amaysim Bundle

How Does amaysim Thrive in Australia's Telecom Market?

Amaysim has revolutionized Australia's mobile landscape, but how does this MVNO truly operate? From its inception, amaysim has stood out by offering affordable and flexible mobile plans. This deep dive explores amaysim's business model, examining its core strategies and impact on the industry.

This exploration of amaysim provides a comprehensive amaysim SWOT Analysis, revealing its strengths and weaknesses. Whether you're considering amaysim plans or simply curious about the mobile plans market, understanding amaysim's operations is key. We'll uncover the intricacies of its amaysim coverage, customer service, and overall value proposition, offering insights for both consumers and industry analysts alike.

What Are the Key Operations Driving amaysim’s Success?

The core operations of amaysim, a mobile virtual network operator (MVNO), center around providing mobile telecommunications services. This involves leveraging the Optus 4G and 5G networks to deliver services without owning the network infrastructure. This strategic choice allows amaysim to concentrate on customer acquisition, service innovation, and marketing.

amaysim's value proposition focuses on offering prepaid mobile plans. These plans are characterized by no lock-in contracts, flexible data options, and unlimited standard national talk and text. The target audience is primarily individual consumers seeking value, simplicity, and control over their mobile spending. The operational model emphasizes digital efficiency and a customer-first approach.

The operational process includes sourcing network capacity from Optus, managing digital platforms for customer self-service, and providing customer support. Distribution is primarily online, facilitating efficient customer onboarding and plan activation. This model translates into benefits like easy plan management and transparent pricing, differentiating amaysim from larger telcos. For those considering a switch, understanding the target market of amaysim is crucial.

amaysim utilizes the Optus network, offering 4G and 5G coverage. The amaysim coverage area is extensive, providing service across Australia. Customers can check the coverage map on the amaysim website to ensure service availability in their area.

amaysim plans typically include unlimited standard national calls and texts. Data allowances vary, with options for data rollover on select plans. International call rates and data add-ons are available.

Customer support is provided through various channels, including online chat, email, and phone. amaysim customer service number and contact details are available on their website. Self-service options are also available through the website and mobile app.

amaysim offers various payment methods, including credit/debit cards and automatic payments. Customers can manage their billing and payments through their online account or the mobile app. Information on how to top up amaysim is readily available.

amaysim's operations are designed for digital efficiency and customer convenience, focusing on providing value through its mobile plans. The company's reliance on the Optus network allows it to avoid the capital-intensive aspects of network ownership. This model enables amaysim to offer competitive pricing and flexible plans, appealing to a broad customer base.

- Utilizes Optus 4G and 5G networks for coverage.

- Offers SIM only deals and a range of mobile plans.

- Focuses on customer-friendly features, such as easy plan management.

- Provides customer support through multiple channels.

