Arcus Biosciences Bundle

How has Arcus Biosciences Transformed the Oncology Landscape?

Arcus Biosciences, a clinical-stage biotech company, is making waves in cancer treatment with its innovative approach. Founded in 2015, Arcus Biosciences set out to develop cutting-edge cancer therapies, focusing on the body's immune response. Their mission, "Combining to Cure," highlights their dedication to creating effective combination treatments.

This deep dive into the Arcus Biosciences SWOT Analysis will explore the Arcus company history, detailing its strategic growth and key achievements in Arcus drug development. From its founding in California to its current mid-cap status, we'll examine the Biotech company's journey, including Cancer research efforts and ongoing Clinical trials, to understand its impact on the future of cancer treatment. We'll also cover the Arcus Biosciences company overview, Brief timeline of Arcus Biosciences, including the Arcus Biosciences founding date, and the Arcus Biosciences key people behind it all.

What is the Arcus Biosciences Founding Story?

The founding of Arcus Biosciences in 2015 marks a significant chapter in the biotech industry. The company's story is one of strategic vision and a commitment to long-term growth, setting it apart from the start. This approach has shaped its trajectory in the competitive field of cancer research and drug development.

Arcus Biosciences company history began with a clear focus on immuno-oncology. This focus, combined with the founders' prior experience, provided a solid foundation for the company's mission. Arcus has consistently aimed to develop novel therapies, making it a notable player in the biotech sector.

This brief timeline of Arcus Biosciences highlights its early strategic decisions and their impact on its growth. The company's early success is a direct result of its founders' foresight and the strategic approach they adopted from the outset.

Arcus Biosciences was founded in 2015 by Terry Rosen and Juan Jaen. They had previously co-founded Flexus Biosciences, which was acquired by Bristol-Myers Squibb in 2015 for $1.25 billion.

- The founders aimed to build a long-term company focused on sustainable growth.

- They identified the growing need to combine multiple therapeutic agents for cancer treatment.

- Arcus focused on developing combinable, best-in-class cancer therapies.

- The company's initial funding included approximately $120 million raised in two financing rounds.

The founders, Terry Rosen and Juan Jaen, brought extensive experience from the biotechnology and pharmaceutical industries. Their prior venture, Flexus Biosciences, provided valuable insights that shaped their vision for Arcus. This experience was crucial in guiding Arcus's strategic direction.

The initial problem or opportunity was the need to combine multiple therapeutic agents for cancer treatment. This realization led Arcus to focus on developing therapies that could be used in combination. This strategic focus has been a key driver of the company's approach to drug development.

Arcus Biosciences secured approximately $120 million in initial funding. The Series A round raised just under $50 million, with significant contributions from the founders and strategic investors. The Series B round in August 2016 raised an additional $70 million, demonstrating strong investor confidence. This early capital was instrumental in advancing Arcus's drug development activities.

