amaysim Bundle

Who Does amaysim Serve? Unveiling Its Customer Base!

In the dynamic telecommunications industry, understanding amaysim SWOT Analysis is crucial for success. amaysim, a leading mobile service provider in Australia, has strategically navigated the market by deeply understanding its customer demographics and target market. This exploration delves into amaysim's journey, from its inception in 2010, offering affordable prepaid mobile plans, to its evolution in response to changing consumer needs.

The initial focus on budget-conscious consumers has evolved as amaysim has adapted to the growing demand for data and diverse digital services. This analysis examines the specifics of amaysim's customer segmentation, including amaysim customer age demographics, amaysim customer income levels, and amaysim customer gender distribution, to reveal how the company has maintained its competitive edge. By examining amaysim target audience location and amaysim customer interests and behaviors, we gain insight into how amaysim continues to refine its amaysim value proposition for customers and tailor its mobile phone plans to meet the evolving demands of the Australian market, impacting its amaysim market share australia.

Who Are amaysim’s Main Customers?

The primary customer segments for the mobile service provider are primarily consumers (B2C) within the Australian market. They focus on individuals who value affordability, flexibility, and simplicity in their mobile phone plans. The Growth Strategy of amaysim has always been centered around providing straightforward, value-driven options.

Their core customer demographics often include younger adults, students, and budget-conscious families. These groups are typically looking for prepaid options without being locked into long-term contracts. This approach allows customers to manage their spending effectively and avoid unexpected bills, a key factor in their customer segmentation strategy.

While specific, up-to-date data on age, gender, and income distribution for the current customer base isn't publicly detailed for 2024-2025, the company has historically attracted those seeking transparent pricing and control over their mobile expenses. The company leverages the Optus 4G and 5G networks, ensuring broad coverage that caters to a wide range of urban and suburban users, making it a strong contender in the telecommunications industry.

Over time, the company has observed shifts in its target segments, particularly with the increasing demand for data. They've adapted by introducing plans with larger data allowances and unlimited talk and text. This has broadened their appeal to include heavy data users who still prioritize affordability.

While individual consumers remain the primary focus, their flexible plans also serve small businesses and sole traders. These entities seek cost-effective mobile solutions without complex business contracts. The prepaid model also attracts temporary residents and international students needing easy-to-manage mobile services upon arrival in Australia.

The customer demographics for the company are diverse, but certain groups are more prevalent. The target market includes younger adults and students who are looking for affordable mobile phone plans. Budget-conscious families also find value in the prepaid options.

- Age: Primarily 18-35 years old, but expanding to include older demographics with increased data needs.

- Income: Wide range, with a strong appeal to those seeking value and control over their spending.

- Location: Urban and suburban areas across Australia, leveraging Optus network coverage.

- Usage: High data consumption, driven by streaming, social media, and general internet use.

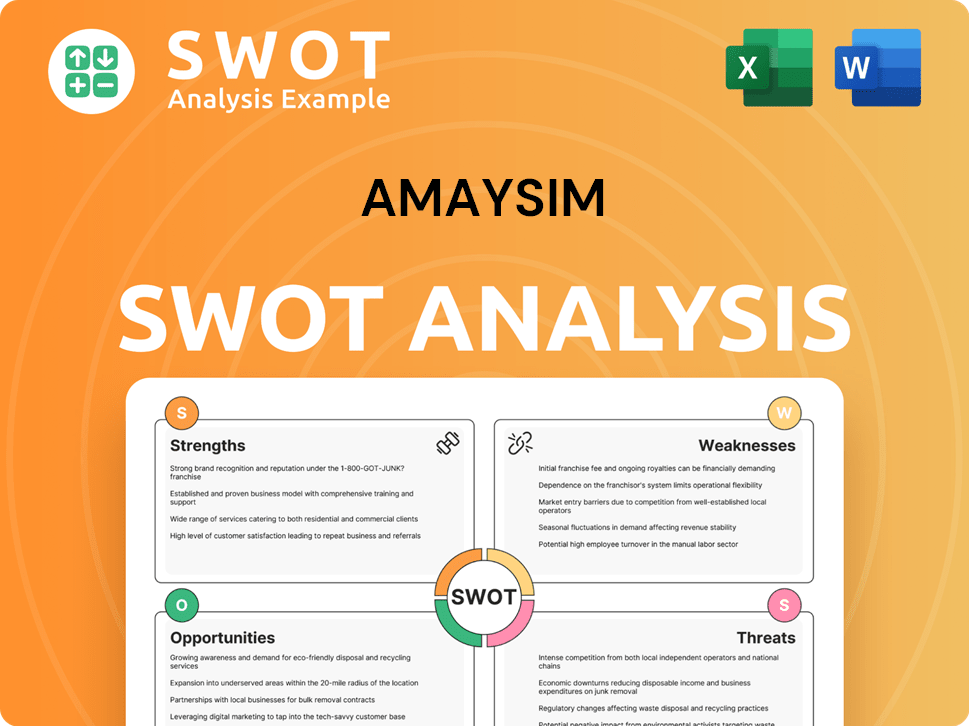

amaysim SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do amaysim’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, and the same holds true for the telecommunications industry. For the amaysim company, this involves a deep dive into what drives their customers' choices in the competitive market of mobile phone plans.

