Alto Ingredients Bundle

Decoding Alto Ingredients: How Does This Biofuel Giant Operate?

Alto Ingredients Company, a key player in renewable energy, is transforming agricultural resources into sustainable fuel and high-value alcohol products. Its recent acquisition of a beverage-grade liquid CO2 processing facility in January 2025 underscores its commitment to innovation. This strategic move is just one example of how Alto Ingredients SWOT Analysis can help understand the company's position.

As a leading producer of specialty alcohols and renewable fuels, understanding the Alto Ingredients business model is crucial. The company's focus on ethanol production, sustainable practices, and its diverse product portfolio serving multiple markets, like health, home & beauty, and renewable fuels, positions it uniquely. This overview will explore Alto Ingredients' operations, including its financial performance, and how it navigates the dynamic biofuel industry, providing insights for investors and industry watchers alike.

What Are the Key Operations Driving Alto Ingredients’s Success?

The core operations of the Alto Ingredients Company revolve around the production and distribution of specialty alcohols, renewable fuels, and essential ingredients. This involves converting natural grain feedstock, primarily corn, into a diverse range of products. These products serve various markets, including health, home & beauty, food & beverage, industry & agriculture, and renewable fuels.

The company's value proposition lies in its integrated approach, from sourcing raw materials to delivering finished products. They focus on optimizing carbon utilization and pursuing sustainability certifications. This commitment to environmental responsibility allows them to offer high-quality, certified ingredients and fuels, differentiating them in the market.

As of 2023, the company processed approximately 150 million bushels of corn annually. They partner with numerous corn and grain suppliers across the Midwest United States. Their facilities, such as the Pekin campus, utilize continuous fermentation distilleries to produce high-value products. Logistics and distribution are critical, with products shipped via barge, rail, and truck to both domestic and international markets.

The company's primary focus is ethanol production, a key component of renewable fuels. This involves the fermentation of corn to produce fuel-grade ethanol. The process is designed for efficiency and scalability, allowing the company to meet the demands of the biofuel industry.

Beyond ethanol, the company produces a range of by-products and specialty alcohols. These include distillers grains for animal feed and various grades of ethyl alcohol used in pharmaceuticals, cosmetics, and food and beverages. This diversification enhances revenue streams and market resilience.

The company emphasizes sustainable practices, including carbon capture and waste minimization. The Pekin campus earned ISCC certification in mid-2024, enabling the export of qualified renewable fuel to European markets at a premium. This commitment aligns with growing environmental regulations and consumer preferences.

Strategic acquisitions, such as the January 2025 purchase of a beverage-grade liquid CO2 processing facility, enhance operational efficiency. This integration supports the company's goal of maximizing resource utilization and minimizing environmental impact. These moves also improve productivity.

The company's operational efficiency and sustainability initiatives are key to its success. These efforts translate into significant benefits for customers and the environment.

- Processing approximately 150 million bushels of corn annually (2023).

- ISCC certification at the Pekin campus (mid-2024).

- Acquisition of a beverage-grade liquid CO2 processing facility (January 2025).

- Use of continuous fermentation distilleries.

