Alto Ingredients Bundle

Can Alto Ingredients Thrive in the Evolving Renewable Energy Sector?

Alto Ingredients, Inc. is a key player in the renewable fuels market, producing specialty alcohols and essential ingredients. Understanding the Alto Ingredients SWOT Analysis is crucial for grasping its position in a dynamic industry. The company's growth strategy is essential for navigating the complexities of renewable fuels and specialty chemicals.

This analysis will explore Alto Ingredients' future prospects, examining its expansion plans, innovation strategies, and overall market position. The company's commitment to sustainable energy and ethanol production positions it to capitalize on the growing demand for renewable solutions. We will delve into how Alto Ingredients' business model and strategic initiatives are designed to enhance its financial performance and market share within the competitive landscape of biofuel production.

How Is Alto Ingredients Expanding Its Reach?

The company's growth strategy involves several expansion initiatives designed to strengthen its market position and diversify revenue streams. These initiatives are crucial for accessing new customer segments, mitigating risks associated with a single market, and responding proactively to industry changes. The company aims to leverage opportunities in the renewable fuels market and beyond.

One of the key focuses is the optimization and expansion of specialty alcohol production. This includes upgrading existing facilities to increase output and efficiency and developing new products for high-growth industrial and consumer applications. The company is also likely to continue maximizing the value of its co-products, such as animal feed and corn oil, from its existing production processes. The company's strategic communications often highlight a commitment to continuous improvement and market responsiveness.

These efforts align with the broader trends in the sustainable energy sector, where demand for renewable fuels continues to evolve. The company's ability to adapt and expand its operations will be critical to its long-term success.

The company is exploring new market entries, both geographically and within additional product categories. This strategy aims to diversify its customer base and reduce dependency on any single market. Expansion into new markets is a key component of the overall Alto Ingredients Growth Strategy.

The company may pursue mergers and acquisitions to consolidate its position or gain access to new technologies and customer bases. These strategic moves can accelerate growth and provide access to resources that would be difficult to develop organically. This approach is part of the company's long-term vision for Alto Ingredients Company Analysis.

Enhancing existing facilities to increase output and efficiency is a priority. This includes upgrading equipment and processes to meet growing demand. The company is also focused on developing new products tailored for specific high-growth industrial and consumer applications. This focus is vital for the company's future prospects.

The company will continue to leverage its co-products, such as animal feed and corn oil, to maximize value from its existing production processes. This approach helps improve overall profitability and sustainability. Efficient co-product utilization is an important part of the company's business model.

The company's strategic communications often emphasize a commitment to continuous improvement and market responsiveness. This includes adapting to changes in industry demand and proactively seeking new opportunities. This proactive approach is critical for maintaining a competitive edge in the Renewable Fuels Market.

- Continuous improvement of existing operations.

- Proactive response to industry changes.

- Expansion into new product categories.

- Geographic expansion to access new markets.

