BlackLine Bundle

How Did BlackLine Revolutionize Financial Close Automation?

From humble beginnings in 2001, BlackLine has transformed the landscape of financial accounting. Founded by Therese Tucker, this cloud platform provider emerged to streamline the cumbersome, manual processes of financial close. Discover the pivotal moments that shaped BlackLine SWOT Analysis and its journey to becoming a leader in the industry.

The brief history of BlackLine company reveals a story of innovation and adaptation within the accounting software sector. Initially focused on wealth management, BlackLine quickly pivoted to address the urgent need for automated financial close solutions. This strategic shift propelled BlackLine's evolution, leading to its current status as a pivotal force in modern financial reporting and a key player in the financial close process.

What is the BlackLine Founding Story?

The story of the BlackLine company began in 2001. It was founded by Therese Tucker, who previously served as CTO at SunGard Treasury Systems, alongside Jeremy Ung.

Tucker, using her retirement savings, embarked on this journey. She was also navigating a divorce and raising two children. Initially named 'Osaba,' the company rebranded to 'BlackLine' just three months after its inception, a change prompted by the 9/11 attacks due to the similarity of the original name to 'Osama Bin Laden.'

The founders identified a problem: the widespread use of manual processes, especially Excel spreadsheets, for essential accounting tasks. Their initial business model targeted software for wealth management firms, but competition was fierce. A crucial turning point occurred when a client requested a tool to automate a specific accounting process. This led BlackLine to shift its focus to accounting automation, a less crowded market at the time, and ultimately led to the development of 'continuous accounting.'

BlackLine operated without external funding until 2013.

- BlackLine secured over $200 million in a Series D round in 2013.

- Institutional investors included Silver Lake and Iconiq Capital.

- The company's early focus was on automating accounting processes.

- BlackLine's evolution highlights a strategic pivot to address market needs.

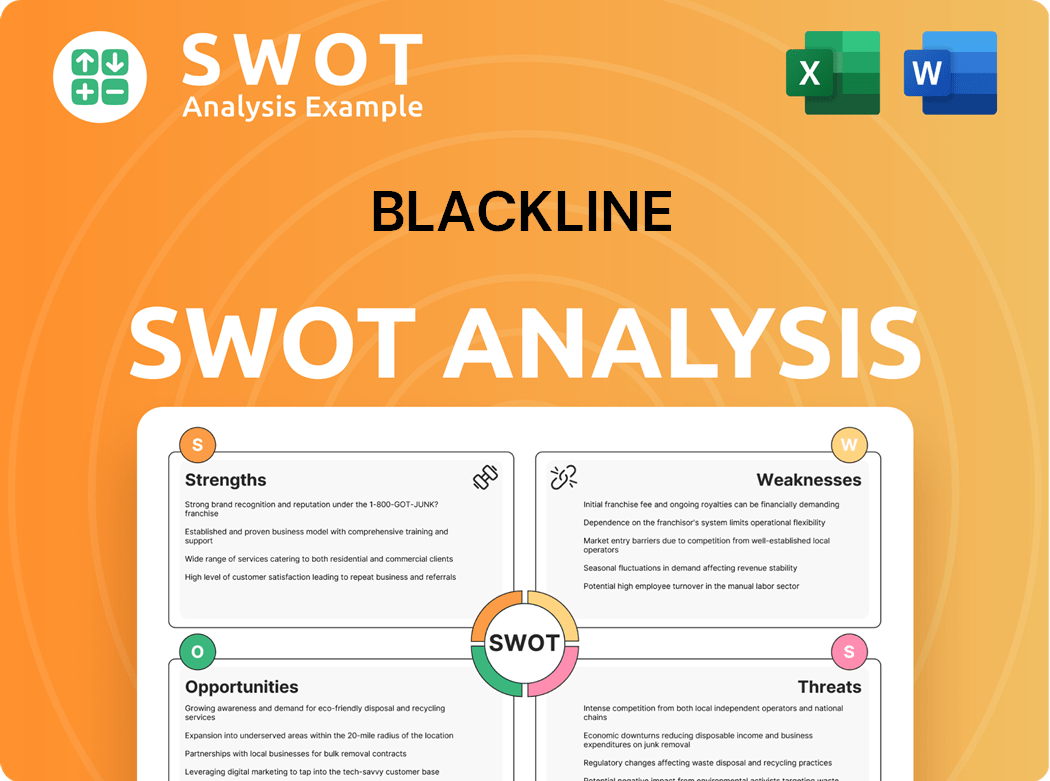

BlackLine SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of BlackLine?

The early growth of the BlackLine company involved a strategic pivot from wealth management software to accounting automation. This shift was crucial for its expansion, alongside the introduction of cloud services, which made accounting tools more accessible. This approach helped attract early clients, such as eBay and Costco, setting the stage for significant growth.

