Blackbaud Bundle

How Did Blackbaud Evolve into a Nonprofit Tech Giant?

From a single billing system to a global leader, Blackbaud's story is one of remarkable transformation. Founded in 1981, the company initially focused on providing software solutions for educational institutions, a vision that quickly expanded. Today, Blackbaud serves over 35,000 customers worldwide, offering a suite of Blackbaud SWOT Analysis and other innovative solutions that have revolutionized the nonprofit sector.

This article delves into the Blackbaud history, examining the key milestones and strategic decisions that propelled the Blackbaud company to its current position. We'll explore the evolution of its Blackbaud software and Blackbaud products, from its early days to its present-day status as a critical provider of nonprofit technology, including fundraising software and CRM solutions. Understanding this trajectory provides valuable insights into the company's future and its impact on the social good sector.

What is the Blackbaud Founding Story?

The Blackbaud story began in 1981, marking the inception of a company that would become a significant player in the nonprofit technology sector. This journey started with a vision to streamline operations for educational institutions, evolving into a broader mission to support the entire nonprofit ecosystem. This early focus laid the groundwork for future innovations and expansions.

Blackbaud's history is rooted in the entrepreneurial spirit of its founder, Anthony Bakker. His initial project, a computerized billing system, showcased the potential for technology to transform administrative tasks. This early success was a catalyst, driving Bakker to establish Blackbaud Microsystems in 1982, setting the stage for the company's growth.

The company's name, Blackbaud, cleverly merges 'blackboard' with 'baud,' reflecting its initial focus on schools and its technological underpinnings. From a single-room office in Long Island, the company began its journey, eventually expanding to serve a global customer base. The evolution of its products, such as the flagship offering, The Raiser's Edge, showcases its commitment to innovation and its understanding of the nonprofit sector's needs.

Anthony Bakker founded Blackbaud in 1981, initially targeting the education sector. The first product, 'Student Billing,' was an accounts receivable system for private K-12 schools.

- Blackbaud Microsystems was incorporated in 1982.

- The company's name combines 'blackboard' and 'baud.'

- The Raiser's Edge, a fundraising SQL database software, became a flagship product.

- The company started in a one-room office in Long Island.

As the company grew, so did its product offerings, expanding beyond its initial focus on educational billing to encompass a wide range of solutions for nonprofits. The development of The Raiser's Edge marked a significant milestone, establishing Blackbaud as a leader in fundraising software. The company's strategic decisions and product innovations have enabled it to support nonprofits of all sizes and missions. To learn more about the company's revenue streams and business model, you can read this article about Blackbaud's Business Model.

Blackbaud SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Blackbaud?

The early phase of the Blackbaud company saw it broaden its customer base beyond schools, embracing various nonprofit organizations. This expansion marked a significant shift in its strategic focus. A key move was the relocation of its headquarters, which was a pivotal moment in its development.

In 1989, Blackbaud moved its headquarters from New York City to Mount Pleasant, South Carolina, a strategic decision aimed at reducing operational costs. At the time, the company had 75 employees. This move saw 15 employees relocating to South Carolina, while 30 remained in a New York City support and training office. The company's growth necessitated a further move to North Charleston, South Carolina, in 1992, as it outgrew its Mount Pleasant headquarters.

A significant milestone in Blackbaud's growth was its commitment to the Windows 95 platform in 1994, which expanded its market reach. This strategic decision led to a substantial increase in annual sales, from $19 million to $26 million. The company's initial public offering (IPO) on NASDAQ in 2004 raised approximately $64 million. This influx of capital fueled further acquisitions and growth initiatives.

Blackbaud broadened its service scope beyond finance to include marketing, fundraising, analytics, and customer relationship management. By the end of 2005, the company had over 13,300 customers, with 97% paying annual maintenance and support fees. These customers spanned diverse nonprofit verticals, including religion, education, and healthcare. The company's expansion continued through strategic acquisitions.

Key acquisitions, such as Campagne Associates in 2006, and Target Software and Target Analysis Group in 2007, strengthened Blackbaud's database management and data mining capabilities for nonprofits. These acquisitions enhanced its ability to provide comprehensive Blackbaud software solutions. For more insights into the company's journey, you can explore the detailed Blackbaud company timeline.