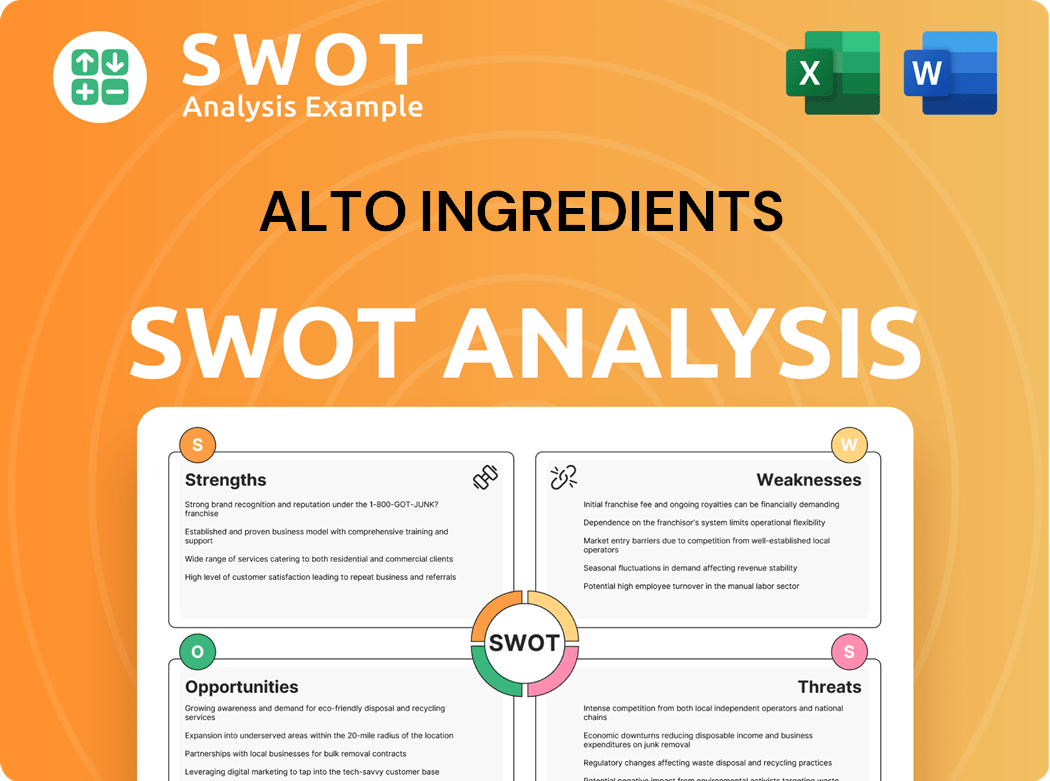

Alto Ingredients SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Alto Ingredients Invest in Innovation?

The innovation and technology strategy of the company is central to its growth, focusing on optimizing production and developing new, high-value products. This includes investments in research and development to improve the efficiency of alcohol production and enhance the quality of specialty ingredients. The company also collaborates with external innovators to integrate cutting-edge solutions.

Digital transformation and automation are key to the company's operational strategy, aiming for improved plant performance, reduced costs, and consistent product quality. The company's focus on renewable products demonstrates a commitment to technological advancement, aligning with broader sustainability initiatives.

The company's approach to innovation is geared towards meeting evolving market demands, particularly in the renewable fuels and sustainable energy sectors. This includes the development of lower carbon intensity fuels and ingredients, showcasing an innovative approach to address current challenges.

The company invests in research and development to enhance its production processes and develop new products. These investments are crucial for improving the efficiency of ethanol production and the quality of specialty ingredients.

Digital transformation and automation are integral to the company's operational strategy. This leads to improved plant performance, reduced operational costs, and enhanced product consistency.

The company's focus on producing high-quality, renewable products demonstrates a commitment to technological advancement. This aligns with broader sustainability initiatives and evolving market demands.

The company often collaborates with external innovators or technology providers. This integration of cutting-edge solutions helps to enhance its production capabilities and product offerings.

The company focuses on developing lower carbon intensity fuels and ingredients. This innovation showcases their approach to meeting the changing needs of the market.

By leveraging technology, the company aims to improve plant performance. This includes enhancing operational efficiency and reducing associated costs.

The company's innovation strategy is multifaceted, focusing on several key areas to drive growth and maintain a competitive edge in the Alto Ingredients Growth Strategy. These strategies are designed to enhance operational efficiency, develop new products, and meet evolving market demands.

- Research and Development: Continuous investment in R&D to improve ethanol production efficiency and enhance the quality of specialty ingredients.

- Digital Transformation and Automation: Implementing digital solutions and automation across operations to improve plant performance, reduce costs, and ensure product consistency.

- Collaboration and Partnerships: Working with external innovators and technology providers to integrate cutting-edge solutions.

- Sustainability Initiatives: Developing lower carbon intensity fuels and ingredients to align with broader sustainability goals and meet market demands for renewable products.

