Blackbaud Bundle

How Does Blackbaud Stack Up in the Nonprofit Tech Arena?

Blackbaud, a titan in the social good sector, is continuously evolving. Recent strategic shifts, including AI integration and the divestiture of EVERFI, are reshaping its trajectory. This analysis dives deep into the Blackbaud SWOT Analysis, exploring its competitive landscape and how it maintains its leadership position.

Understanding the Blackbaud competitive landscape is crucial for anyone involved in the fundraising software market or seeking to understand CRM for nonprofits. This exploration provides a detailed Blackbaud market analysis, examining its key Blackbaud competitors and evaluating its strategic moves. We'll uncover Blackbaud's strengths and weaknesses in comparison to other Nonprofit software vendors, offering actionable insights into this dynamic industry.

Where Does Blackbaud’ Stand in the Current Market?

Blackbaud's core operations center on providing software solutions designed to empower social impact organizations. These solutions span a wide range of needs, including fundraising, financial management, and operational efficiency. The company's value proposition lies in offering a comprehensive suite of tools that address the unique challenges faced by nonprofits, educational institutions, and other social good entities.

The company serves approximately 40,000 customers across over 100 countries, demonstrating a significant global footprint. Their primary product lines, such as Blackbaud Raiser's Edge NXT and Blackbaud Financial Edge NXT, are tailored to meet the specific requirements of the social good sector. Furthermore, Blackbaud's commitment to innovation and customer support solidifies its position as a leading provider in the market.

Blackbaud's market position is further strengthened by its strong financial performance and strategic focus. In Q1 2025, the company reported a GAAP total revenue of $270.7 million, with a non-GAAP organic revenue increase of 5.8%. For the full year 2024, revenue reached $1.155 billion, and the adjusted EBITDA margin was nearly 34%. Blackbaud's customer retention rate remains high, at 92-93%, indicating strong customer loyalty and satisfaction. The company is aiming to achieve a 'Rule of 45' by 2030, emphasizing a balance of growth and profitability.

Blackbaud is a prevalent choice among nonprofits, having tracked nearly $31 billion in donations across over 7,000 U.S.-based charitable entities. This highlights its significant market share in the fundraising software market. The company's solutions are widely adopted by organizations of various sizes, solidifying its position as a key player in the sector.

Blackbaud's financial health is robust, with a strong revenue stream and healthy profit margins. The company's projected GAAP revenue for 2025 is between $1.115 billion and $1.125 billion, with organic revenue growth at constant currency projected at 4.5% to 5.4%. These figures demonstrate the company's ability to maintain financial stability and growth in a competitive market.

The divestiture of the EVERFI business in late 2024, though impacting GAAP total revenue, reflects a strategic shift to refine core offerings. This move aims to enhance profitability and focus on the primary software solutions for social good organizations. This strategic focus is designed to strengthen Blackbaud's competitive position.

With a customer retention rate of 92-93%, Blackbaud demonstrates strong customer loyalty. This high retention rate is a key indicator of customer satisfaction and the value that clients find in Blackbaud's solutions. This contributes to the company's sustained success in the nonprofit software vendors market.

Blackbaud’s competitive advantages include a strong brand reputation, a comprehensive suite of products, and a deep understanding of the nonprofit sector. The company's focus on innovation and customer support further enhances its market position. A deep dive into the Blackbaud competitive landscape reveals these strengths.

- Leading provider of software for social impact.

- Strong financial performance and customer retention.

- Focus on innovation and customer support.

- Comprehensive suite of solutions for fundraising and financial management.

Blackbaud SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Blackbaud?

The Revenue Streams & Business Model of Blackbaud operates within a dynamic competitive landscape, offering a range of solutions tailored for nonprofits and social good organizations. This landscape includes both direct and indirect rivals that provide various software and services. Understanding the key players is crucial for evaluating Blackbaud's market position and strategic advantages.

Blackbaud's competitive environment is shaped by the diverse needs of its target market, which includes a wide array of organizations, from small local charities to large international NGOs. The company's success depends on its ability to provide comprehensive, integrated solutions that meet these varied requirements. This analysis of the Blackbaud competitive landscape considers both established and emerging competitors.

The Blackbaud market analysis reveals a competitive environment where innovation and customer focus are paramount. The company must continually adapt to evolving technological trends and changing customer expectations to maintain its market share. This includes addressing the challenges posed by both direct competitors and broader enterprise software providers.

Direct competitors offer similar solutions focused on donor management and fundraising. These companies provide integrated platforms that cater to the specific needs of nonprofits.

Significant direct competitors include Bloomerang, DonorPerfect, NeonCRM, and Kindful. These companies offer robust features and competitive pricing models.