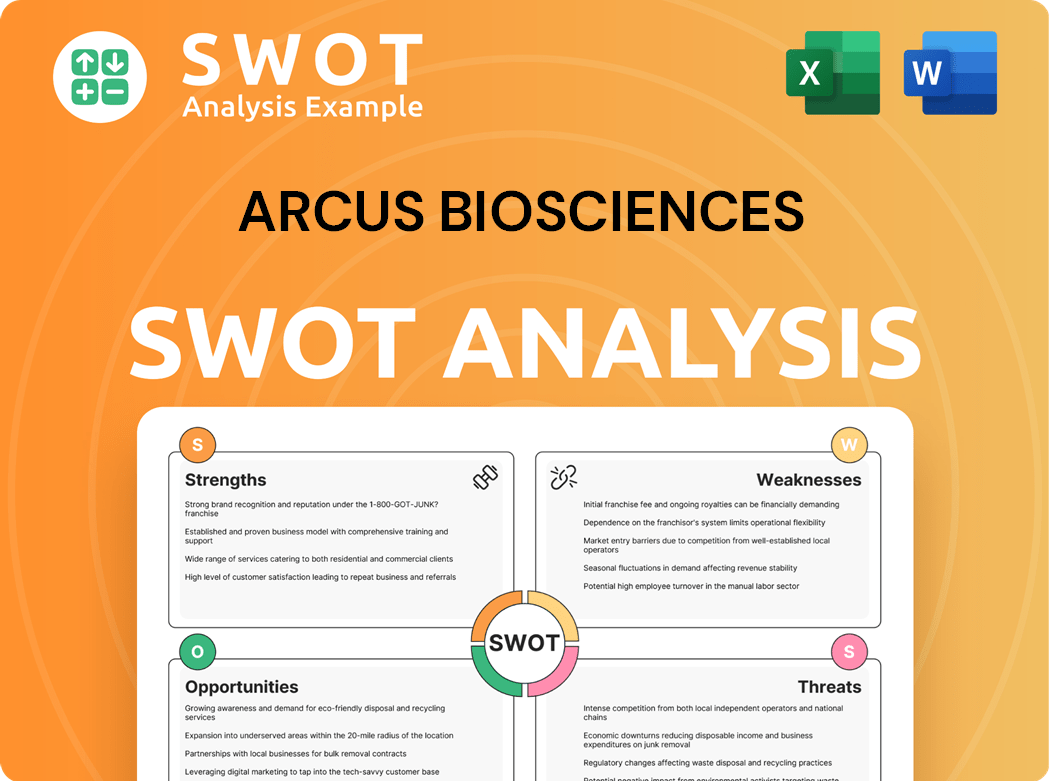

Arcus Biosciences SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Arcus Biosciences?

The early growth of Arcus Biosciences, a biotech company, was marked by rapid progress. Founded in 2015, the company quickly advanced multiple investigational medicines into clinical studies, focusing initially on the ATP-adenosine pathway. By early 2018, Arcus had already initiated clinical trials for its most advanced product candidates and anticipated early clinical data.

Arcus Biosciences expanded its pipeline significantly, now including seven clinical-stage programs. Key programs include casdatifan, domvanalimab, etrumadenant, and quemliclustat. The company's strategy emphasizes combination therapies to address the complexities of the tumor microenvironment. This approach is crucial in understanding the marketing strategy of Arcus Biosciences.

The company's growth was fueled by significant capital raises. Beyond its initial Series A and B rounds totaling $120 million, a Series C round of $107 million was secured in November 2017. A pivotal partnership with Gilead Sciences in May 2020 provided a 10-year collaboration. Gilead's commitment included a $320 million equity investment in January 2024 and a $100 million option continuation payment in July 2024.

As of March 31, 2025, Arcus Biosciences reported a strong financial position with approximately $1.0 billion in cash, cash equivalents, and marketable securities. This financial strength was further bolstered by a $150 million equity financing in February 2025. This capital is expected to support operations through initial pivotal readouts for its key programs.

The company has grown its employee count to 674 as of May 2025. Arcus Biosciences has also entered into strategic partnerships to expand its market reach, such as the collaboration with Taiho Pharmaceutical. Market reception has been positive, with analysts consistently maintaining an 'Overweight' rating on Arcus Biosciences' stock as of May 2025, reflecting confidence in its potential.

