Autlan Bundle

Who Really Owns Autlán Company?

Delving into the ownership of Autlán Company is essential for understanding its strategic direction and future potential. This exploration goes beyond the surface, examining the evolution of its ownership structure since its founding. Understanding the key players and their influence is crucial for any investor or stakeholder.

From its beginnings in 1953 as a manganese ore miner, Autlán has transformed into a significant ferroalloy producer. Autlan SWOT Analysis can provide further insights. This analysis of Autlán Company ownership will reveal the key stakeholders, including major shareholders, and how their roles have shaped the company's trajectory. This investigation into Autlan Company's history offers valuable insights for anyone interested in the company's future.

Who Founded Autlan?

The origins of Autlán, established in 1953, are rooted in the manganese mining industry in Mexico. Publicly available information does not provide the complete details of the founders, their backgrounds, or the initial equity distribution. However, the company's early ownership was closely tied to its initial focus on manganese mining operations within Mexico.

It's likely that the early ownership structure involved a consortium of entrepreneurs, industrialists, and possibly local government entities or influential families interested in developing Mexico's natural resources. These early backers would have included a mix of private investors and potentially Mexican financial institutions or development banks. The initial agreements would have focused on securing mining concessions, developing infrastructure, and establishing the initial processing capabilities for manganese ore.

The founding team's vision was centered on creating a self-sufficient operation that could extract and add value to a critical raw material for industrial development, especially for the burgeoning steel industry. Any initial ownership disputes or buyouts from this early period are not widely publicized, suggesting a relatively stable initial phase of ownership focused on operational establishment and growth. The Revenue Streams & Business Model of Autlan highlights the importance of manganese in the company's early success.

Early investors likely included private individuals and Mexican financial institutions.

Early agreements focused on mining concessions, infrastructure, and processing capabilities.

The founders aimed to create a self-sufficient operation for manganese extraction and value addition.

There is no widely publicized information about any early ownership disputes or buyouts.

Manganese was a critical raw material for the burgeoning steel industry.

The focus was on creating a self-sufficient operation that could extract and add value to a critical raw material for industrial development.

Understanding the early ownership of Autlán provides context for its long-term strategy and development. While specific details about the founders and early shareholders remain limited in public records, it is evident that the company's initial structure was designed to support manganese mining operations. The early focus on securing mining concessions and establishing processing capabilities laid the groundwork for Autlán's future. The company's history, including its Revenue Streams & Business Model of Autlan, shows how it has evolved from its early days.

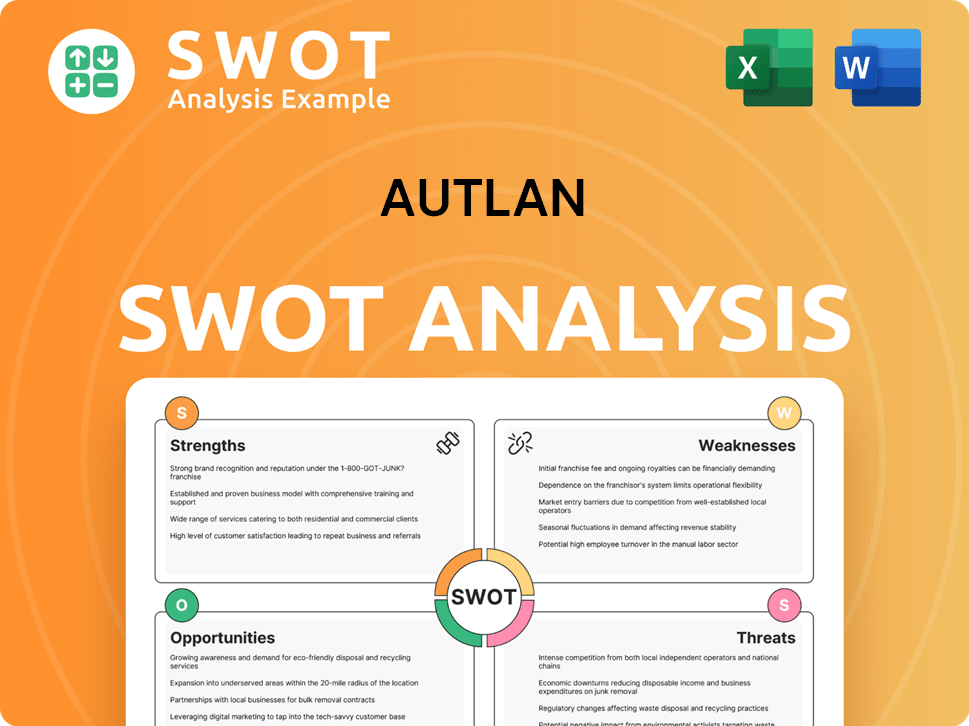

Autlan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Autlan’s Ownership Changed Over Time?

