Arcus Biosciences Bundle

Can Arcus Biosciences Revolutionize Cancer Treatment?

Arcus Biosciences, a pioneering clinical-stage biopharmaceutical company, is making waves in the oncology market with its innovative approach to cancer immunotherapy. Founded in 2015, Arcus has rapidly evolved, building a robust pipeline of drug candidates designed to harness the power of the immune system. Its strategic focus on developing differentiated cancer therapies positions it as a key player in the fight against cancer.

The Arcus Biosciences SWOT Analysis reveals crucial insights into its potential. As of early 2025, the company's future growth is heavily reliant on its ability to successfully navigate clinical trials and secure regulatory approvals for its promising oncology pipeline. Understanding the company's growth strategy and future prospects is critical for investors and industry observers alike, given the high stakes and competitive landscape of the biopharmaceutical sector, especially when considering the company's focus on Cancer Immunotherapy.

How Is Arcus Biosciences Expanding Its Reach?

The expansion initiatives of Arcus Biosciences are primarily focused on advancing its clinical pipeline and strengthening strategic collaborations. These efforts aim to broaden its reach within the oncology market and enhance its competitive position. This strategy involves the development of novel therapies and partnerships to address unmet medical needs in cancer treatment.

A key driver of Arcus Biosciences' growth strategy is the advancement of its clinical trials, particularly in areas such as clear cell renal cell carcinoma (ccRCC) and metastatic pancreatic cancer. The company is also leveraging partnerships to accelerate drug development and expand its market presence. These initiatives are designed to create value for shareholders and improve outcomes for patients.

By focusing on these expansion initiatives, Arcus Biosciences seeks to diversify its revenue streams and maintain a competitive edge in the rapidly evolving oncology landscape. The company's approach includes strategic collaborations and the development of innovative therapies to address unmet medical needs.

Arcus Biosciences is expanding its focus on casdatifan, a HIF-2a inhibitor, with multiple expansion cohorts for ccRCC. New data from the Phase 1/1b ARC-20 study showed improved outcomes. The company plans to initiate the Phase 3 study, PEAK-1, in the first half of 2025, with initial data expected by mid-2025.

Arcus Biosciences is also advancing quemliclustat, a CD73 inhibitor. The PRISM-1 Phase 3 trial, combining quemliclustat with gemcitabine/nab-paclitaxel for first-line metastatic pancreatic cancer, began in Q4 2024. Enrollment is expected to be completed by the end of 2025. Taiho Pharmaceutical dosed its first patient for PRISM-1 in Japan in February 2025.

AB801, a small-molecule AXL inhibitor, is entering expansion cohorts in NSCLC in the second half of 2025. Discussions with the FDA regarding ARC-9, which evaluates etrumadenant in metastatic colorectal cancer, are planned for the first half of 2025. These initiatives aim to diversify the drug pipeline.

The 10-year collaboration with Gilead, established in May 2020, remains a cornerstone of Arcus Biosciences' strategy. This partnership includes time-limited exclusive option rights to clinical programs and co-development of four investigational products. This collaboration supports the company's drug development strategy.

Arcus Biosciences is focused on expanding its clinical pipeline and forming strategic collaborations to drive growth. The company’s approach includes advancing clinical trials and leveraging partnerships to develop new therapies. These efforts are designed to address unmet medical needs and create value.

- Focus on HIF-2a inhibitor, casdatifan, with Phase 3 study PEAK-1 planned for 2025.

- Advancement of quemliclustat in Phase 3 trial PRISM-1 for metastatic pancreatic cancer.

- Expansion of AB801 into NSCLC and discussions with the FDA for ARC-9.

- Continued collaboration with Gilead, which is crucial for the company's future.