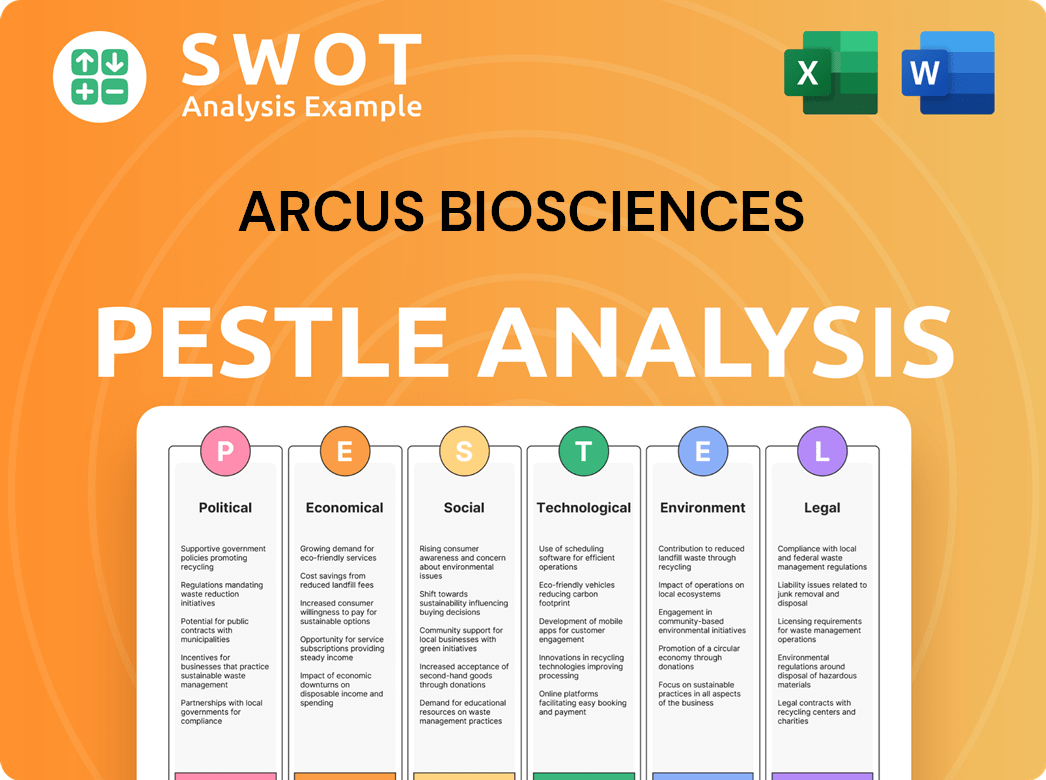

Arcus Biosciences PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Arcus Biosciences history?

The Arcus Biosciences company overview showcases significant milestones in its journey to develop cancer therapies. The biotech company has made strides in clinical trials and strategic partnerships, shaping its trajectory in the competitive field of cancer research and drug development.

| Year | Milestone |

|---|---|

| 2025 | The Phase 1/1b ARC-20 study results for casdatifan, a HIF-2α inhibitor, showed promising results in clear cell renal cell carcinoma (ccRCC), with a 30% confirmed overall response rate (ORR). |

| 2025 | Planned initiation of the Phase 3 PEAK-1 study for casdatifan in combination with cabozantinib for IO-experienced ccRCC patients is scheduled for the second quarter. |

| 2026 | The Phase 3 STAR-221 study for domvanalimab plus zimberelimab and chemotherapy in PD-L1 all-comer first-line metastatic upper GI adenocarcinomas is expected to read out. |

Innovations at Arcus Biosciences are centered on differentiated molecules and combination treatments, particularly in its pipeline drugs. Casdatifan, a HIF-2α inhibitor, has shown encouraging results, and domvanalimab, an anti-TIGIT antibody, is another key program.

Casdatifan, a HIF-2α inhibitor, demonstrated a 30% confirmed overall response rate (ORR) in heavily pretreated ccRCC patients. The median Progression-Free Survival (PFS) for casdatifan monotherapy was 9.7 months.

Domvanalimab, an anti-TIGIT antibody, has shown promising results in combination with zimberelimab and chemotherapy for upper GI adenocarcinomas. The Phase 3 STAR-221 study is anticipated to yield results in 2026.

Quemliclustat, a CD73 inhibitor, entered a Phase 3 trial (PRISM-1) in Q4 2024, combining with gemcitabine/nab-paclitaxel for pancreatic cancer. Enrollment completion is expected by the end of 2025.

Arcus Biosciences has formed major partnerships, notably a 10-year collaboration with Gilead Sciences. The recent expiration of Gilead's exclusive option rights to casdatifan marks a strategic shift.

Arcus secured a $150 million common stock offering in February 2025 to independently advance casdatifan. The company's resilience is demonstrated through securing funding amidst R&D costs.

The potential market opportunity for casdatifan is estimated at $5 billion. This highlights the significant commercial potential of Arcus's lead program.

Challenges for Arcus Biosciences include the inherent risks associated with drug development and the biotech company's financial pressures. In Q1 2025, Arcus reported a net loss of $112 million, a significant increase from the $4 million loss in Q1 2024.