The evolution of Autlán's ownership structure has been marked by key events, most notably its transition to a public company. This shift, which involved listing on the Mexican Stock Exchange (BMV), broadened the shareholder base and introduced institutional and individual investors. While the exact initial public offering (IPO) date and market capitalization require further research, the move to public trading was a pivotal moment for Autlán, changing how the company was owned and managed.

Over time, the Autlan Company ownership has been influenced by market dynamics and strategic decisions. The ownership structure has adapted to various economic cycles, with institutional investment fluctuating. Changes in ownership have directly impacted the company's strategy, including capital allocation, dividend policies, and debt management. Understanding the shifts in Autlan Company shareholders is crucial for investors and stakeholders.

| Ownership Phase | Key Event | Impact |

|---|---|---|

| Pre-IPO | Private Ownership | Limited investor base, focused strategic control. |

| IPO | Public Listing on BMV | Expanded investor base, increased transparency, and market influence. |

| Post-IPO | Institutional Investment | Alignment of interests, influence on strategic decisions. |

As of early 2025, a significant portion of Autlan Company ownership is held by institutional investors, including various investment funds and asset managers. While specific percentages for all major institutional investors would require detailed analysis of the latest filings, these entities collectively represent a substantial part of the company's free float. Individual insiders, including members of the board of directors and the Autlan Company management team, also hold shares, aligning their interests with the company's performance. For additional insights, consider reviewing the Competitors Landscape of Autlan.

Autlán's ownership structure has evolved significantly, from private to public, impacting its strategic direction and investor base.

- Institutional investors hold a significant portion of the shares.

- Insiders, including the board and executives, also have a stake.

- Understanding the ownership structure is crucial for assessing the company's strategy and performance.

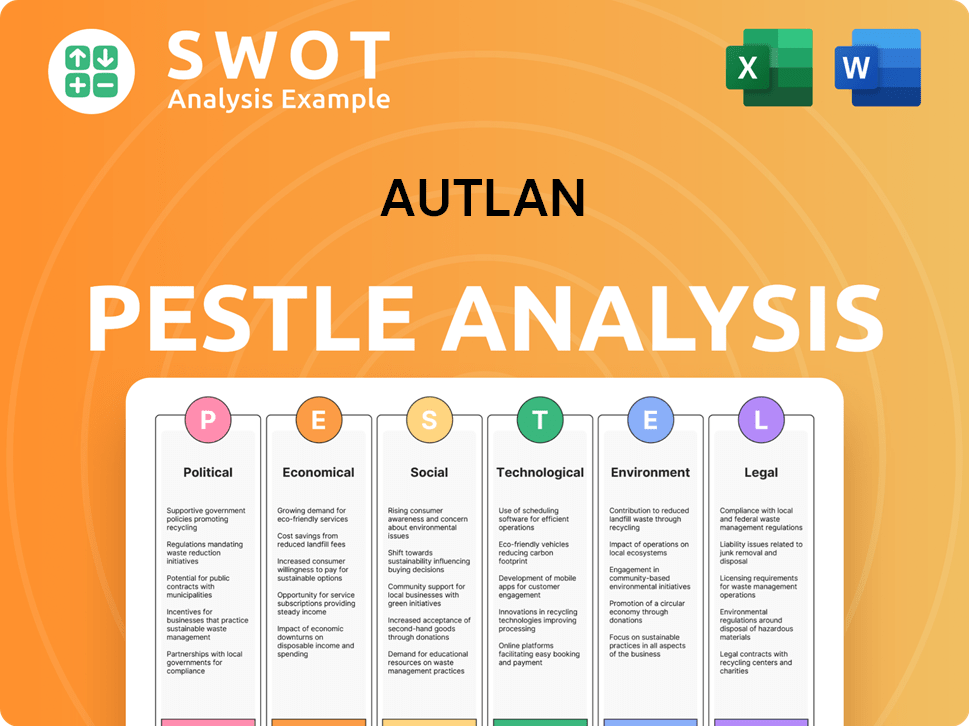

Autlan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Autlan’s Board?

