amaysim Bundle

What's the Story Behind amaysim's Rise?

Amaysim, an Australian mobile virtual network operator (MVNO), revolutionized the telecommunications sector by prioritizing simplicity and affordability. Launched in 2010, the amaysim SWOT Analysis shows the company's foundational vision was to offer transparent and flexible mobile services, a stark contrast to the industry norms. This customer-centric approach allowed amaysim to quickly gain a significant market share.

From its inception, amaysim aimed to empower consumers with greater control over their mobile usage and spending. This focus on user experience and value proposition allowed the company to rapidly gain traction in the competitive Australian market. This brief history of amaysim will explore its origin story, early days, and key milestones, examining how amaysim Australia became a notable player in the mobile market.

What is the amaysim Founding Story?

The amaysim company's story began on June 1, 2010. It was founded by Peter O’Connell, Rolf Hansen, and Christian Magel. These founders saw a gap in the Australian mobile market for simpler, contract-free mobile plans.

Their initial aim was to provide straightforward prepaid mobile services. They operated as a mobile virtual network operator (MVNO) on the Optus network. The first product was a set of prepaid SIM-only mobile plans. These plans were designed for simplicity and flexibility, catering to customers who wanted ease of use.

The name 'amaysim' was chosen to represent 'amazing simplicity,' reflecting the company's core values. Early funding came from seed rounds and strategic investments. This funding helped establish the necessary infrastructure and marketing to launch their services. A major challenge was entering a market already dominated by large telecommunications companies. To overcome this, they focused on differentiating themselves through pricing and customer service.

amaysim was founded on June 1, 2010, by Peter O’Connell, Rolf Hansen, and Christian Magel.

- The founders aimed to offer simple, contract-free mobile plans.

- They launched with prepaid SIM-only mobile plans.

- Initial funding came from seed rounds and strategic investments.

- The company faced the challenge of competing with established telecom giants.

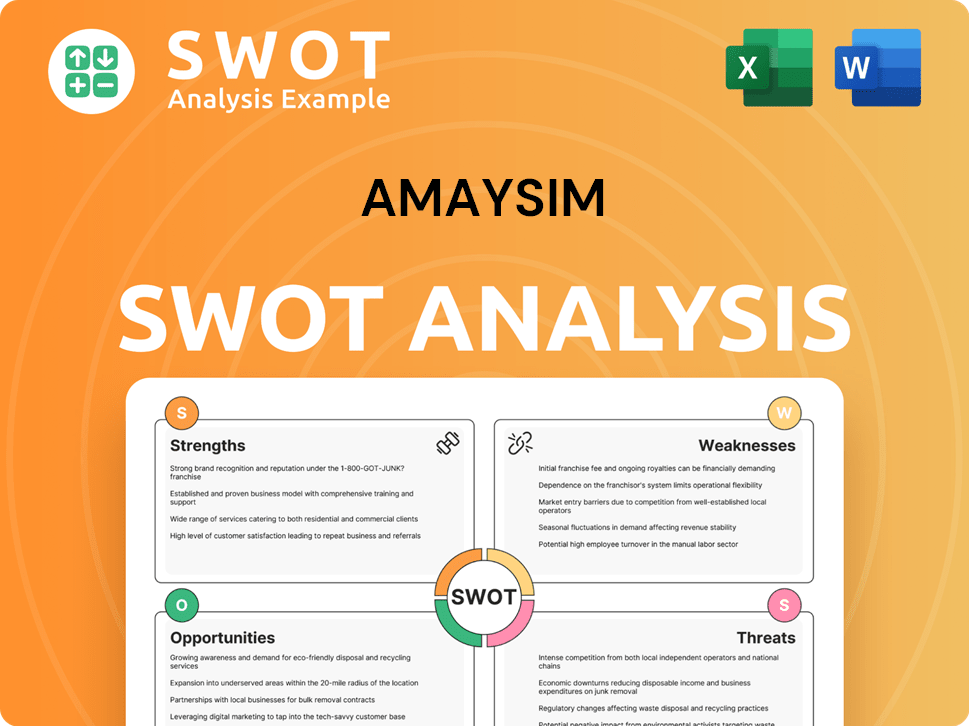

amaysim SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of amaysim?

