Autlan Bundle

How Does Autlán Navigate the Cutthroat Ferroalloy Market?

In the demanding world of steel production, understanding the Autlan SWOT Analysis is crucial for any investor or industry professional. This in-depth analysis explores the competitive landscape of Autlán Company, a key player in the ferroalloy market. We'll dissect its market position, identify its rivals, and uncover the strategies that drive its success.

This deep dive into the Autlán Company competitive landscape will provide a comprehensive

Where Does Autlan’ Stand in the Current Market?

Autlán holds a significant market position within the ferroalloys industry, particularly in the Americas. The company is a key producer of manganese ferroalloys, which are essential for steel production. Its primary focus is on serving the steel industry, providing crucial components for various steel grades. Autlán's operations are geographically concentrated in Mexico, where it has a strong presence, and it is a major supplier to steel producers in North America and beyond.

The company's strategic approach includes vertical integration, encompassing manganese mining, ferroalloy production, and hydroelectric power generation. This integrated model provides Autlán with a degree of control over its supply chain and production costs, setting it apart from competitors that might rely on external sourcing. Autlán’s financial performance, as reflected in its reported revenues and EBITDA, demonstrates its ability to withstand market fluctuations, making it a resilient player in the cyclical commodities market. For a deeper understanding of its business model, consider exploring Revenue Streams & Business Model of Autlán.

While specific market share figures for 2024-2025 are not readily available from public searches, Autlán's consistent investment in its mining assets and production facilities reinforces its long-term commitment to maintaining its market standing. This commitment is crucial in a competitive landscape where factors like raw material costs, energy prices, and global steel demand significantly influence profitability.

Autlán is a major player in the ferroalloys sector, especially in the Americas. It specializes in manganese ferroalloys, which are vital for steelmaking. The company's strong presence in Mexico and its supply network across North America highlight its significant market reach.

Autlán's integrated operations, from mining to power generation, offer a competitive edge. This vertical integration helps in managing costs and supply chain risks. The company's financial stability, as seen in its revenue and EBITDA, supports its ability to navigate market volatility.

The company's primary market is the Americas, with a strong base in Mexico. Autlán has established itself as a key supplier to steel producers in North America. This strategic location allows it to effectively serve a large customer base.

Despite market fluctuations, Autlán has demonstrated resilience. Its investments in assets and facilities show a long-term commitment. The company's financial health is a key factor in maintaining its market position.

The ferroalloys market is influenced by factors such as global steel demand, raw material costs, and energy prices. Autlán's competitive advantages include its vertical integration and strategic geographic presence. The company faces competition from other ferroalloy producers, both domestically and internationally, who also supply the steel industry.

- Market Analysis: Autlán's market share is influenced by steel production trends and global economic conditions.

- Competitive Advantages: Vertical integration and control over key resources give Autlán a competitive edge.

- Strategic Partnerships: Autlán may engage in partnerships to enhance its market position and access to resources.

- Financial Performance: The company's ability to maintain profitability is crucial for its long-term success.

