Acenta Steel Bundle

How has Acenta Steel Company shaped the Steel Industry?

Journey back in time to explore the Acenta Steel SWOT Analysis and the fascinating Acenta Steel history. From its humble beginnings in 1865 as George Gadd, to its evolution into a leading steel stockholder and distributor, Acenta Steel's story is one of strategic adaptation and enduring impact. Discover how this UK-based company, initially focused on supporting the industrial revolution, has navigated the complexities of the steel manufacturing landscape.

Understanding the Acenta Steel Company's early years provides essential context for appreciating its current market position. The company's strategic consolidation and focus on customer needs have been pivotal in its growth. As the steel industry continues to evolve, examining Acenta Steel's milestones offers valuable insights into the dynamics of competition, innovation, and resilience within the sector.

What is the Acenta Steel Founding Story?

The Acenta Steel Company's story begins in 1865 with the establishment of George Gadd in Tipton. While the exact founding details remain somewhat obscure, the company's roots are firmly planted in the industrial landscape of the 19th century. This early start laid the groundwork for what would become a significant player in the steel industry.

The bright bar business, a central element of Acenta Steel history, was consolidated in the 1940s, bringing together four separate entities. This strategic move aimed to create a more integrated and effective supplier of bright and engineering steel bars, catering to the increasing needs of various industrial sectors. The focus on these specialized steel products highlights the company's early commitment to precision and quality.

The initial business model centered on processing and distributing steel products, particularly bright and engineering steel bars. These were essential for manufacturing precision-finished components used in demanding engineering applications. The company's long-term success indicates a period of organic growth, potentially supported by local investments, to establish its operations. Understanding the Mission, Vision & Core Values of Acenta Steel provides further insight into the company's foundational principles.

The company's founding in 1865 by George Gadd in Tipton marked the initial step in its long history.

- The bright bar business was formed in the 1940s through the merger of four businesses.

- The primary focus was on processing and distributing bright and engineering steel bars.

- These steel bars were crucial for precision-finished components in engineering applications.

- The company's early development was shaped by industrialization and demand for steel.

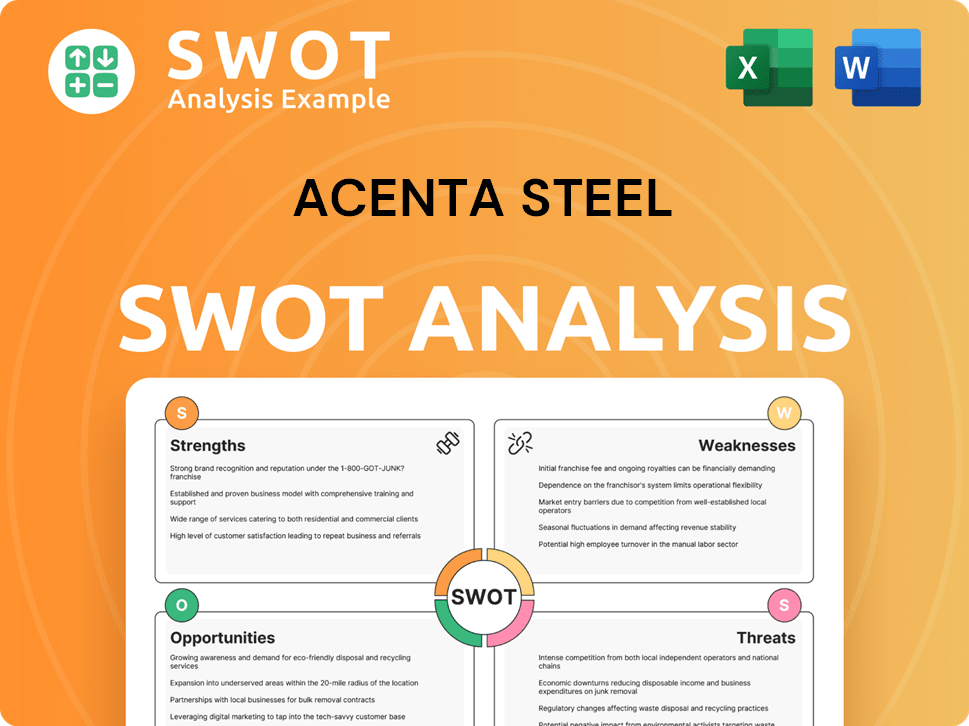

Acenta Steel SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Acenta Steel?