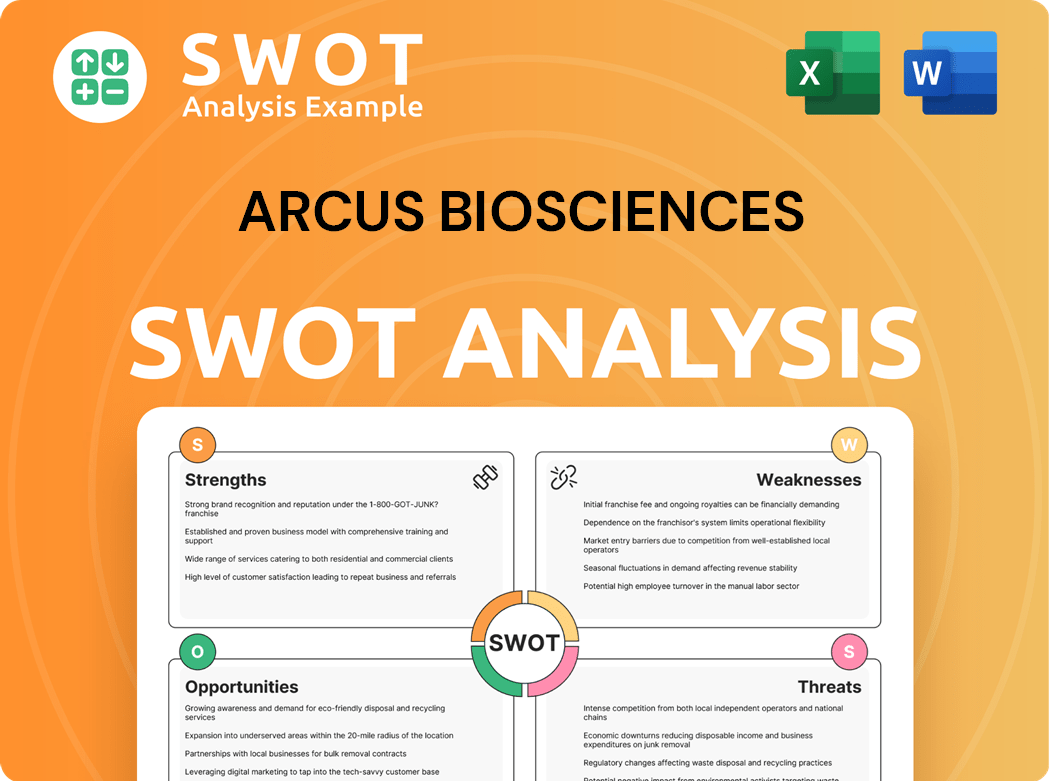

Arcus Biosciences SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Arcus Biosciences Invest in Innovation?

Arcus Biosciences' Marketing Strategy of Arcus Biosciences is deeply rooted in innovation, particularly in the field of cancer immunotherapy. Their approach prioritizes the discovery, development, and commercialization of novel therapies to combat various cancers. This focus is reflected in their robust research and development efforts and strategic partnerships.

The biopharmaceutical company's growth strategy centers around advancing a diverse pipeline of clinical-stage programs. These programs are designed to target multiple pathways within the immune system, aiming to enhance the body's ability to fight cancer. Arcus Biosciences' commitment to innovation is evident in its continuous advancement of investigational medicines into clinical studies, aiming for first- or best-in-class therapies.

Arcus Biosciences' future prospects are closely tied to the success of its clinical trials and the potential for its therapies to gain regulatory approval. The company's ability to secure and maintain strategic collaborations, such as the one with Gilead, further supports its growth trajectory. The company's focus on biology-driven research and development is expected to drive future innovation and market expansion.

Arcus Biosciences concentrates on developing immunotherapies to treat cancer. Their research targets key immune system pathways. This approach aims to enhance the body's ability to fight cancer cells.

The company has a diverse pipeline of clinical-stage programs. These programs target various mechanisms within the immune system. This includes therapies targeting TIGIT, PD-1, and other key targets.

Casdatifan, a HIF-2a inhibitor, has shown promising results in clinical trials. It demonstrated a 30% confirmed overall response rate in clear cell renal cell carcinoma patients. This molecule is expected to enter Phase 3 trials in the first half of 2025.

Arcus Biosciences leverages strategic collaborations to accelerate drug development. Their partnership with Gilead, established in May 2020, is a key example. This collaboration facilitates the co-development of multiple investigational products.