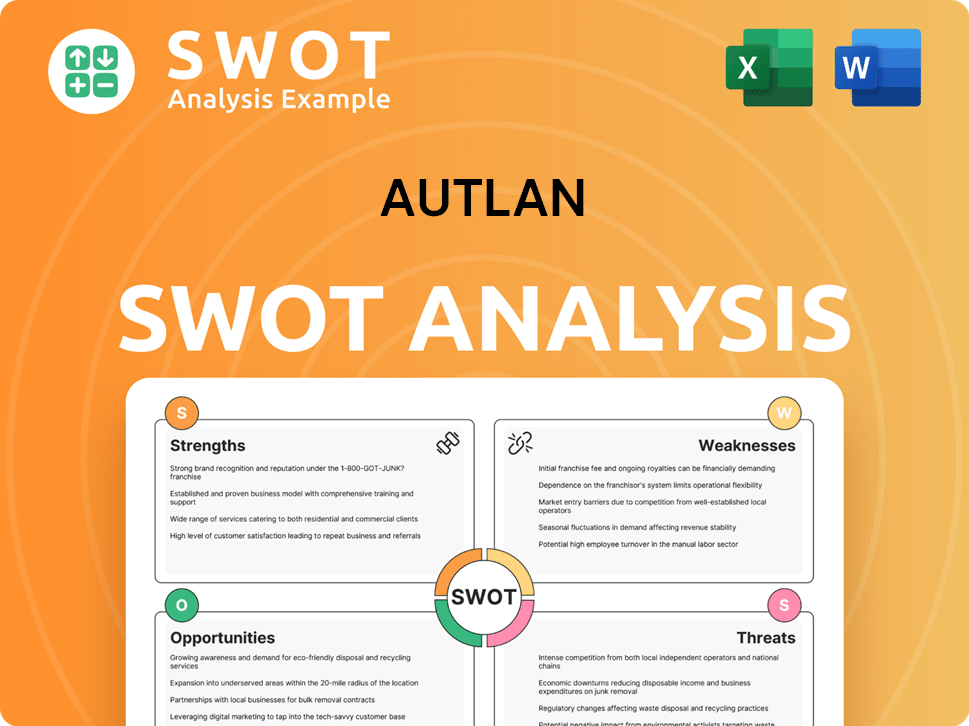

Autlan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Autlan?

The Marketing Strategy of Autlan involves navigating a complex competitive landscape. Autlán, a player in the manganese ore and ferroalloys market, faces both direct and indirect competition. Understanding its rivals is crucial for strategic planning and maintaining a competitive edge.

This Autlan Company competitive landscape analysis examines key competitors and the factors influencing their market positions. The ferroalloys industry is subject to global demand, raw material costs, and geopolitical influences. This requires Autlán to constantly assess its position and adapt its strategies.

Direct competitors of Autlán include other international producers of ferromanganese and silicomanganese. These companies often have significant production capacities and global distribution networks. They compete on price, efficiency, and market reach.

Key competitors include large, diversified mining and metals companies. Eramet and South32 are prominent examples, with strong presences in manganese alloys. These companies are key players in the Autlan Company industry.

Competition is driven by economies of scale, distribution networks, and technological advancements. Price competition is heavily influenced by global steel demand and raw material costs. The Autlan Company market analysis must consider these factors.

Indirect competition comes from alternative materials or processes in steel production. Regional suppliers with lower production costs also pose a threat. Emerging players in regions with significant manganese reserves can disrupt the market.

Geopolitical factors and trade policies significantly influence the competitive landscape. These factors can lead to shifts in market share and the emergence of new alliances. This impacts the Autlan Company business strategy.

The global nature of the steel and ferroalloys markets makes them volatile. Changes in demand, supply chain disruptions, and economic conditions can all affect the competitive dynamics. Staying informed is critical.

Analyzing the strengths and weaknesses of competitors is essential for strategic planning. This includes assessing their production costs, market reach, and technological capabilities. Understanding the Autlan Company competitors is vital.

- Economies of Scale: Larger competitors may have lower production costs.

- Distribution Networks: Extensive networks provide a competitive advantage.

- Technology: Advancements in ferroalloy production can improve efficiency.

- Geographical Presence: Access to key markets and resources is crucial.

- Financial Performance: Strong financial positions enable investment and growth.