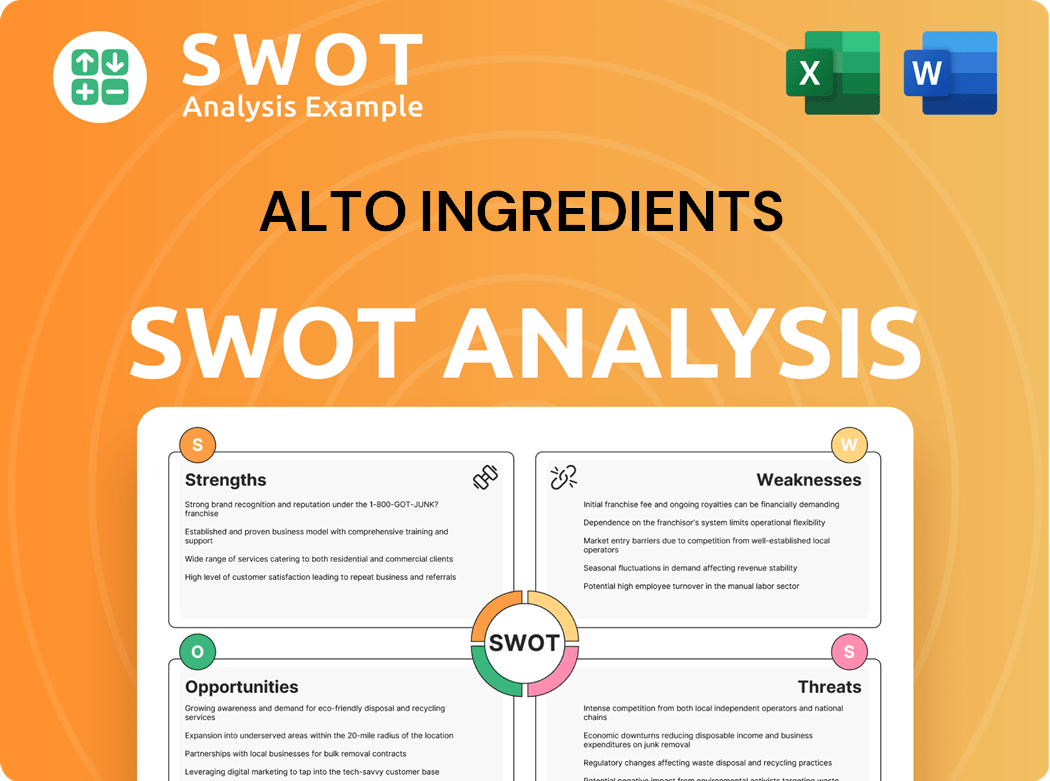

Alto Ingredients SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Alto Ingredients Make Money?

The Alto Ingredients Company generates revenue through various product sales, including specialty alcohols, renewable fuels like ethanol, and essential ingredients such as animal feed and corn oil. The company's financial performance reflects its diverse revenue streams, with sales figures providing insights into its business operations. The company's approach includes strategic measures to enhance profitability and adapt to market dynamics.

Alto Ingredients employs several strategies to monetize its products and services. These include targeting premium markets, optimizing its asset base, and expanding higher-margin production. Cost-cutting measures also play a role in improving financial outcomes, indirectly impacting net revenue and overall profitability. The company continuously evaluates new revenue stream opportunities to leverage its facilities and boost shareholder value.

For the first quarter of 2025, Alto Ingredients reported total net sales of $226.5 million. This is a decrease compared to the $240.6 million in Q1 2024. For the full year 2024, net sales were $965.3 million, down from $1,222.9 million in 2023. The company's ability to adapt to market changes is crucial for its financial health.

The company focuses on premium markets to boost revenue. For instance, sales of ISCC-certified renewable fuel to European markets generated a $1.4 million benefit from premium prices in Q1 2025.

Strategic cost reductions are implemented to improve profitability. The cold idling of the Magic Valley plant and a 16% reduction in headcount during Q4 2024 and Q1 2025 are expected to save approximately $8 million annually starting in Q2 2025.

Changes in market conditions affect revenue sources. A decline in high-quality alcohol premiums in Q1 2025 led to $4.6 million in lower sales. A drop in the return for essential ingredients also impacted results.

The company continuously evaluates and adjusts its strategies. Alto Ingredients is actively exploring new revenue streams to leverage its flexible facilities and enhance long-term shareholder value.

Alto Ingredients' revenue is derived from a diverse product portfolio. This includes specialty alcohols, renewable fuels (ethanol), and essential ingredients like animal feed and corn oil.

The company's financial performance is influenced by its revenue streams and monetization strategies. For instance, the decline in net sales from 2023 to 2024 reflects market impacts and strategic decisions.

