Alto Ingredients Bundle

How has Alto Ingredients, Inc. transformed since 2003?

Discover the remarkable journey of Alto Ingredients, Inc., a company that has strategically navigated the volatile landscape of renewable fuels and specialty chemicals. From its roots as Pacific Ethanol, Inc., to its current diversified portfolio, Alto Ingredients' story is one of adaptation and innovation. Explore how this Alto Ingredients SWOT Analysis reveals the company's strategic shifts and market positioning.

Alto Ingredients' history is a compelling case study in the biofuel company sector, showcasing its evolution from primarily ethanol production to a broader essential ingredients provider. Understanding the Alto Ingredients company history timeline provides crucial insights into its strategic decisions and financial performance. Learn about the company's shift from its Sacramento headquarters to Pekin, Illinois, and how this move has impacted its operations and access to raw materials.

What is the Alto Ingredients Founding Story?

The story of Alto Ingredients, formerly known as Pacific Ethanol, began in 2003. The company was established in Sacramento, California, by Bill Jones and William L. Jones. Their primary focus from the outset was ethanol production, capitalizing on the rising demand for renewable fuels.

The founders recognized the potential of ethanol as a biofuel. Their initial business model centered on converting corn into fuel ethanol. This strategic move positioned the company at the forefront of the burgeoning renewable energy sector. The company's history is closely tied to the evolution of the ethanol market.

A key early decision was to build its own production facilities. By 2009, the company had already constructed four production facilities across the Western states. This rapid expansion highlights the founders' commitment to establishing a strong operational base. While specific details about initial funding are not extensively documented, the company's swift growth into owning and operating multiple facilities suggests significant capital investment. If you are interested in learning more about the company's growth strategy, read this article: Alto Ingredients' Growth Strategy.

Alto Ingredients, originally Pacific Ethanol, was founded in 2003 in Sacramento, California.

- The founders, Bill Jones and William L. Jones, aimed to produce ethanol.

- The company focused on converting corn into fuel ethanol.

- By 2009, Alto Ingredients had built four production facilities.

- The early 2000s saw increasing environmental awareness and a push for alternative energy.

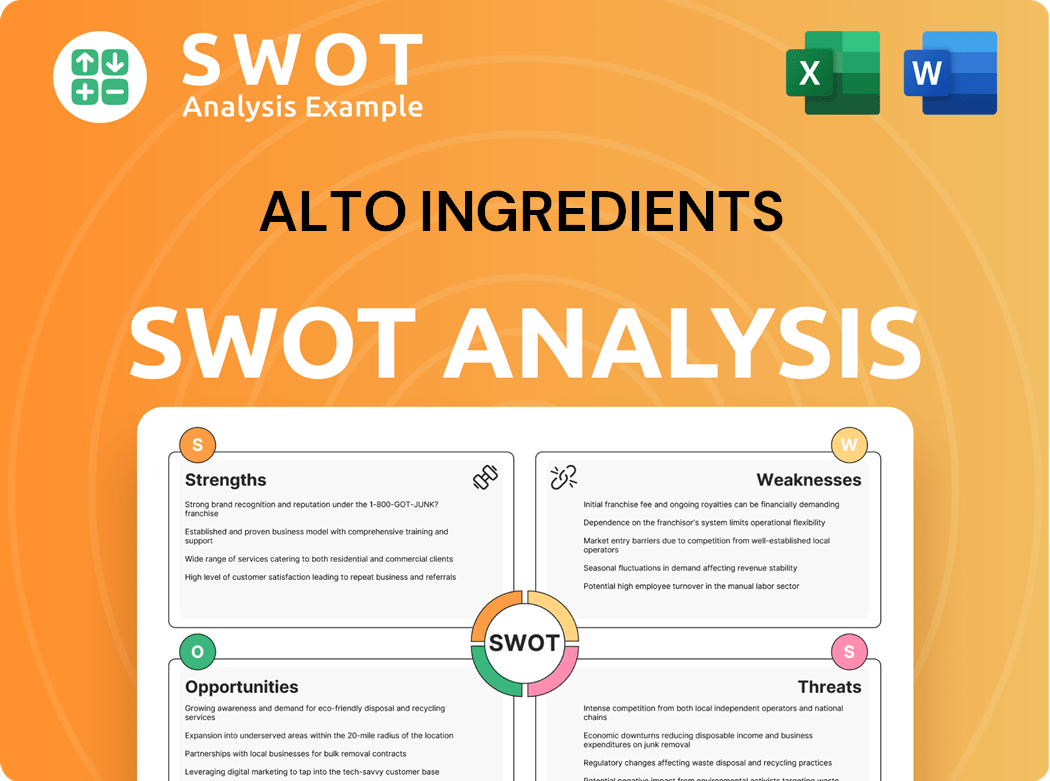

Alto Ingredients SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Alto Ingredients?