The primary drivers for amaysim's customer base revolve around affordability, flexibility, and ease of use. This is reflected in their preference for prepaid plans, which offer greater control over spending and eliminate the risk of unexpected bills. Customers are also drawn to the simplicity and transparency in pricing, a stark contrast to the often complex and opaque structures of traditional post-paid contracts.

The amaysim target market is significantly influenced by these factors, with a clear emphasis on value and convenience. The company's success hinges on meeting these needs by offering competitive data allowances, straightforward plans, and a hassle-free customer experience.

Customers are primarily attracted to amaysim for its cost-effective mobile phone plans. This is a key element in customer acquisition and retention.

The ability to change plans as needed is a significant draw, especially in a market where customer needs can vary. This flexibility is a major advantage of prepaid models.

Transparent pricing and easy-to-understand plans are crucial. Customers value the straightforward approach, avoiding the complexities often associated with traditional contracts.

Competitive data offerings are a major factor in customer decisions. The increasing demand for high data allowances drives product development and marketing strategies.

The absence of long-term commitments appeals to customers who seek freedom and control over their mobile services. This is a key differentiator in the market.

A hassle-free experience, including easy number porting and activation, is a priority. Customers want a seamless transition to their mobile service.

The customer demographics for amaysim often include individuals and families looking for budget-friendly options without compromising on service quality. These customers are typically value-conscious and appreciate the transparency and control offered by prepaid plans. They are often tech-savvy and comfortable managing their accounts online or through an app. According to recent market analysis, the demand for prepaid mobile plans continues to be strong, with a significant portion of the market share held by providers that emphasize affordability and flexibility. For example, in 2024, the prepaid mobile market in Australia accounted for approximately 35% of the total mobile subscriptions, indicating a sustained preference for these types of plans among various customer segments.

Understanding the core needs of the amaysim customer is essential for effective marketing and product development. These needs include:

- Affordable Plans: Customers seek cost-effective options.

- Flexible Data Options: The ability to choose plans that fit their data usage.

- Transparent Pricing: Clear and straightforward pricing structures.

- No Lock-in Contracts: Freedom from long-term commitments.

- Ease of Use: Simple activation and account management.

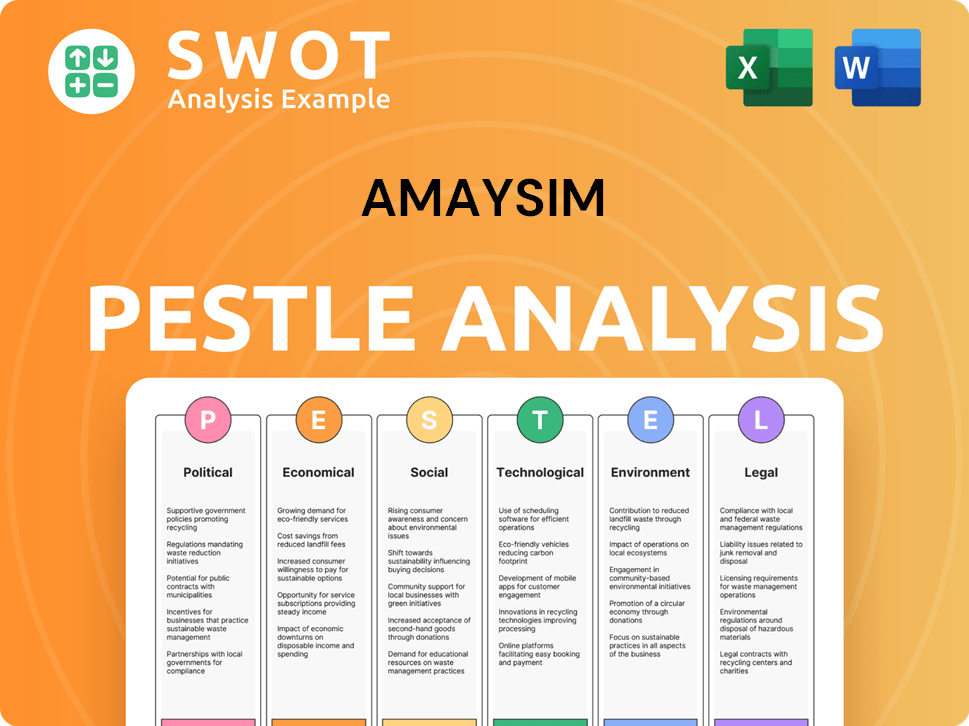

amaysim PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does amaysim operate?