The Alto Ingredients business model involves a multifaceted approach to generate income, focusing on sales of ethanol production, renewable fuels, and essential ingredients. The company's ability to navigate market fluctuations and implement strategic adjustments is key to its financial success. To learn more about Alto Ingredients' strategic direction, you can read about the Growth Strategy of Alto Ingredients.

Alto Ingredients relies on several key revenue drivers to sustain its business. These drivers are essential for understanding the company's financial health and future prospects.

- Sales of specialty alcohols, which are used in various industrial applications.

- Revenue from renewable fuels, particularly ethanol, which is a significant component of the company's business.

- Sales of essential ingredients like animal feed and corn oil, which provide a diversified revenue stream.

- Premium pricing in specific markets, such as the European market for ISCC-certified renewable fuel.

- Cost-saving initiatives, including plant idling and workforce reductions, which indirectly impact profitability.

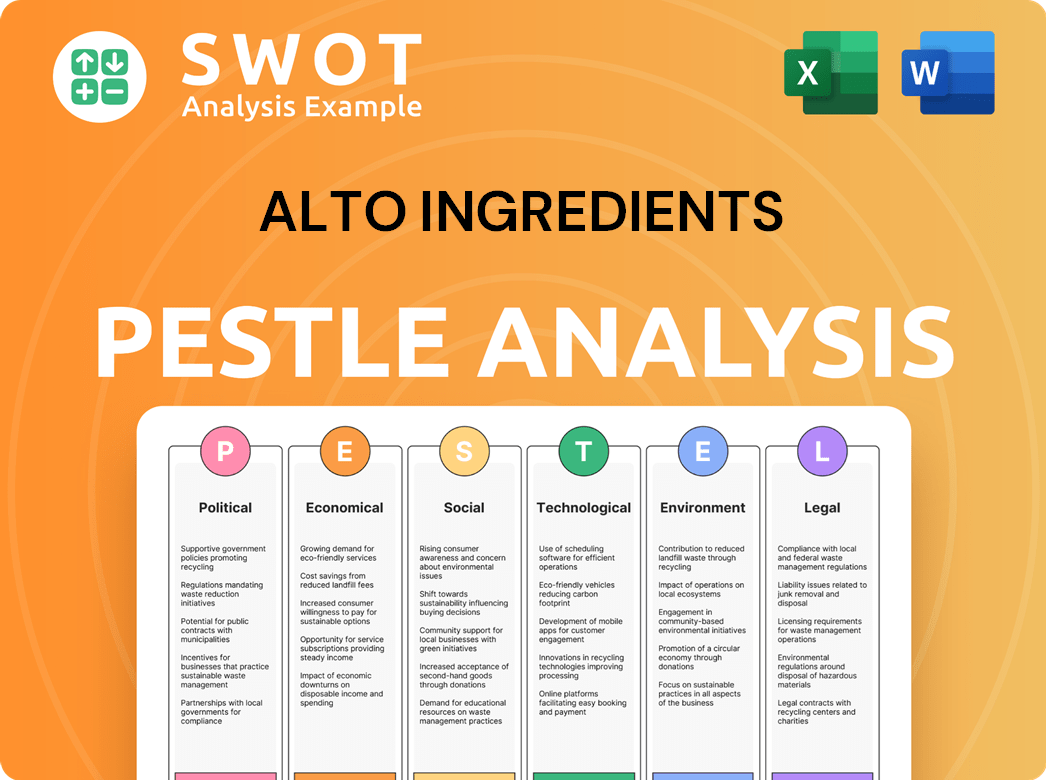

Alto Ingredients PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Alto Ingredients’s Business Model?

The strategic journey of Alto Ingredients is marked by key milestones, strategic shifts, and a focus on maintaining a competitive edge in the dynamic renewable fuels and specialty alcohols market. Recent moves, including acquisitions and operational adjustments, highlight the company's commitment to efficiency and market expansion. The company navigates challenges and capitalizes on opportunities to strengthen its position.

