analysis after purchase.

PESTLE Analysis Template

Uncover Zynex's external landscape with our PESTLE analysis. We delve into political, economic, social, technological, legal, and environmental factors impacting the company. Get expert insights into industry trends and potential challenges. Improve your investment strategies and business decisions today. Purchase now to access the complete analysis.

Political factors

Government healthcare policies heavily influence Zynex. Medicare/Medicaid reimbursement rates directly affect revenue. Tricare payment suspensions exemplify this risk. Zynex's 2024 revenue was $120 million, with 80% from reimbursement. Changes in these policies create financial uncertainty.

The political landscape significantly shapes the regulatory environment for medical devices. Shifts in the FDA's policies could impact Zynex's market access and compliance. In 2024, the FDA approved 150+ novel medical devices. Regulatory changes can introduce hurdles or opportunities for Zynex. Navigating these requires close monitoring of political developments.

Zynex's global expansion hinges on political stability and trade relations. The company faces risks from international sales and operations. For example, in 2024, international sales accounted for 10% of total revenue. Changes in trade policies can disrupt supply chains.

Political Stability

Political stability significantly impacts Zynex's operations and market access. Consistent political climates foster predictable business environments. Conversely, instability can disrupt supply chains and consumer confidence. Zynex's success depends on its ability to navigate these political landscapes effectively. Political stability directly influences investor confidence and market expansion strategies.

- Political risk scores vary across Zynex's operating regions.

- Stable countries typically offer more predictable regulatory environments.

- Instability can lead to delays in product approvals or market entries.

- Zynex monitors political developments to mitigate potential risks.

Government Funding for Healthcare and Rehabilitation

Government funding significantly impacts healthcare demand, directly influencing Zynex. Increased funding for pain management and rehabilitation services boosts device demand. In 2024, U.S. healthcare spending reached $4.8 trillion, reflecting this impact. Federal and state policies on reimbursement rates also matter.

- Healthcare spending in the US is projected to reach $7.2 trillion by 2031.

- Medicare and Medicaid policies are critical.

- Reimbursement rates directly affect Zynex's revenue.

Zynex faces significant political influence through healthcare policies. Medicare/Medicaid directly impacts Zynex's revenue via reimbursement rates; about 80% of Zynex's revenue in 2024 came from reimbursements, totaling $120M. FDA approvals and international trade relations further shape market access and supply chains.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Healthcare Policies | Reimbursement Rates | $120M Revenue, 80% from reimbursement |

| FDA Regulations | Market Access, Compliance | 150+ New Devices Approved |

| Trade Relations | Supply Chain, Sales | 10% Revenue from International Sales |

Economic factors

Economic factors significantly shape healthcare spending by various entities. Zynex's revenue is heavily reliant on reimbursement from insurance providers and government programs. Any economic downturn or shifts in reimbursement policies could negatively affect Zynex's financial performance. For instance, in 2024, healthcare spending in the US reached $4.8 trillion, reflecting its economic sensitivity.

Interest rate fluctuations are crucial for Zynex. Higher rates increase borrowing costs, impacting profitability and expansion plans. Conversely, lower rates can boost investment returns and potentially lower operational expenses. For example, in early 2024, the Federal Reserve held rates steady, affecting Zynex's financial strategy.

Inflation in 2024 and early 2025, hovering around 3% (as of March 2025), can elevate Zynex's raw material expenses. This is particularly relevant for components sourced internationally. If Zynex can't fully transfer these higher costs to consumers, profit margins could shrink. For example, a 5% rise in raw material costs, impacting 40% of COGS, could reduce gross profit by approximately 2%.

Market Conditions and Consumer Spending

Market conditions and consumer spending significantly impact demand for elective medical devices, like Zynex's products. Economic downturns or uncertainties can lead to decreased consumer spending on non-essential medical treatments. The US consumer spending in Q1 2024 rose by 2.5%, showing resilience. However, rising interest rates could curb future spending.

- Consumer spending in Q1 2024 increased by 2.5% in the US.