The company employs a biology-driven approach to drug development. This focuses on studying novel drug combinations. These combinations aim to improve patient outcomes and extend survival rates.

Arcus Biosciences continuously advances investigational medicines into clinical studies. The goal is to develop first- or best-in-class therapies. This strategy supports the company's long-term growth and market position.

Arcus Biosciences' innovation strategy centers on developing novel cancer therapies, particularly immunotherapies. The company's approach involves a multi-faceted strategy encompassing research and development, strategic collaborations, and a focus on clinical trials. This strategy is designed to drive the company's growth and enhance its market position.

- R&D Investments: Significant investments in R&D support a diverse pipeline of clinical-stage programs.

- Targeted Therapies: Focus on therapies targeting TIGIT, PD-1, and other immune checkpoints.

- Strategic Partnerships: Collaborations, such as the one with Gilead, accelerate drug development.

- Clinical Trial Focus: Continuous advancement of investigational medicines into clinical studies.

- Biology-Driven Approach: Emphasis on studying novel drug combinations for improved patient outcomes.

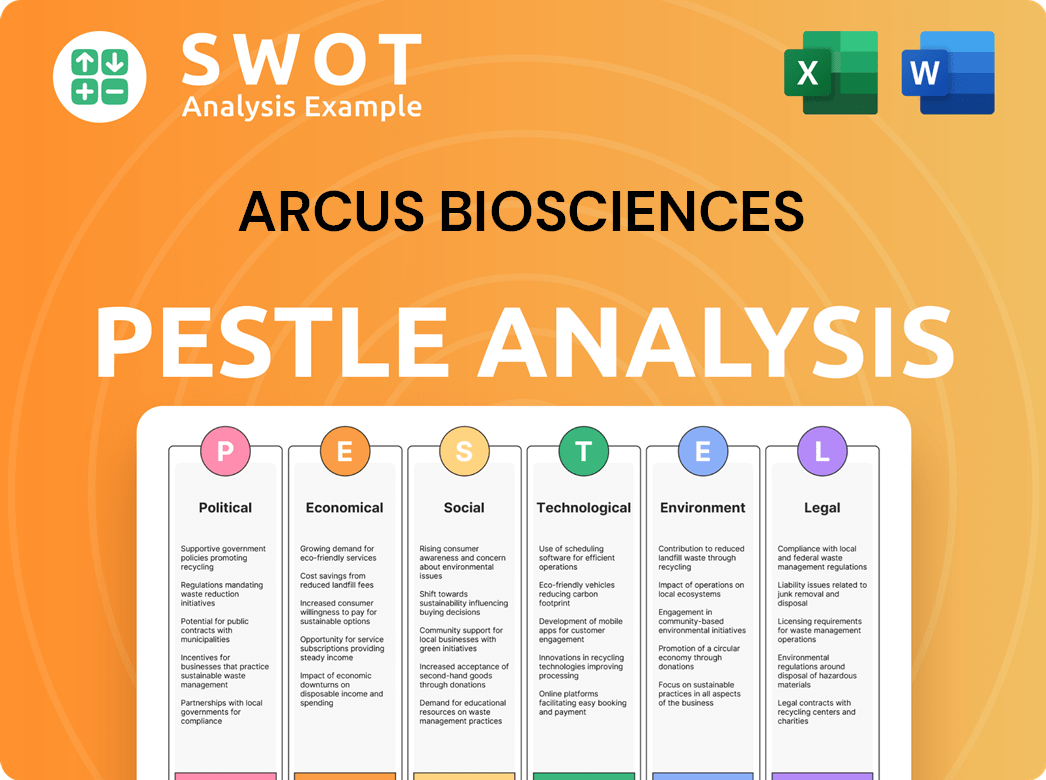

Arcus Biosciences PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Arcus Biosciences’s Growth Forecast?

As of December 31, 2024, Arcus Biosciences reported a strong financial position, with approximately $992 million in cash, cash equivalents, and marketable securities. This robust capital base, excluding the $150 million raised in February 2025, is crucial for supporting its ongoing clinical trials. These trials, including PEAK-1, PRISM-1, and STAR-221, are pivotal for the company's future growth.