The Marketing Strategy of amaysim is heavily focused on the Australian market. As a mobile virtual network operator (MVNO), it leverages the Optus network to provide services across the country. This allows it to reach major cities, regional centers, and rural areas.

The primary geographical focus for amaysim is Australia. While specific market share data by city or region for 2024-2025 isn't publicly available, its strongest customer concentration is likely in urban and suburban areas. These areas have higher mobile service usage and increased competition.

Amaysim's customer base is distributed across Australia. The company's strategy emphasizes a consistent value proposition nationwide. Marketing and service delivery are standardized, focusing on affordability, flexibility, and simplicity.

Amaysim's services are available across Australia. This is made possible through its partnership with Optus. The Optus network provides 4G and 5G coverage.

Amaysim's market entry strategy relies on the established Optus infrastructure. This allows for nationwide scaling without significant infrastructure investment. The company can quickly expand its reach.

There have been no recent announcements of international market expansions. This indicates a continued focus on solidifying its position within Australia. The company is concentrating on its core market.

Given the relatively homogenous nature of the Australian mobile market, there are no significant differences in customer demographics. Amaysim's offerings are designed to appeal to a broad audience across the country. The focus is on providing value to all customers.

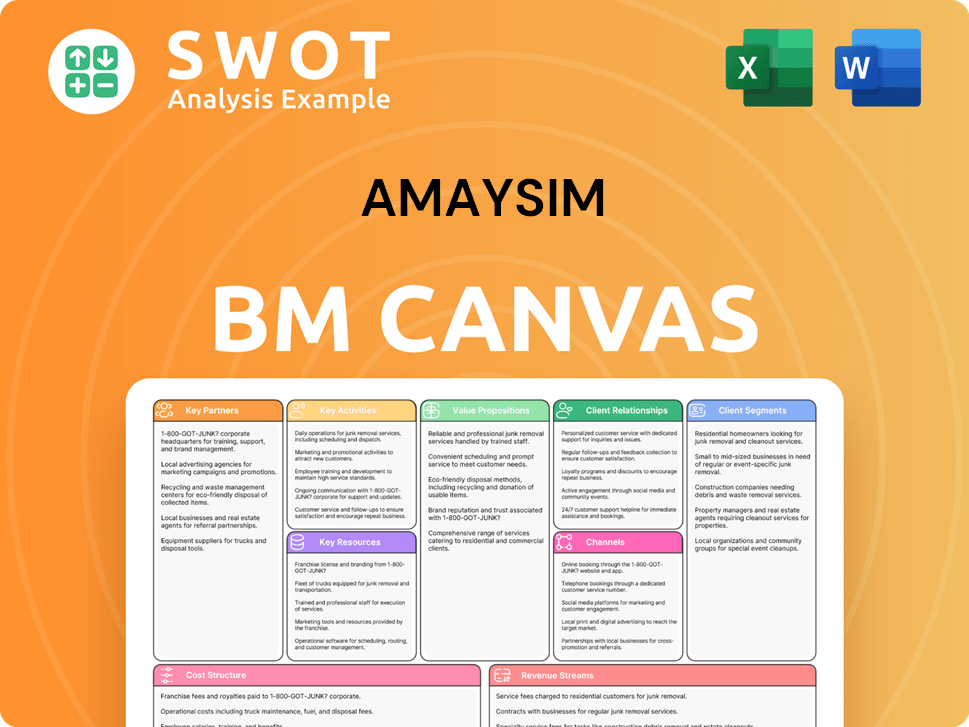

amaysim Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does amaysim Win & Keep Customers?

The company's approach to acquiring and keeping customers centers on digital channels and value-driven offers. For customer acquisition, they use online advertising, social media, and partnerships. They often provide deals like introductory offers and bonus data to attract new users. Referral programs also play a role in bringing in new customers.

Retention strategies are based on offering ongoing value, great customer service, and flexible plan options. The company's flexibility, allowing customers to change plans easily, is a strong retention tool. They use customer relationship management (CRM) systems to personalize communications and offers based on customer behavior. After-sales service is primarily online, with FAQs and a customer service team to resolve issues.

Customer data and segmentation are essential for targeting marketing campaigns and creating new plans that meet evolving customer needs. This helps reduce churn and increase customer lifetime value. In 2024, the telecommunications industry continues to be competitive, with companies like the company focusing on strategies to retain customers. Understanding the competitive landscape is crucial for effective customer acquisition and retention in the mobile phone plans market.