- Product Innovation: Focusing on the development of new products and technologies to expand the product portfolio and increase revenue streams.

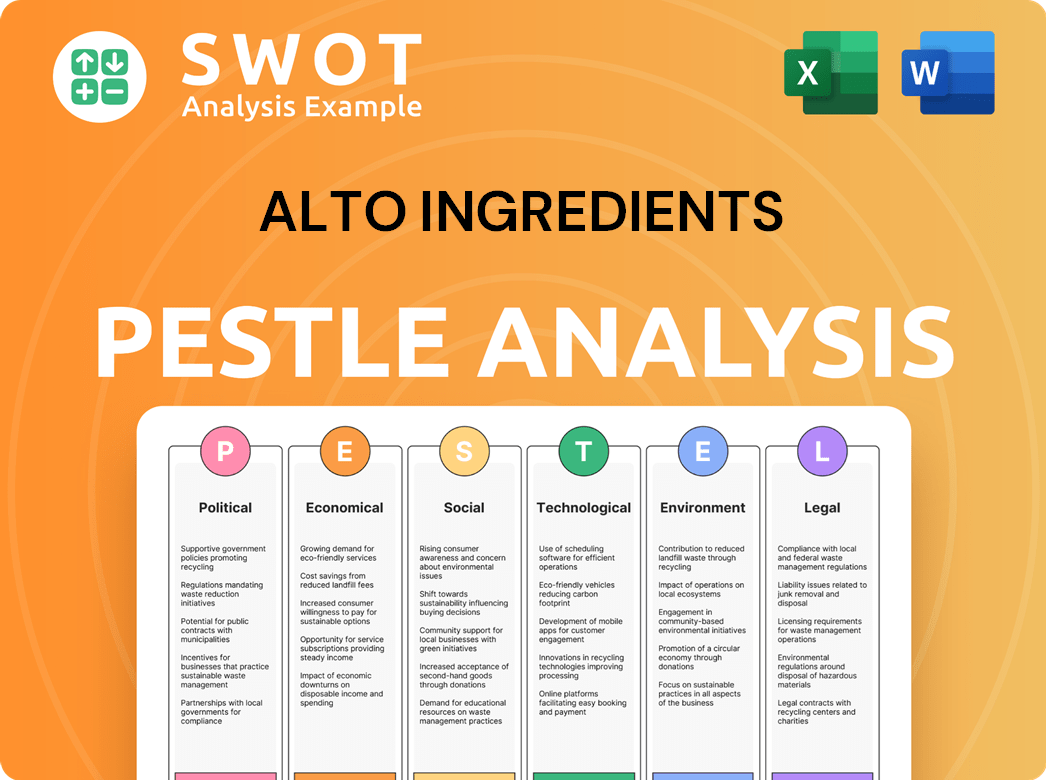

Alto Ingredients PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Alto Ingredients’s Growth Forecast?

The financial outlook for Alto Ingredients is closely tied to its operational efficiency, market demand for specialty alcohols and renewable fuels, and its ability to manage input costs. The company's financial strategy generally focuses on optimizing its asset base and maximizing shareholder value. Recent financial reports indicate a focus on improving profitability through strategic initiatives like increasing specialty alcohol production and reducing debt.

Financial ambitions are often compared to historical performance and industry benchmarks within the renewable fuels and specialty chemicals sectors. Alto Ingredients may engage in capital raises or strategic financing to support growth, particularly for facility upgrades, expansion into new product lines, or potential acquisitions. The overall financial narrative emphasizes sustainable growth, operational excellence, and a focus on high-margin products to ensure long-term financial health.

Understanding Marketing Strategy of Alto Ingredients provides further insights into how the company plans to achieve its financial objectives. The company's financial performance is closely monitored by investors and analysts, with regular updates provided through quarterly earnings reports and annual financial statements. These reports offer crucial data for assessing the company's financial health and future prospects.