The initial product launches of BlackLine focused on providing cloud services. This was a significant innovation at the time, making its accounting software more accessible and cost-effective for businesses. This approach helped BlackLine attract its first major clients, including eBay and Costco.

BlackLine experienced substantial growth, at one point achieving a 50% compound annual growth rate. This rapid expansion saw the company evolve from its initial concept to a robust product offering that streamlined financial close processes. Key to its expansion was its ability to unify data and automate repetitive work.

In 2013, BlackLine secured a Series D round of over $200 million from Silver Lake Partners and Iconiq Capital. By 2015, BlackLine formed a strategic alliance with financial consulting firm McGladrey, offering a business process as a service (BPaaS) platform. These moves fueled further development and market penetration.

BlackLine went public on October 28, 2016, listing on Nasdaq under the symbol BL, raising approximately $151.7 million. This period also included team expansion and entry into new markets. The acquisition of Runbook in September 2016 enhanced offerings for SAP users. By the end of 2024, BlackLine had expanded its user base to 397,477 users and served a total of 4,443 customers.

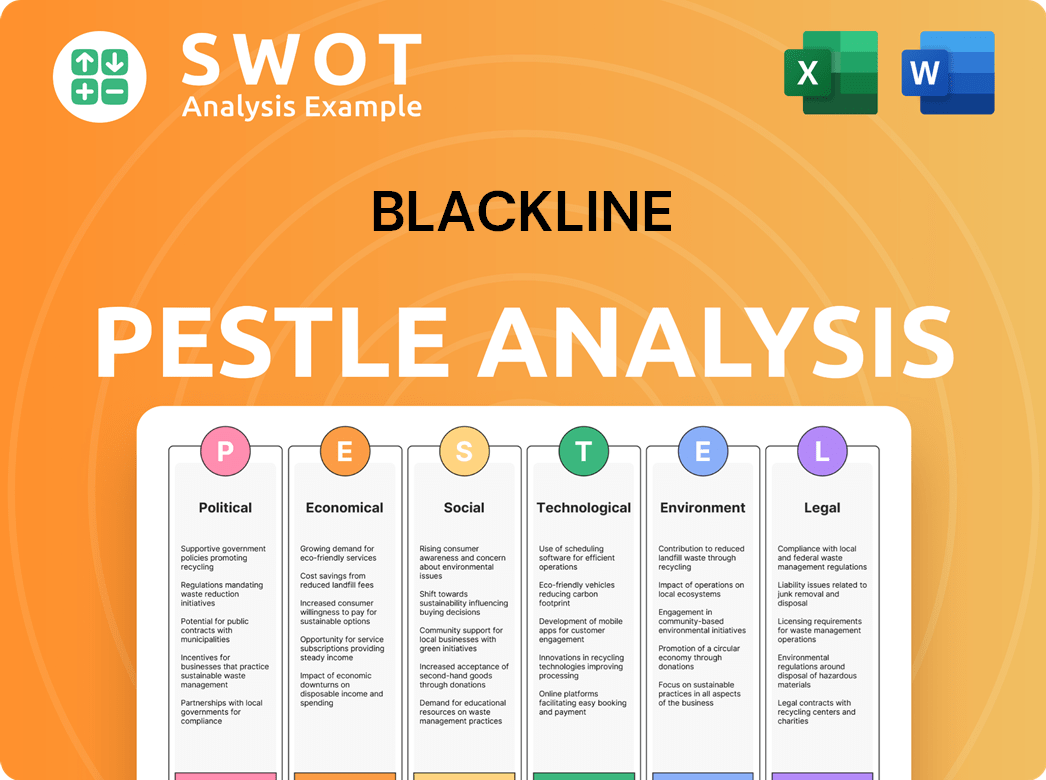

BlackLine PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in BlackLine history?

The BlackLine company's journey is marked by significant milestones, reflecting its growth and impact on financial automation. From its inception, the BlackLine history has been characterized by strategic developments and a commitment to innovation in the realm of accounting software and financial processes.

| Year | Milestone |

|---|---|

| Early 2000s | BlackLine was founded, focusing on automating the financial close process. |

| 2013 | BlackLine went public, marking a significant step in its growth and market presence. |

| 2020 | BlackLine received the Gartner Peer Insights Customers' Choice for Cloud Financial Close Solutions. |

| 2022 | BlackLine received a Top-Rated Award in the Financial Close Category from TrustRadius, achieving an overall score of 8.9 out of 10. |

| 2024 | BlackLine received recognition in the 2024 IDC MarketScape for Worldwide Accounts Receivable Automation Applications for the Enterprise. |

| 2024 | BlackLine was recognized as Most Innovative FinTech Solution by the 2024 Tech Ascension Awards. |

BlackLine has consistently focused on innovation, particularly in the area of financial automation. A key innovation is 'continuous accounting,' aimed at providing a comprehensive overview of a company's finances and streamlining accounting processes.