The early years of Alto Ingredients, formerly known as Pacific Ethanol, Inc., were marked by significant growth and expansion. The company focused on establishing its own production facilities to increase its capacity for ethanol production. This strategic move helped lay the foundation for its future in the renewable fuels sector.

By 2009, Alto Ingredients had established four production facilities in the Western United States. This expansion was crucial for scaling operations and increasing ethanol production capabilities. The company's focus was on meeting the anticipated market demand for fuel ethanol.

During this period, the company significantly expanded its team. Approximately 400 employees were hired in the western U.S., supported by workforce development agencies. This growth in human capital was essential for supporting the increasing production capacity and operational needs.

A key strategic shift for Alto Ingredients was diversifying beyond just fuel ethanol. The company broadened its offerings to include various corn-based specialty alcohols and essential ingredients. This move allowed Alto Ingredients to serve diverse markets, including food and beverage, pharmaceutical, industrial, and renewable fuels.

In late 2024 and early 2025, Alto Ingredients took steps to optimize its asset base and streamline operations. This included cold idling its Magic Valley plant to eliminate unprofitable operations while maintaining it as a renewable fuel terminal. They also integrated Eagle Alcohol's bulk operations into its marketing business. For more information on the company's target market, read Target Market of Alto Ingredients.

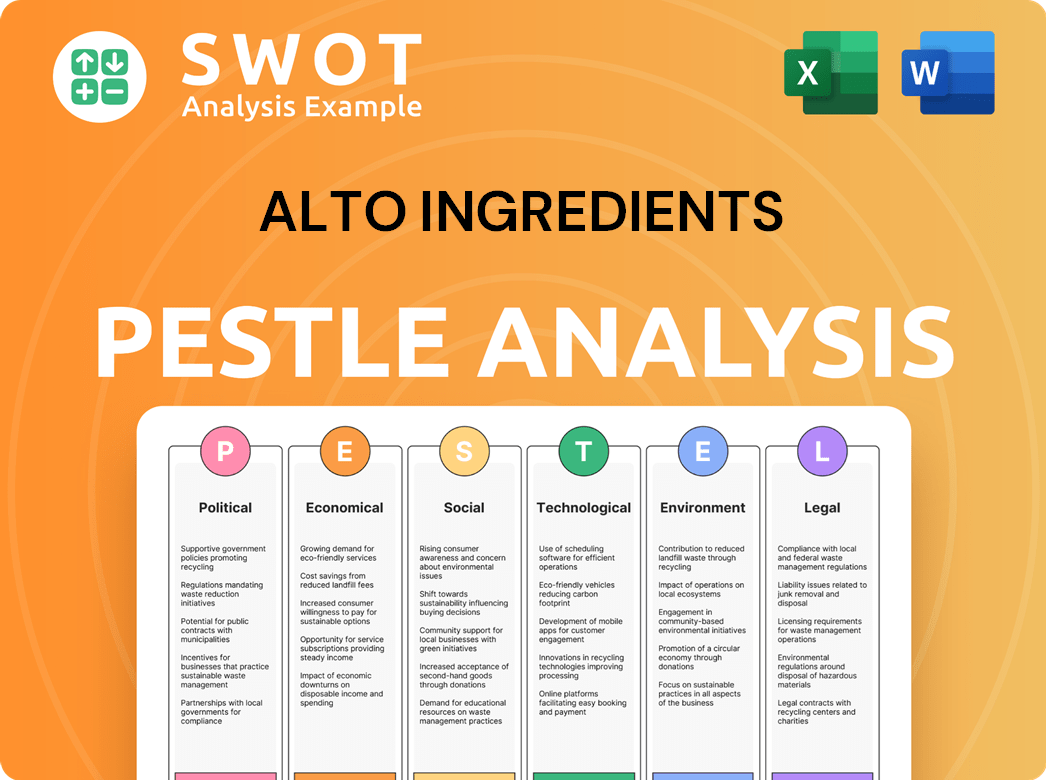

Alto Ingredients PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Alto Ingredients history?

The story of Alto Ingredients, a key player in the biofuel company landscape, is marked by strategic shifts and responses to market dynamics. A pivotal moment involved diversifying beyond ethanol production, expanding into specialty alcohols and ingredients for various sectors. This strategic pivot was crucial for adapting to changing market demands, showcasing Alto Ingredients' adaptability.

| Year | Milestone |

|---|---|

| Ongoing | Continuous exploration of ways to manufacture high-grade alcohols and process corn into various valuable products like high-protein feed, pet food, and renewable fuel. |

| 2025 | Completed a SMETA Pillar 4 audit, enhancing access to premium markets and strengthening customer relationships. |

| February 2025 | The EPA Class VI permit application for carbon capture and storage (CCS) at the Pekin campus was deemed complete. |

| January 2025 | Acquired a beverage-grade liquid CO2 processing facility adjacent to its Columbia plant. |

| Q4 2024 & Q1 2025 | Implemented a 16% workforce reduction. |

Alto Ingredients has consistently sought innovations to leverage its capabilities. This includes efforts to manufacture high-grade alcohols and transform corn into valuable products such as high-protein feed and renewable fuel. The company's pursuit of carbon capture and storage (CCS) at its Pekin campus is a significant step towards reducing its carbon footprint and creating value from CO2 production.