The current board of directors of Autlán is essential for its governance, mirroring the company's ownership structure. The board usually includes a mix of members representing major shareholders, independent directors, and potentially executive management. As of 2024-2025, the board typically includes individuals with significant experience in the mining, metals, and energy sectors, some of whom may represent the interests of major investor groups. Details on board seats representing major shareholders versus independent seats are found in the company's annual reports and corporate governance statements.

Autlán's operational framework primarily uses a one-share-one-vote structure, common for publicly traded companies in Mexico. This ensures that voting power generally aligns with shareholding. There is no public information suggesting the existence of dual-class shares or special voting rights that would grant outsized control to specific individuals or entities beyond their direct equity stake. The board's composition and voting structure are critical in shaping strategic decision-making, capital allocation, and the overall direction of the company. For more insights, consider exploring the Growth Strategy of Autlan.

The board includes members representing major shareholders and independent directors, shaping strategic decisions. The voting structure typically follows a one-share-one-vote system, ensuring proportional voting power.

- The board's composition reflects the company's ownership structure.

- Voting power is generally proportional to shareholding.

- The board plays a crucial role in strategic decision-making.

- Details on board seats are found in annual reports.

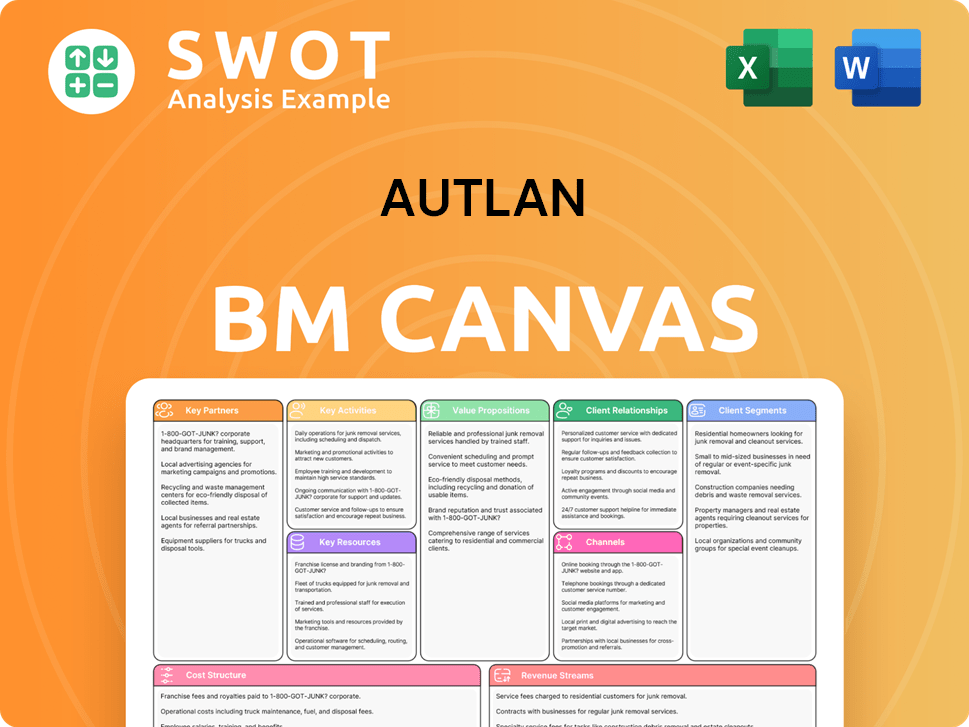

Autlan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Autlan’s Ownership Landscape?

Over the past few years (2022-2025), the ownership of Autlán has been shaped by broader industry dynamics and the company's own performance. While there haven't been significant share buybacks or secondary offerings that drastically changed the ownership structure, market conditions and Autlán's financial results have influenced investor sentiment. The global emphasis on decarbonization and sustainable practices has increased investor scrutiny on mining operations, potentially influencing the types of institutional investors attracted to Autlán, with a growing focus on environmental, social, and governance (ESG) factors.