Arcus Biosciences continues to operate at a loss, typical for clinical-stage biotech companies. The net loss for Q1 2025 was $112 million, with an EPS of -$1.14.

R&D expenses increased to $111 million in Q4 2024 from $93 million in Q4 2023, reflecting the capital-intensive nature of drug development. These high costs impact the company's financial performance.

Analysts anticipate a 41% revenue decline for the current year. Despite this, the company maintains its full-year 2025 revenue guidance between $75 million and $90 million.

The biotech sector's reliance on successful clinical trials and regulatory approvals poses risks. Arcus must navigate these challenges to advance its pipeline.

Arcus operates in a competitive environment, requiring strategic adaptability. The company's ability to secure funding and collaborations is crucial.

The decision to retain full developmental and commercial control of casdatifan provides future optionality. This strategic move is vital for long-term success.

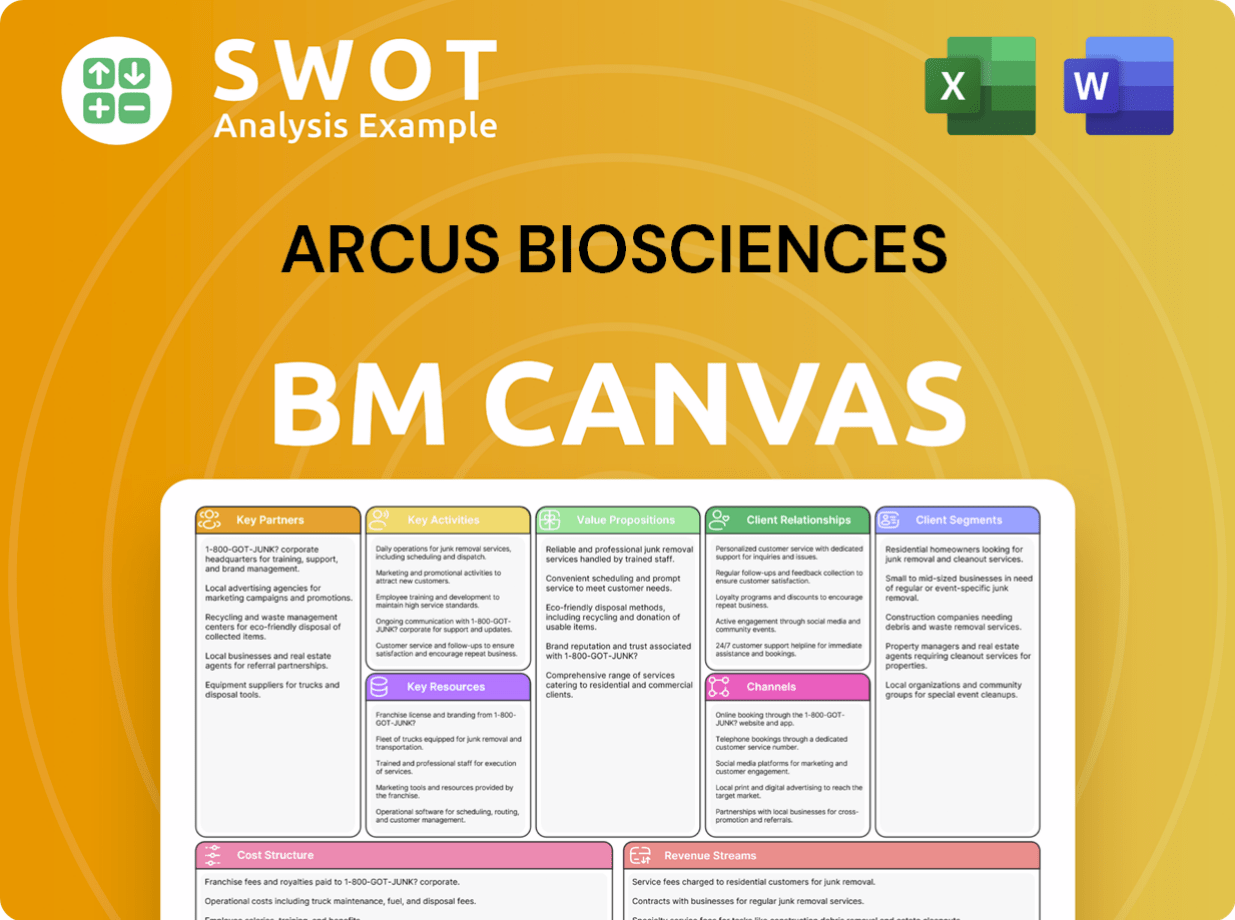

Arcus Biosciences Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Arcus Biosciences?