Expanding beyond ethanol production to include specialty alcohols and ingredients for diverse markets, such as food, beverage, health, home, and beauty, has been a key strategy. This diversification has allowed Alto Ingredients to adapt to changing consumer demands.

The company is pursuing carbon capture and storage (CCS) capabilities at its Pekin campus. This long-term initiative aims to reduce its carbon footprint and create value from CO2 production, with the EPA Class VI permit application deemed complete in February 2025.

Achieving certifications such as Safe Food/Safe Feed and EcoVadis Bronze Medals, and completing a SMETA Pillar 4 audit in 2025, has helped Alto Ingredients access premium markets and strengthen customer relationships.

Processing corn into various valuable products, including high-protein feed for animal nutrition, pet food ingredients, and renewable fuel, demonstrates Alto Ingredients' commitment to maximizing the value of its raw materials.

The acquisition of a beverage-grade liquid CO2 processing facility in January 2025, adjacent to the Columbia plant, is a strategic move. It is aimed at bolstering economics and increasing asset valuation with a payback period of less than two years.

A 16% reduction in the workforce during Q4 2024 and Q1 2025, expected to result in approximately $8 million in annual savings starting in Q2 2025, reflects the company's commitment to improving profitability.

Alto Ingredients faced significant challenges, particularly in 2024 and into 2025. Difficult market conditions led to a net loss of $11.7 million in Q1 2025, similar to Q1 2024. Operational disruptions, such as the cold spike at its Pekin campus in January 2024, increased transportation expenses and reduced production rates.

Alto Ingredients faced difficult market conditions throughout 2024 and into 2025, contributing to financial losses. The company reported a net loss of $42.0 million for the fourth quarter of 2024, compared to a $19.3 million loss in the same period of 2023.

Operational challenges, including a cold spike at the Pekin campus in January 2024, increased transportation expenses, and reduced production rates, impacted the company's performance. These disruptions added to the financial strain.

Lower alcohol premiums and the negative impact of increased renewable diesel and soy crush capacity on corn oil and protein market prices in its operating regions added to the challenges. This made operating the Magic Valley plant unprofitable, leading to its cold idling in late 2024.

Regulatory hurdles, particularly concerning the CCS initiatives, with pending legislation in Illinois potentially affecting proposed CO2 storage locations, complicated the company's efforts. These regulatory uncertainties added to the operational challenges.

In response to these challenges, Alto Ingredients has undertaken significant restructuring and cost-saving initiatives. This includes a 16% reduction in its workforce during Q4 2024 and Q1 2025, expected to result in approximately $8 million in annual savings starting in Q2 2025.

The Magic Valley plant was rendered unprofitable due to market pressures, leading to its cold idling in late 2024. This decision reflects the difficult market conditions and the need for strategic adjustments.

To navigate these hurdles, Alto Ingredients has implemented restructuring and cost-saving measures. The acquisition of a beverage-grade liquid CO2 processing facility in January 2025 is part of a strategic move to bolster economics. For more insights into the company's strategic approach, you can explore the Marketing Strategy of Alto Ingredients.

Alto Ingredients Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Alto Ingredients?

The Alto Ingredients company has a dynamic history, evolving from its inception as Pacific Ethanol, Inc. in 2003. The company expanded its ethanol production capabilities significantly by 2009, building multiple production facilities. A name change to Alto Ingredients, Inc. in January 2021 reflected a strategic shift, followed by a headquarters relocation to Pekin, Illinois. Recent developments include the acquisition of Eagle Alcohol in January 2022 and of Kodiak Carbonic LLC in January 2025, along with strategic moves in renewable fuel and carbon capture.