The development of 'continuous accounting' is a key innovation, providing a wide overview of a company's finances. This approach aims to streamline accounting processes and improve financial visibility.

BlackLine consistently invests in research and development to enhance its offerings. The company's annual R&D investment is approximately $108 million, demonstrating a commitment to innovation.

BlackLine has focused on advancing its Studio360 platform to improve user experience and functionality. This platform is central to its suite of financial automation tools.

Integration of AI-powered solutions, including 'Agentic AI experiences,' is a key focus for delivering autonomous finance capabilities. These solutions aim to automate and optimize financial processes.

BlackLine received recognition in a Forrester report on Top AI Use Cases for Accounts Receivable Automation in 2025. This highlights the company's advancements in AI-driven financial solutions.

Transitioning from seat-based to value-based pricing to align with customer revenue and consumption is a strategic shift. This change aims to better reflect the value BlackLine provides to its customers.

Despite its achievements, BlackLine faces several challenges in the competitive market. These challenges include navigating a competitive cloud-software market and addressing concerns about the macroeconomic environment.

BlackLine operates in a competitive cloud-software market, requiring continuous innovation and strategic adaptation. The company must differentiate itself to maintain its market position.

The enterprise-focused pricing model can be prohibitive for small to mid-sized businesses. This can limit the company's ability to expand its customer base.

The platform's robust feature set can lead to implementation complexity and scalability challenges for some organizations. This can affect user experience and adoption rates.

User feedback has pointed to steep learning curves and occasional slow response times from integration engineers and support. This can impact customer satisfaction.

BlackLine has identified a high degree of risk for potential investors due to its dependency on attracting new customers and retaining existing subscriptions. This emphasizes the importance of customer satisfaction and retention.

Suboptimal intercompany accounting processes create widespread issues for businesses, with 99% of surveyed stakeholders reporting specific challenges. Addressing these issues is crucial for improving financial processes.