The Arcus company history began in 2015 with its founding in Hayward, California, by Terry Rosen and Juan Jaen, focusing on cancer therapies. Arcus Biosciences has since achieved several milestones, including significant funding rounds and strategic collaborations, particularly with Gilead Sciences. The company's progress continues with ongoing clinical trials and strategic partnerships, positioning it for future growth in the biotech industry.

| Year | Key Event |

|---|---|

| 2015 | Arcus Biosciences is founded in Hayward, California, by Terry Rosen and Juan Jaen. |

| 2016 (August) | Arcus completes a Series B funding round, raising an additional $70 million. |

| 2017 (November) | Arcus raises $107 million in a Series C funding round, led by Google Ventures. |

| 2020 (May) | Arcus establishes a 10-year strategic collaboration with Gilead Sciences. |

| 2024 (January) | Gilead makes a $320 million equity investment in Arcus. |

| 2024 (July) | Gilead provides a $100 million option continuation payment to Arcus; Taiho Pharmaceutical exercises its option for quemliclustat in Japan and parts of Asia. |

| 2024 (Q4) | Arcus initiates PRISM-1, a Phase 3 trial of quemliclustat in first-line metastatic pancreatic cancer. |

| 2025 (January) | Richard Markus is appointed as Chief Medical Officer. |

| 2025 (February) | Arcus announces the pricing of a $150 million common stock offering; Taiho Pharmaceutical doses its first patient in Japan for PRISM-1. |

| 2025 (Q1) | Arcus initiates three new expansion cohorts within ARC-20 for casdatifan in ccRCC. |

| 2025 (May 6) | Arcus Biosciences reports Q1 2025 financial results, with $1.0 billion in cash, cash equivalents, and marketable securities. |

Arcus is advancing its late-stage oncology pipeline with a focus on key programs like casdatifan, domvanalimab, and quemliclustat. The company anticipates initiating the Phase 3 PEAK-1 study in Q2 2025 and expects initial data from the casdatifan plus cabozantinib cohort of ARC-20 in mid-2025. Additionally, Arcus plans to advance AB801, an AXL inhibitor, into expansion cohorts in NSCLC during the second half of 2025.

Arcus has a strategic collaboration with AstraZeneca to evaluate casdatifan plus volrustomig in IO-naive ccRCC. As of May 2025, Arcus holds approximately $1.0 billion in cash, cash equivalents, and marketable securities, supporting its clinical trials. Analysts have a strong buy consensus, with price targets suggesting significant potential upside.

Arcus's late-stage programs target markets with a combined potential exceeding $24 billion, focusing on renal cell carcinoma, gastric cancer, non-small cell lung cancer, and pancreatic cancer. The company is aiming to become a fully integrated biopharmaceutical company, moving from discovery through commercialization.

Safety and initial efficacy data for the ARC-20 cohort evaluating casdatifan plus cabozantinib in IO-experienced ccRCC are expected to be presented at ASCO in June 2025. More mature data from the casdatifan monotherapy cohorts in ARC-20 are anticipated in the fall of 2025. The first Phase 3 data readout for domvanalimab plus zimberelimab from the STAR-221 study is expected in 2026.

Arcus Biosciences Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Arcus Biosciences Company?

- What is Growth Strategy and Future Prospects of Arcus Biosciences Company?

- How Does Arcus Biosciences Company Work?

- What is Sales and Marketing Strategy of Arcus Biosciences Company?

- What is Brief History of Arcus Biosciences Company?

- Who Owns Arcus Biosciences Company?

- What is Customer Demographics and Target Market of Arcus Biosciences Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.