- Interest rate hikes may affect future consumer spending.

Currency Exchange Rates

Currency exchange rate volatility presents both risks and opportunities for Zynex, particularly concerning its international sales and procurement. A stronger U.S. dollar can make Zynex's products more expensive for international buyers, potentially decreasing sales volume. Conversely, a weaker dollar could boost international revenue by making products more affordable. These fluctuations directly impact Zynex's profitability when converting foreign earnings back into U.S. dollars, as seen in the 2024 financial reports. The company needs to actively manage these currency risks.

- In Q1 2024, the USD index fluctuated, affecting international transactions.

- Currency hedging strategies are essential to mitigate risks.

- Exchange rate impacts are closely monitored quarterly.

Zynex is significantly impacted by economic factors influencing healthcare spending, particularly reimbursement. Rising interest rates and inflation, about 3% in early 2025, could inflate costs, affecting profitability. Consumer spending on elective devices is sensitive to economic conditions, with a 2.5% increase in Q1 2024 but with rate hikes potentially curbing future spending. Exchange rate fluctuations also pose both threats and chances for the company.

| Factor | Impact | Data (Early 2025) |

|---|---|---|

| Healthcare Spending | Influences reimbursement | US spent $4.8T in 2024 |

| Interest Rates | Affects borrowing costs | Fed held steady in early 2024 |

| Inflation | Raises raw material costs | Approx. 3% (Mar 2025) |

| Consumer Spending | Affects demand | +2.5% in Q1 2024 |

| Exchange Rates | Impacts international sales | USD index fluctuated |

Sociological factors

The global population is aging, with the 65+ age group projected to reach 16% by 2050. This demographic shift correlates with increased chronic pain incidence. In 2024, approximately 20% of adults globally experience chronic pain. This rise boosts demand for Zynex's pain management devices. Recent data shows a growing market for rehabilitation solutions.

Societal shifts towards holistic health and pain management are gaining traction. This includes a growing preference for non-drug therapies. In 2024, the global electrotherapy market was valued at $1.2 billion, reflecting increased interest. This trend supports Zynex's focus on electrotherapy devices, potentially boosting sales.

The emphasis on health, wellness, and active lifestyles significantly influences the demand for Zynex's rehabilitation and pain management products. This trend is supported by a growing market; the global wellness market was valued at $7 trillion in 2023 and is projected to reach $8.9 trillion by 2027. This shift towards proactive health management creates opportunities for Zynex to offer solutions that enhance quality of life and support active living.

Healthcare Access and Disparities

Societal factors significantly influence healthcare access, impacting Zynex's market. Socioeconomic disparities and insurance coverage directly affect who can access and afford Zynex's products, such as pain management devices. In 2024, nearly 8.5% of the U.S. population lacked health insurance, potentially limiting access to necessary medical devices. These disparities can affect Zynex's sales and distribution strategies.

- 8.5% of the U.S. population lacked health insurance in 2024.

- Socioeconomic factors impact healthcare accessibility.

- Insurance coverage affects affordability of medical devices.

Opioid Crisis and Addiction Awareness

The opioid crisis continues to shape healthcare, influencing patient and provider preferences. This situation boosts the need for non-addictive pain solutions, benefiting companies like Zynex. The Centers for Disease Control and Prevention (CDC) reports that in 2023, over 80,000 deaths involved opioids. Awareness campaigns are growing, pushing alternatives. Zynex's devices could see increased demand due to these shifts.

- 80,000+ opioid-involved deaths in 2023 (CDC).

- Growing focus on non-opioid pain relief.

- Increased demand for pain management alternatives.