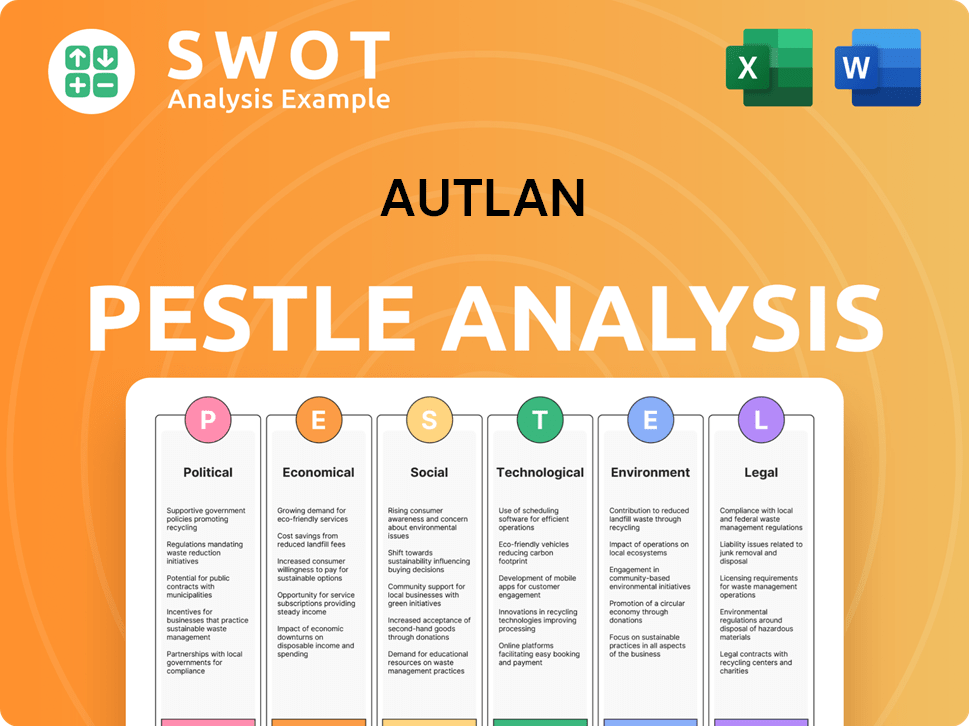

Autlan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Autlan a Competitive Edge Over Its Rivals?

The Autlán Company's competitive advantages stem from its integrated business model and strategic operational efficiencies, setting it apart in the Autlán Company industry. This integration, combined with its self-sufficiency in energy, provides a robust foundation for cost control and market competitiveness. Autlán's approach to its operations allows it to navigate the complexities of the manganese and ferroalloys market with a degree of resilience.

Autlán's strategic focus on vertical integration and energy self-sufficiency highlights its commitment to long-term sustainability and operational excellence. These elements are crucial in the competitive landscape, particularly concerning raw material costs and energy expenses. The company's ability to manage these factors effectively contributes significantly to its financial performance and market position. Its strategic moves reflect a proactive approach to maintaining and enhancing its competitive edge.

Autlán's ability to maintain its competitive edge is supported by its established relationships with key customers, particularly in the steel industry. Its geographic proximity to major steel producers in North America offers logistical advantages and potentially faster delivery times compared to overseas competitors. Autlán's focus on operational efficiency and product quality is an ongoing commitment.

Autlán's ownership of manganese mines and ferroalloy production facilities provides greater control over the supply chain. This reduces reliance on external suppliers, mitigating price volatility and ensuring a consistent supply of raw materials. This strategic integration is a key factor in its Autlán Company market analysis.

The company's hydroelectric power plants provide a significant cost advantage. Generating its own clean energy reduces exposure to fluctuating electricity prices. This proprietary energy source enhances its operational efficiency and cost competitiveness, particularly against rivals dependent on market-priced energy.

Autlán benefits from established relationships with key customers in the steel industry. Its geographic proximity to major steel producers in North America offers logistical advantages and potentially faster delivery times compared to overseas competitors. This strengthens its position in the Autlán Company competitive landscape.

Continuous investment in optimizing mining and ferroalloy production processes indicates a commitment to operational efficiency and product quality. While specific patents are not highlighted, the ongoing efforts suggest a focus on innovation. This focus is crucial for Autlán Company business strategy.