A significant move for Alto Ingredients was the acquisition of a beverage-grade liquid CO2 processing facility in January 2025, adjacent to its Oregon ethanol plant. This is expected to enhance operational efficiency. Furthermore, the company has been adapting to market conditions through strategic initiatives like obtaining ISCC certification for its Pekin campus in mid-2024, enabling exports of renewable fuel to European markets in Q4 2024.

Despite these strategic advancements, Alto Ingredients has faced headwinds, including challenging market conditions. The company has responded with decisive actions, such as idling its Magic Valley facility and reducing its workforce by 16% across Q4 2024 and Q1 2025. These steps aim to streamline operations and reduce costs. The company's financial performance in Q1 2025 reflects these challenges, with a net loss of $11.7 million and a decrease in net sales to $226.5 million.

Alto Ingredients acquired a beverage-grade liquid CO2 processing facility in January 2025, aiming to reduce costs and improve operational coordination. The Pekin campus earned ISCC certification in mid-2024, which allowed the company to begin exporting renewable fuel to European markets in Q4 2024. These moves reflect the company's strategic focus on efficiency and market expansion.

The company implemented several strategic moves to adapt to market conditions. These included idling the Magic Valley facility and reducing the workforce by 16% across Q4 2024 and Q1 2025. These actions were taken to eliminate unprofitable operations and reduce expenses. These moves were in response to market challenges.

Alto Ingredients' competitive advantages stem from its position as a leading producer of specialty alcohols in the U.S., diversified product offerings, and integrated supply chain management. The company emphasizes quality certifications and strategic partnerships. The company is also pursuing carbon capture and storage (CCS) initiatives.

In Q1 2025, Alto Ingredients reported a net loss of $11.7 million, consistent with Q1 2024. Net sales decreased to $226.5 million in Q1 2025 from $240.6 million in Q1 2024. The company anticipates annual savings of approximately $7.8 million to $8 million starting in Q2 2025 due to workforce reductions.

Alto Ingredients maintains a competitive edge through its position as a leading producer of specialty alcohols and its diversified product offerings. The company focuses on quality certifications, including Safe Food/Safe Feed and EcoVadis Bronze Medals. Strategic partnerships and integrated supply chain management further strengthen its market position. For more insights, you can explore the Competitors Landscape of Alto Ingredients.

- Leading producer of specialty alcohols in the U.S.

- Diversified product offerings.

- Integrated supply chain management.

- Strategic partnerships with suppliers and transportation companies.

- Commitment to sustainability, including carbon capture initiatives.

Alto Ingredients Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Alto Ingredients Positioning Itself for Continued Success?

The Alto Ingredients Company holds a significant position as a leading producer and distributor of specialty alcohols, renewable fuels, and essential ingredients within the United States. Its wide-ranging product offerings span various markets, including health, home & beauty, food & beverage, industrial & agriculture, and renewable fuels. The company's commitment to high-quality products and certifications, such as Safe Food/Safe Feed and ISCC certification for renewable fuels, supports customer loyalty.

However, Alto Ingredients faces several key risks, including adverse economic and market conditions, fluctuations in raw material costs, and regulatory changes. The company has experienced financial challenges, reporting a net loss of $60.3 million for the full year 2024. Looking ahead, strategic initiatives focus on cost-saving measures, asset sales, and exploring new revenue streams to improve profitability and position the company for future growth. You can learn more about the Marketing Strategy of Alto Ingredients.

As a major player in the biofuel industry, Alto Ingredients is involved in ethanol production and the distribution of renewable fuels. The company's diverse product portfolio and certifications highlight its commitment to quality and sustainability. The company's reach into diverse markets reflects its broad operational scope.

Key risks include adverse economic conditions, fluctuations in raw material costs, and regulatory changes. The company's carbon capture and storage (CCS) project faces regulatory hurdles. Additionally, competition and technological disruptions in the renewable energy sector pose ongoing threats. The company reported a net loss of $60.3 million for 2024.

Alto Ingredients is focused on improving profitability through cost-saving measures and asset optimization. The company is exploring strategic transactions and new revenue streams. While analysts project unprofitability over the next three years, the company's strategic focus on efficiency, asset optimization, and sustainability aims to sustain and expand its ability to generate revenue.