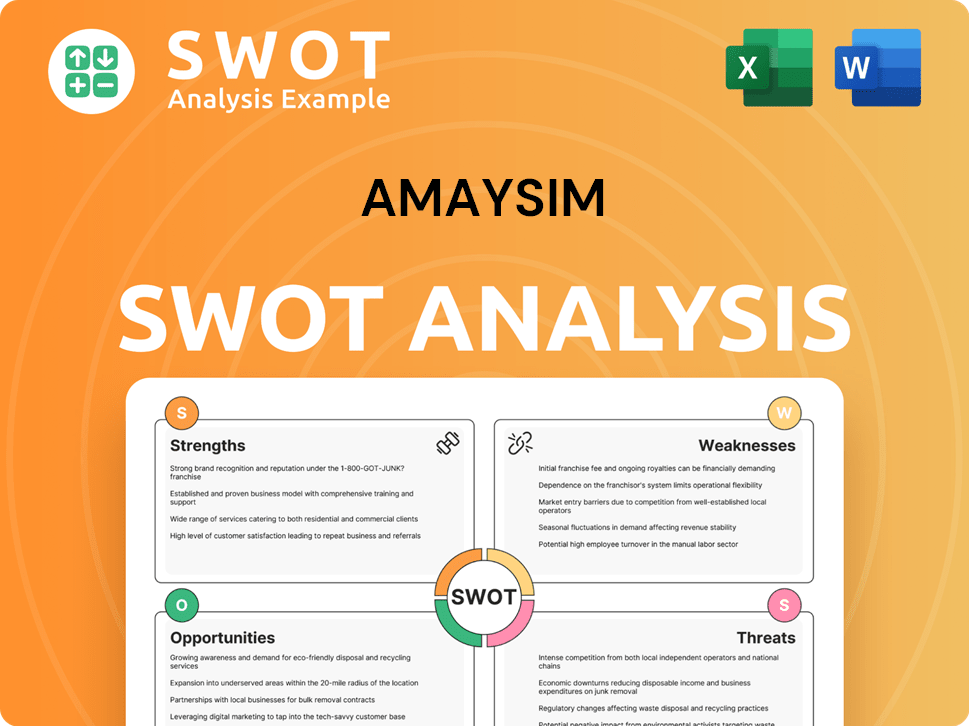

amaysim SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does amaysim Make Money?

The primary revenue stream for amaysim, now part of Optus, is derived from the sale of its prepaid mobile plans and SIM cards. These plans are structured around customers paying upfront for a set amount of data, calls, and texts, typically for a defined period such as 28 or 30 days. Since its acquisition, specific financial figures for amaysim as a standalone entity are not publicly available, but its contribution is integrated within Optus's overall consumer mobile segment.

The company's monetization strategy focuses on simplicity and value, offering tiered pricing based on data allowances. This approach encourages customers to select plans that align with their usage patterns. Features like data rollovers, where unused data carries over to the next recharge period, enhance customer loyalty and the perceived value of the service. The sustained operation of amaysim under Optus indicates its ongoing profitability and strategic importance within Optus's market share.

The business model of amaysim relies heavily on prepaid mobile services, which historically have formed the majority of its income. The company's focus on providing competitive amaysim plans and straightforward offerings has helped it maintain a strong position in the Australian market.

Amaysim's revenue model is centered on prepaid mobile plans. Here's a breakdown:

- Prepaid Plans: Customers pay upfront for data, calls, and texts.

- Tiered Pricing: Plans are structured with different data allowances to cater to various usage needs.

- Data Rollover: Unused data is carried over, increasing customer retention.

- SIM Cards: Revenue from the initial sale of SIM cards.