| Year | Key Event |

|---|---|

| 2003 | Founded as Pacific Ethanol, Inc. |

| 2009 | Built four production facilities in the Western states. |

| 2018 | Sold its last production facility in California, a CO2 facility near Stockton. |

| January 2021 | Changed its name from Pacific Ethanol, Inc. to Alto Ingredients, Inc. |

| March 2021 (approx.) | Shifted headquarters from Sacramento, California to Pekin, Illinois. |

| January 2022 | Acquired 100% of the membership interests of Eagle Alcohol for $14.0 million in cash. |

| Mid-2024 | Pekin campus earned ISCC certification, enabling exports of qualified renewable fuel to European markets. |

| Q4 2024 | Implemented cost-saving initiatives, including cold idling the Magic Valley plant and a 16% reduction in headcount. |

| January 1, 2025 | Acquired a beverage-grade liquid CO2 processor (Kodiak Carbonic LLC) adjacent to its Columbia site. |

| February 2025 | EPA Class VI permit application for carbon capture at Pekin campus deemed complete. |

| March 5, 2025 | Reported Q4 and year-end 2024 financial results, with net sales of $236.3 million and a net loss of $42.0 million for the quarter. |

| March 18, 2025 | Announced two long-standing directors would not stand for re-election at the 2025 Annual Meeting. |

| May 7, 2025 | Reported Q1 2025 financial results, showing a net loss of $11.7 million and net sales of $226.5 million. |

| June 25, 2025 | Scheduled Annual Meeting of Stockholders. |

Alto Ingredients is prioritizing higher-margin production and improved profitability. Key initiatives include optimizing its asset base and targeting premium markets. The company is also heavily invested in carbon capture and storage (CCS) at its Pekin facilities.

Cost-saving measures are expected to yield approximately $8 million annually starting in Q2 2025. These savings are driven by workforce reductions and operational streamlining. The company aims to improve overall financial health through these efforts.

In Q4 2024, Alto Ingredients reported net sales of $236.3 million and a net loss of $42.0 million. Q1 2025 results showed a net loss of $11.7 million with net sales of $226.5 million. The company is working towards profitability through various strategic actions.

Analyst predictions suggest a potential stock price increase of 77.12% from its June 3, 2025 price of $0.928, with an average price target of $1.6437. The company is also considering strategic transactions to enhance long-term value and is optimistic about 2025.

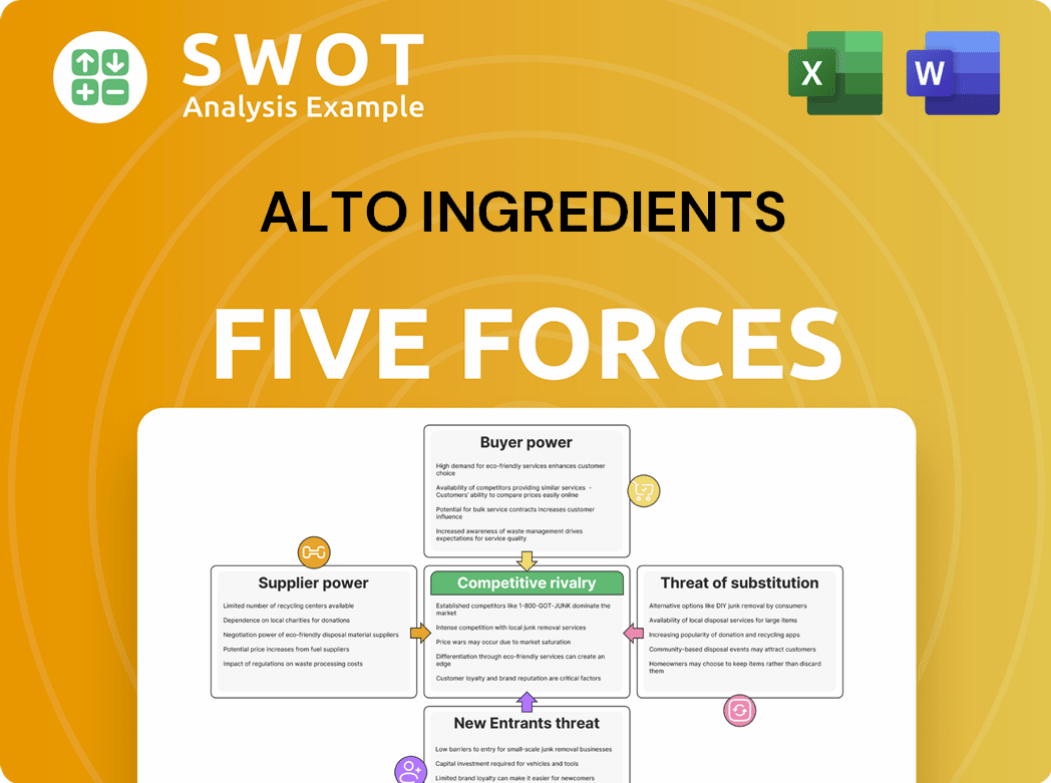

Alto Ingredients Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Alto Ingredients Company?

- What is Growth Strategy and Future Prospects of Alto Ingredients Company?

- How Does Alto Ingredients Company Work?

- What is Sales and Marketing Strategy of Alto Ingredients Company?

- What is Brief History of Alto Ingredients Company?

- Who Owns Alto Ingredients Company?

- What is Customer Demographics and Target Market of Alto Ingredients Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.