Blackbaud Bundle

Who Really Controls Blackbaud?

Understanding the ownership structure of the Blackbaud SWOT Analysis is essential for investors, strategists, and anyone interested in the non-profit technology sector. Blackbaud's journey, marked by its 2004 IPO, has significantly reshaped its ownership landscape, transforming the company's direction. This analysis dives deep into who owns Blackbaud and how their influence shapes the company's future.

From its founding in 1981 by Anthony E. Bakker to its current status as a leading cloud software provider, Blackbaud's history is a testament to its evolution. This exploration of Blackbaud ownership will uncover the key players influencing the company's strategic decisions, including Blackbaud executives and major shareholders, and how acquisitions have impacted its trajectory. Knowing who owns Blackbaud provides crucial insights into its market position and future prospects.

Who Founded Blackbaud?

The story of the Blackbaud company began in 1981 in New York City, founded by Anthony E. Bakker. Initially, Bakker developed a computerized billing system, but the company quickly evolved into a significant player in the software industry. This early focus set the stage for what Blackbaud would become.

By 1982, as the client base grew, Bakker incorporated Blackbaud Microsystems. The company's first product, 'Student Billing,' was a system for private schools. This initial product line expanded, eventually leading to the development of 'The Raiser's Edge,' a flagship fundraising software.

The early ownership structure of Blackbaud is not fully detailed in public records. However, it's common for startups of that era to begin with founder capital before seeking external investments. These initial steps were crucial in setting the foundation for the company's future growth and eventual public offering.

Several key events shaped Blackbaud's early trajectory, influencing its growth and market position. These strategic moves were instrumental in shaping the company's future.

- In 1989, Blackbaud relocated its operations to Mount Pleasant, South Carolina, to reduce operating costs.

- By 1992, the company moved to North Charleston due to expansion.

- A significant event was the 1997 acquisition of Master Software Inc., which effectively doubled Blackbaud's customer base.

- These strategic decisions and product developments were essential for Blackbaud's expansion and its eventual public offering.

Blackbaud SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Blackbaud’s Ownership Changed Over Time?

The evolution of Blackbaud's ownership has been marked by significant transitions, most notably its Initial Public Offering (IPO) in July 2004. This pivotal event transformed the company from a private entity to a publicly traded one, with shares listed on NASDAQ under the ticker symbol 'BLKB.' The IPO raised approximately $64 million, broadening its investor base and setting the stage for future growth. As of May 30, 2025, the company's market capitalization is approximately $2.99 billion, reflecting its sustained presence in the market.

The company's ownership structure is largely influenced by institutional investors, signaling confidence from major investment firms. As of June 6, 2025, Blackbaud has 593 institutional owners and shareholders holding a total of 58,916,447 shares. This ownership structure reflects the company's strategic moves and financial performance over time. The company's history also includes an aggressive acquisition strategy, which has shaped its market position and, indirectly, its ownership dynamics. These strategic shifts influence investor interest and ownership patterns.

| Key Event | Impact on Ownership | Year |

|---|---|---|

| Initial Public Offering (IPO) | Transitioned from private to public; broadened investor base. | 2004 |

| Acquisition of Kintera | Expanded market share and technological capabilities. | 2008 |

| Acquisition of Convio | Further expanded market share. | 2012 |

Major institutional holders include Clearlake Capital Group, L.P., Vanguard Group Inc., and BlackRock, Inc. Notably, Clearlake Capital Group, L.P. held an 18.89% stake as of March 31, 2024, making it the largest institutional investor. These stakeholders play a crucial role in shaping the company's strategic direction. Blackbaud's journey, from its IPO to its current ownership structure, showcases its evolution and its position in the market. To learn more about the company's strategic initiatives, you can explore the Growth Strategy of Blackbaud.

Blackbaud transitioned from a private entity to a publicly traded company in 2004, significantly broadening its ownership. The company's ownership is primarily held by large institutional investors, reflecting confidence from major investment firms.

- The IPO in 2004 raised approximately $64 million.