Alto Ingredients' financial performance is a key indicator of its success in the Renewable Fuels Market. Investors and stakeholders closely monitor metrics such as revenue, gross profit margin, and net income. These figures are essential for evaluating the company's profitability and growth potential.

Ethanol Production is a significant revenue driver for Alto Ingredients. The volume of ethanol produced and sold directly impacts the company's top-line revenue. Changes in ethanol prices and production costs can significantly affect profitability.

The company's financial strategy is closely aligned with its commitment to Sustainable Energy. Investments in renewable diesel and carbon capture projects are examples of how the company is positioning itself for long-term financial success within the sustainable energy sector.

The Alto Ingredients Stock Forecast is influenced by various factors, including market trends, industry developments, and company-specific performance. Investors often analyze financial reports and market data to make informed decisions about the company's stock.

The Q3 earnings report provides a snapshot of the company's recent financial performance. It includes key metrics such as revenue, earnings per share (EPS), and cash flow. Analyzing the Q3 earnings report is crucial for understanding the company's current financial health.

The Competitive Landscape in the renewable fuels market affects Alto Ingredients' financial performance. Competitors' actions, market share, and pricing strategies all influence the company's profitability and growth. Understanding the competitive environment is essential for strategic planning.

Alto Ingredients' Business Model focuses on ethanol production, specialty alcohols, and renewable fuels. The efficiency of this model directly impacts its financial performance. The company's ability to manage costs and maximize production efficiency is critical for its financial success.

Expansion Plans, such as facility upgrades and new product lines, require significant capital investments. These investments are strategically designed to increase revenue and improve profitability. The financial implications of expansion are carefully considered in the company's strategy.

Alto Ingredients' Market Share in the renewable fuels sector is a key indicator of its competitive position. Increased market share can lead to higher revenues and improved financial performance. The company's strategies are often aimed at increasing its market presence.

Biofuel Production Capacity directly impacts the company's revenue potential. The ability to produce biofuels efficiently and at scale is essential for financial success. Investments in production capacity are a crucial part of the company's financial strategy.

Alto Ingredients Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Alto Ingredients’s Growth?

The future of Alto Ingredients' Growth Strategy and its prospects are subject to several risks and obstacles. These challenges range from market pressures and regulatory changes to internal operational hurdles. Successfully navigating these issues is critical for the company to achieve its expansion plans and maintain its position in the Renewable Fuels Market.

Market competition, especially from larger chemical companies and emerging renewable fuel producers, presents a continuous challenge. Fluctuations in commodity prices, such as corn and natural gas, which are key inputs for Ethanol Production, also pose a significant risk. These factors can directly impact production costs and profit margins, affecting the company's financial performance analysis.

Regulatory changes and technological disruptions could also pose significant threats. Environmental policies and fuel standards can influence demand, while the emergence of alternative production methods could impact the company's long-term viability. Internal resource constraints, including access to skilled labor and capital, may further hinder expansion efforts and affect its biofuel production capacity.

The Renewable Fuels Market is highly competitive, with numerous players vying for market share. Competition can come from established chemical companies and new entrants in the sustainable energy sector. This competitive landscape can put downward pressure on prices and margins.

Corn and natural gas prices are subject to significant fluctuations, influencing Ethanol Production costs. High corn prices increase the cost of feedstock, while rising natural gas prices raise energy expenses. This volatility can squeeze profit margins and affect financial performance.

Changes in environmental policies and fuel standards can significantly impact the demand for Alto Ingredients' products. Regulations regarding carbon emissions and renewable fuel mandates can affect the company's market access and profitability. Staying compliant with evolving regulations is crucial.

The emergence of new technologies or alternative production methods poses a long-term risk. If more efficient or cost-effective methods of biofuel production arise, Alto Ingredients' business model could be challenged. Continuous innovation and adaptation are essential.

Access to skilled labor and capital for expansion projects can limit growth. Securing adequate funding and maintaining a skilled workforce are critical for supporting expansion plans. These constraints can affect the company's ability to increase its biofuel production capacity.