Bloomerang is a cloud-based donor management application with CRM, online donations, email marketing, and reporting. Pricing starts at $125 per month for 1000 contacts.

DonorPerfect is an online fundraising software focused on tracking and managing donors. It provides tools for various fundraising activities.

NeonCRM offers comprehensive features starting at $49 per month. It is suitable for nonprofits seeking diverse fundraising capabilities.

Kindful has gained traction with over 10,000 nonprofit customers. It offers a range of features to support nonprofit operations.

In addition to direct competitors, Blackbaud faces competition from broader enterprise software providers and specialized solutions. This includes companies offering customizable nonprofit solutions and advanced financial management tools.

- Salesforce: Offers customizable nonprofit solutions.

- Oracle NetSuite: Provides advanced financial management capabilities.

- Donately: Manages over $2 million in donations monthly and focuses on customizable donation forms.

- Enterprise Software: Blackbaud also competes with larger players like SAP, Certinia, Microsoft, Oracle, and Acumatica.

- Emerging Players: Platforms focused on specific aspects like mobile bidding and auction software (e.g., OneCause) or those integrating with broader business suites (e.g., Copper CRM, Insightly) present alternatives.

- Market Trends: The impact of mergers and alliances, as well as the increasing adoption of AI tools by a wider range of nonprofits, also shapes the competitive dynamics.

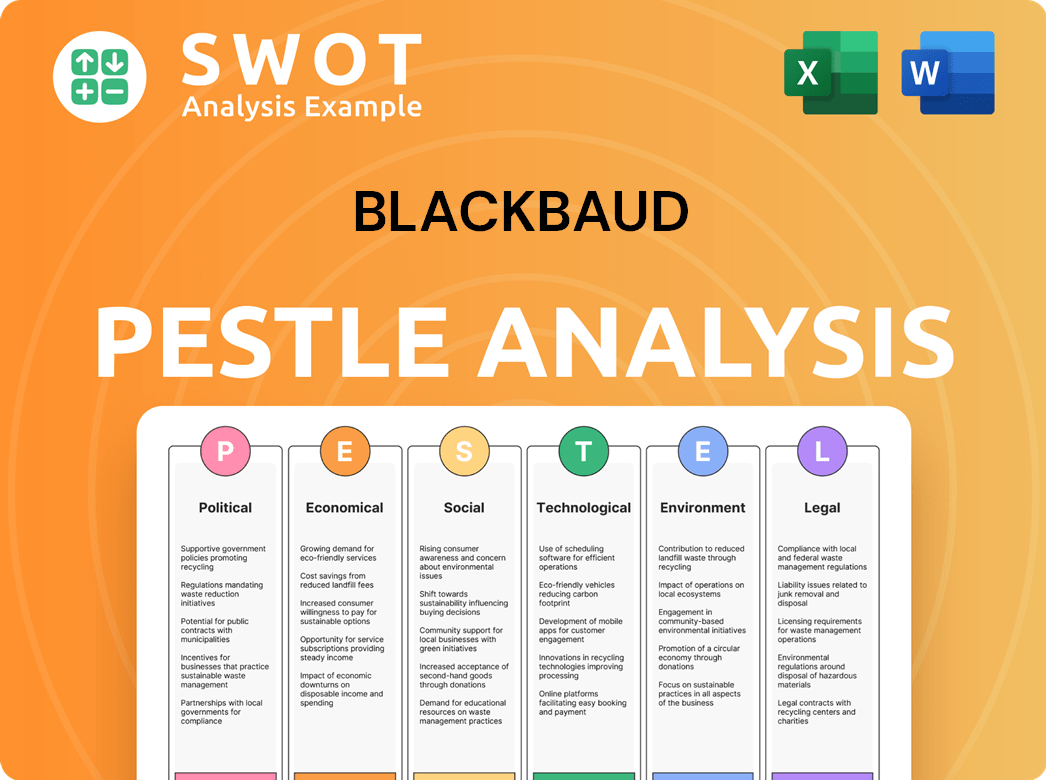

Blackbaud PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Blackbaud a Competitive Edge Over Its Rivals?

The competitive landscape for Blackbaud is shaped by its deep industry expertise and comprehensive suite of integrated solutions. As the 'clear leader in the social impact software market,' Blackbaud has established a strong presence. This position is reinforced by continuous innovation, especially in areas like AI and data intelligence, which are key differentiators in the Marketing Strategy of Blackbaud.

Blackbaud's core competitive advantages include its proprietary technology and robust product portfolio. Solutions like Raiser's Edge NXT and Financial Edge NXT are widely adopted and consistently improved with new features. By mid-2025, Blackbaud aims to have all critical workflows in Raiser's Edge NXT available in a single web view, enhancing user experience. The integration of AI, such as Blackbaud Co-Pilot, provides valuable insights and automates tasks, giving customers a distinct edge in fundraising and operations.