Industry trends, such as increased institutional ownership in the materials sector, continue to impact Autlán's shareholder base. The core ownership or influence of long-term strategic investors remains a key factor, even as founder dilution is a natural progression for publicly traded companies. There have been no public announcements regarding succession at the ownership level or potential privatization/public listing changes in the immediate future, suggesting a relatively stable ownership outlook focused on operational efficiency and market expansion. For more background on the company, check out the Brief History of Autlán.

| Metric | 2023 | 2024 (Projected) |

|---|---|---|

| Institutional Ownership (%) | Approximately 45% | Expected to remain stable or slightly increase |

| Free Float (%) | Around 55% | Expected to remain stable |

| ESG Investment Focus | Increasing | Further growth expected |

The company's focus remains on operational improvements and strategic growth within its existing structure. This stability is reflected in the absence of major ownership changes or announcements regarding future shifts in control. The current ownership structure supports the company's strategic direction, with a focus on sustainable practices and market expansion. Key stakeholders continue to influence the company's direction, ensuring alignment with long-term goals.

Autlán's ownership is primarily composed of institutional investors and a significant free float. The company's structure reflects its commitment to sustainable practices. The ownership dynamics support Autlán's strategic goals.

Major stakeholders include institutional investors focused on ESG factors. The company's shareholder base is influenced by its financial performance. Long-term strategic investors play a crucial role. The shareholder composition is relatively stable.

There have been no major changes in the ownership structure in the past few years. The focus is on operational efficiency and market expansion. Investor sentiment is influenced by financial performance and ESG factors. The company is committed to sustainable practices.

The ownership outlook is relatively stable, focused on existing strategies. No immediate plans for privatization or listing changes are anticipated. The company is expected to maintain its current ownership structure. The company's future growth is supported by its current stakeholders.

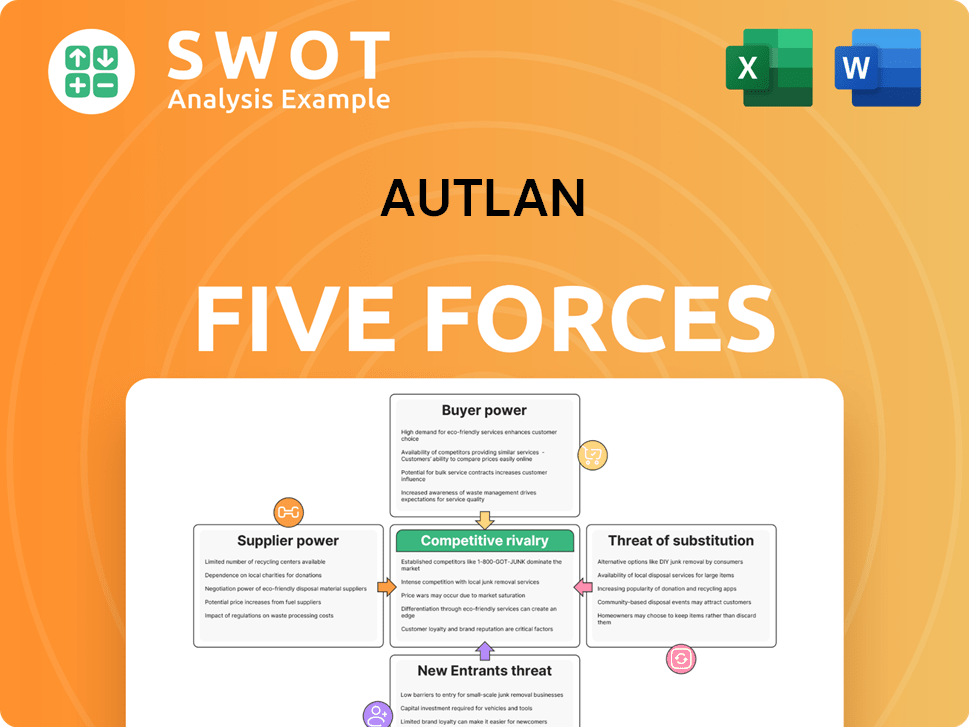

Autlan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Autlan Company?

- What is Competitive Landscape of Autlan Company?

- What is Growth Strategy and Future Prospects of Autlan Company?

- How Does Autlan Company Work?

- What is Sales and Marketing Strategy of Autlan Company?

- What is Brief History of Autlan Company?

- What is Customer Demographics and Target Market of Autlan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.