Societal aging boosts demand for pain solutions. Preferences for non-drug therapies increase, favoring Zynex. Health, wellness trends support Zynex’s products. Healthcare access disparities, highlighted by 8.5% uninsured in 2024, can affect device accessibility. Opioid crisis impacts preferences, increasing need for alternatives.

| Factor | Impact on Zynex | Data (2024-2025) |

|---|---|---|

| Aging Population | Increased Demand | 16% of population aged 65+ by 2050 |

| Wellness Trends | Positive Impact | Wellness market: $8.9T by 2027 |

| Opioid Crisis | Boosts Demand | 80,000+ opioid deaths (2023, CDC) |

Technological factors

Technological advancements in electrotherapy and medical devices are rapidly evolving. Zynex can leverage these changes to innovate and improve its product offerings. In 2024, the global medical devices market was valued at $545.5 billion. New technologies create opportunities and challenges for Zynex. They need to keep pace with the industry's dynamic shifts.

Zynex's R&D is vital; it drives innovation. They develop new tech, like their laser oximeter. In Q1 2024, Zynex spent $2.5M on R&D. This investment supports future products. Successful launches boost their market position.

Advancements in manufacturing tech directly affect Zynex's costs and efficiency. Automated processes and 3D printing could lower production costs. In 2024, the medical device market saw increased adoption of these technologies. This could lead to improved margins for Zynex, reflecting positively on their financial performance in 2025.

Data Security and Privacy Technology

Zynex, as a medical device company, faces significant technological challenges related to data security and privacy. They must comply with evolving regulations like HIPAA in the U.S., which saw over 500 data breaches in 2023. Staying current on cybersecurity measures is crucial. The global cybersecurity market is projected to reach $345.4 billion by 2028.

- HIPAA compliance is essential to avoid hefty penalties.

- Data breaches can severely damage a company's reputation.

- Investment in robust cybersecurity systems is required.

- The company should adopt the latest encryption technologies.

Integration of Technology in Healthcare Delivery

The healthcare sector's tech integration, like telemedicine and remote monitoring, significantly impacts Zynex. This shift presents opportunities for Zynex's devices or demands tech adjustments. The global telehealth market is projected to reach $225 billion by 2025. Increased use of AI in diagnostics and patient care could also influence Zynex's product development. Data from 2024 indicates a 30% rise in telehealth adoption.

- Telehealth market expected to hit $225B by 2025.

- 2024 saw a 30% increase in telehealth adoption.

Technological advancements drive Zynex's product innovation in electrotherapy and medical devices. R&D spending in Q1 2024 was $2.5M, crucial for new tech like their laser oximeter. Manufacturing tech and AI integration in healthcare significantly influence Zynex, offering both opportunities and challenges, particularly with cybersecurity in the evolving telehealth market.

| Aspect | Details | Data |

|---|---|---|

| Market Size (Medical Devices) | Global valuation in 2024 | $545.5B |

| R&D Spending (Zynex, Q1 2024) | Investment in innovation | $2.5M |

| Telehealth Market Projection | Estimated market size by 2025 | $225B |

| Telehealth Adoption | Increase in 2024 | 30% |

Legal factors

Zynex must adhere strictly to FDA rules for medical devices. This includes getting 510(k) clearance for new products. Zynex reported total revenue of $36.4 million for Q1 2024. Also, they must maintain compliance for all current devices. Non-compliance can lead to significant penalties.

Healthcare reimbursement laws and policies significantly affect Zynex. These regulations, including those from Medicare, Medicaid, and private insurers, directly influence the company's revenue. For instance, the temporary suspension by Tricare shows the impact of payer-related issues. Any changes to these laws and policies can lead to financial risks. Zynex's revenue in 2023 was $144.8 million, reflecting the importance of these factors.

As a medical device maker, Zynex faces product liability risks, potentially leading to hefty legal fees and reputational harm. In 2023, the company reported $1.4 million in legal expenses. Product recalls, like the one in 2024, can also trigger litigation. Successful suits may impact Zynex's financials and market standing.

Intellectual Property Laws

Zynex must actively protect its intellectual property (IP). This involves securing patents and trademarks for its medical devices and related technologies. IP protection is crucial to prevent competitors from copying Zynex's innovations. Securing these rights is vital for maintaining market share and profitability. In 2024, Zynex spent approximately $2.5 million on patent-related activities.

- Patents filed: Zynex filed for 12 new patents in 2024.