The company's brand equity and customer loyalty are significant assets. Blackbaud's long history and specialized focus have fostered strong relationships and trust within its customer base, as evidenced by a high customer retention rate of 92-93%. The ability to offer integrated solutions across fundraising, financial management, education, and corporate social responsibility creates economies of scale, providing a unified platform that many smaller competitors cannot match. This positions Blackbaud well in the nonprofit software vendors market.

Blackbaud's solutions, such as Raiser's Edge NXT and Financial Edge NXT, are widely used and continuously enhanced. The integration of AI, exemplified by Blackbaud Co-Pilot, provides valuable insights and automates tasks. This gives customers a distinct edge in fundraising and operations, enhancing their competitive position in the fundraising software market.

Blackbaud's long history and specialized focus on the social good sector have fostered strong relationships and trust. This is evidenced by a high customer retention rate of 92-93%. The company's ability to offer integrated solutions creates economies of scale, which many smaller Blackbaud competitors cannot match.

Operational efficiencies, including the transition to three-year contractual revenue contracts, enhance revenue predictability. Blackbaud is also investing in its talent pool, with plans for a new office in India to enhance access to tech talent. These advantages are sustainable due to Blackbaud's continuous investment in product development and strategic partnerships.

- Transition to three-year contractual revenue contracts enhances revenue predictability.

- Investment in talent pool, including a new office in India, enhances access to tech talent.

- Continuous investment in product development and strategic partnerships.

- Leveraging identity resolution services from LiveRamp to improve data intelligence.

Blackbaud Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Blackbaud’s Competitive Landscape?

Understanding the Blackbaud competitive landscape involves assessing the industry trends, future challenges, and opportunities that shape its position in the nonprofit software market. The company, as a leading provider of software and services for social good organizations, navigates a dynamic environment influenced by technological advancements, evolving donor behaviors, and increasing regulatory scrutiny. A thorough Blackbaud market analysis reveals a landscape ripe with both potential and obstacles.

The future outlook for Blackbaud depends on its ability to adapt to these changes, innovate its offerings, and maintain its market share against competitors. The company's strategic decisions, including investments in AI, data analytics, and cloud-based solutions, will be critical to its success. This article will explore the key elements influencing Blackbaud's future, providing insights for stakeholders interested in the nonprofit technology sector.

The social impact software industry is seeing a surge in AI and ML adoption, with over 60% of nonprofits using AI tools to streamline operations and personalize donor engagement. Data analytics and data-driven decision-making are becoming increasingly important, with nonprofits prioritizing donor-centric management. Digital transformation and mobile-first engagement are also key trends, driving the adoption of cloud software and virtual platforms.

Nonprofits face persistent financial sustainability challenges and struggle to find and retain tech talent. The cost of advanced tools and ethical considerations in AI deployment also pose challenges. Increased regulation, particularly regarding data privacy and security, adds complexity. These factors require strategic adaptation and innovation to ensure continued growth.

Significant growth opportunities exist in emerging markets for social impact software, product innovations, and strategic partnerships. Enhancing core solutions, expanding payment processing capabilities, and accelerating corporate and employee donations offer avenues for expansion. The strategic divestment of EVERFI allows for a sharpened focus on its core social impact software.

Blackbaud is focused on enhancing its core solutions, expanding payment processing capabilities, and accelerating corporate and employee donations. The company aims to achieve a 'Rule of 45' by 2030, demonstrating a clear strategy for resilient growth. Continued investment in innovation and its established market position suggest its competitive stance will evolve through deeper AI integration.

Blackbaud's strategy hinges on leveraging AI, enhancing data capabilities, and delivering comprehensive solutions. By focusing on these areas, the company aims to maintain its market leadership and drive growth. The company's commitment to innovation and strategic partnerships is crucial in a competitive landscape. For more insights into the company's journey, explore the Brief History of Blackbaud.

- Deepening AI Integration: Implementing AI-powered tools like Blackbaud Co-Pilot and integrating AI into core solutions.

- Enhancing Data Capabilities: Investing in data intelligence and identity resolution services to provide better donor insights.

- Comprehensive Solutions: Delivering connected solutions for a diverse customer base to meet evolving needs.

- Strategic Divestment: Focusing on core social impact software by divesting non-core assets.

Blackbaud Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Blackbaud Company?

- What is Growth Strategy and Future Prospects of Blackbaud Company?

- How Does Blackbaud Company Work?

- What is Sales and Marketing Strategy of Blackbaud Company?

- What is Brief History of Blackbaud Company?

- Who Owns Blackbaud Company?

- What is Customer Demographics and Target Market of Blackbaud Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.