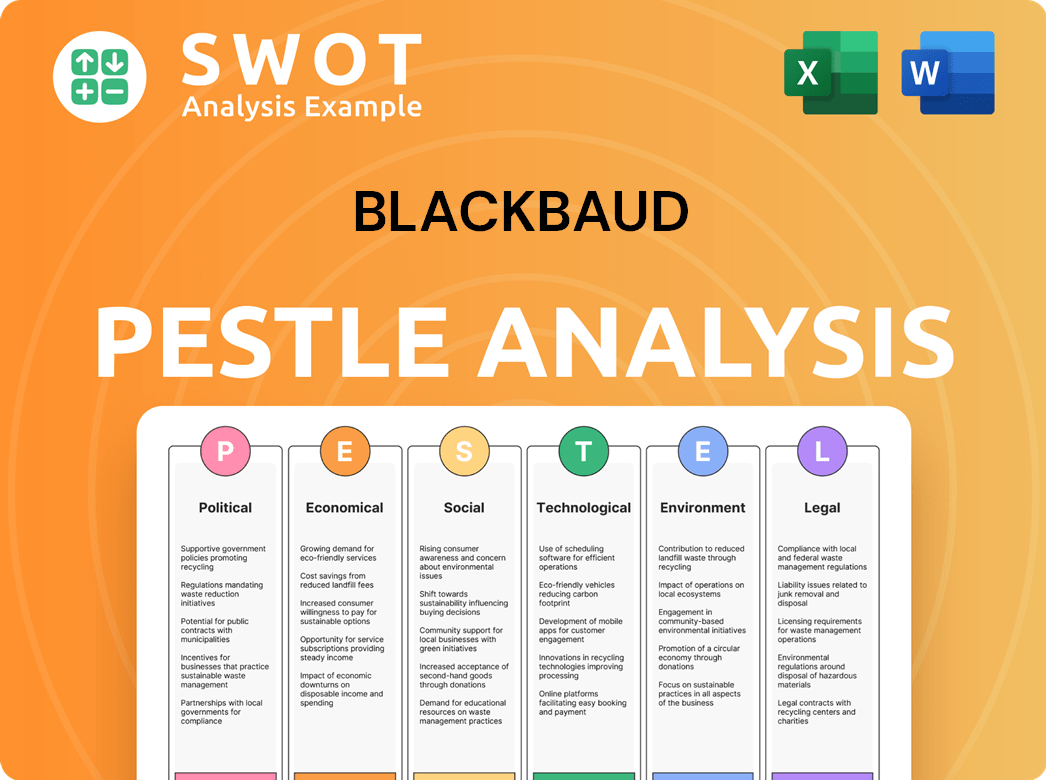

Blackbaud PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Blackbaud history?

The Blackbaud company has a rich history marked by strategic expansions and technological advancements. Its journey includes significant product launches, strategic acquisitions, and responses to market challenges, shaping its position as a key player in the nonprofit technology sector.

| Year | Milestone |

|---|---|

| 1982 | Launched The Raiser's Edge for DOS, its flagship fundraising software. |

| 1994 | Released The Raiser's Edge for Windows, modernizing its core product. |

| 2007 | Began an aggressive acquisition strategy, starting with Kintera Inc. |

| 2012 | Acquired Convio Inc., expanding its online fundraising capabilities. |

| 2014 | Acquired MicroEdge, broadening its grantmaking solutions. |

| 2017 | Acquired JustGiving, further enhancing its online fundraising offerings. |

| 2021 | Acquired EVERFI for $750 million, diversifying into education technology. |

| 2024 | Divested EVERFI, streamlining operations and enhancing future financial outcomes. |

Innovation has been a core focus for

In 2024 and 2025,

Leveraging its Intelligence for Good program to integrate machine learning and AI capabilities to streamline workflows and enhance efficiency for nonprofits.

Recent advancements include AI-driven insights for fundraising and online donation forms proven to increase conversion rates with intelligent suggested gift amounts.

Plans to deliver 100% of core Financial Edge NXT capabilities in a unified view by Q1 2025, including automated invoice scanning using Microsoft AI Document Intelligence.