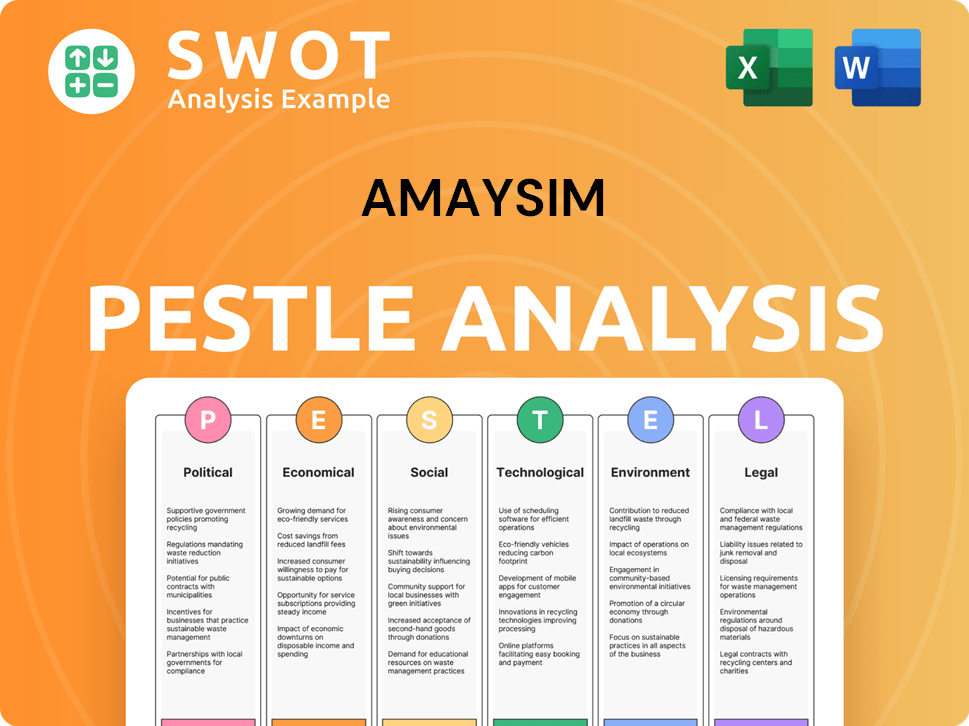

amaysim PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped amaysim’s Business Model?

The journey of amaysim has been marked by significant milestones and strategic shifts. A key moment was its initial public offering (IPO) on the Australian Securities Exchange (ASX) in July 2015, which fueled expansion and raised its public profile. This provided the company with capital to grow and increase its visibility in the competitive telecommunications market.

A major strategic move occurred in late 2020 when Optus acquired amaysim's mobile business for A$250 million. This acquisition fundamentally changed amaysim's operational structure, integrating it more closely with Optus while allowing it to retain its distinct brand and customer focus. This deal was a pivotal point, reshaping its market position and operational dynamics.

Operational challenges have included intense competition within the Australian telecommunications market. Amaysim has responded by continually refining its plan offerings, emphasizing digital self-service, and maintaining competitive pricing. Its competitive advantages lie in its strong brand recognition as a value-for-money provider, its agile MVNO business model that allows for lower overheads compared to network owners, and its focus on a seamless digital customer experience. For those looking for a detailed overview, Brief History of amaysim offers further insights.

The IPO in July 2015 provided capital for expansion. The Optus acquisition in late 2020 for A$250 million was a significant strategic move. These events shaped amaysim's trajectory in the competitive mobile market.

The acquisition by Optus allowed amaysim to leverage Optus's infrastructure. This strategic alignment helped amaysim to maintain its brand identity while benefiting from Optus's resources. The focus remained on providing competitive mobile plans.

Amaysim's competitive advantages include its strong brand recognition and value-for-money offerings. Its agile MVNO model allows for lower overheads. The focus on digital customer experience provides a seamless user experience.

Amaysim continues to adapt to new trends by offering competitive 5G access. It leverages the Optus 5G network. It provides flexible options to meet changing consumer demands for data and connectivity. This includes offering various SIM only deals.

The Australian telecommunications market is fiercely competitive, marked by price wars and evolving consumer expectations. Amaysim has responded by focusing on digital self-service and competitive pricing to maintain its market position. The company continually refines its amaysim plans to stay relevant.

- Emphasis on digital self-service to improve customer experience and reduce costs.

- Continuous plan refinement to meet changing consumer demands.

- Competitive pricing strategies to attract and retain customers.

- Leveraging the Optus network for amaysim coverage and 5G access.