Autlán's core strengths include its vertically integrated model, energy self-sufficiency, and established customer relationships. These advantages are largely sustainable due to the significant capital investment required for mining and processing operations. The company's strategic positioning is enhanced by its focus on operational efficiency and product quality.

- Vertical integration ensures control over the supply chain.

- Self-sufficiency in energy reduces costs and environmental impact.

- Established customer relationships provide a stable market.

- Continuous operational improvements enhance efficiency.

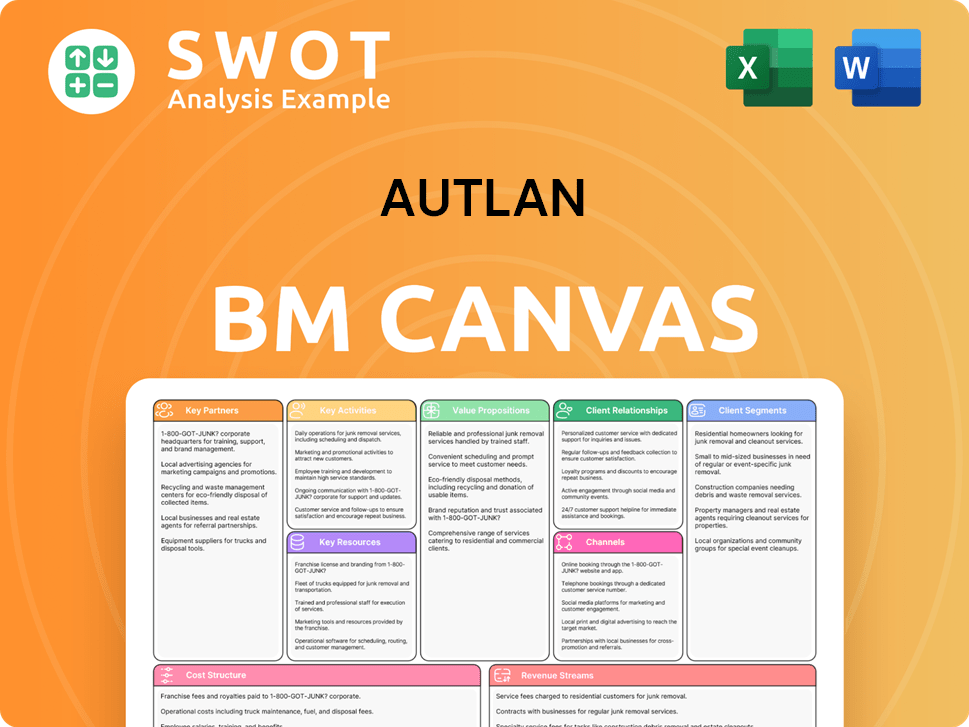

Autlan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Autlan’s Competitive Landscape?

The competitive landscape for Autlán is significantly influenced by the ferroalloys industry's dynamics. The company's performance is closely tied to the global steel industry, which is a major consumer of ferroalloys. This industry is subject to various external factors, including economic cycles, technological advancements, and regulatory changes.

Understanding the Autlán Company competitive landscape involves analyzing industry trends, future challenges, and potential opportunities. Market analysis reveals that the company's success depends on its ability to adapt to evolving industry demands and maintain a competitive edge. The company's business strategy must consider these factors to ensure sustainable growth.

The ferroalloys sector is primarily driven by global steel production, with demand influenced by construction, automotive, and manufacturing. The increasing focus on sustainable steel production presents both challenges and opportunities. Technological advancements in steelmaking processes can also impact the demand for specific ferroalloys.

Navigating the cyclical nature of the steel industry and managing commodity price volatility are significant challenges. Maintaining cost competitiveness in a global market is crucial, and potential competition from new entrants or technological disruptions must be addressed. Regulatory changes related to environmental standards, mining practices, and international trade policies will continue to impact operational costs and market access.