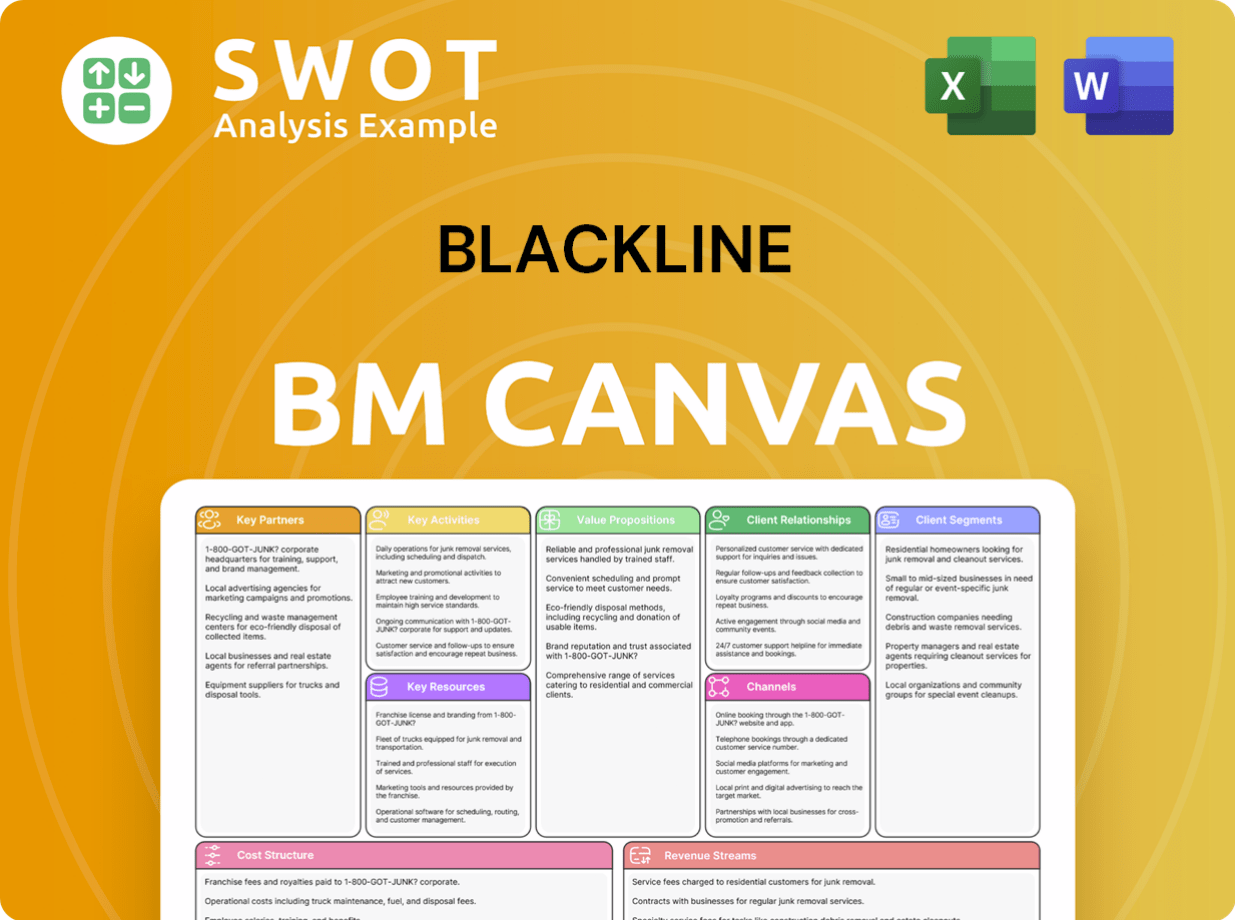

BlackLine Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for BlackLine?

The BlackLine company has a rich history marked by strategic growth and innovation, solidifying its position as a leader in financial automation. From its inception in 2001, the company has evolved significantly, adapting to market demands and technological advancements to become a prominent player in the accounting software industry.

| Year | Key Event |

|---|---|

| 2001 | Therese Tucker and Jeremy Ung founded BlackLine, initially named 'Osaba,' in Los Angeles. |

| 2005 | The company decided to focus exclusively on accounting automation and control functionality. |

| 2013 | BlackLine received its first outside funding, a Series D investment exceeding $200 million from Silver Lake Partners and Iconiq Capital. |

| 2015 | BlackLine formed a strategic alliance with McGladrey to offer a business process as a service (BPaaS) platform. |

| 2016 | BlackLine acquired European competitor Runbook for $34 million and went public on Nasdaq under the ticker symbol BL, raising $151.7 million. |

| 2018 | Huffman joined as Chief Operating Officer. |

| 2020 | BlackLine was named a Gartner Peer Insights Customers' Choice for Cloud Financial Close Solutions. |

| 2021 | Therese Tucker stepped down as CEO in January but returned as co-CEO in March 2023. |

| 2022 | BlackLine received a Top-Rated Award in the Financial Close Category from TrustRadius. |

| June 2023 | A BlackLine-commissioned survey revealed that 99% of intercompany stakeholders face challenges with financial processes. |

| November 2024 | BlackLine launched its Studio360 Platform. |

| December 2024 | BlackLine was recognized as a Leader in the IDC MarketScape for Worldwide Accounts Receivable Automation Applications for the Enterprise. |

| February 11, 2025 | BlackLine announced its Q4 and full-year 2024 financial results, reporting total GAAP revenues of $653.3 million for the full year 2024, an 11% increase from 2023. |

| March 31, 2025 | BlackLine served 4,455 customers and had 393,892 users. |

| May 6, 2025 | BlackLine announced Q1 2025 financial results, with GAAP revenues of $166.9 million, a 6% increase from Q1 2024. |

| June 4, 2025 | BlackLine presented at the 45th Annual William Blair Growth Stock Conference, discussing strategic shifts and growth opportunities. |

BlackLine anticipates an inflection point in growth in the latter half of 2025. The company is targeting 13-16% revenue growth over the next three to five years. This growth will be driven by demand generation and pipeline build, showing the potential for continued expansion and market penetration.

Key strategic initiatives include geographical expansion in Mainland Europe and Asia. Strengthening partnerships with SAP and Workday is also a priority. Continued innovation in AI and the Studio360 platform will be crucial for maintaining a competitive edge in the market.

BlackLine's leadership emphasizes fundamentally reimagining how accounting and finance professionals work. This involves expanding Studio360 capabilities and integrating cutting-edge Agentic AI experiences. This strategic focus aims to transform financial operations through automation and technology.

The company aims to achieve a gross margin of approximately 85% and an operating margin between 26% and 30% in the long term. These financial targets demonstrate BlackLine's commitment to sustainable and profitable growth. The company's focus remains on empowering organizations with accurate, efficient, and intelligent financial processes.

BlackLine Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of BlackLine Company?

- What is Growth Strategy and Future Prospects of BlackLine Company?

- How Does BlackLine Company Work?

- What is Sales and Marketing Strategy of BlackLine Company?

- What is Brief History of BlackLine Company?

- Who Owns BlackLine Company?

- What is Customer Demographics and Target Market of BlackLine Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.