The company's financial strategy focuses on efficiently allocating resources to advance its pipeline of cancer immunotherapy treatments. The cash reserves are intended to fund these trials through their initial pivotal read-outs. The company's financial health is a key factor in its ability to execute its growth strategy and realize its future prospects in the competitive biopharmaceutical market.

In Q4 2024, Arcus Biosciences reported revenues of $36 million, an increase from $31 million in Q4 2023. This growth was primarily driven by license and development services from the Gilead collaboration, contributing $28 million, and $8 million from other collaborations. For the full year 2024, total revenues reached $261.13 million. However, Q1 2025 saw revenues decrease to $28 million, significantly down from $145 million in Q1 2024 and below the forecast of $38.61 million.

Arcus Biosciences anticipates GAAP revenue between $75 million and $90 million for the full year 2025. Analysts project a 41% revenue decline for the current year, with consensus estimates around $128 million, reflecting a 9.6% reduction in sales over the past 12 months. This indicates a challenging period ahead, despite the company's strong cash position and ongoing clinical trials.

Research and Development (R&D) expenses were $111 million for Q4 2024, up from $93 million in Q4 2023. Gross R&D reimbursements from collaborations, mainly Gilead, reached $165 million for the full year 2024. In Q1 2025, R&D expenses were $122 million, compared to $109 million in Q1 2024. 2025 is expected to be a peak year for development costs.

General and Administrative (G&A) expenses were $28 million for Q4 2024, slightly down from $29 million in Q4 2023. For Q1 2025, G&A expenses were $28 million, compared to $32 million in Q1 2024. The company reported a net loss of $93 million in Q2 2024, compared to $75 million in Q2 2023.

Despite a strong current ratio of 4.5 and more cash than debt, Arcus Biosciences is experiencing a rapid cash burn. Analysts' 12-month price targets average $19.60, with a high estimate of $25.00 and a low of $14.00. Some analysts project a potential upside of nearly 196% to 220.98%. The company's financial performance will be crucial for its future prospects.