The early growth of Acenta Steel Company involved strategic business consolidations in the 1940s, particularly in its bright bar division. This expansion enabled the company to broaden its product offerings, establishing a stronger market presence in bright and engineering steel bars. By 2018, it had become the UK's largest independent processor and distributor, showcasing its commitment to meeting diverse customer needs.

The company established six sites across the UK, including processing facilities in Willenhall and a hot rolled bars division in Dudley. Distribution arms were set up in Rugby, Manchester, Southampton, Sunderland, and Newport, South Wales. This broad geographical spread allowed

In 2018, Aar Tee Industries Holdings Pte Limited acquired

Later, the company faced financial uncertainties, with its funding withdrawn by Royal Bank of Scotland and replaced by a new receivables purchase agreement in May 2023. The steel industry faces challenges, with the overall apparent steel consumption in the EU projected to decline by 0.9% in 2025. This highlights the dynamic and competitive landscape within the

The company employed approximately 350 staff across its UK sites. The sites included processing facilities and distribution centers strategically located to serve a wide customer base. The acquisition by Aar Tee Industries Holdings Pte Limited was a significant milestone in the company's

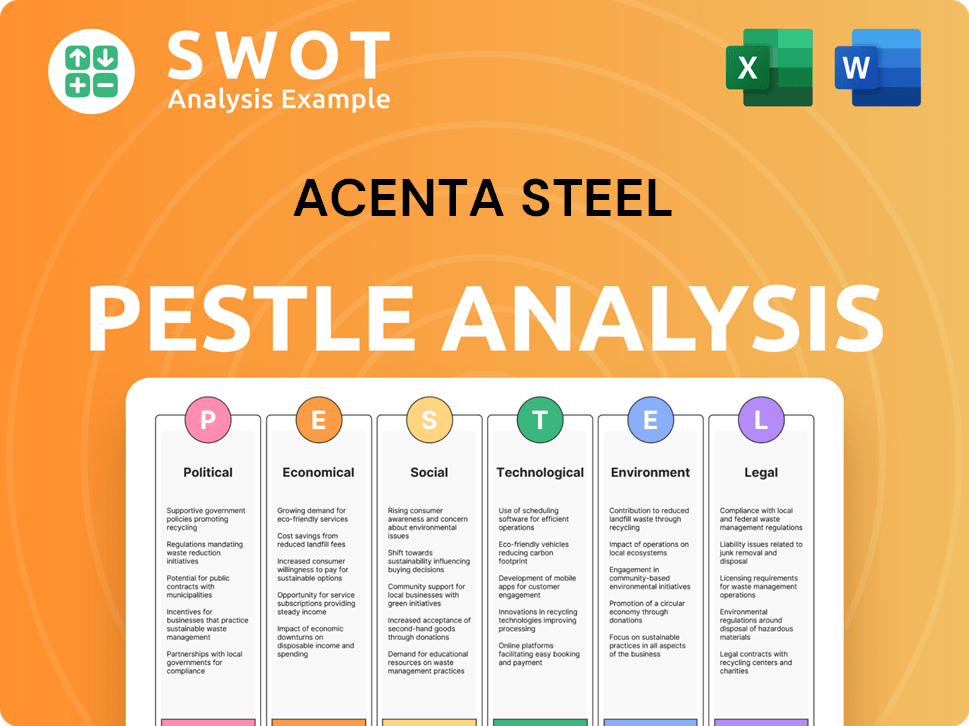

Acenta Steel PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Acenta Steel history?

The Acenta Steel Company, tracing its roots back to the 19th century as George Gadd in Tipton, has a rich Acenta Steel history marked by significant milestones in the steel industry. The evolution of Acenta Steel reflects its adaptability and resilience in a competitive market.

| Year | Milestone |

|---|---|

| 19th Century | Founded as George Gadd in Tipton, marking the beginning of the Acenta Steel Company. |

| 1940s | Consolidated four businesses to form the bright bar division, strengthening its position in the engineering steel market. |

| 2018 | Acquired by Aar Tee Industries Holdings Pte Limited, aiming for further growth and innovation. |

| 2018 | Became the UK's largest independent processor and distributor of bright and engineering steel bars. |

| 2023 | Faced challenges including the need to secure new financing. |

While specific innovations are not widely documented, the company's focus on precision-finished materials for critical engineering applications suggests a commitment to advanced manufacturing techniques. The acquisition by Aar Tee Industries Holdings Pte Limited in 2018 also signaled an intent to leverage global trading capabilities for further innovation.