Economic downturns can reduce demand for fuel and impact the profitability of ethanol production. Reduced consumer spending and lower industrial activity can decrease the overall market for renewable fuels. This can negatively impact Alto Ingredients' stock forecast.

Alto Ingredients addresses these risks by diversifying its product portfolio, optimizing operational efficiency, and closely monitoring regulatory changes. Risk management frameworks and scenario planning are likely employed to prepare for market shifts and operational challenges. The company's sustainability initiatives and carbon capture projects are also crucial.

The risks can directly impact Alto Ingredients' financial performance, including its revenue, profitability, and stock price. Fluctuations in commodity prices, regulatory changes, and market competition can influence the company's Q3 earnings report and overall financial health. Investors should consider these factors.

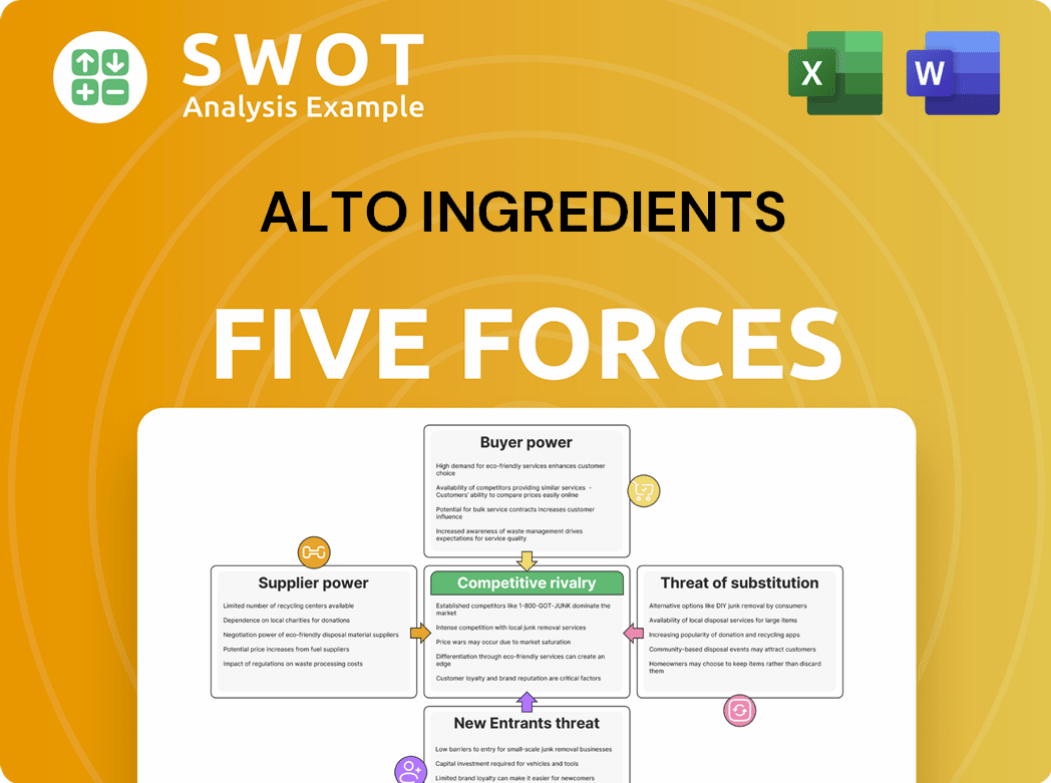

Alto Ingredients Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Alto Ingredients Company?

- What is Competitive Landscape of Alto Ingredients Company?

- How Does Alto Ingredients Company Work?

- What is Sales and Marketing Strategy of Alto Ingredients Company?

- What is Brief History of Alto Ingredients Company?

- Who Owns Alto Ingredients Company?

- What is Customer Demographics and Target Market of Alto Ingredients Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.