The company utilizes a variety of digital channels to acquire new customers. These include search engine marketing (SEM), display advertising, and social media campaigns. Partnerships with comparison websites are also a key acquisition strategy. Introductory offers and promotional deals are frequently used to attract new customers.

Sales are primarily conducted online, focusing on a seamless digital sign-up process. This streamlined approach makes it easy for potential customers to choose a plan and activate their service quickly. The ease of sign-up is a crucial factor in converting website visitors into paying customers.

Retention strategies focus on providing ongoing value, excellent customer service, and flexible plan options. The ability for customers to easily change or pause their plans is a key retention tool. Personalization through CRM systems helps tailor communications and offers.

After-sales service is primarily managed through online support, FAQs, and a customer service team. The goal is to efficiently resolve customer issues and maintain high levels of customer satisfaction. Effective customer service is critical for reducing churn and increasing customer lifetime value.

Customer data and segmentation are crucial for targeting marketing campaigns. This approach allows for the development of new plans that align with evolving customer needs. This targeted approach helps to reduce churn and improve customer lifetime value.

The company's value proposition includes competitive pricing, flexible plans, and a focus on customer convenience. This is designed to attract and retain customers in the competitive telecommunications industry. Offering value is vital for long-term success.

A strong emphasis on digital channels for both acquisition and retention is a key strategy. This includes online advertising, social media, and a user-friendly online experience. Digital focus helps reach a wider audience and streamline customer interactions.

Effective customer segmentation enables tailored marketing messages and plan offerings. Understanding different customer segments allows for more personalized experiences. Customer segmentation helps in better understanding the amaysim target market.

Offering competitive pricing is a core element of the acquisition strategy. This involves regularly reviewing and adjusting pricing to remain attractive in the market. Competitive pricing is essential for attracting new customers.

Strategies are designed to increase customer lifetime value (CLTV). This involves improving customer satisfaction and reducing churn rates. Focusing on CLTV ensures long-term profitability and sustainability in the telecommunications industry.

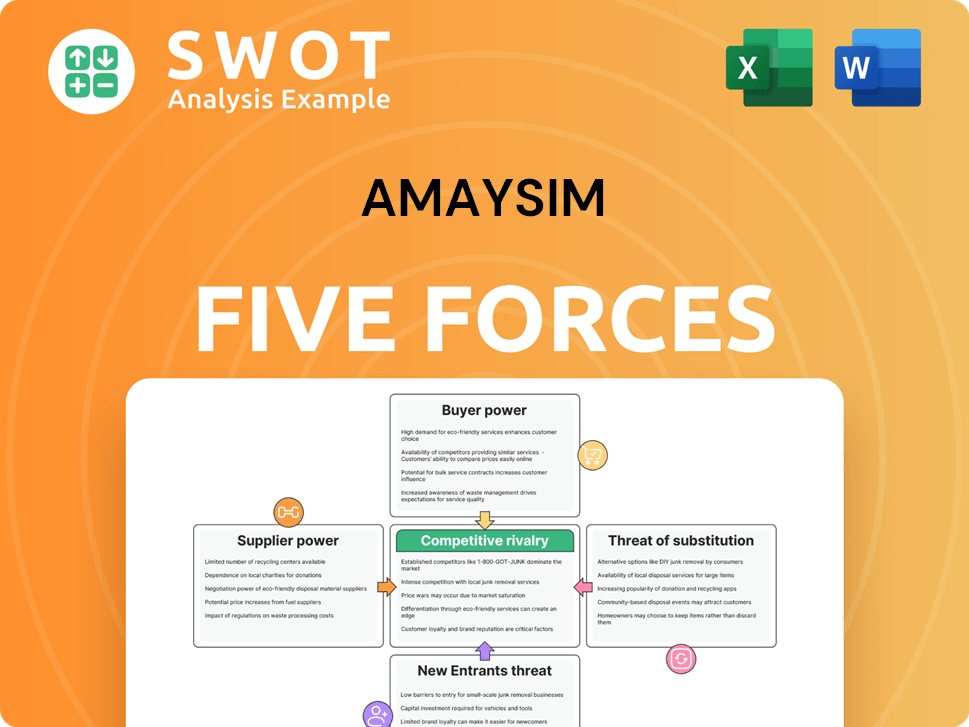

amaysim Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of amaysim Company?

- What is Competitive Landscape of amaysim Company?

- What is Growth Strategy and Future Prospects of amaysim Company?

- How Does amaysim Company Work?

- What is Sales and Marketing Strategy of amaysim Company?

- What is Brief History of amaysim Company?

- Who Owns amaysim Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.