The steel industry faced challenges, including decreasing apparent steel consumption in the EU, which declined by 1.3% in the second quarter of 2024.

The withdrawal of funding by Royal Bank of Scotland in May 2023 highlighted financial vulnerabilities within the company.

Geopolitical tensions and economic uncertainties have significantly impacted raw material prices and market stability.

The steel manufacturing sector faces intense competition, necessitating strategic adjustments and operational efficiency.

The shift toward sustainable practices, such as electric arc furnaces (EAFs) and hydrogen-based steelmaking, presents both challenges and opportunities.

The EU's apparent steel consumption is projected to decline by 0.9% in 2025, indicating continued market pressures.

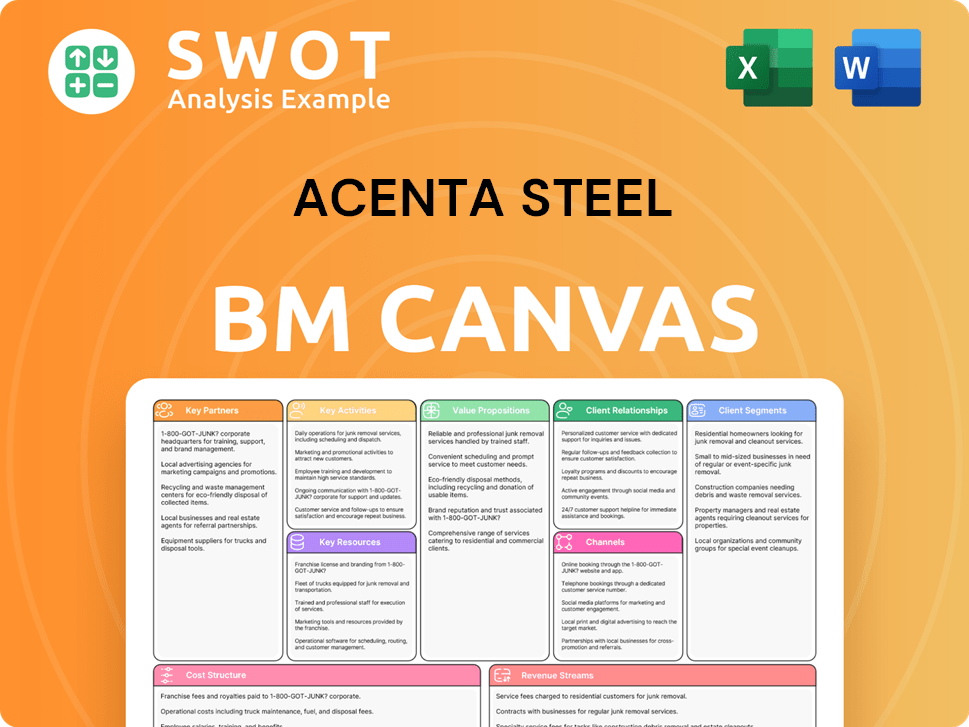

Acenta Steel Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Acenta Steel?

The Acenta Steel Company's journey has been marked by significant shifts and developments within the steel industry. From its origins in 1865 with George Gadd in Tipton to its evolution through acquisitions and changes in ownership, the company has navigated the complexities of the steel manufacturing sector. The bright bar business was established in the 1940s through the combination of four businesses, which set the stage for future expansions. The acquisition by Aar Tee Industries Holdings Pte Limited in 2018, and subsequent renaming to Aartee Bright Bar, aimed to strengthen its position in the market. However, the company faced challenges, as seen by its administration in February 2023, reflecting the volatile nature of the steel industry. For a deeper understanding of their target market, read this article: Target Market of Acenta Steel.