- As of May 30, 2025, market capitalization is approximately $2.99 billion.

- Clearlake Capital Group, L.P. held an 18.89% stake as of March 31, 2024.

- Blackbaud has 593 institutional owners and shareholders as of June 6, 2025.

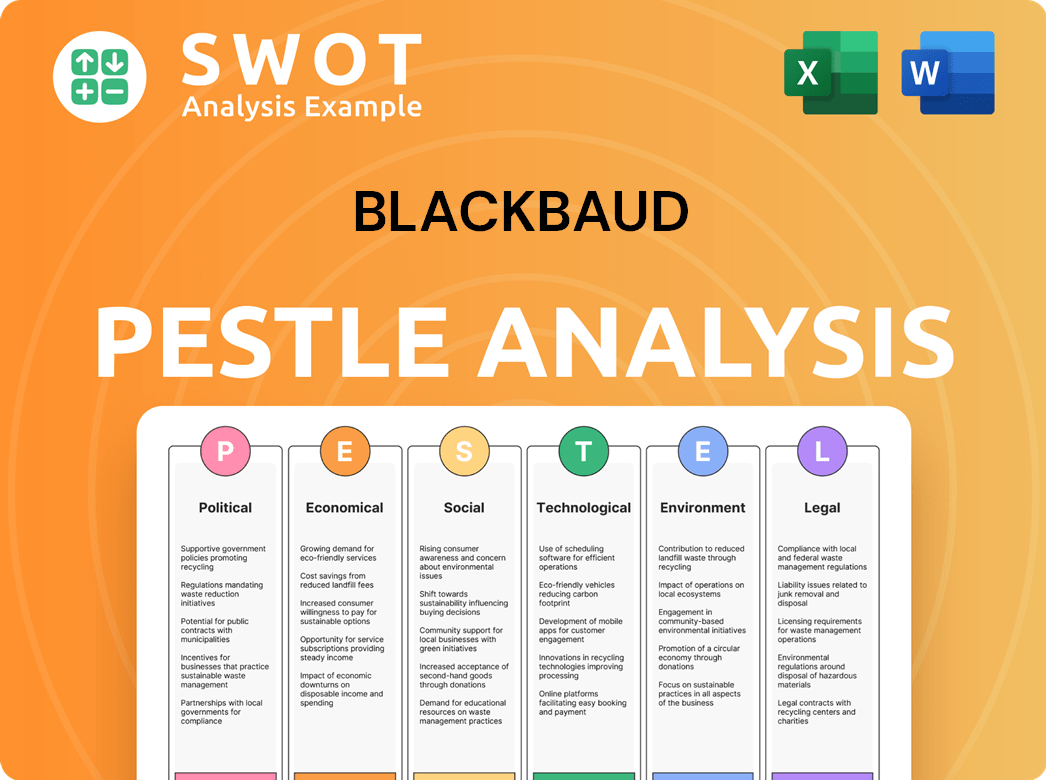

Blackbaud PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Blackbaud’s Board?

The strategic direction and operational oversight of the Blackbaud company are managed by its executive leadership team and the Board of Directors. The Board of Directors is responsible for evaluating proposals and making decisions that are in the best interests of the company and its stockholders. Details regarding current board members and their affiliations, including major shareholders and independent seats, are available in the company's proxy statements. For example, the 2025 Annual Meeting of Stockholders, which took place on June 12, 2024, included the election of three Class B directors for terms ending in 2027.