The company has faced various challenges, including market downturns and competitive threats.

Despite economic challenges,

The company has demonstrated a commitment to returning value to shareholders, repurchasing 10% of its outstanding common stock in 2024 and planning to buy back an additional 3% to 5% in 2025.

Blackbaud Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Blackbaud?

The Blackbaud history is marked by significant milestones. Starting with a school billing system in 1981, the company evolved, incorporating in 1982 and relocating its headquarters to Mount Pleasant, South Carolina, in 1989. The release of The Raiser's Edge in 1994 marked a pivotal moment. Subsequent years saw strategic acquisitions, including Kintera, Convio, MicroEdge, and JustGiving, broadening its reach in the nonprofit technology sector. An IPO in 2004, the sale by Anthony Bakker in 1999, and the 2021 acquisition of EVERFI also shaped its trajectory. The company divested EVERFI in 2024, streamlined operations, and launched AI initiatives, including Blackbaud Copilot, and reported full-year revenue of $1.155 billion. In Q1 2025, Blackbaud reported GAAP total revenue of $270.7 million.

| Year | Key Event |

|---|---|

| 1981 | Anthony Bakker developed a computerized billing system, laying the foundation for the company. |

| 1982 | Blackbaud Microsystems was incorporated in New York City, and Student Billing was launched. |

| 1989 | Blackbaud relocated its headquarters to Mount Pleasant, South Carolina. |

| 1994 | The Raiser's Edge for Windows was released, and the company committed to the Windows 95 platform. |

| 1999 | Anthony Bakker sold Blackbaud. |

| 2004 | Blackbaud completed its Initial Public Offering (IPO) on NASDAQ. |

| 2007 | Acquired Kintera, Inc. and Target Software/Target Analysis Group, expanding into online fundraising and data mining. |

| 2012 | Acquired Convio, Inc., strengthening digital engagement tools. |

| 2014 | Acquired MicroEdge, entering the grantmaking and corporate social responsibility (CSR) software markets. |

| 2017 | Acquired JustGiving, expanding peer-to-peer fundraising capabilities. |

| 2021 | Acquired EVERFI, expanding into education technology. |

| 2024 | Divested EVERFI, streamlined operations, and reported full-year revenue of $1.155 billion. |

| 2024 | Launched new AI initiatives, including Blackbaud Copilot and enhanced AI-driven insights for fundraising. |

| 2025 Q1 | Reported GAAP total revenue of $270.7 million, with non-GAAP organic revenue increasing by 5.8%. |

Blackbaud is focused on maintaining its strategic focus and operational progress. The company plans to continue its investment in innovation, particularly AI integration. This includes enhancing its product roadmap, with upcoming product update briefings in Fall 2025. They aim to drive long-term profitable growth by accelerating product innovation.

For 2025, the company projects GAAP revenue between $1.115 billion and $1.125 billion, representing an organic growth of 4.2% to 5.1% at constant currency. They anticipate non-GAAP adjusted EBITDA margins of 34.9% to 35.9% and non-GAAP earnings per share of $4.16 to $4.35. Blackbaud also plans to repurchase an additional 3% to 5% of its outstanding shares in 2025.

Blackbaud is heavily investing in AI. They have launched initiatives like Blackbaud Copilot and are enhancing AI-driven insights for fundraising. A key goal is achieving a 'Rule of 45' by 2030, which likely refers to a financial metric. This focus is part of the company's broader strategy to leverage technology for social good.

The future trajectory of the company is tied to successfully navigating digital transformation trends within nonprofits. They will leverage their extensive, sector-specific dataset. The company is also focused on addressing cybersecurity concerns and competitive pressures. Blackbaud aims to optimize transactional revenue and modernize pricing and multi-year contracts.

Blackbaud Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Blackbaud Company?

- What is Growth Strategy and Future Prospects of Blackbaud Company?

- How Does Blackbaud Company Work?

- What is Sales and Marketing Strategy of Blackbaud Company?

- What is Brief History of Blackbaud Company?

- Who Owns Blackbaud Company?

- What is Customer Demographics and Target Market of Blackbaud Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.