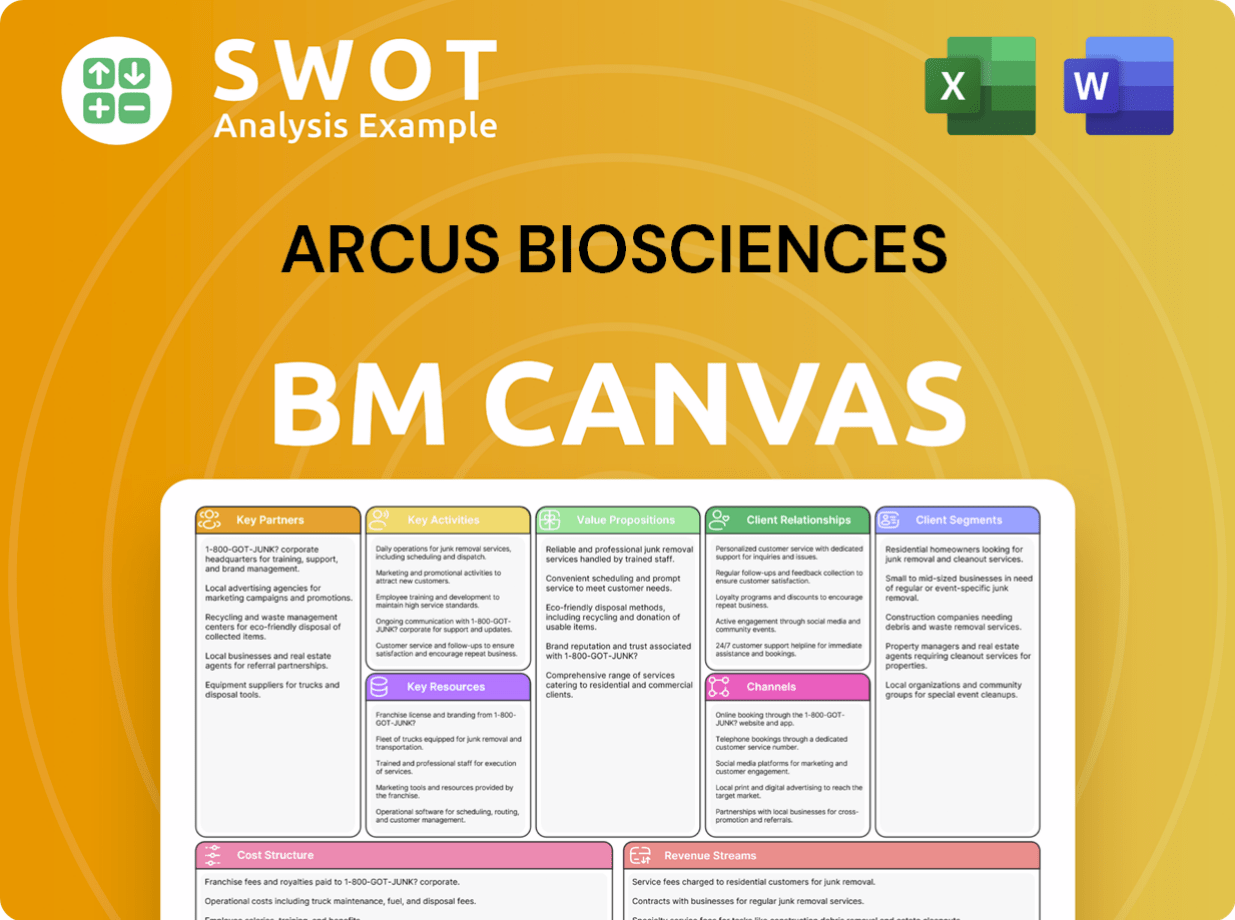

Arcus Biosciences Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Arcus Biosciences’s Growth?

The path for Arcus Biosciences, a biopharmaceutical company, towards achieving its Growth Strategy and realizing its Future Prospects is fraught with potential risks and obstacles. Operating within the volatile biotechnology sector, the company faces challenges ranging from intense competition to the inherent uncertainties of drug development and regulatory approvals. These factors could significantly impact its clinical trial outcomes, market position, and financial health.

The Cancer Immunotherapy market is highly competitive, with established pharmaceutical giants and other biotechnology firms vying for market share. Arcus Biosciences must navigate this landscape while managing the complexities of clinical trials, potential delays, and the risk of adverse events. Financial sustainability is also a key concern, especially given the high costs associated with research and development and the dependency on successful clinical outcomes.

The company's financial performance, as reflected in its negative earnings per share (EPS) and negative free cash flow, highlights the financial strain that can arise from these challenges. The strategic decisions, such as partnerships and resource allocation, are crucial for mitigating these risks. However, the success of these strategies hinges on factors that may not always align with expectations, potentially leading to further financial pressures.

Arcus Biosciences faces stiff competition from companies with greater resources and established products. This includes competition from drugs like Merck's belzutifan, which is already on the market. The competitive landscape requires Arcus Biosciences to differentiate its offerings and execute its clinical trials effectively.

The success of Arcus Biosciences heavily relies on the outcomes of its Clinical Trials. Unexpected adverse events or undesirable side effects could emerge, which could impact the company's Arcus Biosciences stock price forecast. Upcoming data readouts, such as those for casdatifan with cabozantinib in mid-2025, are crucial and any failures could be detrimental.

Biopharmaceutical Company like Arcus Biosciences must navigate complex regulatory processes. Delays in approvals can impact timelines and financial projections. The reliance on preliminary data and interim results introduces uncertainty, as these do not guarantee future success, affecting Arcus Biosciences drug development strategy.

Supply chain complexities pose inherent risks for Biopharmaceutical Company. While not explicitly detailed in recent reports, manufacturing and supplying products for clinical trials can be challenging. Any disruptions could lead to delays in clinical trials and impact the company's ability to meet its goals. These factors affect the company's ability to meet its Arcus Biosciences upcoming catalysts.

High research and development costs can strain financial resources, affecting cash flow and profitability. Arcus Biosciences financial performance reflects these challenges, as demonstrated by its negative EPS of -$4.23 and a return on equity of -63.17%. Significant negative free cash flow of -$174 million also indicates financial pressure.

