Autlan Bundle

What Makes Autlán a Mining Powerhouse?

Explore the fascinating Autlan SWOT Analysis and uncover the rich history of Autlán Company, a key player in Mexico's mining and ferroalloy sector. From its humble beginnings in 1953, Autlán has transformed into a publicly traded entity with a significant market presence. Discover how this Mexican company has navigated decades of growth and innovation.

The journey of Autlán, a prominent name among Mexican companies, is a compelling narrative of resilience and strategic adaptation. Understanding the Autlan history reveals the company's evolution from a regional mining venture to a diversified enterprise. This brief history of Autlan Company Mexico will highlight its key milestones, financial performance, and its impact on the mining industry.

What is the Autlan Founding Story?

The story of the Autlan Company begins in the heart of Mexico. It is a tale of pioneering spirit and strategic adaptation within the mining industry. The company's journey reflects Mexico's drive to build its industrial capacity.

Compañía Minera Autlán, S.A.B. de C.V. officially began on October 5, 1953, in Autlán, Jalisco, Mexico. This marked the start of a significant chapter in the history of Mexican companies. The company's initial focus was on exploiting manganese resources.

The founders aimed to utilize Mexico's natural resources to meet domestic industrial needs. This focus on manganese ore set the stage for Autlán's early operations and future growth. The company quickly became a key player in the Mexican mining sector.

Autlan's early years were marked by a commitment to extracting and selling manganese ore. The company's business model centered on this core activity. A significant turning point came in the 1960s.

- The company relocated its operations to the Molango district in Hidalgo.

- This move followed the discovery of a large manganese deposit.

- This strategic decision secured Autlán's access to its primary raw material.

- The company's expansion was influenced by the economic context of mid-20th century Mexico.

The relocation to Molango was a pivotal moment in the Autlan history. The Molango deposit is considered the largest manganese deposit in Central and North America. This move significantly boosted the company's access to its main raw material. The company's expansion was influenced by the economic context of mid-20th century Mexico, aiming to develop national industrial capabilities and utilize domestic resources.

While specific details about the founders are not widely publicized, the establishment of Autlán as a Mexican-managed entity was a significant development. Its creation was influenced by the economic context of mid-20th century Mexico, aiming to develop national industrial capabilities and utilize domestic resources. The company's history reflects Mexico's efforts to build its industrial base.

The initial funding sources are not explicitly detailed in publicly available information. However, its status as a pioneering Mexican-managed mining company suggests a strong national impetus behind its establishment. Autlan's story is a testament to the company's resilience and strategic vision. The company's journey reflects Mexico's drive to build its industrial capacity.

Autlan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Autlan?

The early growth and expansion of the Autlán Company were marked by strategic decisions that transformed it into a vertically integrated enterprise. Following its establishment in 1953, the company shifted operations to the Molango district in Hidalgo in the 1960s. This move was prompted by the discovery of significant manganese deposits.

A pivotal step in the Autlan history was the acquisition of Ferroaleaciones Teziutlán, S.A. de C.V. in Puebla in 1973. This move marked the company's entry into ferroalloy production. It allowed Autlán to process its manganese ore into ferroalloys, a key component for steel production, transforming the company into a vertically integrated entity.

Further expansion of its ferroalloy production capacity occurred with the inauguration of the Tamós ferroalloy plant in Veracruz in the 1970s. This facility became one of the world's most important medium-carbon ferromanganese plants. The 1990s saw the acquisition of Ferroaleaciones de México, S.A. de C.V., which added the Gómez Palacio ferroalloy plant to Autlán's portfolio.

After a period under federal government management in the 1980s, Autlán returned to the private sector. It successfully re-listed on the Mexican Stock Exchange in 1995. This period solidified Autlán's leadership in ferroalloys within Mexico. The company also obtained ISO 9001 certification for its facilities.

In the 2010s, Autlán diversified its business units into Manganese, Metallorum (precious metals), and Energy. A notable development in its energy division was the full acquisition of Compañía de Energía Mexicana (CEM) in 2014. CEM operates the Atexcaco hydroelectric plant, which began operations in 2011. This strategic move aimed to reduce electricity costs and enhance competitiveness.

