Acenta Steel Bundle

How Does Acenta Steel Company Thrive in the Steel Industry?

Acenta Steel Company, a key player in the steel sector, offers a wide array of steel products, including tubes and sheets, to various industries. The company's focus on tailored solutions and efficient delivery sets it apart, serving over 5,000 customers worldwide as of 2024. Understanding Acenta Steel's operations is vital for anyone interested in the Acenta Steel SWOT Analysis and the dynamic world of steel.

The steel manufacturing process and steel production are critical to the global economy, and Acenta Steel Company plays a significant role in this. This exploration will uncover how Acenta Steel Company navigates industry challenges, from fluctuating raw material prices to increased competition, while providing valuable steel products. By examining its strategies, we can gain insights into its financial performance and future outlook.

What Are the Key Operations Driving Acenta Steel’s Success?

The core operations of Acenta Steel Company center around the distribution and processing of a wide array of steel products. These products, including tubes, sections, and sheets, are crucial for various industrial applications. The company's focus on customized solutions and efficient delivery services is a key element of its value proposition.

Acenta Steel Company's value proposition is built on meeting specific customer needs and fostering loyalty. A 2024 study highlighted that 70% of clients prioritize tailored services, a demand Acenta Steel aims to fulfill. This customer-centric approach is supported by a robust operational framework.

The operational processes at Acenta Steel Company are designed to ensure efficiency and timely delivery. A vertically integrated supply chain controls stock-holding, cutting, and distribution. This integration helps optimize efficiency and ensures timely product delivery. This model led to a 15% reduction in lead times compared to competitors in 2024, and in Q1 2025, inventory turnover rates increased by 10% due to improved stock management. The company's established market position within the UK steel industry and its experienced management team further contribute to its operational stability and strategic decision-making.

Acenta Steel Company distinguishes itself through value-added processing, such as cutting and shaping, which delivers steel in a more customer-ready form and improves margins. This approach enhances the company's ability to meet specific customer needs. The company’s financial performance and operational strategies are detailed in an article about Acenta Steel Company, providing further insights into their business model.

- Vertically integrated supply chain for streamlined operations.

- Value-added processing to provide customer-ready steel products.

- Experienced management team and established market position in the UK.

- Focus on customized solutions to meet specific customer demands.

Acenta Steel SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Acenta Steel Make Money?

The primary revenue stream for Acenta Steel Company stems from the sales of its diverse range of steel products. These include tubes, sections, sheets, and specialized bright and engineering steel bars. The company strategically focuses on customized steel solutions and value-added processing services to enhance its monetization strategies.

In 2024, the demand for customized steel solutions saw a significant increase. This surge in demand contributed to an increase in market share. Furthermore, value-added services have also played a crucial role in improving profit margins.

The company's broad product range and focus on engineering bars across Europe aim to capture a significant market share. Acenta Steel also has a strong international presence, with exports accounting for a substantial portion of total sales. Future expansions into new geographic markets are strategic moves to unlock new revenue sources.

Acenta Steel Company generates revenue primarily through the sale of various steel products, including tubes, sections, sheets, and specialized bars. Their monetization strategy is centered on providing customized steel solutions and value-added processing services. The company's approach is further supported by its international presence and strategic expansions.

- Customized steel solutions experienced a 15% increase in demand in 2024, which boosted Acenta Steel's market share by 8%.

- Revenue from value-added services rose by 4% in Q1 2025, with these services improving margins by 10-15%.

- The global engineering steel market was valued at around $120 billion in 2024, with a projected annual growth of 3-5% through 2025, offering a significant market for Acenta Steel's specialized products.

- Exports represented 30% of total sales in 2024, indicating a diversified revenue base across North America, Europe, and Asia.

- The Asia-Pacific steel market is expected to reach $1.2 trillion by 2025, presenting opportunities for expansion. For more information, you can read about the Owners & Shareholders of Acenta Steel.

Acenta Steel PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Acenta Steel’s Business Model?

The Marketing Strategy of Acenta Steel has been shaped by key strategic moves and milestones. A significant move was the December 2020 agreement to merge its engineering bar divisions with LIBERTY Steel, forming AARTEE Bright Bar. This partnership positioned the company as a leader in the UK's bright bar steel market, catering to diverse sectors.

Operational challenges, including fluctuating steel prices and supply chain disruptions, have impacted the steel manufacturing process and steel production. The company has responded by focusing on customized solutions and efficient delivery. These strategies are crucial in a market where economic slowdowns, like the projected 2.4% global growth in 2024, can threaten sales.

Acenta Steel's competitive edge stems from its specialized product range and established market position. Their vertically integrated supply chain and industry partnerships contribute to their success. The company is also exploring opportunities in green infrastructure and sustainable steel markets, which are projected to reach $2.15 trillion and $140 billion by 2025 and 2030, respectively, while integrating technological advancements.

The formation of AARTEE Bright Bar in December 2020 through a partnership with LIBERTY Steel. This created a strong presence in the UK's bright bar steel market. This strategic move enhanced the company's specialized product focus and market position.

Focus on customized solutions and efficient delivery to foster customer loyalty. Leveraging industry partnerships to boost market share, with strategic alliances boosting market share by 15% in 2024. Exploring opportunities in green infrastructure and sustainable steel markets.

Specialized product range, including bright and engineering steel bars, providing deep expertise. Established market position in the UK's bright steel bar market. Vertically integrated supply chain, ensuring efficiency and timely delivery.