Following its launch, the amaysim company quickly gained traction. This early success was driven by its straightforward and adaptable prepaid mobile plans, which resonated with consumers. The company prioritized digital customer acquisition and user-friendly online platforms to attract new subscribers.

amaysim's strategy centered on digital marketing and a user-friendly website to acquire customers. They introduced various data allowances and unlimited talk and text options to meet diverse customer needs. Customer feedback played a crucial role in refining offerings.

The company experienced significant subscriber and revenue growth early on. By 2015, amaysim had over 700,000 subscribers, showcasing strong market acceptance. The company's Initial Public Offering (IPO) on the Australian Securities Exchange (ASX) in 2015 raised approximately AUD 200 million. This funding supported platform enhancements and market position strengthening.

amaysim differentiated itself by focusing on a pure-play MVNO model, avoiding service bundling complexities. This focus on its core offering was pivotal in its early success. The company's ability to offer competitive pricing, as highlighted in an article about the Target Market of amaysim, further contributed to its growth.

amaysim's early success significantly impacted the mobile market. The company's focus on simplicity and value resonated with a broad customer base. The strategic decisions made during this period laid the foundation for its future trajectory.

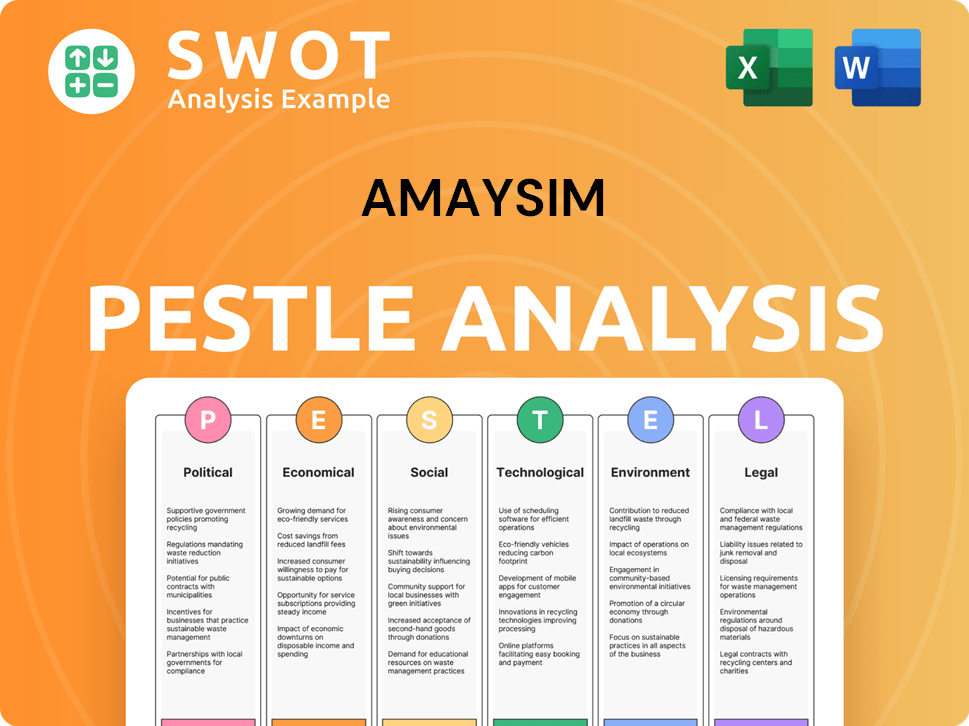

amaysim PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in amaysim history?

The amaysim company has a history marked by significant milestones and strategic shifts within the competitive Australian mobile market. From its early days, the company has navigated a dynamic landscape, achieving notable successes and adapting to various challenges. Its journey reflects key strategies in the telecommunications industry.

| Year | Milestone |

|---|---|

| 2010 | amaysim was founded, entering the Australian mobile market as a Mobile Virtual Network Operator (MVNO). |

| 2017 | amaysim acquired Vaya, another Australian MVNO, expanding its customer base and market presence. |

| 2020 | Optus acquired amaysim's mobile business for AUD 250 million, marking a significant strategic shift. |

One of the key innovations of amaysim was its early adoption of a fully digital customer experience. This included everything from SIM activation to account management, which set a new standard in the industry. Furthermore, the company consistently offered competitive, data-rich plans and flexible options like data banking, which was popular with consumers.

amaysim pioneered a fully digital customer experience, streamlining processes from SIM activation to account management. This approach improved customer convenience and operational efficiency, setting a precedent in the industry.