| Year | Key Event |

|---|---|

| 1865 | Origins traced back to George Gadd in Tipton. |

| 1940s | Bright bar business established through the combination of four businesses. |

| 2018 | Acquired by Aar Tee Industries Holdings Pte Limited. |

| 2021 | Became Aartee Bright Bar, following the 2018 acquisition by Aartee Group. |

| February 2023 | Aartee (formerly Acenta) entered administration. |

| May 2023 | Aartee Bright Bar's funding was withdrawn and replaced with a new uncommitted receivables purchase agreement. |

The steel industry faces both challenges and opportunities. The EU's apparent steel consumption is projected to decline in 2024 and 2025. However, the global mining steel industry market was valued at $875.7 billion in 2024 and is projected to reach $1.45 trillion by 2035, driven by demand from construction, automotive, and infrastructure sectors. The hot-rolled steel flat bar market is estimated at $15 billion in 2025.

Sustainability initiatives are reshaping the steel industry. There is a strong focus on green steel and decarbonization, including the adoption of electric arc furnaces (EAFs) and hydrogen-based steelmaking. EAF steel output is expected to grow significantly in the coming decades. Technological innovations, such as AI and automation, are improving production processes.

Supply chain resilience and regionalization are key strategic priorities for steel companies. Companies are aiming to reduce reliance on foreign suppliers. The steel market faces uncertainty from fluctuating raw material prices and geopolitical tensions. The ability to adapt to these shifts will be crucial for companies in the steel industry.

The long-term demand for steel in construction, automotive, and infrastructure remains strong. The ability to invest in sustainable practices and leverage technological advancements will be crucial. Acenta Group, a different entity, reported net sales of 7 MSEK (approximately $0.67 million USD) in January-March 2025, aiming for 35 MSEK (approximately $3.3 million USD) in sales for the full year 2025.

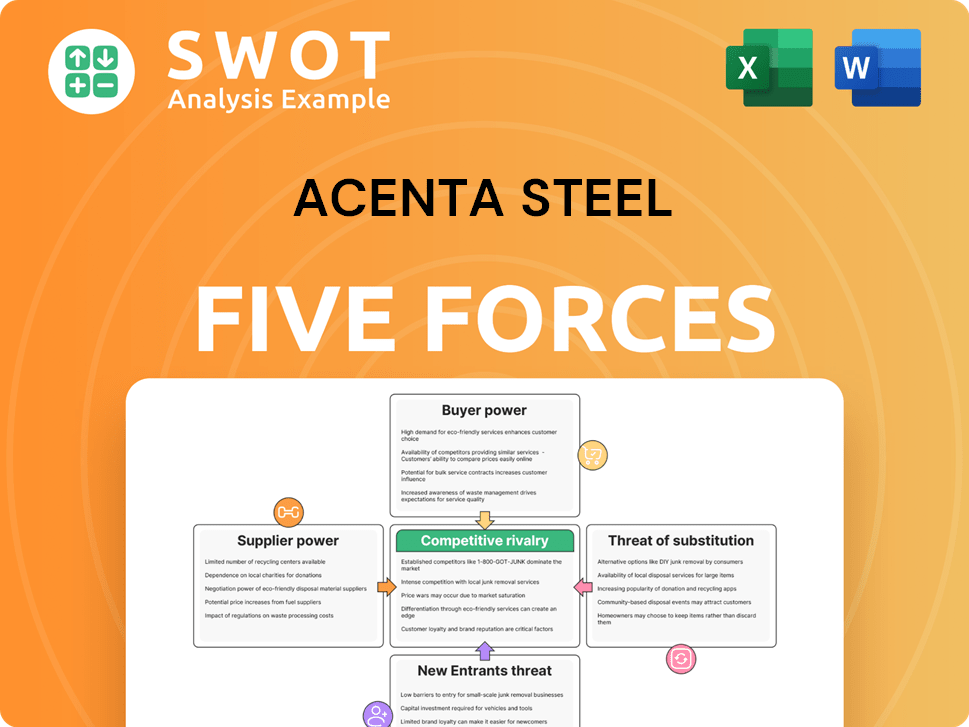

Acenta Steel Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Acenta Steel Company?

- What is Growth Strategy and Future Prospects of Acenta Steel Company?

- How Does Acenta Steel Company Work?

- What is Sales and Marketing Strategy of Acenta Steel Company?

- What is Brief History of Acenta Steel Company?

- Who Owns Acenta Steel Company?

- What is Customer Demographics and Target Market of Acenta Steel Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.