Fluctuating steel prices, with up to 10% fluctuations. Dependence on volatile sectors like automotive and construction. Global supply chain disruptions, with shipping costs spiking by up to 15% in 2024. Economic slowdowns, with global growth slowing to 2.4% in 2024.

Acenta Steel's focus on specialized steel products and efficient operations provides a competitive advantage. The company's ability to adapt to market changes and leverage partnerships supports its growth. The company's commitment to sustainability and technological advancements further strengthens its position.

- Specialized product range: bright and engineering steel bars.

- Vertically integrated supply chain: controlling stock-holding, cutting, and distribution.

- Industry partnerships: boosting market share.

- Focus on green infrastructure and sustainable steel markets.

Acenta Steel Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Acenta Steel Positioning Itself for Continued Success?

The company holds a significant position within the UK steel industry, particularly in the bright steel bar market. The UK steel industry's turnover reached approximately £14 billion in 2024, indicating the substantial market in which it operates. Serving over 5,000 customers globally across various sectors, it showcases a broad customer base and international reach.

However, the company faces risks such as fluctuating steel prices and dependence on volatile sectors. The global steel demand is projected to recover modestly in 2025, with an anticipated increase of 1.2%, reaching 1,772 Mt. This recovery, coupled with the company's focus on customized solutions, efficient delivery, and expansion into growing markets, positions the company to sustain and potentially expand its profitability in the future.

Acenta Steel is a key player in the UK's bright steel bar market. In 2024, the UK steel industry's turnover was around £14 billion. The company serves over 5,000 customers worldwide, demonstrating a strong market presence.

The company faces risks including fluctuating steel prices and dependence on sectors like automotive and construction. Global supply chain disruptions and increased competition also pose challenges. Rising energy costs and trade policies further add to the risks.

The company aims to expand its global presence, targeting regions with industrial growth. It is also exploring opportunities in green infrastructure and sustainable steel markets. Technological advancements are being considered to boost efficiency and optimize supply chains.

Strategic plans include potential acquisitions and partnerships to expand product offerings. The global steel demand is projected to recover modestly in 2025. The company focuses on customized solutions, efficient delivery, and market expansion.

The company's future depends on its ability to navigate market volatility and capitalize on growth opportunities. Target Market of Acenta Steel gives more insights into the company's customer base and market approach.

- The company's international presence, with exports accounting for 30% of total sales in 2024, is a strength.

- Rising energy costs, which increased by an average of 15% for steel manufacturers in 2024, pose a significant threat.

- The Asia-Pacific steel market is projected to reach $1.2 trillion by 2025, offering growth potential.

- The company must address uncertainties regarding its financial stability.

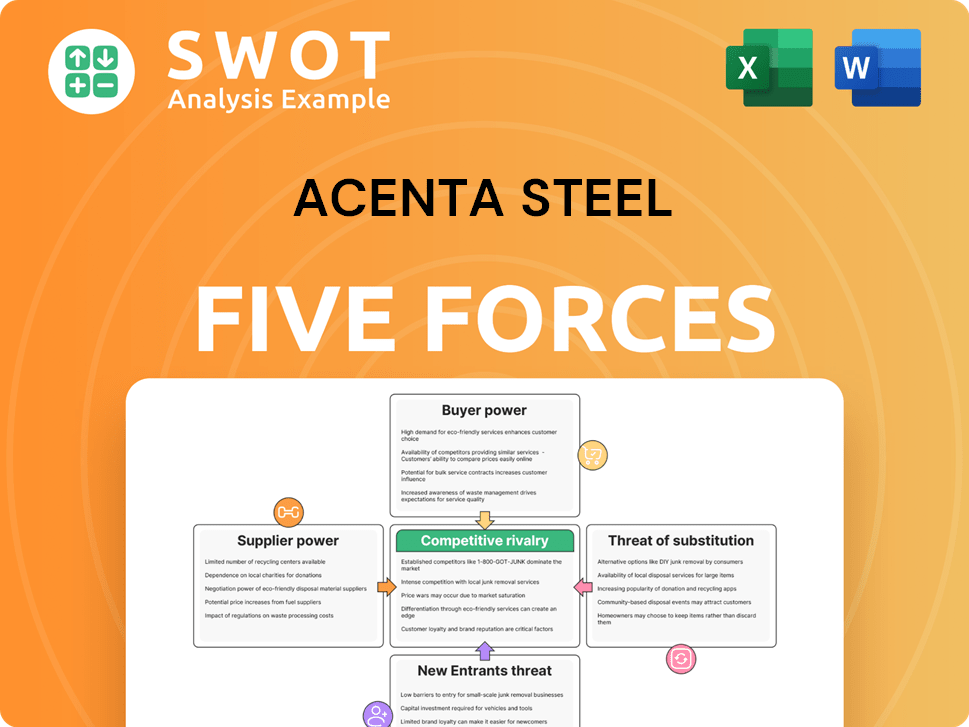

Acenta Steel Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Acenta Steel Company?

- What is Competitive Landscape of Acenta Steel Company?

- What is Growth Strategy and Future Prospects of Acenta Steel Company?

- What is Sales and Marketing Strategy of Acenta Steel Company?

- What is Brief History of Acenta Steel Company?

- Who Owns Acenta Steel Company?

- What is Customer Demographics and Target Market of Acenta Steel Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.