The company consistently introduced competitive data plans, offering a variety of options to meet different customer needs. These plans played a crucial role in attracting and retaining customers in a highly competitive market.

amaysim introduced data banking, allowing customers to roll over unused data to the next month. This feature enhanced customer value and flexibility, which resonated well with consumers.

In 2017, amaysim acquired Vaya, expanding its customer base and market share through strategic acquisitions. This move demonstrated the company's growth strategy and market consolidation efforts.

The company faced intense competition from larger telcos and other MVNOs, requiring continuous innovation in pricing and service offerings. Market downturns and regulatory changes presented additional hurdles, necessitating agile responses and strategic adjustments. The acquisition by Optus in 2020, for AUD 250 million, was a significant strategic shift, allowing amaysim's mobile services to continue under the Optus umbrella.

amaysim faced fierce competition from major telecommunications companies and other MVNOs, requiring constant innovation. This competitive pressure demanded aggressive pricing strategies and enhanced service offerings.

Economic downturns and shifts in market conditions presented challenges, requiring strategic agility. These external factors necessitated quick adaptation to maintain market position and profitability.

Regulatory changes in the telecommunications sector introduced further challenges, necessitating strategic pivots. Adapting to these changes was crucial for compliance and sustained market presence.

The acquisition of amaysim's mobile business by Optus in 2020, for AUD 250 million, was a significant strategic move. This transition allowed amaysim to leverage Optus's resources while continuing to serve its customer base.

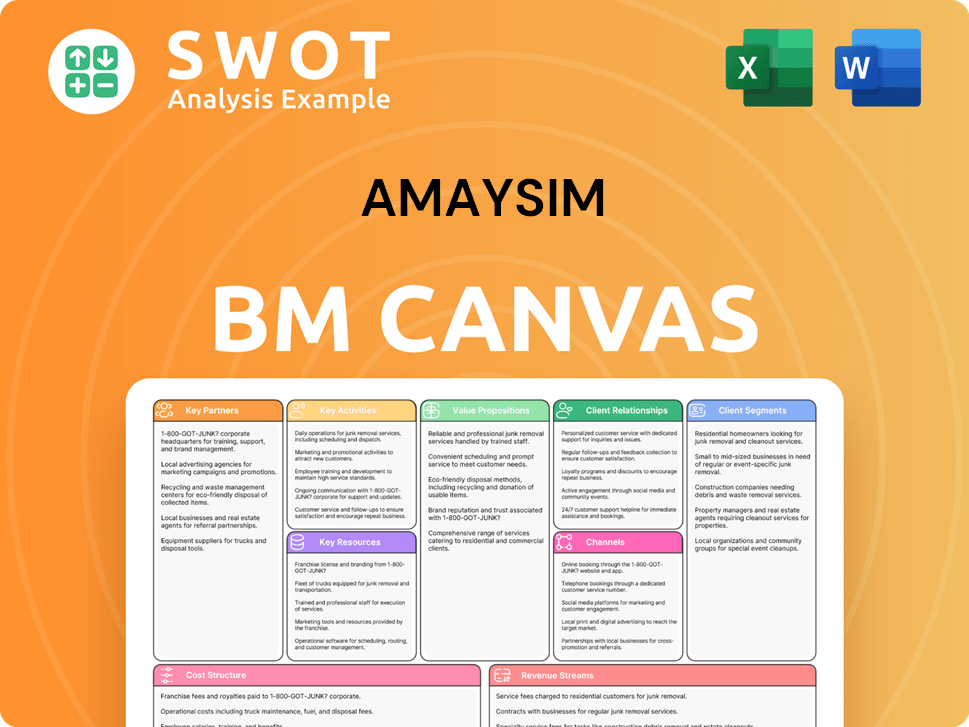

amaysim Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for amaysim?