- Trademark registrations: The company registered 5 new trademarks.

- Legal costs: Approximately $1 million in legal fees were spent.

- Revenue impact: Protected IP contributed to 15% of Zynex's revenue in 2024.

Healthcare Privacy Laws (e.g., HIPAA)

Zynex, operating in the healthcare sector, must strictly adhere to healthcare privacy laws, particularly HIPAA, to safeguard patient data. HIPAA compliance is crucial to prevent hefty fines, which can be substantial, potentially reaching millions of dollars depending on the violation's severity. Non-compliance can also lead to significant reputational damage, eroding patient trust and impacting business relationships. In 2024, HIPAA violations resulted in penalties ranging from $100 to $50,000 per violation, with an annual total exceeding $10 million.

Zynex is heavily regulated, facing FDA compliance and strict adherence to laws. Healthcare reimbursement rules from Medicare and private insurers directly impact revenue, with shifts causing financial risk. Legal battles like product liability and IP infringements pose further challenges.

| Legal Area | Details | 2024 Data |

|---|---|---|

| FDA Compliance | 510(k) clearance for new products | Q1 Revenue: $36.4M |

| Reimbursement | Medicare, Medicaid, private insurers impact revenue | 2023 Revenue: $144.8M |

| Product Liability/IP | Risk of legal fees/protecting IP through patents and trademarks | Legal costs in 2023: $1.4M; 12 new patents filed |

Environmental factors

Zynex faces environmental considerations in waste management. Proper disposal of medical devices and batteries is crucial. This includes adhering to regulations like the WEEE Directive. The global medical waste management market was valued at $12.8 billion in 2024. It's projected to reach $18.5 billion by 2029.

Zynex should prioritize supply chain sustainability, a critical environmental factor. This involves responsible sourcing of raw materials and components. For instance, in 2024, companies face increased scrutiny regarding their environmental impact. The focus is on reducing carbon footprints, with the medical device industry under pressure to adopt sustainable practices. This includes verifying suppliers' environmental compliance.

Zynex's energy use in manufacturing and operations impacts its carbon footprint, though less than in energy-intensive sectors. Reducing energy use and adopting renewables can enhance sustainability. In 2024, the healthcare sector's carbon footprint was about 8.5% of the U.S. total. Initiatives to cut emissions, like energy-efficient tech, align with environmental goals.

Packaging and Material Usage

Zynex must consider the environmental impact of its packaging. Sustainable practices are increasingly important for companies. This includes using eco-friendly materials and reducing waste. Zynex's choices impact its environmental footprint and brand image.

- The global market for sustainable packaging is projected to reach $437.8 billion by 2027.

- Around 30% of plastic packaging waste is recycled globally.

Climate Change Considerations

Climate change considerations are less direct for Zynex but still relevant. Regulations designed to combat climate change could influence the company's suppliers or operational costs over time. For instance, the global market for medical devices is expected to reach $612.7 billion by 2025, according to Statista, potentially impacted by environmental policies. These policies might indirectly affect the medical device supply chain.

- Potential for increased operational costs due to environmental regulations.

- Indirect impact through supply chain disruptions from climate-related events.

- Long-term considerations for sustainable business practices.

Environmental factors influence Zynex through waste disposal, especially adhering to directives like the WEEE. Supply chain sustainability, focusing on responsible sourcing and reduced carbon footprints, is also critical. Zynex’s energy use and packaging choices additionally shape its environmental footprint. Sustainable packaging market will hit $437.8B by 2027.

| Factor | Impact on Zynex | 2024/2025 Data |

|---|---|---|

| Waste Management | Compliance, costs, brand | Medical waste market at $12.8B (2024), to $18.5B (2029). |

| Supply Chain | Reputation, expenses | Increased scrutiny of environmental impact in 2024. |

| Energy & Packaging | Operational efficiency | Sustainable packaging to hit $437.8B by 2027. |

PESTLE Analysis Data Sources

This Zynex PESTLE Analysis relies on financial reports, medical tech publications, government health policies, and industry reports.