Autlán's expansion also included its first international acquisition of an electrolytic manganese dioxide (EMD) plant in Spain. This move aimed to serve the alkaline battery market and diversify income sources beyond steel applications. As of 2024, manganese operations represent approximately 90% of total sales. For more insights into the Owners & Shareholders of Autlan, you can explore further details.

Autlan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Autlan history?

The Autlan Company's history is marked by significant milestones, reflecting its adaptability and commitment to innovation within the mining and ferroalloy industries. The company has navigated through various economic cycles and industry-specific challenges, consistently striving for operational excellence and sustainable practices. These achievements underscore Autlan's resilience and its strategic approach to growth and development.

| Year | Milestone |

|---|---|

| 1990s | Obtained ISO 9001 certification for all facilities, demonstrating a commitment to quality. |

| 1993 | Returned to the private sector after a period of federal government management in the 1980s. |

| 2010s | Achieved ISO 14001 certification, highlighting a dedication to environmental management. |

| 2011 | Established the Atexcaco Hydroelectric Plant, a 'run-of-the-river' system for sustainable energy. |

| 2024 | Refinanced debt with a syndicated loan of US$130 million, improving its financial profile. |

Autlan has consistently pursued innovation, particularly in sustainable energy and processing technologies. A notable advancement is the Atexcaco Hydroelectric Plant, which provides clean, renewable energy for its operations. Furthermore, the company operates the world's only nodulization rotary kiln for manganese ore at its Molango unit, enhancing ferroalloy production.

The 'run-of-the-river' system, operational since 2011, supplies clean energy, reducing costs and environmental impact. This initiative showcases Autlan's commitment to sustainable practices and energy efficiency.

The Molango unit utilizes a unique nodulization rotary kiln to improve manganese ore properties. This technology enhances ferroalloy production, contributing to operational efficiency.

Despite its achievements, Autlan has faced challenges, including market downturns and competitive pressures. The steel industry's performance, a key consumer of Autlan's ferroalloys, has impacted the company. Moreover, Autlan's revenue concentration, with a significant portion of income from a few buyers, presents a risk that the company actively monitors.

The steel industry's performance directly affects Autlan's ferroalloy division, creating financial pressure. The company must adapt to fluctuating demand and market dynamics.

A significant portion of Autlan's revenue comes from a limited number of buyers, which poses a risk. Diversification of the customer base and product portfolio is crucial.

The mining industry is highly competitive, requiring Autlan to continuously innovate and improve efficiency. This includes strategic financial moves and operational adjustments.

Autlan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Autlan?

The Autlan Company's history is a testament to strategic adaptation and expansion within the mining and ferroalloy industries. Starting in 1953, the company has navigated significant shifts, including government intervention and privatization, while continuously expanding its operations and diversifying its portfolio. Key milestones include the discovery of major manganese deposits, vertical integration into ferroalloy production, and the establishment of an energy division, all contributing to its growth and market position.

| Year | Key Event |

|---|---|

| 1953 | Compañía Minera Autlán is founded in Autlán, Jalisco, as the first Mexican-managed mining enterprise to exploit manganese. |

| 1960s | Operations are transferred to Molango, Hidalgo, following the discovery of the largest manganese deposit in Central and North America. |

| 1973 | Acquisition of Ferroaleaciones Teziutlán, S.A. de C.V., marking Autlán's vertical integration into ferroalloy production. |

| 1975 | Autlán is listed on the Mexican Stock Exchange. |

| 1980s | The Federal Government takes over the company's management. |

| 1993 | GFM acquires Autlán, returning the company to the private sector, and the Gómez Palacio ferroalloys plant begins operations. |

| 1990s | Autlán obtains ISO 9001 certification for all its facilities. |

| 2003 | Autlán celebrates its 50th anniversary. |

| 2011 | The Atexcaco Hydroelectric Plant begins operations. |

| 2014 | Autlán acquires full control of Compañía de Energía Mexicana (CEM), integrating the Atexcaco hydroelectric plant and forming the Energy Division, and the Naopa open-pit mine also begins operations. |

| 2015 | The company reorganizes its operations into three divisions: Ferroalloys, Mining, and Energy, and updates its corporate image. |

| 2010s | Autlán receives new certifications, including Socially Responsible Enterprise (ESR) from CEMEFI, FAMI-QS, ISO 9001, and ISO 14001. |

| 2024 (Q3) | Autlán posts net income of $4.3 million, reversing losses from the previous year, with total sales increasing by 3.8% to $89.6 million. |

| 2024 (November) | Successful syndicated debt refinancing of US$130 million improves the company's maturity profile. |

| 2025 (Q1) | Autlán reports sales of USD 80.14 million and a net loss of USD 7.45 million. |