Here's a look at the key milestones in the amaysim history, from its launch to its current standing within the telecommunications landscape. The amaysim company has seen significant changes since its inception.

| Year | Key Event |

|---|---|

| June 1, 2010 | amaysim officially launched its prepaid mobile services in amaysim Australia. |

| 2012 | Reached 100,000 customers, showcasing early market acceptance. |

| 2015 | Successfully completed an Initial Public Offering (IPO) on the ASX, raising AUD 200 million. |

| 2016 | Introduced data banking, allowing customers to roll over unused data. |

| 2017 | Acquired Vaya, another Australian MVNO, expanding its customer base. |

| 2017 | Expanded into the energy market with the acquisition of Click Energy. |

| 2018 | Reached 1 million mobile subscribers. |

| 2020 | amaysim's mobile business was acquired by Optus for AUD 250 million. |

| 2021 | amaysim's energy business (Click Energy) was sold to AGL. |

| 2024-2025 | Continues to operate as a distinct brand under the Optus umbrella, focusing on value-driven mobile plans. |

As of late 2024 and early 2025, amaysim continues to operate as a distinct brand under Optus, focusing on the value segment of the amaysim mobile market. This arrangement allows amaysim to leverage Optus's extensive infrastructure while retaining its brand identity and customer base. The acquisition by Optus has provided amaysim with financial stability and access to resources for further growth.

The company is expected to prioritize enhancing its digital customer experience and expanding its range of flexible mobile plans. The increasing demand for high-speed data will likely shape product development. Analyst predictions suggest a continued focus on customer retention and attracting new subscribers through competitive pricing. For more details, you can read about the Mission, Vision & Core Values of amaysim.

Industry trends, such as the growing demand for high-speed data and digital-first customer interactions, will likely influence amaysim's product development and marketing efforts. The competitive landscape in the Australian mobile market remains dynamic, with ongoing pressure on pricing and service offerings. amaysim is expected to adapt to these changes by focusing on value and customer satisfaction.

The future outlook for amaysim, now integrated into a larger entity, remains rooted in its founding vision of providing simple and affordable mobile solutions to the Australian market. The focus will likely be on maintaining a strong customer base and attracting new subscribers through competitive pricing and innovative offerings. The company's ability to adapt to evolving market demands will be crucial for its continued success.

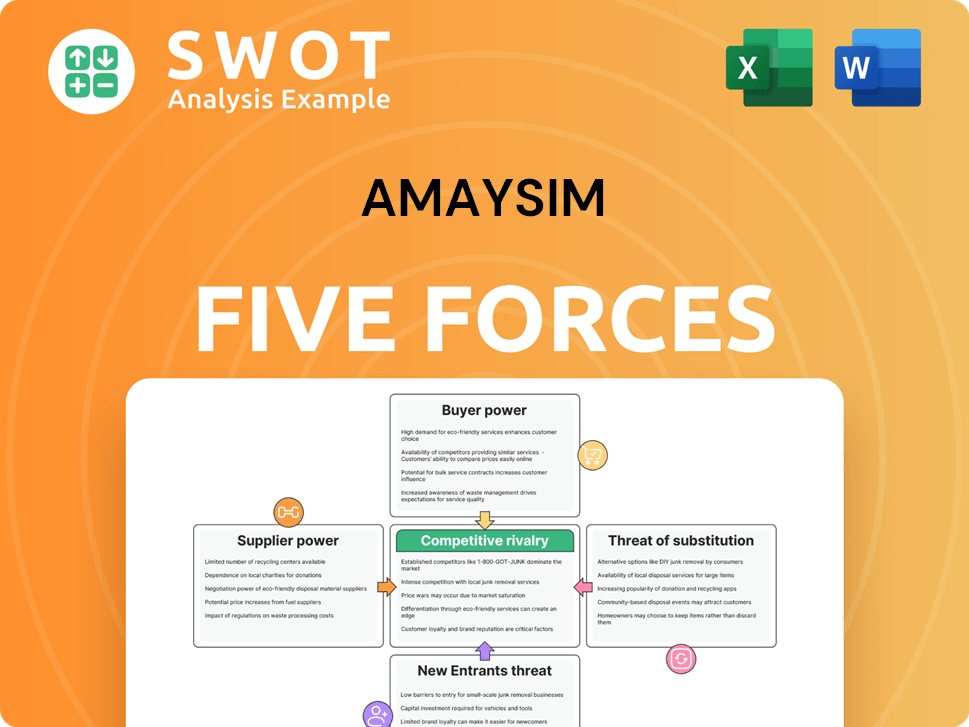

amaysim Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of amaysim Company?

- What is Growth Strategy and Future Prospects of amaysim Company?

- How Does amaysim Company Work?

- What is Sales and Marketing Strategy of amaysim Company?

- What is Brief History of amaysim Company?

- Who Owns amaysim Company?

- What is Customer Demographics and Target Market of amaysim Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.