Growing demand for high-strength, lightweight steel offers significant opportunities, often requiring specific ferroalloy compositions. Expanding into emerging markets with developing infrastructure can also drive growth. The emphasis on sustainable sourcing and production in the steel value chain favors companies with integrated models and renewable energy capabilities.

Autlán's integrated model and renewable energy sources provide a competitive advantage in the market. The company's strategy likely includes operational optimization, potential diversification within the ferroalloys sector, and strategic partnerships. These strategies aim to ensure resilience and capitalize on growth opportunities in a dynamic market. For a deeper understanding of Autlán's growth strategy, refer to Growth Strategy of Autlán.

Autlán's competitive landscape is shaped by its ability to adapt to market fluctuations and technological advancements. The company must address challenges related to commodity price volatility and maintain cost-effectiveness. Opportunities lie in sustainable practices and expanding into new markets.

- Market Analysis: Understanding the cyclical nature of the steel industry is crucial for forecasting demand and managing inventory.

- Strategic Partnerships: Forming alliances can improve market access and share resources, enhancing competitiveness.

- Technological Adaptation: Investing in new technologies can improve production efficiency and meet evolving customer needs.

- Sustainability: Focusing on sustainable practices can attract environmentally conscious customers and reduce operational costs.

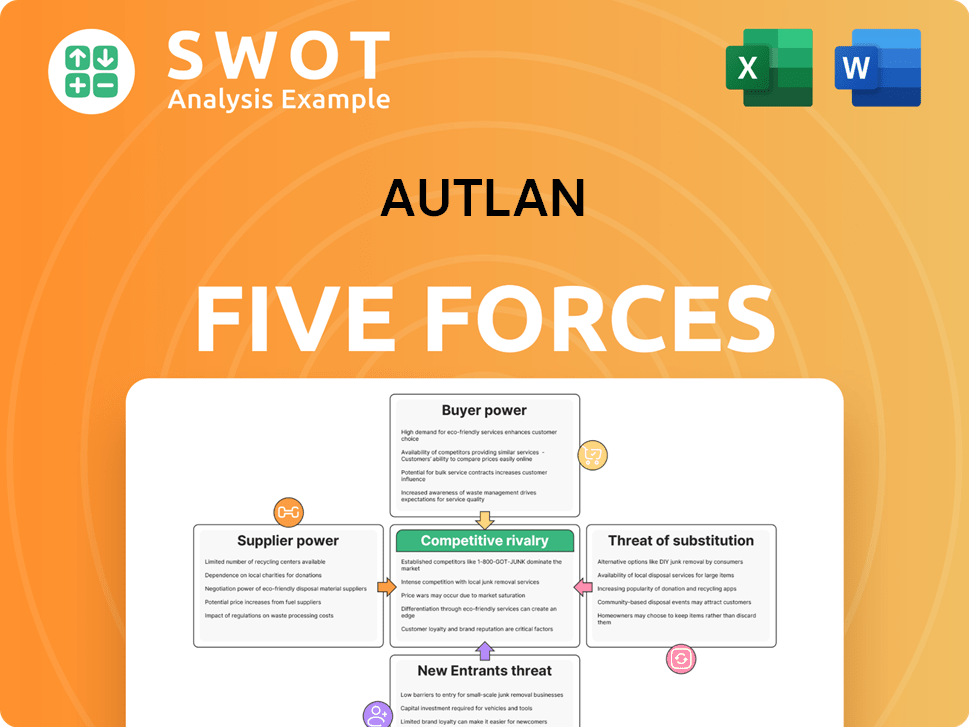

Autlan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Autlan Company?

- What is Growth Strategy and Future Prospects of Autlan Company?

- How Does Autlan Company Work?

- What is Sales and Marketing Strategy of Autlan Company?

- What is Brief History of Autlan Company?

- Who Owns Autlan Company?

- What is Customer Demographics and Target Market of Autlan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.