Autlán aims to maximize company value through operational excellence, focusing on efficiency and improvements across all divisions. The company is committed to maintaining its low-cost structure and just-in-time delivery system to provide a competitive edge in the market. Ongoing investments, such as the US$8 million CAPEX in the first three quarters of 2024, support this strategy.

The company plans to drive organic growth in its mining operations and manganese ferroalloy production. Autlán aims to enhance its gold production by 15% through Autlán Metallorum, expanding its market presence. This growth strategy is supported by continuous innovation and the exploration of new opportunities within its core business areas.

Autlán is actively seeking opportunities for portfolio diversification and operational synergies through acquisitions in profitable sectors. This strategy aims to strengthen its market position and create value by combining resources and expertise. The company's focus on strategic acquisitions is a key component of its long-term growth plan.

The company is committed to innovative renewable energy initiatives, such as wind and solar projects, to contribute to Mexico's sustainable development. This focus reduces costs and aligns with Autlán's vision for responsible resource utilization. This commitment also supports its long-term sustainability goals and enhances its competitive position.

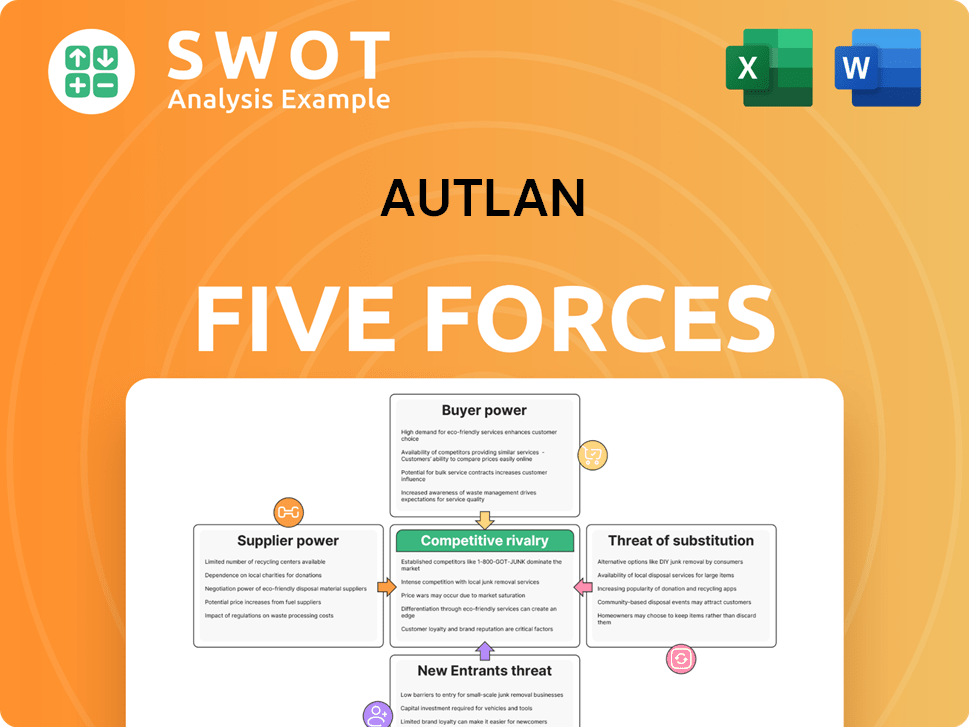

Autlan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Autlan Company?

- What is Growth Strategy and Future Prospects of Autlan Company?

- How Does Autlan Company Work?

- What is Sales and Marketing Strategy of Autlan Company?

- What is Brief History of Autlan Company?

- Who Owns Autlan Company?

- What is Customer Demographics and Target Market of Autlan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.