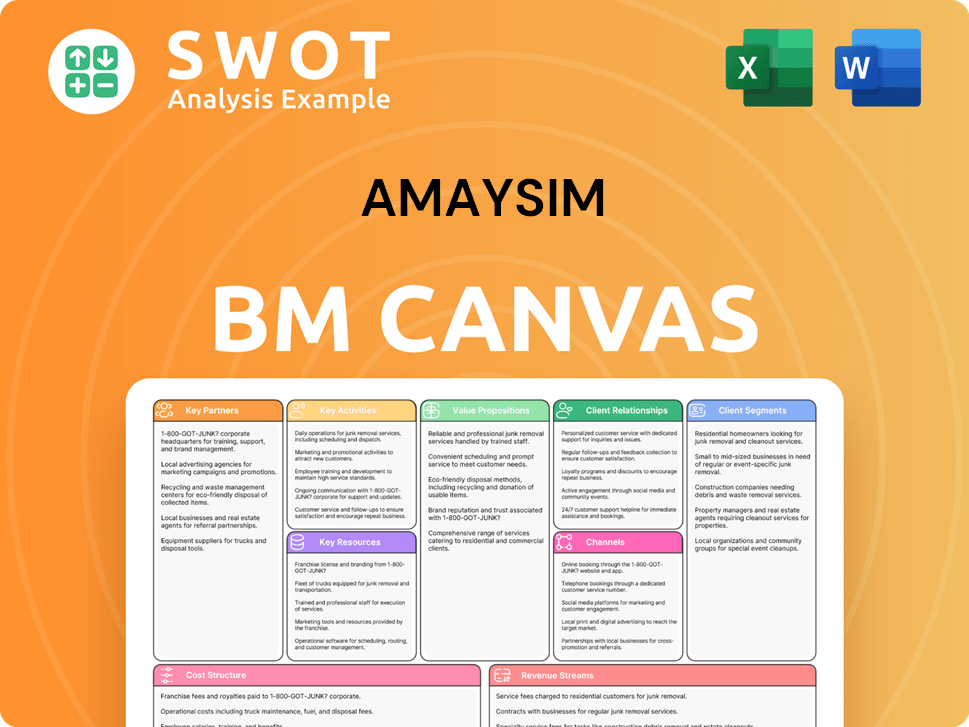

amaysim Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is amaysim Positioning Itself for Continued Success?

The company, operating within the Australian mobile virtual network operator (MVNO) market, competes with other MVNOs and the major network operators. Its primary focus is on the value segment, offering competitive mobile plans. As part of Optus, its market position is closely tied to Optus's overall strategy.

Key risks include intense competition, regulatory changes, and technological disruptions. The most significant risk is its reliance on the Optus network, where any service disruptions or changes in the wholesale agreement could significantly impact operations. The company's future hinges on its ability to attract and retain customers through simplified, flexible, and affordable mobile solutions.

The company holds a significant position within the Australian MVNO market. It competes with other MVNOs like ALDI Mobile and Kogan Mobile, and with major network operators such as Telstra, Optus, and Vodafone. Its reach is primarily national within Australia. The company's focus is on providing affordable SIM only deals.

Key risks include intense competition, which can lead to pricing pressures. Regulatory changes in the telecommunications sector could also impact operational flexibility or cost structure. Technological disruption, such as the increasing demand for higher bandwidth, requires continuous adaptation. The primary risk is its reliance on the Optus network.

The company continues to enhance its digital customer experience and offer competitive prepaid mobile plans. Its future is closely tied to Optus's overall strategy for the value segment. Plans include attracting and retaining customers through simplified, flexible, and affordable mobile solutions. The company leverages the strength and reach of the Optus network.

The company focuses on enhancing its digital customer experience. It offers competitive prepaid mobile plans. It leverages the strength and reach of the Optus network. The company adapts to evolving consumer needs in the prepaid mobile sector. The company provides a simplified approach to amaysim plans.

The company's success depends on managing competitive pressures and adapting to technological changes. Maintaining a strong relationship with Optus is crucial for its operational stability. The company's ability to offer competitive amaysim review and attractive plans determines its market share and profitability.

- Focus on customer experience and digital platforms.

- Continuous assessment of amaysim coverage and network performance.

- Adaptation to changing consumer preferences in the prepaid market.

- Strategic alignment with Optus's long-term goals.

amaysim Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of amaysim Company?

- What is Competitive Landscape of amaysim Company?

- What is Growth Strategy and Future Prospects of amaysim Company?

- What is Sales and Marketing Strategy of amaysim Company?

- What is Brief History of amaysim Company?

- Who Owns amaysim Company?

- What is Customer Demographics and Target Market of amaysim Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.