The company is implementing cost-saving measures, focusing on efficiency improvements in water and energy usage. Asset sales, mergers, or other strategic transactions are being considered to rationalize underperforming assets. The focus is on optimizing carbon, including the newly acquired liquid CO2 processing facility, and evaluating new revenue streams.

The company reported a net loss of $60.3 million for 2024, including significant asset impairments. Analysts forecast the company to remain unprofitable over the next three years, with revenue growth projected at 2.4% per annum. These financial challenges highlight the need for strategic initiatives to improve profitability and shareholder value.

- Focus on cost-saving measures to improve efficiency.

- Explore asset sales and strategic transactions to optimize the portfolio.

- Evaluate new revenue streams to leverage existing facilities.

- Improvement in water and energy efficiency.

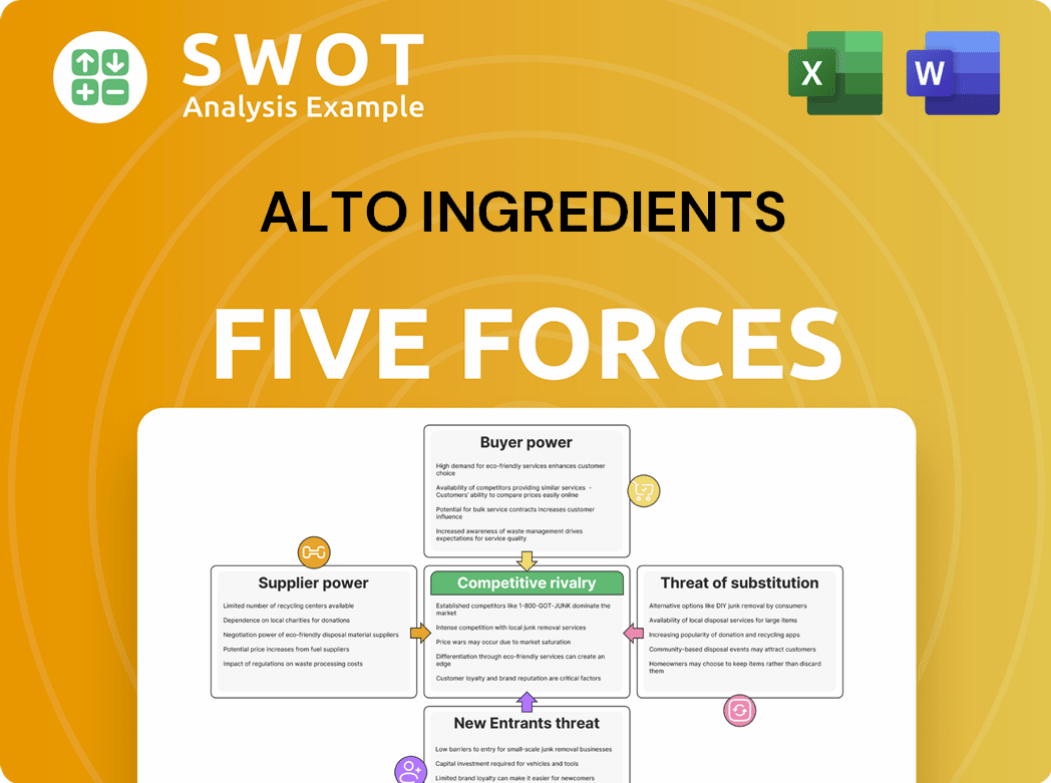

Alto Ingredients Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Alto Ingredients Company?

- What is Competitive Landscape of Alto Ingredients Company?

- What is Growth Strategy and Future Prospects of Alto Ingredients Company?

- What is Sales and Marketing Strategy of Alto Ingredients Company?

- What is Brief History of Alto Ingredients Company?

- Who Owns Alto Ingredients Company?

- What is Customer Demographics and Target Market of Alto Ingredients Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.