As of April 2024, Clearlake Capital Group held an 18.3% stake in Blackbaud, highlighting the influence of major shareholders. The Board of Directors had also scheduled an advisory vote to approve the 2023 compensation of its named executive officers and a proposal for the amendment and restatement of the Blackbaud, Inc. 2016 Equity and Incentive Compensation Plan. The company's governance structure and the board's responses to acquisition attempts underscore the interplay between major shareholders and the company's strategic direction. To learn more about the company's background, check out Brief History of Blackbaud.

| Board Member | Affiliation | Role |

|---|---|---|

| Michael Gianoni | CEO, Blackbaud | Director |

| Margaret A. "Peg" McHugh | Independent Director | Director |

| Mark F. Maybank | Independent Director | Director |

Blackbaud operates with a one-share-one-vote structure. However, the company had a stockholder rights plan, often referred to as a 'poison pill,' implemented on October 7, 2022. This plan declared a dividend of one preferred share purchase right for each outstanding share of common stock. Each preferred share had 1,000 votes, voting with the common stock, and entitled the holder to purchase one one-thousandth of a share of Series A Junior Participating Preferred Stock. This rights agreement was designed to protect stockholders in the event of certain acquisition attempts. However, in mid-March 2024, Blackbaud's board of directors unanimously terminated this stockholder rights plan.

The Board of Directors plays a crucial role in the Blackbaud company's strategic decisions.

- The Board oversees the company's operations.

- Major shareholders, like Clearlake Capital Group, have significant influence.

- The company's governance structure includes a one-share-one-vote system.

- The Board terminated the stockholder rights plan in March 2024.

Blackbaud Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Blackbaud’s Ownership Landscape?

Over the past few years, Blackbaud has shown a strong commitment to returning capital to its shareholders. In 2024, the company repurchased roughly 10% of its outstanding common stock. When including net share settlements related to employee stock compensation, this figure rose to approximately 11%. Looking ahead to 2025, Blackbaud plans to continue this strategy, projecting to buy back between 3% and 5% of its total outstanding shares. As of March 31, 2025, nearly $545 million remained available under its stock buyback program, which was expanded and renewed in July 2024.

A key trend influencing Blackbaud's ownership and strategic direction is the increasing presence of institutional investors. As of June 6, 2025, institutional investors hold a significant portion of the company's shares, with major holders including Vanguard Group Inc. and BlackRock, Inc. Notably, Clearlake Capital Group, L.P., the largest institutional investor with an 18.89% stake as of March 31, 2024, has been actively involved, even making unsolicited bids to take the company private. However, the Blackbaud board has rejected these offers, citing that they undervalue the company. This dynamic highlights the ongoing evolution of Blackbaud's growth strategy and its ownership landscape.

In terms of mergers and acquisitions, Blackbaud completed the divestiture of EVERFI in 2024, a strategic move aimed at aligning its portfolio with core objectives and improving financial performance. This means EVERFI's financial results will not be included in Blackbaud's 2025 financial guidance and results. Furthermore, the company made a strategic investment in Momentum, a generative AI startup focused on social impact, in 2023. The company's leadership has also emphasized its dedication to enhancing shareholder value. Blackbaud aims to achieve a 'Rule of 45' by 2030, a metric combining revenue growth and adjusted EBITDA margin, signaling a focus on consistent mid-single-digit organic revenue growth and margin expansion.

Institutional investors hold a large portion of Blackbaud's shares. Vanguard Group Inc. and BlackRock, Inc. are among the largest holders. Clearlake Capital Group, L.P. is the largest institutional investor with a substantial stake.

Blackbaud has been actively buying back its shares. In 2024, around 10% of the outstanding common stock was repurchased. The company plans to continue this strategy in 2025, with an expected buyback of 3% to 5% of total shares.

Blackbaud divested EVERFI in 2024 to better align with its core goals. The company also invested in Momentum, a generative AI startup. These moves reflect the company's evolving strategic direction.

Blackbaud aims for a 'Rule of 45' by 2030, focusing on revenue growth and margin expansion. The company is committed to enhancing shareholder value. This indicates a focus on sustainable financial performance.

Blackbaud Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Blackbaud Company?

- What is Competitive Landscape of Blackbaud Company?

- What is Growth Strategy and Future Prospects of Blackbaud Company?

- How Does Blackbaud Company Work?

- What is Sales and Marketing Strategy of Blackbaud Company?

- What is Brief History of Blackbaud Company?

- What is Customer Demographics and Target Market of Blackbaud Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.