Arcus Biosciences employs strategic partnerships, like the one with Gilead, to mitigate risks. However, the reliance on cash runway projections and clinical milestones introduces execution risks. If new focus areas do not achieve clinical success, it could lead to financial strain, impacting Arcus Biosciences partnership deals.

Arcus Biosciences reported a negative EPS of -$4.23. The company's return on equity is -63.17%, indicating significant financial challenges. The negative free cash flow of -$174 million reflects the high costs associated with research and development and clinical trials. These numbers highlight the need for effective financial management and successful clinical outcomes to ensure long-term sustainability.

Arcus Biosciences uses strategic partnerships, such as the collaboration with Gilead, to access additional resources and expertise. The company also focuses on prioritizing high-value programs to manage resources efficiently. These strategies are crucial for navigating the competitive landscape and mitigating the risks associated with drug development. The company must also focus on Arcus Biosciences research and development.

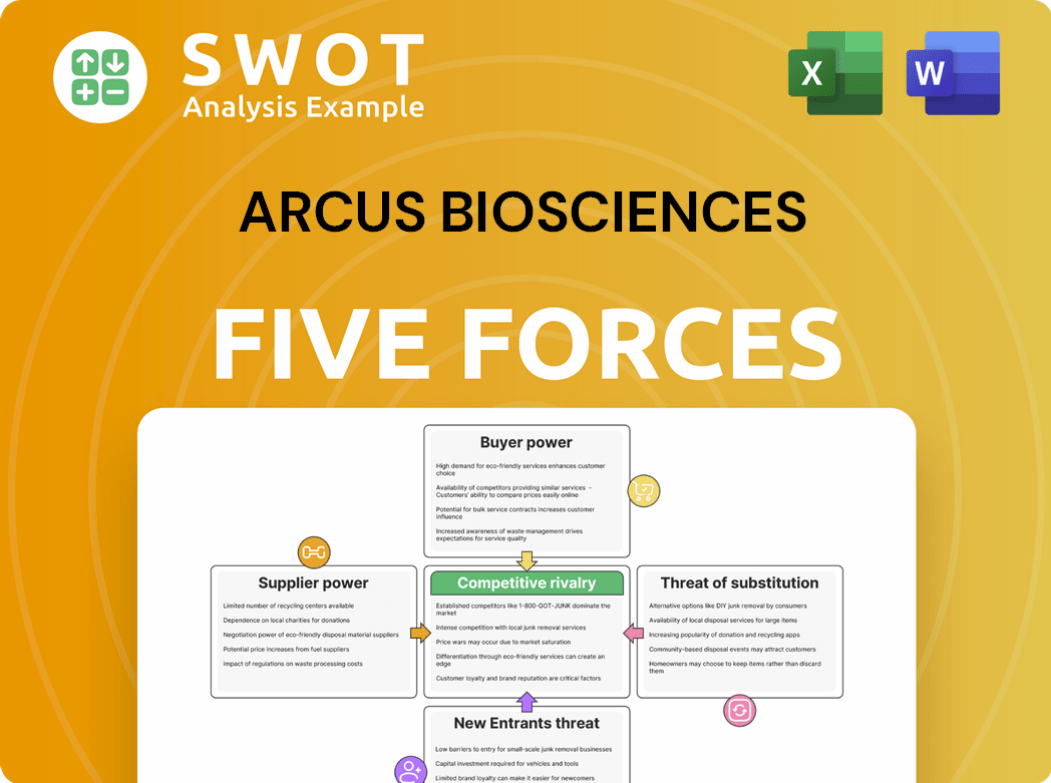

Arcus Biosciences Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Arcus Biosciences Company?

- What is Competitive Landscape of Arcus Biosciences Company?

- How Does Arcus Biosciences Company Work?

- What is Sales and Marketing Strategy of Arcus Biosciences Company?

- What is Brief History of Arcus Biosciences Company?

- Who Owns Arcus Biosciences Company?

- What is Customer Demographics and Target Market of Arcus Biosciences Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.